Ordinary Meeting

Meeting Date: Tuesday,

27 May, 2025

Location: Council

Chambers, City Administrative Building, Bridge Road, Nowra

Time: 5.30pm

Membership

(Quorum – 7)

Clr

Patricia White – Mayor

Ward 1 Ward

2 Ward

3

Clr Jason Cox Clr

Ben Krikstolaitis Clr

Denise Kemp

Clr Matthew Norris -

Assist. Deput Mayor Clr Bob Proudfoot Clr

Gillian Boyd

Clr Peter Wilkins -

Deputy Mayor Clr

Jemma Tribe Clr

Karlee Dunn

Clr

Selena Clancy Clr

Luciano Casmiri Clr

Natalee Johnston

Please note: The proceedings of this meeting (including presentations,

deputations and debate) will be webcast, recorded and made available on

Council’s website, under the provisions of the Code of Meeting

Practice. Your attendance at this meeting is taken as consent to the

possibility that your image and/or voice may be recorded and broadcast to the

public.

Shoalhaven City Council live

streams its Ordinary Council Meetings and Extra Ordinary Meetings. These

can be viewed at the following link

https://www.shoalhaven.nsw.gov.au/Council/Meetings/Stream-a-Council-Meeting.

Statement

of Ethical Obligations

The Mayor and Councillors are

reminded that they remain bound by the Oath/Affirmation of Office made at the

start of the council term to undertake their civic duties in the best interests

of the people of Shoalhaven City and to faithfully and impartially carry out

the functions, powers, authorities and discretions vested in them under the

Local Government Act or any other Act, to the best of their skill and

judgement.

The Mayor and Councillors are also reminded of the

requirement for disclosure of conflicts of interest in relation to items listed

for consideration on the Agenda or which are considered at this meeting in

accordance with the Code of Conduct and Code of Meeting Practice.

Agenda

1. Acknowledgement

of Country

Walawaani (welcome),

Shoalhaven City Council recognises the First Peoples

of the Shoalhaven and their ongoing connection to culture and country. We

acknowledge Aboriginal people as the Traditional Owners, Custodians and Lore

Keepers of the world’s oldest living culture and pay respects to their

Elders past, present and emerging.

Walawaani njindiwan (safe journey to you all)

Disclaimer: Shoalhaven City Council acknowledges and

understands there are many diverse languages spoken within the Shoalhaven and

many different opinions.

2. Moment of

Silence and Reflection

3. Australian

National Anthem

4. Apologies /

Leave of Absence

5. Confirmation

of Minutes

· Ordinary

Meeting - 13 May 2025

6. Declaration

of Interests

7. Presentation of Petitions

8. Mayoral Minute

9. Deputations and Presentations

10. Notices of Motion / Questions on Notice

Notices of Motion / Questions on Notice

CL25.158..... Rescission Motion - CL25.152 Post exhibition

report - Planning Proposal: 131 St Vincent Street, Ulladulla................................................................................. 1

CL25.159..... Notice of Motion - CL25.152 Post exhibition

report - Planning Proposal: 131 St Vincent Street, Ulladulla................................................................................. 3

CL25.160..... Notice of Motion - Addressing Illegal Tobacco and

Vaping Concerns in Shoalhaven........................................................................................................................ 4

CL25.161..... Notice of Motion - Shoalhaven War Memorials............................................. 6

11. Call Over of the

Business Paper

12. A Committee of the

Whole (if necessary)

13. Committee Reports

Nil

14. Reports

CEO

CL25.162..... Financial Sustainability Productivity and

Efficiency Report........................... 9

CL25.163..... DPOP 2024-25 - Quarterly Performance and Budget

Report (January - March) 21

City Performance

CL25.164..... Councillor Expenses and Facilities Policy - For

Adoption........................... 33

CL25.165..... Ongoing Register of Pecuniary Interest Returns -

April 2025..................... 39

CL25.166..... Kangaroo Valley Show - Request for Application of

Partial Public Holiday 2026/2027...................................................................................................................... 41

CL25.167..... Investment Report - April 2025.................................................................... 45

City Services

CL25.168..... Proposed Sub-Lease - 42 Clipper Road, Nowra -

Illawarra Area Child Care Ltd 50

CL25.169..... Proposed New Lease - Shop 3, 69 Princes Highway,

Milton (Milton Courtyard Studios) - Mark Hurley.................................................................................. 53

CL25.170..... Report Back - Nowra CBD Parallel/Angle Parking

Investigation................. 57

CL25.171..... Progress Report - Financial & Practical

Feasibility of increasing internal delivery of Traffic Control Services................................................................................ 60

CL25.172..... Deed of Mutual Termination - BLERF - 0111 Improve

resilience of four showgrounds in Shoalhaven............................................................................................... 63

CL25.173..... Landfill Gas Services Contract Extension.................................................... 73

CL25.174..... Tenders - Shoalhaven Material Recovery Facility -

Pavements.................. 75

CL25.175..... Tenders - Traffic Control Services Panel..................................................... 78

City Development

CL25.176..... Report Back: Impact of Events in Huskisson............................................... 81

Shoalhaven Water

CL25.177..... Proposed Exhibition - Shoalhaven Water

Development Servicing Plan... 102

15. Confidential Reports

Reports

CCL25.15.... Landfill Gas Services Contract Extension

Local Government Act - Section 10A(2)(d)(i) - Commercial

information of a confidential nature that would, if disclosed prejudice the

commercial position of the person who supplied it.

There is a public interest

consideration against disclosure of information as disclosure of the

information could reasonably be expected to reveal commercial-in-confidence

provisions of a contract, diminish the competitive commercial value of any

information to any person and/or prejudice any person’s legitimate

business, commercial, professional or financial interests.

CCL25.16.... Tenders - Shoalhaven Material Recovery Facility -

Pavements

Local Government Act - Section 10A(2)(d)(i) - Commercial

information of a confidential nature that would, if disclosed prejudice the

commercial position of the person who supplied it.

There is a public interest

consideration against disclosure of information as disclosure of the

information could reasonably be expected to reveal commercial-in-confidence

provisions of a contract, diminish the competitive commercial value of any

information to any person and/or prejudice any person’s legitimate

business, commercial, professional or financial interests.

CCL25.17.... Tenders - Traffic Control Services Panel

Local Government Act - Section 10A(2)(d)(i) - Commercial

information of a confidential nature that would, if disclosed prejudice the

commercial position of the person who supplied it.

There is a public interest

consideration against disclosure of information as disclosure of the

information could reasonably be expected to reveal commercial-in-confidence

provisions of a contract, diminish the competitive commercial value of any

information to any person and/or prejudice any person’s legitimate

business, commercial, professional or financial interests.

|

|

Ordinary

Meeting – Tuesday 27 May 2025

Page

1

|

CL25.158 Rescission

Motion - CL25.152 Post exhibition report - Planning Proposal: 131 St Vincent

Street, Ulladulla

HPERM Ref: D25/221509

Submitted

by: Clr Luciano Casmiri

Clr Bob

Proudfoot

Clr Peter

Wilkins

Purpose / Summary

The following Rescission Motion, of which due notice has

been given, is submitted for Council’s consideration.

|

Recommendation

That Council rescind the

Motion relating to Item CL25.152 Post exhibition report - Planning Proposal:

131 St Vincent Street, Ulladulla of the Council Meeting held on Tuesday 13

May 2025.

|

Background

The following resolution was

adopted at the Ordinary Meeting held 13 May 2025 (MIN25.235).

That Council:

1. More fully

consider the potential land use conflict concerns associated with noise and

dust from the adjacent concrete batching plant before finalising the Planning

Proposal.

2. Consult with

the owner of the adjacent concrete batching plant (Heidelberg Materials) to

better understand the existing site operations and future plans.

3. In

collaboration with the proponent, commission an independent desktop review of

the proponent’s Air and Odour Assessment and Acoustic Assessment and risk

assessment of land use conflict issues (noise and dust) raised in community and

agency submissions as follows:

a. The scope of

the desktop assessment, project brief and list of consultant/s be agreed to

with Council staff.

b. The proponent

fund and commission the assessment to streamline the procurement process.

c. The draft

report is reviewed by Council staff.

4. If the

independent review concludes that the risks can be satisfactorily addressed

through suitable provisions in the Local Environmental Plan (LEP) amendment and

at development application stage, finalise the Planning Proposal as exhibited

subject to the following:

a. Liaise with

the NSW Department of Planning, Housing & Infrastructure (DPHI) on a

potential local provision that to be included in the amendment that requires

the delivery of the promised affordable housing outcomes, given that the

Gateway determination does not require a Voluntary Planning Agreement to be

entered into before the LEP is amended.

b. Acknowledge

that the height and floor space ratio (FSR) controls resulting from this

Planning Proposal will potentially be increased by 20 to 30% under the

affordable housing bonus incentives in the Housing State Environmental Planning

Policy.

5. If the

independent review concludes that the land use conflict risks cannot be

satisfactorily addressed at development application stage, report the matter

back to Council for direction.

|

|

Ordinary

Meeting – Tuesday 27 May 2025

Page

1

|

CL25.159 Notice

of Motion - CL25.152 Post exhibition report - Planning Proposal: 131 St Vincent

Street, Ulladulla

HPERM Ref: D25/221530

Submitted

by: Clr Luciano Casmiri

Clr Bob

Proudfoot

Clr Peter

Wilkins

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That

Council:

1. Adopt the Planning Proposal

(PP-2024-109) for 131 St Vincent Street, Ulladulla as exhibited, to amend the

Shoalhaven Local Environmental Plan 2012 as follows:

a. Rezone the land to MU1 Mixed Use

b. Increase the maximum height of

buildings to 15m, 17m and 21m

c. Introduce a Floor Space Ratio of

3.5:1

2. Forward the endorsed Planning

Proposal to the NSW Parliamentary Counsel’s Office to proceed to

finalisation.

3. Advise stakeholders, including those

who have made a submission, of this decision and when amendments will be

effective.

|

Note by the CEO

This Notice of Motion will be

dealt with if the preceding Rescission Motion is carried.

|

|

Ordinary

Meeting – Tuesday 27 May 2025

Page

1

|

CL25.160 Notice

of Motion - Addressing Illegal Tobacco and Vaping Concerns in Shoalhaven

HPERM Ref: D25/219701

Submitted

by: Clr Selena Clancy

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That

Council:

1. Acknowledges that smoking remains

the leading cause of preventable disease and death in Australia, and that

vaping is an emerging public health challenge, particularly among young

people.

2. Notes with concern that Shoalhaven,

particularly Nowra CBD, has seen a proliferation of tobacco retailers with

approximately 9 stores in the central Nowra locale, all within walking

distance of schools.

3. Notes with concern that according to

NSW Health data, there has been an increase in the number of tobacconists

opening across NSW, rising from 14,500 four years ago to 19,500 today.

4. Acknowledges the recent roundtable

discussions held in Nowra with NSW Opposition Health Minister Kellie Sloane

regarding the concerning growth of illegal tobacco trade and its links to

organised crime.

5. Advocates to the NSW Government in

support of the proposed Upper House inquiry into illegal tobacco sales, which

would examine:

a. The proliferation of tobacco and

vape outlets

b. Departmental responsibility for

compliance and enforcement

c. Licensing schemes for tobacconists

d. Landlord responsibilities

e. Money laundering schemes operating

via tobacconists

f. Impact on human health and

business profits

6. Advocates to the NSW Government that

the standard instrument LEP zonings related to mixed-use and employment

zones, and the exempt and complying criteria under the SEPP (Exempt and

Complying Development Codes) 2008 are revised to mandate that tobacconist

stores require approval through a development application.

7. Investigates, as part of the current

LEP review process, any existing mechanisms to require development

applications for tobacconist stores to open in the Shoalhaven Local

Government Area, even where it is a change of use of an existing retail or

commercial space.

8. Advocate to NSW Health for them to

liaise directly with local schools to develop and implement educational

programs about the dangers of vaping and smoking, with a particular focus on

prevention among young people.

9. Advocates to both State and Federal

Governments for increased compliance officers and resources dedicated to

enforcement against illegal tobacco and vape sales in the Shoalhaven region.

10. Writes to the NSW Government expressing

Council's concern about the proximity of tobacco retailers to schools in

Nowra and requesting their cooperation in enacting appropriate regulatory

changes.

|

Background

The Shoalhaven region, like many

areas across NSW, is experiencing concerning trends in both traditional tobacco

use and the emerging issue of vaping. According to health data, smoking remains

the leading preventable cause of disease and death, while vaping is

increasingly popular among youth who may not fully understand the associated

health risks.

Recent changes to tobacco and

vaping regulations have attempted to address some concerns, with vapes

containing nicotine and disposable vapes banned as of January 1, 2024. However,

the illegal sale of these products continues to be an issue, particularly in

regional areas like Shoalhaven where enforcement resources may be limited.

The siting of tobacco shops and

the sale of harmful products is not currently regulated by land use to the

degree that would allow full assessment of impacts where proximity to other

land uses presents potential conflict (for example, schools). A new tobacconist

shop, for example, will require a development application and social impact

assessment only under certain circumstances. However, a tobacconist can open

and trade by filling out a few forms. The high number of businesses of this

kind opening in close proximity to primary and secondary schools poses a

significant health risk to children and must be addressed as a matter of

urgency.

NSW Opposition Health Minister

Kellie Sloane has recently renewed calls for an Upper House inquiry into

illegal tobacco sales, describing it as a "huge problem" with 19,500

registered tobacco-selling outlets in NSW, an increase of 5,000 in four years.

She has highlighted concerns about those retailers "underpinned by

criminal activity and people selling illicit tobacco and vapes to kids."

The proximity of tobacco

retailers to schools in Nowra is of particular concern, with nine stores

identified in the central Nowra locale, all within walking distance of schools.

This presents a public health risk, especially to young people who may be vulnerable

to nicotine addiction through exposure to these products.

The health impacts of vaping and

tobacco use are well-documented, with vapes often containing harmful chemicals

found in cleaning products, nail polish remover, weed killer, and bug spray.

Many vapes labelled "nicotine-free" have been tested and shown to

contain high levels of nicotine, creating a new generation of nicotine-addicted

individuals.

This Notice of Motion builds

upon the previous Motion (CL24.173) presented by Clr Serena Copley and seeks to

address the evolving situation with additional measures focused on supporting

the inquiry into illegal tobacco, enhancing educational initiatives, and

advocating for greater enforcement resources.

|

|

Ordinary

Meeting – Tuesday 27 May 2025

Page

1

|

CL25.161 Notice

of Motion - Shoalhaven War Memorials

HPERM Ref: D25/221391

Submitted

by: Clr Selena Clancy

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That

Council:

1. Establish a War Memorials Register

for the Shoalhaven that:

a. Documents all war memorials on

public and private land in the Shoalhaven LGA.

b. Ensures all memorials are listed on

the NSW War Memorials Register.

c. Includes condition assessments and

maintenance requirements.

d. Identifies which memorials are

included in Council's asset register.

2. Develop a comprehensive War

Memorials Management Policy that:

a. Clearly defines responsibilities for

memorial management between Council and other stakeholders (e.g., RSL).

b. Establishes maintenance standards

and schedules.

c. Sets out processes for applying for

grants, including from the NSW Office for Veterans Affairs Community War Memorials

Fund.

d. Ensures inclusion of all service

branches in appropriate memorials.

e. Establishes protocols for new

memorial proposals.

3. Take immediate action regarding the

following specific memorials:

a. Formally assess and document the

condition of the Wall of Remembrance at the JB Maritime Museum and the Court

of Remembrance in Voyager Memorial Park.

b. Register the RAAF 107 Squadron

memorial on Island Point Road with the NSW War Memorials Register.

c. Investigate the discrepancies in the

Court of Remembrance regarding tri-service representation and the absence of

Merchant Navy recognition.

d. Verify the dedication of the Court

of Remembrance War Memorial element (No record has ever been located that the

Court of Remembrance has been dedicated as a War Memorial, and it remains

unregistered.

e. Review and standardise the criteria

for inclusion on war memorials, addressing the inconsistency where names

range from the Fallen to civilian committee members of local RSL.

4. Apply for funding through the NSW

Office for Veterans Affairs Community War Memorials Fund for:

a. Restoration and ongoing maintenance

of the Wall of Remembrance.

b. Appropriate recognition of the 50

personnel who lost their lives locally during WWII, including immediate

reversal or justification of the Council policy that excludes fallen listed

on the Wall of Remembrance from being commemorated on the Court of Remembrance

on the grounds that it is a ‘Single Service’ memorial.

c. Improvement of signage and

interpretive materials at local war memorials.

5. Direct the CEO to prepare a report

on:

a. The status of all war memorials in

the Shoalhaven, their condition, and maintenance requirements.

b. The current process for managing

memorial applications and maintenance. Noting that the Shoalhaven City

Council Plaques and Memorials Policy dated 28 October 2022 states a review of

the forementioned policy within 12 months of the date of the election of the

new Council is available on request. Confirmation that this is the correct

policy is also requested.

c. Historical grant applications and

allocations for memorial maintenance.

d. Recommendations for improved

coordination between Council, RSL, and other stakeholders.

e. Budget implications for implementing

a comprehensive memorial management system.

f. Implementation status of

Ordinary Meeting resolution of 07 February 2022 to promulgate both Heritage

Consultants report and Working Groups report with identified errors and

omissions.

6. Establish a War Memorial Advisory

Committee to:

a. Review grant applications.

b. Provide ongoing advice to Council on

memorial management.

c. Ensure appropriate recognition of

all service branches.

d. Include

representatives from Council, RSL, historical societies, representatives from

HMAS Albatross (including Chaplain services), Special Operations Command and

relevant community members.

|

Background

As a result of the Council

Strategy and Asset Committee disbanding, in May 2021, Council established a

Working Party to investigate RAAF, RAF, and American involvement in the

Shoalhaven during World War II and to make recommendations regarding heritage

preservation and memorial establishment (MIN21.265). This work has revealed

significant gaps in the management, recognition and maintenance of war

memorials in the Shoalhaven area, particularly those related to WWII aviation

heritage and personnel who lost their lives locally during the war. (Side note,

RAF was not in the Shoalhaven).

A subsequent Heritage

Consultants report, commissioned by the Planning Department was prepared

without consultation with the Working Group and contained significant errors

and omissions, notably failing to recognise the sacrifice of Fallen

commemorated on the Wall of Remembrance.

This motion seeks to address significant concerns regarding

the preservation of our military heritage and the proper recognition of those

who served and sacrificed. The current approach appears fragmented, with

unclear responsibilities and processes, potentially leading to the neglect of

important memorials and the exclusion of certain service branches. Implementing

a systematic approach to memorial management will honour our history

appropriately and ensure ongoing preservation of these important community

assets.

Research undertaken by the RAAF Nowra Working Group has

revealed concerning gaps in how we maintain and manage our war memorials. The

Wall of Remembrance, which records RAAF, RN, and Army casualties that occurred

locally during WWII, was found in a derelict and disassembled condition.

Similarly, inconsistencies exist with the Court of Remembrance in Voyager

Memorial Park, where important aspects of service recognition appear to have

been lost during transitions between memorials. The RAAF 107 Squadron memorial

on Island Point Road, while apparently an official memorial, is not included on

the NSW Register of War Memorials, highlighting administrative oversights.

It is unclear whether Council or RSL have primary carriage of

management covering War Memorials, and Council appears to have limited records

regarding the Wall of Remembrance or Court of Remembrance. This administrative

ambiguity has real consequences. Despite the availability of NSW Office of

Veterans Affairs’ Community War Memorials Fund grants, which could have

provided resources for memorial refurbishment and maintenance, these

opportunities have not been consistently pursued. While Council has successfully

applied for some grants (approximately $60,000 over the past three years),

there is no transparent process for how these funds are allocated or how

memorial maintenance decisions are made.

Our war memorials are more than stone and metal - they are

tangible connections to our heritage and powerful reminders of sacrifice. The

50 service personnel who lost their lives locally during WWII deserve

appropriate remembrance and honour. As custodians of community memory, Council

has a responsibility to ensure these memorials are properly maintained,

accurately documented, and accessible to current and future generations. This

motion provides a structured pathway to fulfill that obligation through clear

policy, dedicated resources, and collaborative decision-making between all

stakeholders.

These suggestions will provide the Shoalhaven community with

an improved understanding of and appreciation for our military heritage and

remembrance.

|

|

Ordinary

Meeting – Tuesday 27 May 2025

Page

1

|

CL25.162 Financial

Sustainability Productivity and Efficiency Report

HPERM Ref: D25/185722

Department: Financial

Sustainability

Approver: James

Ruprai, Acting CEO

Purpose:

The purpose of this report is to

inform Councillors and the community of the productivity and efficiency actions

that have been taken from January to March 2025 to improve Council's financial

sustainability.

Summary and Key Points for

Consideration:

· The

financial sustainability project commenced in February 2024, in response to the

independent financial sustainability review (CL23.420).

The project coordinates the organisation’s efforts to address its

financial sustainability challenges, through the delivery of agreed actions and

initiatives.

· In

adopting the recommendations of the AEC Financial Sustainability Review (MIN23.667),

Council resolved to report the organisation’s progress in achieving

efficiencies against the productivity and efficiency target on a quarterly

basis.

· This

report summarises the actions taken to improve Council’s financial

sustainability from January to March 2025.

· A

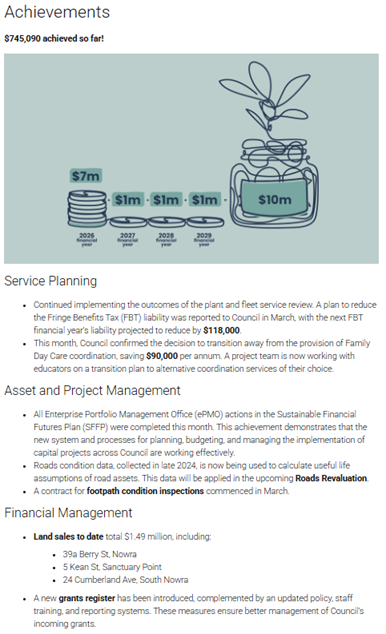

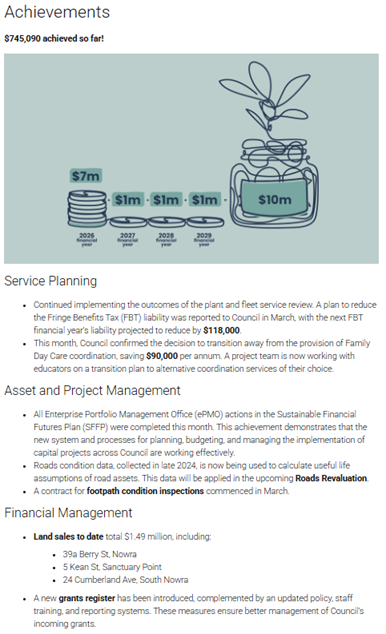

Sustainable

Financial Futures Plan was presented to Council, that describes the

commitment to deliver a minimum of $10 million in savings over the next 4

financial years ($7 million in FY26, and $1 million per annum in FY27, FY28 and

FY29). The draft FY26 budget, which includes $7 million in savings, is now open

for community feedback.

· During

January to March 2025, Council has achieved one-off savings/income of $1.684

million and no recurrent general fund savings/income. This holds the

total recurrent general fund savings at $2.548 million and brings the one-off

general fund savings/income to $95.731 million. This reflects the full

financial sustainability actions taken since the project commenced in early

2024.

· In

FY25 QBR1, an internally restricted reserve was created, called the Financial

Sustainability Reserve (FSR). Savings realised from FY25 QBR1 onwards

have been transferred to the FSR reserve. As at QBR2, the FSR balance was

$2.8 million. As of QBR3, the FSR balance has grown to $4.1 million.

|

Recommendation

That

Council:

1. Receive the productivity and

efficiency report for the period from January to March 2025.

2. Note the actions taken during the

period that have supported progress towards the vision identified in

Council’s Sustainable Financial Futures Plan.

|

Options

1. The productivity

and efficiency report for the period from January to March 2025 be received for

information.

Implications: Nil

2. Further

information regarding action taken during the period to improve Council’s

financial sustainability be requested.

Implications: Any changes or additional matters can

be added to future reports.

Background and Supplementary

information

In November 2023, AEC provided a report (CL23.420)

to Council on its financial sustainability. In this report, Council was

informed that the general fund net operating position has been in a deficit

position over the past eight years and there is a structural deficit to fund

recurrent expenditure of $25-35 million per annum. AEC made 27 recommendations,

including an SRV, and that all had to be implemented to ensure Council’s

financial sustainability.

The Financial Sustainability project has been established to

coordinate Financial Sustainability actions and initiatives in response to MIN23.667,

MIN24.44

and from report CL23.420

– AEC Financial Sustainability review from November 2023. The project

commenced in February 2024 and has 3 major workstreams:

1. Asset and Project

Management

2. Financial Management

3. Service Planning

In December 2024, Council was

presented a Sustainable Financial Futures Plan (see attached) that details the

actions and operational savings plan to improve Council’s financial

sustainability. The Sustainable Financial Futures Plan (SFFP) includes a

commitment to deliver operational savings to meet the agreed $10m savings

target over the next 4 years.

The SFFP is available on

Council’s website to ensure the financial sustainability actions and

progress to date is clearly communicated and transparent. The Councillors and

community are updated monthly via Council’s website on the status of the

actions taken and progress made on the agreed savings plan. This

complements the quarterly Productivity and Efficiency Report to Council, with

the objective to make the financial sustainability actions and progress more

accessible and understood by the community.

In the March 2005 Financial

Sustainability update on Council’s website, the Sustainable Financial

Futures Plan was updated with the latest status of actions including:

· Marking

actions as complete.

· Updating the

outcomes achieved to date.

· Adjusting

completion dates where staff need more time to deliver the action.

As part of the March 2025

update, 33 of 75 actions have been completed. This represents significant

progress towards Council’s vision of being a financially sustainable

organisation. The Sustainable Financial Futures Plan will be updated

again in June 2025.

Summary of financial sustainability

initiatives

Reducing costs –

staffing

As a result of the recruitment

process that was established in 2024 in response to MIN24.44,

over 100 vacancies are now held across Council. Salary savings this quarter are

captured as part of QBR3, totalling $1.276 million.

There are operational challenges

associated with holding this number of vacancies across the organisation, which

is being felt in some areas of Council more than others. The vacancies

mean there are potential impacts to meeting the agreed delivery program,

maintaining service levels and the potential for facilities to close due to

lack of staffing.

To achieve the Sustainable

Financial Futures savings plan, $3.5 million of salary savings have been

incorporated into the draft FY26 budget. This saving will be realised

through the implementation of the agreed actions resulting from the critical vacancy

and recruitment review, that was completed in February 2025.

Reducing costs – plant

and fleet

In QBR1, it was reported that

Council sold excess plant and fleet, and received sales proceeds of $500,000

($330,000 general fund, $170,000 water fund). Further reviews of

Council’s plant and fleet operation have resulted in additional vehicles

being sold, with sales proceeds to be reported in QBR3 of $407,924 in general

fund and $37,500 in water fund. The reduction in Council’s fleet

through these sales will result in annual plant hire savings of $270,471 for

general fund and $16,746 for water fund, to be recognised in FY26 at QBR1.

There are also 7 light vehicles

and 1 truck scheduled for sale in May, as a result of ongoing financial

sustainability actions being taken.

Other actions taken to improve

the financial sustainability of Council’s plant and fleet operation

included updating the leaseback vehicle selection list and adjusting the

replacement schedule. The Executive Leadership Team is revisiting these

items with the objective of implementing additional changes to further reduce

the ongoing operational and capital expenses associated with plant and fleet.

The status of Council’s actions in response to the AEC

Plant and Fleet service review was reported to Council on 11 March 2025 (CL25.75)

Reducing costs – other

efficiency ideas

Since May 2024, Council staff

have been working on 3% challenge ideas to deliver department level cost

savings and revenue generating initiatives that will contribute to the savings

target. The current status of the 3% challenge is:

· 89

ideas implemented

· 111

ideas are work in progress

· 158

ideas investigated and closed as the idea was not feasible

· 54

ideas investigated and are on hold due to significant workload and/or change

impact

· 104

not started

From FY26, a reduction has been

applied to department ‘materials and contracts’ budgets. The

continued focus on cost savings and revenue generation ideas from the 3%

challenge will ensure department budgets stay on track and support the delivery

of the $7 million in operational savings from the Sustainable Financial Futures

Plan.

Service review outcome

– Family Day Care

The findings of the Shoalhaven

Family Day Care (SFDC) service review was reported to Council on 18 February

2025 (CL25.42),

with Council resolving to transition away from Council providing the service.

As part of assessing whether the

service’s delivery is appropriate, effective, and efficient, the SFDC

service review considered the need for the service, the outcomes achieved and

Council’s role in providing the service. The service review identified

that while there is significant need for childcare places in the Shoalhaven and

that SFDC was providing 190 FDC (Family Day Care) places, that Council’s

provision of a FDC co-ordination service was not critical for achieving the

provision of those childcare places. This is because each FDC educator operates

as a small business and other FDC co-ordination services are currently

operating or interested in operating in the Shoalhaven, including both

not-for-profit and privately-owned services. One of these is a well-established

not-for-profit organisation based in the Illawarra region with the sole purpose

of providing FDC services.

As Council provides a FDC

coordination service rather than directly providing childcare places, it became

clear that families could still have access to FDC places and educators could

still operate if they were supported to transition to another FDC coordination

service. With multiple FDC coordination services in the area, educators would

be able to choose the provider that best suited them. Whilst SFDC has been

struggling to achieve the educator numbers needed to be cost neutral after

covering the fixed costs associated with a service’s baseline operation,

other providers have an established base where any additional educators would

boost their organisational sustainability.

The implication of this decision

is that Educators will be supported to move to an alternative Family Day Care

coordination provider. Consultation has taken place with some alternative

providers who are willing to consider enrolling SFDC educators with their

service. Once all educators have been placed with an alternative

provider, Council will surrender its licence to operate FDC, and the service

will close.

This has resulted in 5 Council

staff (3.6 FTE) involved in the operation of SFDC being displaced and

potentially eligible for redundancy.

The financial sustainability

outcome is a direct ongoing benefit to Council’s general fund of

approximately $90,000 per annum. This recurrent saving will be formally

realised in a future Productivity and Efficiency report, once the FDC service

has concluded and all financial obligations are finalised.

Improving organisational efficiencies – other service

reviews

Forward service review program for the next 3 years has been

approved by ELT, with the 2025 calendar year program scheduled. Table 1

below shows the current work in progress program and status update on each.

Table 1: Service Review Program

Schedule

|

Service review

|

Review Type

|

Review

Completion

|

Review

Resourcing

|

Status

|

|

Holiday

Haven

|

Business

process improvement

|

Apr-24

|

In-house

|

Review

Complete - implementation underway under BAU

|

|

Fleet & Mechanical

|

Internal process/ structure/services

|

Jun-24

|

Consultant

|

Review complete – implementation

underway

|

|

Fire

Safety Certificates

|

Business

process improvement

|

Aug-24

|

In-house

|

Review

complete – implementation underway

|

|

Asset

custodian model (incl. PM function)

|

Structure

|

Dec-24

|

In-house

|

Structural

review complete – implementation underway

|

|

Family Day Care

|

Business model - commercial

|

Feb-25

|

In-house

|

Review complete – implementation underway

|

|

Communications

and Media

|

Internal

process /structure/services

|

Mar-25

|

In-house

|

Review

complete – implementation planning underway

|

|

Waste

tipping vouchers

|

Internal

process/business model

|

Apr-25

|

In-house

|

Work

in progress

|

|

Safety

review

|

Internal

process

|

May-25

|

In-house

|

New

– scoping underway

|

|

Bereavement

Services

|

Business

model - commercial

|

May-25

|

Consultant

|

Review

complete – implementation underway

|

|

Library

Services

|

Business

process improvement

|

May-25

|

In-house

|

Work

in progress

|

|

Shoalhaven

Entertainment Centre

|

Business

model - commercial

|

July-25

|

In-house with

consultant for peer review /

financial modelling

|

Work

in progress – options analysis

|

|

Holiday

Haven

|

Business

model - commercial

|

Dec-25

|

Consultant

|

Not

started – to be scoped in mid-2025

|

|

Legal

|

Business

model - internal resources

|

TBC

|

In-house

|

On

hold pending resource availability

|

|

Customer Experience

|

Internal process /structure/services

|

TBC

|

In-house

|

On hold – pending other service reviews completion

|

Reducing debt – land sales

As of March 2025, the

operational land sales program had achieved sales of $1.49 million FY25 year to

date. This income has been directed to fund critical capital works.

The sales results achieved to date is below the goal of $7 million, however

income from an auction held in March will be recognised in the next quarterly

report.

Internal Consultations

The financial sustainability

project consults internal stakeholders formally through weekly Executive

Leadership Team meetings and monthly in Shoalhaven Leadership Team meetings.

Four budget workshops were held

with Councillors in March, with the proposed capital carry forwards, fees and

charges, capital program, operational income and expenditure under

review. The draft FY26

The previous report advised that

Councillors would be briefed on the Bereavement Services service review in

March 2025. This briefing occurred in April and will be reported in the

next quarterly Productivity and Efficiency report.

External Consultations

Council’s Finance Review

Panel are being consulted on the ongoing commercial services review program

from May 2025, to provide robust and objective feedback on the draft service

review options and financial analysis, prior to the review being considered by

Council.

External experts are also being

engaged on the Shoalhaven Entertainment Centre service review, using a hybrid

resourcing model with internal staff completing the service review data

collection and analysis. A Request For Quotation (RFQ) via the LG Panel

is now underway, seeking external expert advice and quality assurance of the

service review in progress.

The scope of the RFQ is:

1. Complete a peer

review on the staff assessment of the current service delivery.

2. Provide peer

review on the service improvement options developed by staff.

3. Complete

financial modelling of the draft service improvement options based on expert

knowledge and the data collected.

4. Provide expert

advice on the service review options by providing a structure for decision

making, considering community impact, risk, financial impact and other relevant

factors for the options.

5. In collaboration

with SCC project team, attend a meeting with the Executive team, and a

Councillor briefing, to provide expert summary of the service review.

This approach, which relies on

staff assuming responsibility for the detailed service review workload, and

obtaining expert guidance through peer review, is anticipated to deliver an

improved result compared to solely relying on a consultant or conducting an

internal review.

Community Consultations

This quarter, the financial

sustainability project commenced monthly project updates of the

organisation’s progress against the agreed actions and savings target via

Council’s website. The objective of this regular communication is

to make financial sustainability updates more accessible to the community and

includes an infographic showing the high-level project status, a clickthrough

high level monthly update, and a detailed monthly update with a CEO video.

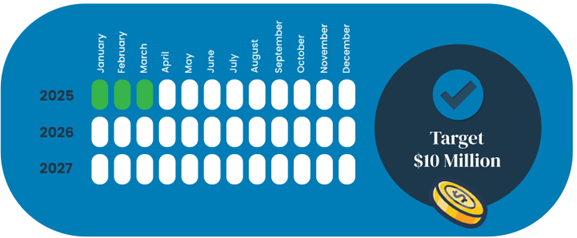

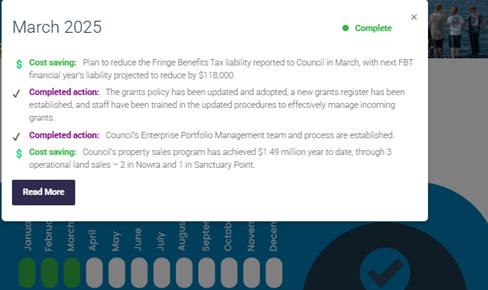

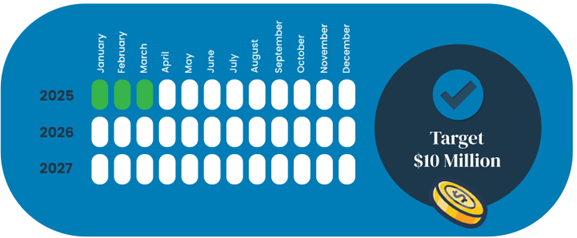

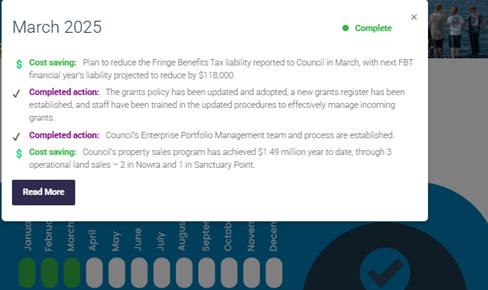

Image 1: SFFP overview status

Image 2: Pop-out monthly summary

Image 3: Detailed monthly actions update

The Sustainable Financial

Futures Plan was also updated in March, with the latest status of actions,

updated completion dates (where staff need more time to complete the action)

and savings achieved to date. This resulted in the completion of 33 of 75

actions. The SFFP will continue to be updated quarterly and published to

the community on the website.

In May, the Financial

Sustainability Project Manager will present on the status of the

organisation’s progress towards the Sustainable Financial Futures Plan to

the CCB Executive meeting.

Policy and Statutory Implications

Council’s Motor Vehicle Policy

has been adopted after endorsement by the Executive Leadership Team and a

presentation to the February Consultative Committee. The key revisions to

the Motor Vehicle Policy in support of Council’s financial sustainability

objective include:

Leaseback Eligibility and

Guidelines:

Clearer parameters outline where

leaseback may be offered, eligibility criteria, and employee responsibilities,

helping to ensure fair and consistent application of leaseback options.

Fuel Card Usage:

Updated guidelines on fuel cards

use not permitted interstate (excluding ACT) without Director approval.

Insurance Claims &

Excess Payments:

Updated guidelines on when

employee contribution may be required where an at-fault insurance claim is

made.

Take-Home Vehicle Usage

and Personal Use Provisions:

The updated policy provides

refined rules for employees who have a job requirement to take-home operational

vehicles, whether ongoing or for specific projects, and clarifies specific

allowed use while on call, with conditions that permit minor, reasonable

personal deviations from work routes and weekend use (e.g., to attend to

immediate family needs) to ensure appropriate response times.

Car Allowance Recipients

and Private Vehicle Usage:

Specific guidelines clarify car

allowance recipient responsibilities, including the requirement for private

vehicles used for Council duties to meet insurance, safety, and operational

standards. The policy encourages fleet vehicle use for council business

whenever feasible and sets out reimbursement procedures for private vehicle

usage when a council vehicle is unavailable.

Financial Implications

January 2025 – March

2025 general fund report

Recurrent saving realised

(grey-shaded rows were included in a previous productivity and efficiency

report but are included to show the total achievement realised):

|

Category

|

Initiative

|

Saving/Income

|

Realised

|

Amount

|

|

Other efficiency ideas

|

Reduction in events support programme and marketing

budget

|

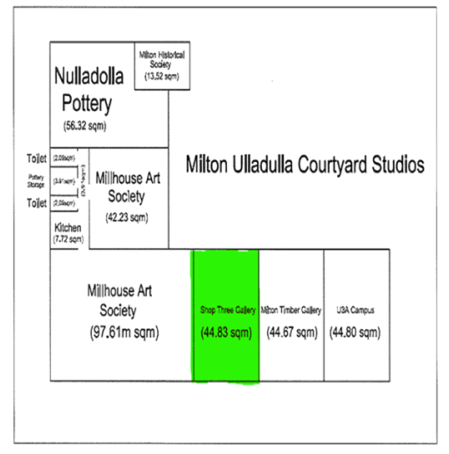

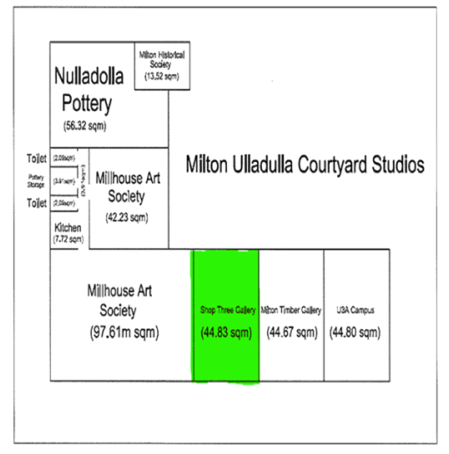

Saving

|

24/25

original budget

|

-$500,000

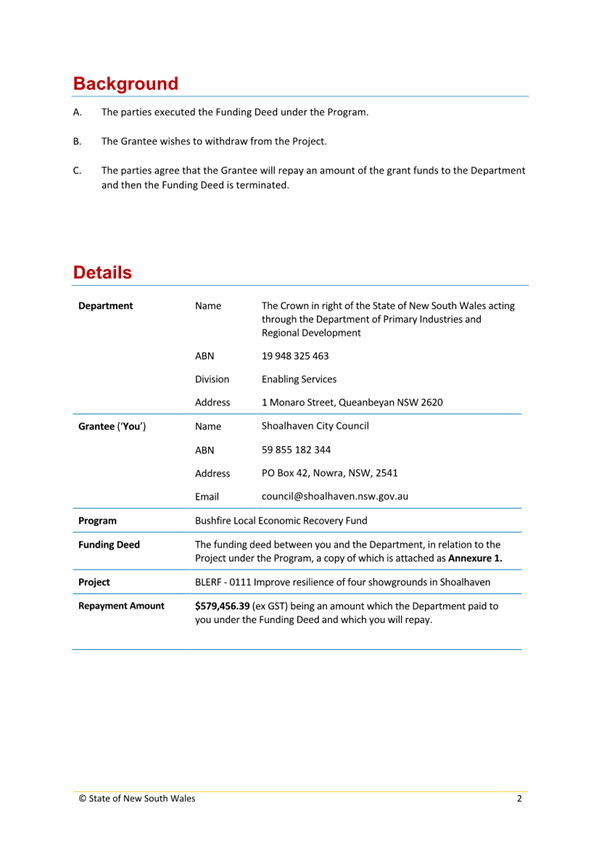

|

|

Revenue generation

|

Increase in revenue – fees and charges review

– general fund

|

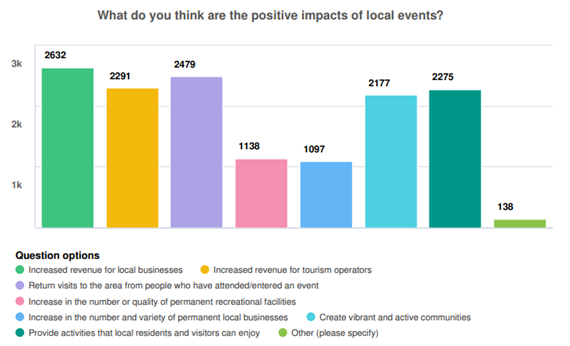

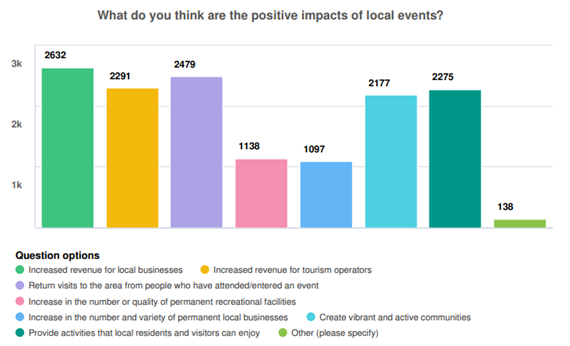

Income

|

24/25

original budget

|

+$1,303,000

|

|

Revenue generation

|

Increase in revenue – DA fee recovery

|

Income

|

FY25

QBR1

|

+$50,000

|

|

Changes to operating hours

|

Reduced operating hours

|

Saving

|

FY25

QBR1

|

-$320,758

|

|

Other efficiency ideas

|

Reduction in general fund operating budgets

|

Saving

|

FY25

QBR1

|

-$322,934

|

|

Changes to operating hours

|

Reinstatement of operating hours – Berry and

Greenwell Point

|

Saving

reversal

|

FY25

QBR2

|

+$47,500

|

|

Changes to operating hours

|

Realisation of reduced operating hours – Shoalhaven

Entertainment Centre and Sanctuary Point Library

|

Saving

|

FY25

QBR2

|

-$12,900

|

|

Other efficiency ideas

|

Reduction in general fund operating budgets

|

Saving

|

FY25

QBR2

|

-$75,998

|

|

Revenue generation

|

Increase in revenue – Swim, Sport Fitness

|

Income

|

FY25

QBR2

|

+$10,000

|

|

Recurrent

productivity and efficiency general fund TOTAL

|

|

|

|

$2,548,090

|

One-off savings to date include:

|

Category

|

Initiative

|

Saving/Income

|

Realised

|

Amount

|

|

Pausing capital projects

|

Pause capital projects

|

Saving (deferred spend)

|

FY24 QBR3

|

-$90,000,000

(total project cost excluding grant funding)

|

|

Increased cost controls

|

23/24 reduced department spending (no discretionary

spending, holding vacancies)

|

Saving

|

FY24

QBR3

|

-$1,700,000

|

|

Increased cost controls

|

24/25 reduced department spending year to date across

general fund

|

Saving

|

FY25

QBR1

|

-$368,975

|

|

Plant and fleet

|

24/25 plant and fleet general fund asset sales

|

Revenue

|

FY25

QBR1

|

+$330,000

|

|

Increased cost controls

|

24/25 reduced department spending year to date across

general fund

|

Saving

|

FY25

QBR2

|

-$42,000

|

|

Salary savings

|

24/25 net salary savings from vacancies year to date

across general fund

|

Saving

|

FY25

QBR2

|

$1,606,602

|

|

Salary

savings

|

24/25

QBR3 net salary salaries from vacancies across general fund

|

Saving

|

FY25 QBR3

|

$1,276,000

|

|

Plant

and fleet

|

24/25

plant and fleet general fund asset sales

|

Revenue

|

FY25 QBR3

|

$407,924

|

|

One-off

productivity and efficiency general fund TOTAL

|

|

|

|

$95,731,501

|

Summary of financial outcomes

achieved to date:

During January to March 2025,

Council has no recurrent general fund savings/income and one-off savings/income

of $1.684 million. This brings the total recurrent general fund savings

to $2.548 million and one-off general fund savings/income to $95.731

million. This reflects the full financial sustainability actions taken

since the project commenced in early 2024.

In QBR1, an internally

restricted reserve was created, called the Financial Sustainability Reserve

(FSR). Savings realised from FY25 QBR1 onwards are transferred to the FSR

reserve. As at QBR2, the FSR balance was $2.8 million. As of QBR3,

the FSR balance has grown to $4.1 million.

Risk Implications

There are financial, resource

and reputational risks associated with not addressing the financial

sustainability of the organisation. These risks are being addressed

through risk assessment of activities undertaken and implementation of risk

mitigation measures, including but not limited to communications, engagement,

financial and workload planning.

As part of managing the risks,

regular community updates will be provided as the financial sustainability

initiatives progress.

|

|

Ordinary

Meeting – Tuesday 27 May 2025

Page

1

|

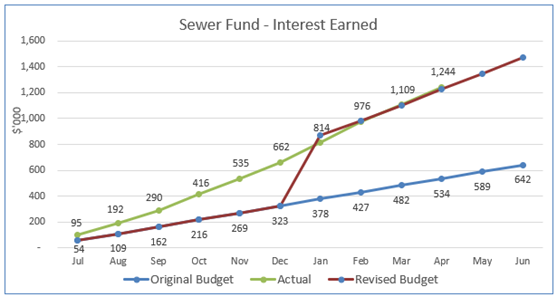

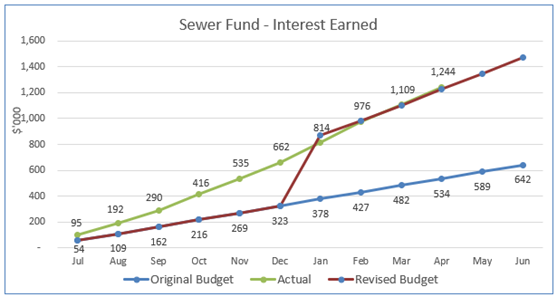

CL25.163 DPOP

2024-25 - Quarterly Performance and Budget Report (January - March)

HPERM Ref: D25/158720

Department: Government

Relations, Strategy & Advocacy

Approver: James

Ruprai, Acting CEO

Attachments: 1. DPOP

2024-25 - Quarterly Performance Report (January - March) (under separate cover)

⇨

2. Quarterly

Budget Report - March 2025 (under separate cover) ⇨

3. FY

24-25 – Q3 - Proposed Carry Forwards (under separate cover) ⇨

4. FY

24-25 – Q3 - Proposed Revotes (under separate cover) ⇨

5. Uncompleted

Notice of Motion and Mayoral Minutes Report - 1 October 2024 to 30 March 2025 (Addendum)

⇨

6. Completed Notice of Motion

and Mayoral Minutes Report - 1 October 2024 to 22 May 2025 (Addendum) ⇨

Purpose:

The purpose of this report is to

include the Quarter 3 performance report on the 2024-25 Delivery Program and

Operational Plan and present the proposed budget adjustments in the March 2025

Quarterly Budget Review for adoption.

Summary and Key Points for

Consideration:

· This

report outlines highlights for Quarter 3 performance (January to March 2025)

against actions and targets set in Council’s 2024-25 Delivery Program and

Operational Plan (DPOP).

· This

report includes the proposed budget adjustments outlined in the March 2025

Quarterly Budget Review Report.

· Council

has limited unrestricted funds. This continues to be a matter for concern for

Council and is regularly addressed in Council business papers, briefings and is

evident in Council’s Long Term Financial Plan.

· The

balance of grants spent in advance at 31 March 2025 decreased to $11.5M

(December 2024 grants in advance were $19.3M). The decrease from 31 December

2024 is due to grant receipts. Key grant monies collected in General Fund were

attributed to LRCI Phase 1, 2 & 4, Fixing Country Bridges, and Restart NSW

Sustainable Tourism. The receipts collected relating to Natural disasters were

funds for Emergency Works (EW) and Immediate Reconstruction Works (IRW) from

the 1012, 1034, and 1119 events.

· The

budget adjustments proposed (carry forwards and quarterly budget adjustments)

have a positive general fund unrestricted cash net impact of $0.4M. The 30 June

2025 forecast closing unrestricted cash balance has increased from $3.6M as

reported at the December quarter to $4.0M in the attached report.

· Savings

of $1.3M realised this quarter and quarantined within the internally restricted

Financial Sustainability Reserve (FSR) bring the reserve balance to $4.1M at 31

March 2025. Had this $4.1M not been quarantined within the FSR general fund

unrestricted cash would have been forecast to be $8.1M.

· General

Fund budget adjustments are positive and result in a reduction to the forecast

general fund operating deficit. The major adjustments outlined in this report

are a decrease in Waste Levy expenses and the reduction in forecast employee

expenses.

· Net

favourable budget adjustments are proposed for both Water and Sewer Fund,

increasing the projected operating surplus forecast for each fund.

· Council

will not achieve the mandated Office of Local Government (OLG) performance

measures for 30 June 2025 – including Operating Performance Ratio and

Infrastructure Renewal Ratio. Council is forecast to meet the required NSW

Treasury Corporation debt covenant ratios.

|

Recommendation

That

Council:

1. Receive the March Quarterly

Performance Report on the 2022-26 Delivery

Program and 2024-25 Operational Plan and

publish on Council’s website.

2. Receive the March 2025 Quarterly

Budget Review Report.

3. Adopt the budget adjustments as

outlined in the March 2025 Quarterly Budget Report Document.

|

Options

1. Adopt the

recommendation

Implications: The budget will be adjusted as

outlined in the March 2025 Quarterly Budget Report Document.

2. Adopt an

alternative recommendation

Implications: Staff will be required to rework the

quarterly performance and budget report in accordance with the alternative

resolution.

Background and Supplementary

information

Section 404 of the Local

Government Act, 1993 requires the General Manager (Chief Executive Officer) to

provide progress reports to the Council with respect to the principal

activities detailed in the Delivery Program (Operational Plan) at least every 6

months. Furthermore, all councils must continue to consider a Quarterly

Budget Review report.

Clause 203 of the Local

Government (General) Regulation 2021 requires the Responsible Accounting

Officer (Chief Financial Officer) to prepare and submit to the Council, a

Quarterly Budget Review Statement that shows, by reference, the estimates of

income and expenditure set out in the Operational Plan and a revised estimate

of the income and expenditure for the full financial year.

The Responsible Accounting

Officer is also required to report as to whether they believe the financial

position of the Council is satisfactory, having regard to the original estimate

of income and expenditure.

The March 2025 Quarterly Budget Review Statement (QBRS)

includes an analysis of the year-to-date result and the reasons for the

adjustments from the previously adopted budget by fund. Any proposed changes to

the budget are included in the attached March Quarterly Budget Review

Statement.

Summary of Delivery Program

Operational Plan 2024-25 Performance

Table 1 below provides a

breakdown of performance as at 31 March 2025 across each of the key themes

outlined in the Community Strategic Plan - Shoalhaven 2032.

Table 1: Action performance as at 31 March 2025 by Community Strategic

Plan 2032 Theme area

|

CSP Theme

|

Progress snapshot

|

|

Resilient, safe,

accessible and inclusive communities

|

94% actions on track or

completed

|

|

Sustainable, liveable

environments

|

89% actions on track or

completed

|

|

Thriving local

economies that meet community needs

|

94% actions on track or

completed

|

|

Effective, responsible

and authentic leadership

|

92% actions on track or

completed

|

Of the 135 DPOP actions, the

following five actions have been rated as ‘Completed’ in the third

quarter of the year:

· 1.1.02.01

- Work with the NSW Government to progress the Crown Lands Plans of Management

· 2.1.04.01

– Stage works greater than $250,000 with a Design/Approval stage and

Construction/Commissioning Stage in separate financial years

· 4.2.03.01

– Annual review and update of Council’s Workforce Plan to ensure

strategies are updated and implemented

· 4.2.10.01

– Establish an Enterprise Project Management Office to oversee and

support project governance through management of the corporate Project

Management Framework and asset project readiness for inclusion in capital

budgets

· 4.3.01.04

– Support the conduct of the 2024 Local Government elections

The remaining 130 actions are rated as ‘on

track’, ‘on hold’, ‘deferred’ or ‘requires

attention’.

Key

Highlights

Council has consistently

delivered a range of services, projects and activities which work towards

achieving the 11 key priorities outlined in Council’s Delivery Program

2022-26. Performance comments are provided in the report against each of the 135

actions and related targets in Council’s 2024-25 Operational Plan.

The complete DPOP Quarterly

Performance Report (January - March) is included as Attachment 1.

Significant achievements between

January and March 2025 include:

· Initiatives

undertaken to support and foster connections in the community were Harmony

Week, Thrive Together Pop Ups, International Women’s Day Committee,

Neurodiversity Panel and Youth Week Planning.

· Completion

of the Lake Conjola Fire Station upgrade.

· Open

Space and Recreation Planning have submitted all Plans of Management to Crown

Lands for review, with permission to exhibit received for all documents.

· Local

Repair Program projects completed this quarter include repairs to Jervis Bay

Road, Burrier Road, Greenwell Point Road, Forrest Road and Yalwal Road pavement

rehabilitation and widening.

· Stormwater

Drainage Program projects completed include Scott Street sinkhole and Callala

Beach sinkhole.

· Pathways

Program projects completed include the Myola Active Transport (South Coast

Footpaths) and River Road, Shoalhaven Heads.

· Advocacy

on behalf of businesses and community for connectivity upgrades and expansion

of mobile and internet networks this quarter included increasing the bandwidth

in the town of Berry for peak periods, investigation of AI technologies for

Council systems, and investigation into wi-fi options at community hubs.

· The

Tourism Van was active at Berry Markets, Ulladulla Civic Centre and White Sands

Park supporting local and international travellers. There were 1,421 new

visitors to the online shop this quarter with strong sales for local products,

souvenirs, Valentine’s Day hampers, beach guides, climbing books and

hiking maps.

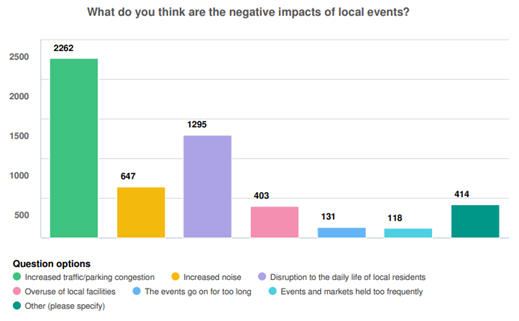

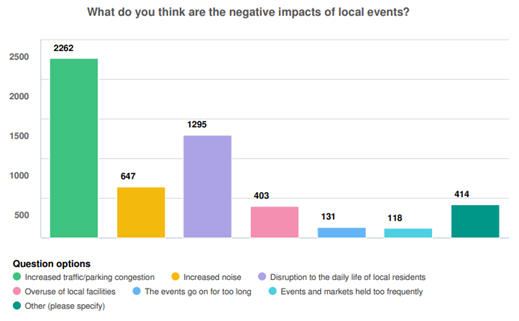

· Media

and Communications unit held 18 active community engagement projects. The

‘Get Involved’ site saw 22,693 visitors, with 4,421 individuals

completing the surveys. The top three survey responses were for events in

Huskisson, the Community Infrastructure Strategic Plan and the Community

Strategic Plan.

Requires

Attention

Table 2 below outlines

the six Action items that have been reported as ‘requires

attention’ at 31 March 2025. Full performance comments are in the

attached report and remedial actions have been reported to senior management.

Table 2: DPOP Actions

rated as ‘requires attention’ as at 31 March 2025

|

Ref.

|

Action

|

Quarter 3 Comment (summary)

Full comments in attached report

|

|

1.1.06.01

|

Implement an inspection

regime required to ensure the satisfactory operation of on-site sewage

management systems for the maintenance of public and environmental health

|

Environmental Health

Officers are implementing the inspection regime for on-site sewage management

systems. Where systems have failed the inspection appropriate compliance

action is undertaken to achieve compliance which is supported by education on

the operation of the respective system and the associated health and

environmental risks associated with poorly performing or managed systems.

|

|

2.2.01.01

|

Finalise the local

planning documents to guide the development of the Moss Vale Road North Urban

Release Area

|

Public Exhibition

outcomes for Draft Development Control Plan Chapter and Infrastructure

Funding Options Paper for the Urban Release Area reported to Council in

February 2025 for consideration. Council resolved to 'defer' the matter to a

briefing.

|

|

2.2.01.02

|

Develop planning

controls and character statements to manage the contribution new development

makes to neighbourhood or local character, including contemporary development

and heritage controls for Berry

|

Work

progressing including:

City

Wide LEP Character aims/objectives - Planning Proposal exhibition reported to

Council Nov 2024. Matter paused to enable briefing that was held on 3 April

2025. Next steps pending.

Strategic

Growth Principles - adopted in Dec 2024. LSPS document being amended to

incorporate.

Additional

Heritage Conservation Area in Berry - Planning Proposal to amend the LEP

submitted to NSW Gov for required initial Gateway Determination in Dec 2024.

Decision pending.

New DCP Chapter, Berry

East - draft to be reported to Council for consideration in April 2025 to

enable it to progress to exhibition.

|

|

2.2.02.01

|

Assess and determine development

applications within legislative timeframes and community expectations

|

The

percentage of DAs which have been determined within 40 statutory days has

declined in the latest quarter. Further focus is required on improving

internal processes and identifying efficiencies. The overall performance of

Development Services has improved for the quarter in line with the new

metrics used in the Minister's Statement of Expectations Order for 2024-25.

|

|

2.3.03.02

|

Support organisational

environmental due diligence

|

This

action relates to the completion of environmental assessments. For this

quarter, this primarily includes the completion of Review of Environmental

Factors (REF) for existing dog off-leash access areas. Work on REFs has

continued and two final drafts were completed (Cormorant Beach and Shoalhaven

Heads Seven Mile Beach). These are undergoing final review.

|

|

3.1.03.01

|

Promote

the Shoalhaven as a diverse region with a focus on off-season visitation

|

Summer in Shoalhaven is

peak season however spend year on year for the quarter has been down 10% by

both locals and visitors. This is due to cost of living pressures as well as

a decrease in marketing across all levels of government. Engagement and leads

to shoalhaven.com are down 16% due to a significant decrease in operational

budget.

|

On

Hold

Table 3 below, outlines

the five Action items that have been reported as ‘on hold’ as at 31

March 2025. Full performance comments are in the attached report and remedial

actions have been reported to senior management.

Table 3: DPOP Actions

rated as ‘on hold’ as at 31 March 2025

|

Ref.

|

Action

|

Quarter 3 Comment (summary)

Full comments in attached report

|

|

1.2.02.02

|

Staged implementation of

Shoalhaven Entertainment Centre's Strategic Business and Marketing Plan

|

Shoalhaven Entertainment Centre's Strategic Business

and Marketing Plan is on hold due to a pending service review.

|

|

4.1.03.01

|

Review and update the

Bereavement Services Business Plan to reflect updated licencing requirements

and legislation

|

Service review in progress. Business Plan will be updated

once review completed and recommendations considered. Interment Industry

Scheme and Licencing requirements will be included in the updated plan.

|

|

4.1.01.02

|

Run 'Voice of the

Customer' programme by responding to feedback and identifying process

improvements to close the feedback loop

|

The program was on hold during Q3 for phone and in

person customer satisfaction surveys due to the cost. Customer requests

satisfaction surveys were still active and a process is in place to review

the feedback and identify improvements. Customer request customer

satisfaction in Q3 was 87.1%. Phone CSAT surveys have been enabled in Q4.

|

|

4.2.01.05

|

Complete review and

update of the key strategic business documents and plans of Shoalhaven Water

as required under the Regulatory and Assurance framework for local water

utilities

|

Work continues on the Development Servicing Plan, to

include in Long Term Financial Plan that will inform the Shoalhaven Water

Strategic Business Plan. This plan will be presented to Council during the

next financial year.

|

|

4.3.01.01

|

Facilitate staff

education and awareness of the International Association for Public

Participation (IAP2) Framework

|

Funding for staff training in IAP2 has been requested

and is under consideration for FY25-26.

|

Deferred

There are no Action items that

have been reported as ‘deferred’ as at 31 March 2025.

Quarterly Notices of Motion

Reports

The full report of Uncompleted and Completed Notices of

Motion’s, Attachment 5 and Attachment 6, will be provided

as an addendum.

March 2025 Quarterly Budget Results

Overview

The areas of focus for the

quarter ended 31 March 2025 were:

· The

adoption of the budgeting strategies and guiding economic parameters for the

preparation of the initial Draft of the 2025/26 Budget (MIN25.27).

· The

lodgement of an application with the Independent Pricing and Regulatory

Tribunal (IPART) for a Special Rate Variation increase of 12%. (MIN24.691)

· Working

on the Delivery Program Operational Plan and Budget 2025-26 including a series

of four Councillor briefings on the proposed Draft Budget covering areas of

Capital Carry Forwards, the 2026 Proposed Capital Program, FY 2026 Operational

Income and Expenditure and Projected Cash Position. All materials presented,

including a detailed Department by Department Operating Position and Head

Count, were provided to Councillors on the Councillor Portal.

Council’s Financial

Sustainability Review (FSR) project continued during the quarter with $1.3M in

additional savings being realised for the 3-month period to 31 March 2025. The

savings have been quarantined in Council’s FSR Reserve which currently

stands at $4.1M and predominately consisted of salary savings. Salary savings

were calculated as the net result of general fund vacancies realised to 31

March 2025 less redundancies paid, and adjustments required for additional

workers compensation, and on-costs.

Favourable adjustments also

included a decrease of $4.8M in other expenses arising from the receipt of

prior years’ refunds of Waste Levy. A review was undertaken of the past

three years of Waste Levies paid, and tonnage over the weighbridge had not been

fully reduced for allowable deductions for waste diverted from landfill. This

saving all relates to the restricted Waste fund and does not impact

unrestricted cash, but it does improve the balance of the Waste Fund

restriction. Most of the positive adjustments in the March quarter related to

restricted sources and had little impact on General Fund unrestricted cash.

The key driver of the $448K

increase in general fund unrestricted cash was attributed to positive budget

adjustments relating to Strategic Planning Projects mainly on the Nowra

Riverfront. This anticipated improvement in cash position is important because

of Council’s limited unrestricted funds balance, which is regularly

addressed in Council business papers, briefings and is evident in Council Long

Term Financial Plan (LTFP). Management of Council’s cash position

continues to require considerable effort from the Finance and Disaster Recovery

Teams to ensure that Council’s restricted cash reserves are not breached

– given the on-going expenditure on disaster recovery works and the

resulting processing and receipt of recovery and other grant funding

acquittals.

At 31 March 2025, Council has

spent $11.5M of General Fund cash in advance for grant funded projects whereby

the grant monies have not yet been receipted, with $5.9M of this relating to

Natural Disaster projects. This resulted in a preliminary negative unrestricted

cash position of $13.5M. To restore Council’s unrestricted cash back to

NIL, the Council’s internal restrictions were utilised in accordance with

Council’s Liquidity Contingency Policy. This policy ensures that external

restriction amounts remain protected.

The majority of the $5.9m grants spent in advance ($3.0m

decrease from last quarter) relates to Public Works funded projects restoring

levees from the damage caused by Natural Disaster Event 1034. It is unlikely

that any grant funds for these projects will be receipted prior to 30 June

2025.

It is imperative that Council

remains cash flow positive when delivering these significant works. Failure to

do so will place pressure on Council’s unrestricted cash position and

could result in projects being temporarily suspended until cash is made

available.

Preliminary General Fund Year

End Results and Quarterly Review Movements

General Fund

Council’s General Fund

revised December budget for 2024-25 was projecting a deficit before capital of

$20.3M or an Operating Performance Ratio of negative 8.5%. This quarterly

review has identified a decrease in Council’s projected General Fund’s

deficit as a result of continued salary savings and one-off Waste Levy refunds.

The updated projected General Fund deficit is $12.8M or Operating Performance

Ratio of negative 6.1%.

The savings for the quarter

include $1.3M in Financial Sustainability Review savings that were identified,

removed from budgets and transferred to a Financial Sustainability Reserve.

The following table presents a

high-level summary of the budget and movements for the General Fund for Quarter

3 2024-25:

Table 4: General Fund budget movements for Quarter 3 2024/25

|

($'000)

|

Current Adopted Budget

|

March QR Adjustments

|

March QR Revised Budget

|

YTD Actuals

|

|

Favourable / (Unfavourable)

|

|

Net Operating Result

|

35,602

|

2,418

|

38,020

|

56,651

|

|

Net Operating Result before Capital Grants & Contributions

|

(20,336)

|

7,556

|

(12,780)

|

32,680

|

Finance is closely monitoring

actual expenditure across Council. The improvements in financial culture, which

have been embedded throughout the organisation over the previous 12 months,

have resulted in improved fiscal outcome for the organisation. YTD expenditure

is $231M compared to a full year proposed revised budget of $330M – this

represents 70% of the full year budget (as revised at Q3) and is an appropriate

year to date spend.

Actual employee costs are

currently 68.7% of the proposed revised full year budget (which was revised

downwards this quarter). This is under the three-quarter mark at 75% despite

the peak summer period having just passed. Further salary savings are expected

in the last quarter of the year due to vacancies which are likely to improve

Council’s net operating deficit position.

Materials

and services YTD expenditure represents 65.9% of the revised full year budget

which is below the 75% expected at 31 March. Areas of council that are planning

for more materials spending in Q4 include:

· Waste (timing

of invoices mainly waste contracts and electricity)

· Swim

Sport and fitness (timing of expenses due to seasonality of maintenance work)

· Environmental

Services (conducts operational projects that can only be completed at certain times

of the year which were partially completed in Q3 and continue into Q4).

· Building