Ordinary Meeting

Meeting Date: Tuesday,

25 February, 2025

Location: Council

Chambers, City Administrative Building, Bridge Road, Nowra

Time: 5.30pm

Membership

(Quorum – 7)

Clr

Patricia White – Mayor

Ward 1 Ward

2 Ward

3

Clr Jason Cox Clr

Ben Krikstolaitis Clr

Denise Kemp

Clr Matthew Norris -

Assist. Deput Mayor Clr Bob Proudfoot Clr

Gillian Boyd

Clr Peter Wilkins -

Deputy Mayor Clr

Jemma Tribe Clr

Karlee Dunn

Clr

Selena Clancy Clr

Luciano Casmiri Clr

Natalee Johnston

Please note: The proceedings of this meeting (including presentations,

deputations and debate) will be webcast, recorded and made available on

Council’s website, under the provisions of the Code of Meeting

Practice. Your attendance at this meeting is taken as consent to the

possibility that your image and/or voice may be recorded and broadcast to the

public.

Shoalhaven City Council live

streams its Ordinary Council Meetings and Extra Ordinary Meetings. These

can be viewed at the following link

https://www.shoalhaven.nsw.gov.au/Council/Meetings/Stream-a-Council-Meeting.

Statement

of Ethical Obligations

The Mayor and Councillors are

reminded that they remain bound by the Oath/Affirmation of Office made at the

start of the council term to undertake their civic duties in the best interests

of the people of Shoalhaven City and to faithfully and impartially carry out

the functions, powers, authorities and discretions vested in them under the

Local Government Act or any other Act, to the best of their skill and

judgement.

The Mayor and Councillors are also reminded of the

requirement for disclosure of conflicts of interest in relation to items listed

for consideration on the Agenda or which are considered at this meeting in

accordance with the Code of Conduct and Code of Meeting Practice.

Agenda

1. Acknowledgement

of Country

Walawaani (welcome),

Shoalhaven City Council recognises the First Peoples

of the Shoalhaven and their ongoing connection to culture and country. We

acknowledge Aboriginal people as the Traditional Owners, Custodians and Lore

Keepers of the world’s oldest living culture and pay respects to their

Elders past, present and emerging.

Walawaani njindiwan (safe journey to you all)

Disclaimer: Shoalhaven City Council acknowledges and

understands there are many diverse languages spoken within the Shoalhaven and

many different opinions.

2. Moment of

Silence and Reflection

3. Australian

National Anthem

4. Apologies /

Leave of Absence

5. Confirmation

of Minutes

· Ordinary

Meeting - 18 February 2025

6. Declaration

of Interests

7. Presentation of Petitions

8. Mayoral Minute

Mayoral Minute

MM25.1....... Mayoral Minute - 2025 Australia Day Honours........................ 1

MM25.2....... Mayoral Minute - 2025 Shoalhaven City Council

Australia Day Awards...................................................................................... 2

MM25.3....... Mayoral Minute - Senior Staff Contractual Matters

Committee - Appointment of a CEO........................................................... 4

MM25.4....... Mayoral Minute - Freedom of Entry 2026................................ 8

MM25.5....... Mayoral Minute - Waminda Birthing on Country -

Major Milestone - Minga Gudjaga Gunyahlamia Birth Centre and Community Hub........................................................................ 9

9. Deputations and Presentations

10. Notices of Motion / Questions on Notice

Notices of Motion / Questions on Notice

CL25.25....... Notice of Motion - Fleet & Plant

Accountability and Transparency......................................................................... 14

CL25.26....... Notice of Motion - AEC Fleet & Plant Service

Review Report................................................................................................ 15

CL25.27....... Notice of Motion - AEC Financial Sustainability

Review - Actions Taken to Reduce FBT Liability.................................. 16

CL25.28....... Notice of Motion - Shoalhaven City Council Apply

the Statutory Minimum for the Cambewarra Pony Club.............. 17

CL25.45....... Notice of Motion - Council's Green Electric

Vehicle Policies 19

CL25.46....... Notice of Motion - Southern Water Services

Entity............... 20

CL25.47....... Notice of Motion - Pensioner Rebates................................... 21

CL25.48....... Notice of Motion - Community Lease Policy

Consideration.. 23

11. Call Over of the

Business Paper

12. A Committee of the

Whole (if necessary)

13. Committee Reports

Nil

14. Reports

CEO

CL25.49....... Financial Sustainability Productivity and

Efficiency Report... 24

City Performance

CL25.50....... DPOP 2024-25 - Quarterly Performance and Budget

Report (October - December)............................................................ 31

CL25.55....... Investment Report - January 2025........................................ 44

CL25.51....... Policy - Councillor Expenses and Facilities........................... 50

CL25.52....... Ongoing Register of Pecuniary Interest Returns -

January 2025........................................................................................ 57

CL25.53....... Code of Conduct and Code of Conduct Procedures............. 59

CL25.54....... Complaint Handling Policy..................................................... 62

City Services

CL25.56....... Audit Kerbside Wheely Bins Use & Cross

Contamination Levels..................................................................................... 65

City Development

CL25.57....... Consideration - Proponent DCP Amendment Request

– 48 to 52 Paradise Beach Road, Sanctuary Point.......................... 73

CL25.58....... Adjustment - Delegation - Plan Making (LEP)

Process......... 86

CL25.59....... Progress Update - Detailed Planning - Moss Vale

Road North Urban Release Area............................................................... 89

Shoalhaven Water

CL25.60....... Connection to Town Sewerage System - 20 Church

Street Milton - DA24/2386................................................................ 99

CL25.61....... Policy Review - Backflow Prevention and Cross

Connection Control.................................................................................. 103

15. Confidential Reports

Nil

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

MM25.1 Mayoral

Minute - 2025 Australia Day Honours

HPERM

Ref: D25/59010

|

Recommendation

That Council recognise and congratulate Mrs Nellie Mooney OAM

of Burrill Lake, who was the only Shoalhaven recipient in the Governor

General’s 2025 Australia Day Honours.

|

Details

On 26 January 2025, 732

recipients were recognised in the 2025 Australia Day Honours List, as bestowed

by the Governer-General and Chancellor of the Order of Australia, Her

Excellency the Honourable Ms Sam Mostyn AC.

The Shoalhaven this year had one

recipent, Mrs Nellie Mooney of Burrill Lake who received an OAM in recognition

of her service to the Indigenous commuities of the Shoalhaven region as per the

citation below:

THE ORDER OF AUSTRALIA IN THE

GENERAL DIVISION

Nellie Beatrice Mooney OAM of

Burrill Lake for service to the Indigenous community of the

Shoalhaven region.

· In

1988 Nellie was one of the founding members of the Wandarma Aboriginal

Education Consultative Group in Ulladulla. She held the position of

President from 1988 to 2018 and became a Life Member in 1996.

· In

1987 Nellie was one of the founding members of the Aboriginal Homework Centre

– Milton-Ulladulla District and was a Coordinator from 1987 to 2008.

· As

an inaugural member of the Ulladulla Aboriginal Land Council since 1988, Nellie

has held the position of Chairperson, President and Board Member for a period

of nine years each.

· In

1982 Nellie was one of the founding members of the South Coast Medical Service

Aboriginal Corporation (formerly Nowra Aboriginal Medical Services) and also an

Inaugural Board Member.

· Nellie

was awarded the Shoalhaven City Council’s Australia Day Citizen of the

Year Award in 2018 and the Nanga Mai Award, NSW Department of Education in

2015.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

MM25.2 Mayoral

Minute - 2025 Shoalhaven City Council Australia Day Awards

HPERM

Ref: D25/59880

|

Recommendation

That Council acknowledge all nominees and write to

congratulate the winners of the Shoalhaven City Council Australia Day Awards

which were presented on 26 January 2025 in a combined Citizenship and

Australia Day Award Ceremony held at Swordfish Brewery, Sussex Inlet.

|

Details

A very successful Shoalhaven

Australia Day Awards and Citizenship Ceremony was held at the Swordfish

Brewery, Sussex Inlet on Sunday 26 January 2025.

Australia Day Amabassdor, Mr

Andy Paschalidis an accomplished sports journalist, broadcaster and

humanitarian attended the event as our special guest, presenting the awards to

the recipients and later facilitated free heart health testing kiosks at the

event as part of his charity, Heartbeat of Football.

Twenty-six people were nominated

for the three awards, with winners selected by the Shoalhaven City Australia

Day judging panel.

I would like to congratulate the

following winners:

· Shoalhaven

Citizen of the Year Winner:

David Vadre Jones won the

Shoalhaven Citizen Award for his tireless volunteer work and fundraising. He

was the driving force behind the establishment of the Coastal Patrol and

Neighbourhood Centre in Sussex Inlet, combined with his involvement in the

local Men's Shed, Neighbourhood Watch and volunteering at Inasmuch Community

Residential Aged Care.

· Young

Citizen of the Year:

William Dewsbury-Love was

awarded the Shoalhaven Young Citizen Award for being an integral member of the

Shoalhaven High School community for six years, demonstrating a genuine passion

for creating positive change both at school and beyond.

· Proudly

Australian Award:

The Proudly Shoalhaven Award, open to

individuals and community groups, was given to North Shoalhaven Meals on

Wheels which has been operating for 58 years with an army of 250 volunteers

who cook, pack and deliver meals each day throughout the Shoalhaven, while Peter

Williams, who has played his bugle at Anzac Day and Remembrance Day

services at local schools to thousands of students for the past 20 years,

received highly commended for the Proudly Shoalhaven Award.

The Citizenship Ceremony was

also a highlight of the day with 32 conferees making their pledge to to become

an Australian.

Congratulations to the staff

involved in bring the event together and thank you to Clr Peter Wilkins, Deputy

Mayor who was the MC for the day and to Councillors Clancy, Kemp and Norris for

assisting staff on the day.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

MM25.3 Mayoral

Minute - Senior Staff Contractual Matters Committee - Appointment of a CEO

HPERM

Ref: D25/69302

|

Recommendation

1. That

the Purpose, Delegated Authority and membership of the Senior Staff and Contractual

Matters Committee be as follows:

|

Meetings per year – As required

No set commencement time

|

Quorum – Three (3)

(5001E)

|

|

Purpose and Delegated Authority

The Committee be

delegated authority under Section 377 of the Local Government Act to consider information and advice from the Chief

Executive Officer (CEO) with respect to organisational structure and

related topics.

CEO Appointment and Performance Review

Sub- Committee

In

accordance with the ‘Guidelines for the Appointment and Oversight of

General Managers 2022’:

1. Undertake recruitment for the

position of the CEO in the circumstance that the position becomes vacant as

follows:

a. Final short- listing of candidates

b. Interview of Short-listed

candidates

c. Ensuring reference checks and other

relevant background checks are completed

d. Completion of a Selection Panel

Report which is to be provided for consideration to a closed Meeting

of the Council that:

i. outlines the selection process

ii. recommends the most meritorious applicant with

reasons

iii. recommends an

eligibility list if appropriate

iv. recommends that no

appointment is made if the outcome of interviews is that there are no

suitable applicants

2. Undertake performance reviews

of the CEO including:

a. inviting

non- member Councillors to contribute to the performance review process by

providing feedback to the mayor on the CEO’s performance relevant to

the agreed performance criteria.

b. conducting

performance reviews

c. reporting

the findings and recommendations of reviews to the council in closed

session for determination, and

d. development

of the performance agreement.

Note: Section 377(1)(a) of the Local

Government Act provides that the appointment of a Chief Executive Officer

(General Manager) can only be determined by resolution of the Elected

Council.

|

|

Chairperson – Mayor

|

|

2024-2025 Councillor / Staff Membership

Mayor White - Chairperson

All Councillors

CEO

|

Sub- Committee to

undertake Delegations 1&2:

• Mayor

(Clr White)

• Deputy

Mayor ( Clr Wilkins)

• Assistant

Deputy Mayor ( Clr Norris)

• Clr Clancy ( as

per resolution MIN254.530)

Additional Member – Delegation 1

• Independent

Member

Additional Members – Delegation 2

• Appointed

External Professional Facilitator (Observer)

• Clr Nominated by CEO

|

2. That the Council formally delegate

to the Mayor the following tasks with respect the Appointment of a CEO :

a. Selection of provider of Recruitment

Services in accordance with Council Procurement Procedures

b. Securing the services of an

Independent Person to participate in the appointment process.

c. The CEO’s position description

is current and evaluated in terms of salary to reflect the responsibilities

of the position.

d. The proposed salary range reflects

the responsibilities and duties of the position.

e. The position is advertised according

to the requirements of the Act.

f. Information packages are

prepared, and

g. Applicants selected for interview

are notified.

|

Details

Council at the Meeting held on

28 October 2024 resolved to appoint members to the Senior Staff Contractual

Matters Committee as outlined in MIN24.530.

In preparation for the

recruitment of the CEO, I have identified that in accordance with the Guidelines

for the Appointment and Oversight of General Managers issued by the Office

of Local Government it would be in the interest of the Council to make slight

amendments to the arrangements that Council has in place for the operation of

that Committee.

The resolution of the Council of

28 October 2024 was as follows: (MIN24.530)

SENIOR STAFF AND

CONTRACTUAL MATTERS COMMITTEE :

|

Meetings per year – As required

No set commencement time

|

Quorum – Three (3)

(5001E)

|

|

Purpose and Delegated Authority

The Committee be

delegated authority under Section 377 of the Local Government Act to consider information and advice from the Chief

Executive Officer (CEO) with respect to organisational structure and related

topics.

CEO Appointment and Performance Review

Sub- Committee

In

accordance with the ‘Guidelines for the Appointment and Oversight of

General Managers 2022’:

1. Undertake recruitment for the

position of the CEO in the circumstance that the position becomes vacant.

2. Undertake performance reviews

of the CEO including:

a. inviting non- member Councillors to contribute to the performance

review process by providing feedback to the mayor on the CEO’s

performance relevant to the agreed performance criteria.

b. conducting performance reviews

c. reporting the findings and recommendations of reviews to the council

in closed session for determination, and

d. development of the performance agreement.

Note: Section 377(1)(a) of the Local

Government Act provides that the appointment of a Chief Executive Officer

(General Manager) can only be determined by resolution of the Elected

Council.

|

|

Chairperson – Mayor

|

|

2024-2025 Councillor / Staff Membership

Mayor White - Chairperson

All Councillors

CEO

Sub- Committee to

undertake Delegations 1&2:

Mayor White

Deputy Mayor Clr Wilkins

Clr Clancy

Appointed External Professional Facilitator

(Observer)

Clr Nominated by CEO

|

In preparation for the

recruitment of the CEO, I have identified that in accordance with the Guidelines

for the Appointment and Oversight of General Managers issued by the Office

of Local Government it would be in the interest of the Council to make slight

amendments to the arrangements that Council has in place for the operation of

that Committee.

Proposed amendments to the

changes recommended in this Minute are :

1. Including an

additional Councillor on the Sub- Committees

The addition of another Councillor on the Sub- Committee

which is established with respect to both appointment and performance review

would be beneficial for the processes. It is proposed in this report that the

Councillor holding the position of Assistant Deputy Mayor of the Council at the

time would be a suitable appointment. This would result in the Mayor, together

with the peers that Councillors appoint as their Deputy Mayor and Assistant

Deputy Mayor to fulfill these roles with another Councillor appointed

annually.

2. Clarifying the

delegations of the Sub- Committee of the Senior Staff Contractual Committee for

the separate tasks of Recruitment and Performance Review

The processes for the Appointment and Performance Review as

outlined in the Guidelines are distinct and separate.

For clarity it is proposed that amendments be made to the

structure and delegations to clarify the role of the CEO Appointment Sub-

Committee as follows:

(a) CEO Appointment Sub

– Committee

It is proposed that the following role of the Sub-Committee

for CEO Appointment as outlined in the Guidelines be included for clarity in

the guidelines as follows:

• Final

short- listing of candidates

• Interview

of Short-listed candidates

• Ensuring

reference checks and other relevant background checks are completed

• Completion

of a Selection Panel Report which is to be provided for consideration to

a closed Meeting of the Council that:

§ outlines

the selection process

§ recommends

the most meritorious applicant with reasons

§ recommends

an eligibility list if appropriate

§

recommends that no appointment is made if the outcome of interviews is that

there are no suitable applicants

In accordance with the provisions in the Guidelines, it is

therefore proposed that the Mayor will be delegated the following tasks with

respect to the early phases of the appointment process:

• Selection

of provider of Recruitment Services in accordance with Council Procurement

Procedures.

• Securing

the services of an Independent Person to participate in the appointment

process.

• the

CEO’s position description is current and evaluated in terms of salary to

reflect the responsibilities of the position

• the

proposed salary range reflects the responsibilities and duties of the position

• the

position is advertised according to the requirements of the Act

• information

packages are prepared, and

• applicants

selected for interview are notified.

3. Independent and Other

Committee Members.

It is proposed that the Sub- Committee arrangements be re-

worded to reflect the following:

• When

actioning the appointment delegations of the Sub-Committee ( Part 1) the

services of an independent person to the Council will be engaged to

participate. The individual selected by the Mayor will have appropriate

experience and background to understand the role of the CEO and the requisite

experience and attributes of an ideal candidate for the position.

• When

actioning with the performance review aspects of the delegation (Part 2) the

Sub- Committee membership will continue to be supplemented by an Appointed External Professional Facilitator

(Observer) and an additional Councillor who is nominated by the CEO.

It is proposed that the

arrangements outlined above be confirmed to facilitate the appointment of the

CEO position in a timely manner.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

MM25.4 Mayoral

Minute - Freedom of Entry 2026

HPERM

Ref: D25/72148

|

Recommendation

That Council:

1. Support hosting a Freedom of Entry

Ceremony and Civic Celebration in October 2026, noting the significance of

the Defence connection to the Shoalhaven.

2. Investigate

initial budget investigations and event planning commencement with key

stakeholders.

|

Details

Shoalhaven has a very, very

strong connection to the Australian Defence Force (ADF) with two Navy bases,

HMAS Albatross and HMAS Creswell and the Fleet Air Arm at Albatross being

located within our City.

Being a Defence City, Shoalhaven

has a long, proud tradition of valuing our relationship with the ADF, and in

doing so celebrating the tradition of the Mayor handing the keys to the City

over, in a reflection of the traditions in medieval times when cities were

fortressed

Traditionally, the Shoalhaven

have extended an invitation to ADF to have a Freedom of Entry Parade and Civic

Celebration every four years, with the last one being held in 2022 and

incorporated the Fleet Air Arm for the first time and their 75th

anniversary celebrations which coincided with the Freedom of Entry event.

Freedom of Entry is a formal

ceremony where the ADF receive a ceremonial scroll, marking open passage or

“the keys to the City” and signifies the bestowing of freedom of

the City. A Freedom of Entry is the highest accolade that can be bestowed on an

individual or group of citizens and signifies a high level of trust with the

recipients.

The ceremony itself is unique to

Navy and will create memories for many personnel who have never experienced

this event. The event is also a great opportunity for our community to show

their appreciation for our defence forces and their families posted locally.

Following recent discussions

with representatives of HMAS Albatross, HMAS Cresswell and the Fleet Air Arm a

keen interest was expressed to have another Freedom of Entry event as per the

four year schedule in October 2026, noting a key element of the ceremony is a

sunset salute which is best undertaken in the early weeks of daylight saving

which is the event is preferred to take place in October.

Should you wish to read more about this tradition.

Freedom of Entry | Royal Australian Navy

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

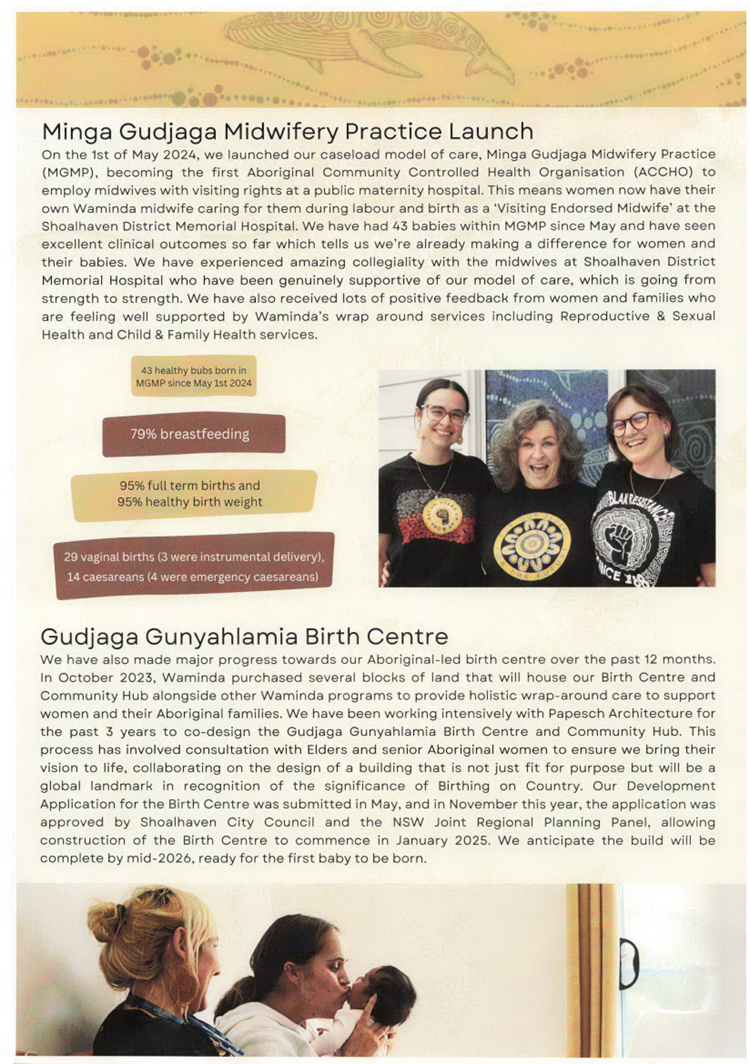

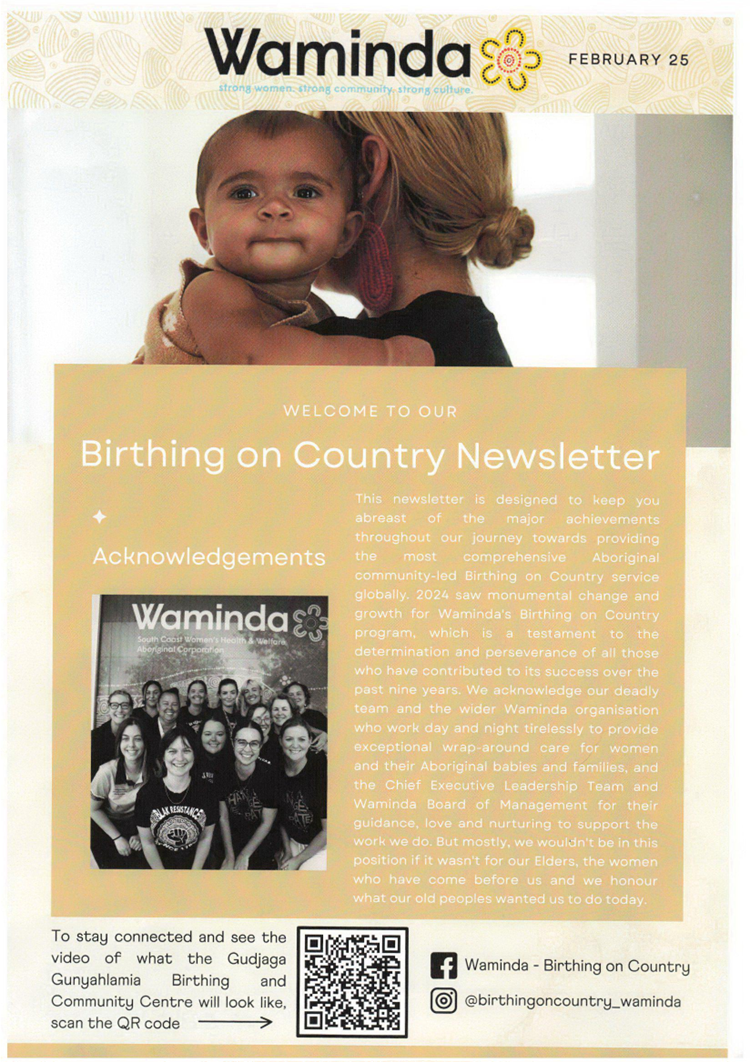

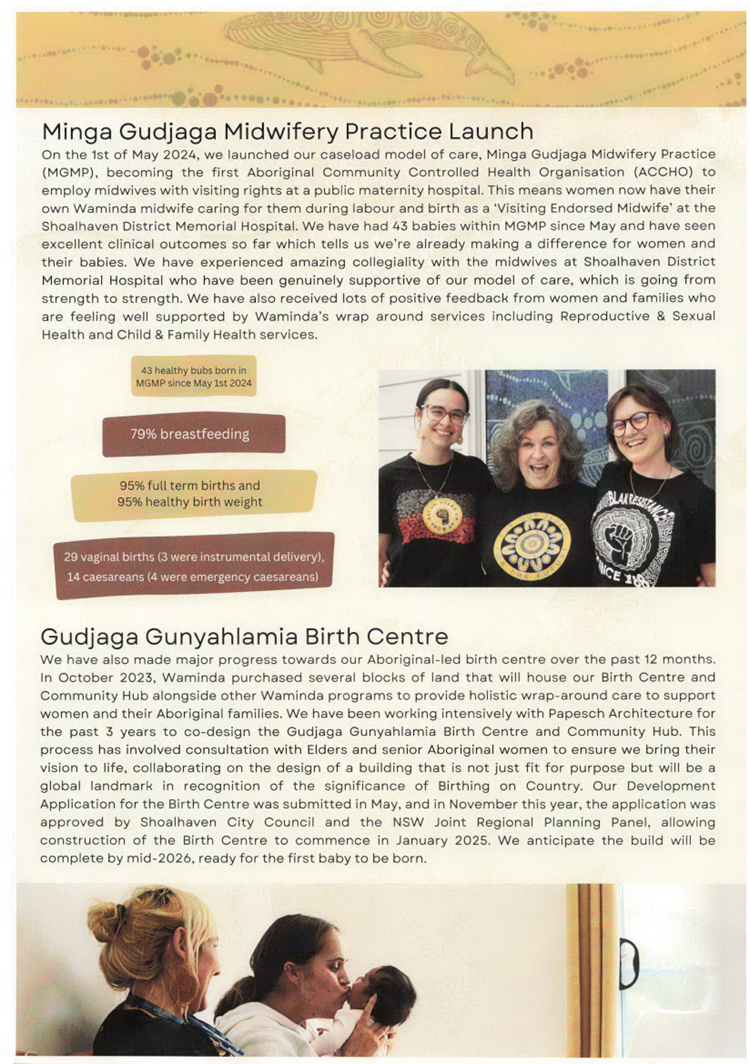

MM25.5 Mayoral

Minute - Waminda Birthing on Country - Major Milestone - Minga Gudjaga Gunyahlamia

Birth Centre and Community Hub

HPERM

Ref: D25/72170

Attachments: 1. Waminda

Newsletter ⇩

|

Recommendation

That Council write to Waminda acknowledging the recent sod

turning for the Birthing on Country project, on 18 February 2025 and

recognises this as a major milestone and achievement in progressing the

Gudjaga Gunyahlamia Birth Centre and Community Hub.

|

Details

On 18 February 2025 I had the

privilege to attend Waminda’s the sod turning ceremony, marking the

beginning of the Birthing on Country project, which aims to provide a holistic,

and comprehensive approach to pre and postnatal care for Aboriginal women,

children and their families.

The sod turning, which took

place on site at 102-106 Hillcrest Ave South Nowra, signifies the culmination

of an immense body of work that Waminda and other key stakeholders have done

over the past 3 years to bring this project to fruition.

On behalf of Shoalhaven City

Council, I congratulate Waminda and all those involved in this project, a world

first in Aboriginal community- led Birthing on Country service and look forward

to attending the opening event, following the completion of the projects in

approximately mid-2026.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.25 Notice

of Motion - Fleet & Plant Accountability and Transparency

HPERM Ref: D25/39207

Submitted

by: Clr Jason Cox

Note: This item was deferred from

the Ordinary meeting of 18 February 2025.

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That

Council instruct the Acting CEO to provide a list of ALL the new vehicles

including the types and models purchased throughout 2024 to 31 December and

the allocation and purpose thereof.

|

Background

Fleet and Plant accountability

and transparency in the public and rate payer's interest.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.26 Notice

of Motion - AEC Fleet & Plant Service Review Report

HPERM Ref: D25/42035

Submitted

by: Clr Jason Cox

Note: This item was deferred from

the Ordinary meeting of 18 February 2025.

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That

Council instruct the Acting CEO that the AEC Fleet & Plant Service review

report of June 2024 be moved from a confidential report to a public one.

|

Background

In the public and rate payer's

interest for transparency and accountability.

Note by the CEO

It would be in the interest of

the Council to resolve to Direct the Acting CEO to release the information

contained in the report which is not subject to confidentiality

provisions under legislation, OR that the Council be provided a report to a

future meeting which in effect releases the components of the report which are

not considered confidential under legislation.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.27 Notice

of Motion - AEC Financial Sustainability Review - Actions Taken to Reduce FBT

Liability

HPERM Ref: D25/42049

Submitted

by: Clr Jason Cox

Note: This item was deferred from

the Ordinary meeting of 18 February 2025.

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

In

relation to the AEC Financial Sustainability review report of November 2024.

The report mentions the FBT levels of 2021 to 2024 being of concern. Request

what actions have been taken to date to greatly reduce the FBT liability to

Council.

|

Background

FBT increased exponentially (up

to 10 times) from 2021 to 2024. A report showing how processes are being put in

place to address this is required to give transparency to the community over

councils management of fleet vehicles.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.28 Notice

of Motion - Shoalhaven City Council Apply the Statutory Minimum for the Cambewarra

Pony Club

HPERM Ref: D25/58681

Submitted

by: Clr Jason Cox

Note: This item was deferred from

the Ordinary meeting of 18 February 2025.

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That

Council:

1. Resolves to apply the minimum

statutory annual rental amount for the duration of the terms of its lease

with the Cambewarra Pony Club.

2. Direct the Acting CEO (or delegate)

to enter into negotiations with the Pony Club executive around various

provisions of the lease including, but not limited to, rates; waste services;

and, effluent pump-out arrangements, and that staff report the outcomes/options

arising from negotiations to Council.

3. The Pony Club retain the ability to

sub-lease and/or rent the property for use by others to assist the Clubs

ongoing viability.

|

Background

The Cambewarra Pony Club has been in existence for over 50

years and given the land was 100% donated specifically for the exclusive use of

the CPC it is a bit rough to hit a community group with SCC Rates on SCC land

they do a great job in maintaining.

The attempt by SCC to claim commercial rent on a club

membership of approx. 45 members is going to probably close them if there

isn’t some assistance as they would at $195 per member which is made up

of $60 to club for 2 free ride days per month and the balance to NSW Pony Clubs

of $135. They would have to double their membership to break-even / remain

potentially viable.

Note by the CEO

Councillors are advised the current lease (1/1/23 to 31/12/23)

is rent $800 p.a. + GST + lessee responsible for 100% outgoings (operational

land – all outgoings levied). A draft lease was proposed for

further 12 months (1/1/24 to 31/12/24) but has not been executed. That lease

had rent at $833 p.a. + GST + lessee responsible for 100% outgoings

(operational land – all outgoings levied)

Council has been discussing with the lessee, what agreement to

enter into, e.g.: exclusive lease to Club, lease with option to sub-licence,

seasonal licence, or hiring facility. There are differing views on appropriate

leasing/licensing arrangement. Annual rental around $1,000 p.a + 100% outgoings

is indicated by Councils valuer, for a future new exclusive lease.

The current minimum statutory

rent is $604 p.a. For Council, forgoing outgoing expenses is expected to be in

the vicinity of $3,000.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.45 Notice

of Motion - Council's Green Electric Vehicle Policies

HPERM Ref: D25/61911

Submitted

by: Clr Jason Cox

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

It

is requested that the Acting CEO furnish a detailed report on the cost of

acquiring and running these vehicles, in particular a full detailed costing

analysis of the previous Mayors Electric Vehicle, itemised running including

FBT, breakdown and any other relevant expenses.

|

Background

The previous Council had pursued

a policy of reducing emissions by purchasing electric vehicles. The previous

Mayor instigated a policy of purchasing electric powered vehicles, particularly

for her private and Council business use.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.46 Notice

of Motion - Southern Water Services Entity

HPERM Ref: D25/62332

Submitted by: Clr

Jason Cox

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That the Acting CEO prepare

a report to Council advising why, when and if the policy was updated/changed

to replace a nominated SCC Councillor with the CEO or nominated delegate.

Furthermore, what dividends has Southern Water Services paid Council over the

past 3 years? This report should be tabled for the next ordinary meeting of

council on the 11 March 2025.

|

Background

Historically, Southern Water

Services was initially set up to counter any moves by the State Govt to

incorporate Shoalhaven City Water into the catchment area of Sydney.

Previously, a nominated councillor was appointed to the Shoalhaven/Southern

Water Services Board. Currently the Acting CEO represents the Council on the

Southern Water Services board. In the interests of transparency and

accountability to ensure that the appointed delegate ensures the best financial

interest and return of Council and community ratepayers.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.47 Notice

of Motion - Pensioner Rebates

HPERM Ref: D25/62819

Submitted

by: Clr Denise Kemp

Clr Patricia

White

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That Council:

1. Advocate and write to the NSW

premier and state government for an increase in pensioner rebates (funded by

the NSW Government) for council rates, water and sewerage.

2. Endorse a petition (intended to be

lodged to the NSW government) on increase Pensioner rebates to be placed in

Councils Administration Buildings, Gallery and Libraries to collect

signatures for support.

3. Write

to the local state members Liza Butler MP, Gareth Ward MP, and related

ministers providing a copy of this recommendation and seeking their support.

|

Background

NSW gives pensioners a 50% rebate on their council rate. The

catch ? It’s to a maximum of $250 and has been this amount for more than

thirty years.

NSW pensioners who have been pensioners for a long period of

time, know that the NSW council rate rebate of $250 a year is getting

smaller and smaller in proportion to their council rates, which could

easily top $1000 or $1500 a year these days.

The same goes for the annual $87.50 water and $87.50 sewerage

rebates.

Both the council rate rebate and the water and sewerage

rebates are legislated in NSW local government act 1993,which commenced on the

first of July 1993,over 30 years ago.

Back then the council rebate was set at 50 percent up to a

maximum of $250 per annum to all pensioners who own their home. Clearly, the

intention was to give rate relief to pensioners in council areas

where rates were comparatively low. If, at that time ,your rates were higher

than $500, your rebate would not be 50%,but less. Obviously, rates under $500

were linked to comparatively low land values, which meant owner occupiers

tended to be nowhere near well off. Those owner occupiers would receive a 50per

cent discount.

However, with rates under or at $500 a year now non-existent,

you could say that the NSW pensioner council rate rebate is the most flagrant

,most significant example of bracket creep in Australia. Research indicates

currently that pensioners are paying an increase of 37 percent on rates since

2009out of their low basic pensions.

It shows that pensioner purchase power is declining as a

result of CPI plus increases in council rates. These declines are not being

compensated to the full extent by the march and September pensions indexations

anymore.

With the cost of living increases, i.e. electricity

charges, food, rent, medication etc, rent pensioners are doing it tough.

Currently eligible pensioners in NSW are entitled to a

rebate on their council rates and water charges. The rebate is mandatory and is

available for all NSW councils.

REBATE AMOUNTS

Up to $250 off ordinary council rates

Up to $87.50 off annual water rates

Up to $87.50 off annual sewage rates

ELIGIBILITY

Pensioner concession card holders

Gold card holders with Total permanent incapacity

Gold card holders with extreme disablement adjustment

War widow or widower

Wholly dependent partner entitled to the pensioner concession

card.

The cost of living has risen, yet the rebate has not been

adjusted for over 30 years.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.48 Notice

of Motion - Community Lease Policy Consideration

HPERM Ref: D25/67476

Submitted

by: Clr Jemma Tribe

Clr Natalee

Johnston

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That

the Acting CEO urge Council staff to consider ‘Profit Sharing’

arrangements in the lease of Council owned buildings (rented by community

groups delivering essential services to the community), in lieu of steep

increases to the base rental rate.

|

Background

We understand that staff are currently

examining Council’s leasing policy for community groups who rent council

owned spaces. There have been several instances brought to our attention in

recent months where contracts currently being renegotiated include a base rate

that is significantly higher than what is currently in place. We recognise that

it is difficult balancing increased property valuations with affordability for

not-for-profit organisations, while also considering the essential nature of

the service they provide to the community. We ask that Council staff drafting

this policy consider a ‘profit sharing’ component in lieu of steep

base rate increases for Council to gain increased returns in a financially

sustainable way. This would enable those organisations who can contribute more

to do so and those who are smaller, yet still provide an essential service for

the community, to survive. For example, Mollymook Surf Club provides an

essential service to the community through Life Saving programs, training and

more. The building is also a desirable venue weddings and other functions.

While the volunteer Surf Lifesaving Committee cannot afford major increases to

the rent, a share of venue hire charges could be considered.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.49 Financial

Sustainability Productivity and Efficiency Report

HPERM Ref: D25/15796

Department: Financial

Sustainability

Approver: James

Ruprai, Acting CEO

Purpose:

The purpose of this report is to

inform Councillors and the community of the productivity and efficiency actions

that have been taken from October to December 2024 to improve Council's

financial sustainability.

Summary and Key Points for

Consideration:

· The

financial sustainability project commenced in February 2024, in response to the

independent financial sustainability review (CL23.420).

The project coordinates the organisation’s efforts to address its

financial sustainability challenges, through the delivery of agreed actions and

initiatives.

· In

adopting the recommendations of the AEC Financial Sustainability Review (MIN23.667),

Council resolved to report the organisation’s progress in achieving

efficiencies against the productivity and efficiency target on a quarterly

basis.

· This

report summarises the actions taken to improve Council’s financial

sustainability from October to December 2024.

· A

Sustainable

Financial Futures Plan has been presented to Council, that describes the

commitment to deliver a minimum of $10 million in savings over the next 4

financial years ($7 million in FY26, and $1 million per annum in FY27, FY28 and

FY29). Planning work is now underway to allocate the $7 million savings into

the draft FY26 budget.

· During

October to December 2024, Council has captured recurrent general fund

savings/income of $51,398 and one-off savings/income of $1.648 million.

This brings the total recurrent general fund savings to $2.548 million and

one-off general fund savings/income to $94.074 million. This reflects the

full financial sustainability actions taken since the project commenced in

early 2024.

· In

QBR1, an internally restricted reserve was created, called the Financial

Sustainability Reserve (FSR). Savings realised from FY25 QBR1 onwards are

transferred to the FSR reserve. As of QBR2, the FSR balance has grown to

$2.76 million.

|

Recommendation

That

Council:

1. Receive the productivity and

efficiency report for the period from October to December 2024.

2. Note the actions taken during the

period that have supported progress towards the vision identified in

Council’s Sustainable Financial Futures Plan.

|

Options

1. The productivity

and efficiency report for the period from October to December 2024 be received

for information.

Implications: Nil

2. Further information

regarding action taken during the period to improve Council’s financial

sustainability be requested.

Implications: Any changes or additional matters can

be added to future reports.

Background and Supplementary

information

In November 2023, AEC provided a report (CL23.420)

to Council on its financial sustainability. In this report, Council was

informed that the general fund net operating position has been in a deficit

position over the past eight years and there is a structural deficit to fund

recurrent expenditure of $25-35 million per annum. AEC made 27 recommendations,

including an SRV, and that all had to be implemented to ensure Council’s

financial sustainability.

The Financial Sustainability project has been established to

coordinate Financial Sustainability actions and initiatives in response to MIN23.667,

MIN24.44

and from report CL23.420

– AEC Financial Sustainability review from November 2023. The project

commenced in February 2024 and has 3 major workstreams:

1. Asset and Project

Management

2. Financial Management

3. Service Planning

In December 2024, Council was

presented a Sustainable Financial Futures Plan (see attached) that details the

actions and operational savings plan to improve Council’s financial

sustainability. The Sustainable Financial Futures Plan (SFFP) includes a

commitment to deliver operational savings to meet the agreed $10m savings

target over the next 4 years.

The SFFP is available on

Council’s website to ensure the financial sustainability actions and

progress to date is clearly communicated and transparent. The Councillors and

community will be updated monthly via Council’s website on the status of

the actions taken and progress made on the agreed savings plan. This will

complement the existing quarterly Productivity and Efficiency Report to

Council, with the objective to make the financial sustainability actions and

progress more accessible and understood by the community.

Summary of financial sustainability

initiatives

Reducing costs –

executive restructure

An executive level restructure

was completed in December 2024, resulting in the rationalisation of the

executive structure from six directorates to four directorates and the

disestablishment of 20 long-term vacancies. The restructure savings will

be $1.6 million annually. Due to termination payments resulting from the

restructure, the savings will be realised from the FY26 original budget

onwards.

Reducing costs –

staffing

As a result of the recruitment

process that was established in 2024 in response to MIN24.44,

over 100 vacancies are now held across Council. Salary savings up until

December 2024 are captured as part of QBR2, totalling $1.606 million.

There are operational challenges

associated with holding this number of vacancies across the organisation, which

is being felt in some areas of Council more than others. The vacancies

mean there are potential impacts to meeting the agreed delivery program,

maintaining service levels and the potential for facilities to close due to

lack of staffing.

Reducing costs – plant

and fleet

Over the last quarter, the plant

and fleet project has continued to action the service review

recommendations. The focus for this quarter has been on updating

Council’s Motor Vehicle Policy, reviewing leaseback vehicle list, vehicle

pricing and employee contribution to reduce Council’s FBT liability, and

completing the external plant hire tender. The financial benefits of a

reduced FBT liability will begin to be realised from QBR3. There is

ongoing review of the total plant and fleet across Council, with further sales

of under-utilised plant expected in QBR3.

Reducing costs –

changes to operating hours

In QBR2, an additional $12,900

in savings will be reported through the realisation of the benefit for the

following changes:

· Shoalhaven

Entertainment Centre – close Sundays and reduced café hours

· Sanctuary

Point Library – close on Saturdays

In QBR2, additional budget

adjustments will be made to address the Council resolutions to reverse the

operating hours decisions for Berry Village Pool (MIN24.627,

CL24.363)

and Greenwell Point Village Pool (MIN25.3,

CL25.3).

The increase in annual operating costs of these resolutions is $47,500.

The net change in operating

costs being reported in QBR2 is an increase in operating costs of $34,600.

Reducing costs – other

efficiency ideas

Departments across Council are

continuing to work through efficiency ideas, with the following changes being

reported in QBR2:

· A

reduction in operational costs of $42,000 for this financial year due to the

cancellation of the 2024 staff Christmas party

· Annual

rental savings of $45,000 from the consolidation of staff office space

· Swim,

Sport and Fitness and Library Services departments have continued efforts to

find and report operational savings from various team initiatives, totalling

$11,469

· Annual

reduction in Director materials and services budgets of $19,529 recognised in

QBR2 due to consolidation of Directorates through the executive restructure

(this will be a recurrent saving of $20,000 from FY26 onwards)

Revenue generation

In QBR2, $10K of additional

income will be recognised annually in Swim Sport Fitness, through the

implementation of 3% challenge initiatives.

Improving organisational efficiencies - service reviews

Forward service review program for the next 3 years has been

approved by ELT, with the 2025 calendar year program scheduled. Table 1

below shows the current work in progress program and status update on each.

Table

1: Service Review Program Schedule

|

Service review

|

Directorate

|

Type

|

Start

|

Due

|

Resources

|

Status

|

|

Library Services

|

Development

|

Business process improvement

|

Feb-25

|

TBC

|

In-house

|

Work recommencing in Feb 25

|

|

Holiday Haven

|

Services

|

Business process improvement

|

Dec-23

|

Apr-24

|

In-house

|

Review Complete - implementation underway under BAU

|

|

Legal

|

Performance

|

Business model - internal resources

|

Feb-24

|

Dec-24

|

In-house

|

On hold pending resource availability

|

|

Family Day Care

|

Development

|

Business model - commercial

|

Mar-24

|

Jul-25

|

In-house

|

Review complete – Council decision pending

|

|

Fleet & Mechanical

|

Services

|

Internal process/ structure/services

|

Mar-24

|

Jun-24

|

Consultant

|

Review complete - implementation underway under BAU

|

|

Communications and Media

|

CEO

|

Internal process /structure/services

|

Jun-24

|

Jul-25

|

In-house

|

Work in progress – ELT feedback received and finalisation of

review underway

|

|

Customer Experience

|

Performance

|

Internal process /structure/services

|

TBC

|

TBC

|

In-house

|

On hold – pending other service reviews completion

|

|

Bereavement Services

|

Services

|

Business model - commercial

|

Jul-24

|

Mar-25

|

Consultant

|

Review complete – Councillors to be briefed in March 2025

|

|

Shoalhaven Entertainment Centre

|

Services

|

Business model - commercial

|

Jan-25

|

May-25

|

In house

|

Work in progress – scope approved

|

|

Holiday Haven

|

Services

|

Business model - commercial

|

May-25

|

Oct-25

|

Consultant

|

Not started – to be scoped in mid-2025

|

|

Asset custodian model (incl. PM function)

|

Services

|

Internal process /structure

|

Ongoing

|

Ongoing

|

In house

|

Part structural elements implemented. Further review of outdoor

maintenance underway.

|

|

Waste tipping vouchers

|

Services

|

Internal process/business model

|

Jan-25

|

Apr-25

|

In house

|

New – work in progress

|

|

Safety review

|

Performance

|

Internal process

|

Jan-25

|

TBC

|

In house

|

New – scoping underway

|

Internal Consultations

The financial sustainability

project consults internal stakeholders formally through weekly Executive

Leadership Team meetings and monthly in Shoalhaven Leadership Team meetings.

A financial sustainability

workshop was held in November to brief the new Councillors on the outcomes and

recommendation for the Shoalhaven Family Day Care (SFDC) service review.

In 2025, financial

sustainability workshops will be scheduled as required, rather than on a

pre-arranged monthly schedule. The next workshop will be in March, where

Councillors will be briefed on the outcome and recommendations from the Bereavement

Services review.

External Consultations

Abraxa Management Consulting

have been engaged to complete the Bereavement Services review, with this

engagement due to finish in March 2025. For future service reviews, the

project team is working with the Executive Leadership Team to strike the right

balance of use of consultants versus internal resources to complete service

review work.

Community Consultations

During this quarter, the

Financial Sustainability project team participated in community consultation on

the proposed special rate variation. This included attending a pop-up

consultation at a local market and supporting the facilitation of the SRV

workshops. This gave the project a voice with community to explain why we

are in a financial challenge and what actions we have taken so far to address

the structural deficit.

The project manager also

presented on the Financial Sustainability project progress to the CCB Executive

meeting in November 2024.

In 2025, the Financial

Sustainability project will be sharing monthly videos on the

organisation’s progress against the agreed actions and savings

target. The objective of this regular communication is to make financial

sustainability updates more accessible to the community (rather than large

volumes of text on the website) and consistent (rather than updating only when

there is something big to share).

Policy and Statutory Implications

Council’s Motor Vehicle

Policy has been endorsed by the Executive Leadership Team and will be presented

to the February Consultative Committee in February, as the final review before

being adopted.

Financial Implications

October 2024 – December

2024 general fund report

Recurrent saving realised

(grey-shaded rows were included in a previous productivity and efficiency

report but are included to show the total achievement realised):

|

Category

|

Initiative

|

Saving/Income

|

Realised

|

Amount

|

|

Other efficiency ideas

|

Reduction in events support programme and marketing

budget

|

Saving

|

24/25

original budget

|

-$500,000

|

|

Revenue generation

|

Increase in revenue – fees and charges review

– general fund

|

Income

|

24/25

original budget

|

+$1,303,000

|

|

Revenue generation

|

Increase in revenue – DA fee recovery

|

Income

|

FY25

QBR1

|

+$50,000

|

|

Changes to operating hours

|

Reduced operating hours

|

Saving

|

FY25

QBR1

|

-$320,758

|

|

Other efficiency ideas

|

Reduction in general fund operating budgets

|

Saving

|

FY25

QBR1

|

-$322,934

|

|

Changes to operating hours

|

Reinstatement of operating hours – Berry and

Greenwell Point

|

Saving

reversal

|

FY25

QBR2

|

+$47,500

|

|

Changes

to operating hours

|

Realisation

of reduced operating hours – Shoalhaven Entertainment Centre and

Sanctuary Point Library

|

Saving

|

FY25 QBR2

|

-$12,900

|

|

Other

efficiency ideas

|

Reduction

in general fund operating budgets

|

Saving

|

FY25 QBR2

|

-$75,998

|

|

Revenue

generation

|

Increase

in revenue – Swim, Sport Fitness

|

Income

|

FY25 QBR2

|

+$10,000

|

|

Recurrent

productivity and efficiency general fund TOTAL

|

|

|

|

$2,548,090

|

One-off savings to date include:

|

Category

|

Initiative

|

Saving/Income

|

Realised

|

Amount

|

|

Pausing capital projects

|

Pause capital projects

|

Saving (deferred spend)

|

FY24 QBR3

|

-$90,000,000

(total project cost excluding grant funding)

|

|

Increased cost controls

|

23/24 reduced department spending (no discretionary

spending, holding vacancies)

|

Saving

|

FY24

QBR3

|

-$1,700,000

|

|

Increased cost controls

|

24/25 reduced department spending year to date across

general fund

|

Saving

|

FY25

QBR1

|

-$368,975

|

|

Plant and fleet

|

24/25 plant and fleet general fund asset sales

|

Revenue

|

FY25

QBR1

|

+$330,000

|

|

Increased

cost controls

|

24/25

reduced department spending year to date across general fund

|

Saving

|

FY25 QBR2

|

-$42,000

|

|

Salary

savings

|

24/25

net salary savings from vacancies year to date across general fund

|

Saving

|

FY25 QBR2

|

$1,606,602

|

|

One-off

productivity and efficiency general fund TOTAL

|

|

|

|

$94,047,577

|

Summary of financial outcomes

achieved to date:

During October to December 2024,

Council has captured recurrent general fund savings/income of $51,398 and

one-off savings/income of $1.648 million. This brings the total recurrent

general fund savings to $2.548 million and one-off general fund savings/income

to $94.074 million. This reflects the full financial sustainability

actions taken since the project commenced in early 2024.

In QBR1, an internally

restricted reserve was created, called the Financial Sustainability Reserve

(FSR). Savings realised from FY25 QBR1 onwards are transferred to the FSR

reserve. As at QBR1, the FSR balance was $1.06 million. As of QBR2,

the FSR balance has grown to $2.76 million.

Risk Implications

There are financial, resource

and reputational risks associated with not addressing the financial

sustainability of the organisation. These risks are being addressed

through risk assessment of activities undertaken and implementation of risk

mitigation measures, including but not limited to communications, engagement,

financial and workload planning.

As part of managing the risks,

regular community updates will be provided as the financial sustainability

initiatives progress.

|

|

Ordinary

Meeting – Tuesday 25 February 2025

Page

0

|

CL25.50 DPOP

2024-25 - Quarterly Performance and Budget Report (October - December)

HPERM Ref: D25/34121

Department: Government

Relations, Strategy & Advocacy

Approver: James

Ruprai, Acting CEO

Attachments: 1. DPOP

2024-25 - Quarterly Performance Report (Oct - Dec) (under separate cover)

2. Quarterly

Budget Review Report - December 2024 (under separate cover)

3. FY

24-25 - Q2 - Proposed Carry Forwards (under separate cover)

4. FY 24-25 - Q2 - Proposed

Revotes (under separate cover)

Purpose:

The purpose of this report is to

include the Quarter 2 performance report on the 2024-25 Delivery Program and

Operational Plan and present the proposed budget adjustments in the December

2024 Quarterly Budget Review for adoption.

Summary and Key Points for

Consideration:

· This

report outlines highlights for Quarter 2 performance (October to December 2024)

against actions and targets set in Council’s 2024-25 Delivery Program and

Operational Plan (DPOP).

· This

report includes the proposed budget adjustments outlined in the December 2024

Quarterly Budget Review Report.

· Council

has limited unrestricted funds. This continues to be a matter for concern for

Council and is regularly addressed in Council business papers, briefings and is

evident in Council’s Long Term Financial Plan.

· The

balance of grants spent in advance at 31 December 2024 increased to $19.3M

(September 2024 grants in advance were $14.7M). The increase from 30 September

2024 is due to growth in the prepaid natural disaster works which have been

funded from Council’s cash reserves, and is awaiting payment from the

funding body.

· The

budget adjustments proposed (carry forwards and quarterly budget adjustments)

have a positive general fund unrestricted cash net impact of $1.3M. The 30 June

2025 forecast closing unrestricted cash balance has increased from $2.26M as

reported at the September quarter to $3.55M in the attached report. The

anticipated increase in interest earned was responsible for the positive

budgeted cash movement.

· Savings

of $1.7M realised this quarter and quarantined within the internally restricted

Financial Sustainability Reserve (FSR) bringing the reserve balance up to

$2.76M at 31 December 2024. Had this $2.76M not been quarantined within the FSR

general fund unrestricted cash would have been forecast to be $6.31M.

· General

Fund budget adjustments are positive and result in a reduction to the forecast

general fund operating deficit. The major adjustments outlined in this report

are an increase to forecast interest income and the reduction in forecast

employee expenses.

· Net

favourable budget adjustments are proposed for both Water and Sewer Fund,

increasing the projected operating surplus forecast for each fund.

· Council

will not achieve the mandated Office of Local Government (OLG) performance

measures for 30 June 2025 – including Operating Performance Ratio, Debt

Service Cover Ratio and Infrastructure Renewal Ratio. Council is forecast to

meet the required NSW Treasury Corporation debt covenant ratios.

· Due

to timing of proposed land sales, Council will not repay early an additional

$10M in loan borrowings before 30 June 2025. The proceeds will instead remain

restricted in the Industrial Land Development Reserve, and will not be

available for expenditure.

· Repurpose

the previous loan drawn down for the construction of Sanctuary Point Library

construction, to other capital projects, in accordance with the original budget

adopted by Council (MIN24.244

and MIN24.338).

Staff will repay the original loan and enter into negotiations to draw own a

new loan for an equal amount.

|

Recommendation

That

Council:

1. Receive the December Quarterly

Performance Report on the 2022-2026 Delivery

Program and 2024-25 Operational Plan and

publish on Council’s website.

2. Receive the December 2024 Quarterly

Budget Review Report.

3. Adopt the budget adjustments as

outlined in the December 2024 Quarterly Budget Report Document.

4. Repay in full the loan 1238 taken

out on 28/10/2022 from NSW Treasury Corp originally borrowed for the

Sanctuary Point Library.

5. Enter negotiations with commercial

lenders for a 10-year loan agreement of $5.5M to fund the repayment of the

loan taken out on 28/10/2022 for the Sanctuary Point Library, the proceeds of

which are being used to fund projects that form part of Council’s 2025

Capital Works Program.

6. Delegate authority to the Acting

Chief Executive Officer to execute the loan agreement.

|

Options

1. Adopt the

recommendation

Implications: The budget will be adjusted as

outlined in the December 2024 Quarterly Budget Report Document.

Council will be able to pay out

loan 1238 with NSW Treasury Corp and take out a new loan with a commercial

lender to fund capital projects in accordance with the adopted 2024/25 Delivery

Program and Budget.

2. Adopt an

alternative recommendation

Implications: Staff will be required to rework the

quarterly performance and budget report in accordance with the alternative

resolution.

Council will need to find

alternate funding for capital works projects already underway, while holding

cash proceeds from a loan taken out from NSW Treasury Corp that are not

currently able to be spent.

Background and Supplementary

information

Section 404 of the Local

Government Act, 1993 requires the General Manager (Chief Executive Officer) to

provide progress reports to the Council with respect to the principal

activities detailed in the Delivery Program (Operational Plan) at least every 6

months. Furthermore, all councils must continue to consider a Quarterly

Budget Review report.

Clause 203 of the Local

Government (General) Regulation 2021 requires the Responsible Accounting

Officer (Chief Financial Officer) to prepare and submit to the Council, a

Quarterly Budget Review Statement that shows, by reference, the estimates of

income and expenditure set out in the Operational Plan and a revised estimate

of the income and expenditure for the full financial year.

The Responsible Accounting

Officer is also required to report as to whether they believe the financial

position of the Council is satisfactory, having regard to the original estimate

of income and expenditure.

The December 2024 Quarterly Budget Review Statement (QBRS)

includes an analysis of the year-to-date result and the reasons for the

adjustments from the previously adopted budget by fund. Any proposed changes to

the budget are included in the attached December Quarterly Budget Review

Statement.

Summary of Delivery Program

Operational Plan 2024-25 Performance

Table 1 below provides

breakdown of performance as at 31 December 2024 across each of the key themes

outlined in the Community Strategic Plan - Shoalhaven 2032.

Table 1: Action performance as at 31 December 2024 by Community

Strategic Plan 2032 Theme area

|

CSP Theme

|

Progress snapshot

|

|

Resilient, safe,

accessible and inclusive communities

|

88% actions on track or

completed

|

|

Sustainable, liveable

environments

|

92% actions on track or

completed

|

|

Thriving local

economies that meet community needs

|

89% actions on track or

completed

|

|

Effective, responsible

and authentic leadership

|

92% actions on track or

completed

|

Of the 135 DPOP actions, the

following 4 actions have been rated as ‘Completed’ in the second

quarter of the year:

· 2.1.04.01

– Stage works greater than $250,000 with a Design/Approval stage and

Construction/Commissioning Stage in separate financial years

· 4.2.03.01

– Annual review and update of Council’s Workforce Plan to ensure strategies

are updated and implemented

· 4.2.10.01

– Establish an Enterprise Project Management Office to oversee and

support project governance through management of the corporate Project

Management Framework and asset project readiness for inclusion in capital

budgets

· 4.3.01.04

– Support the conduct of the 2024 Local Government elections

The remaining 131 actions are rated as ‘on

track’, ‘on hold’, ‘deferred’ or ‘requires

attention’.

Key

Highlights

Council has consistently

delivered a range of services, projects and activities which work towards

achieving the 11 key priorities outlined in Council’s Delivery Program

2022-26. Performance comments are provided in the report against each of the 135

actions and related targets in Council’s 2024-25 Operational Plan.

The complete DPOP Quarterly

Performance Report (October - December) is included as Attachment 1.

Significant achievements between

October and December 2024 include:

· Initiated

project planning for the review of the Disability Inclusion Action Plan (DIAP)

2022-26 and finalised the Draft Reconciliation Action Plan (RAP) for public

exhibition.

· Provided

feedback on strategic transport planning projects by Transport for NSW,

including the Nowra Bypass, Illawarra Shoalhaven Strategic Regional Integrated

Transport Plan, Princes Highway upgrade, and Milton-Ulladulla Bypass.

· Certified

and gazetted the Open Coast & Jervis Bay Coastal Management Plan (CMP). The

Lake Conjola CMP and Lower Shoalhaven River CMP are in Stage 4, with Sussex

Inlet, St Georges Basin, Swan Lake, and Berrara Creek CMPs entering Stage 4 for

public exhibition in early 2025.

· Continued

preparation and review of Bushcare Action Plans, completing plans for Red Head

Villages (Cunjurong Point – Manyana), Orient Point, River Road,

Shoalhaven Heads, and Boongaree.

· Supported

Aboriginal Tourism Operators in developing tourism businesses, with 12

Aboriginal businesses listed on the shoalhaven.com website.

· Participated

in Illawarra Shoalhaven Joint Organisation (ISJO) projects, including the Early

Childhood Education and Care Regional Strategy and the Joint Organisation Net

Zero Acceleration program.

· Conducted

community engagement programs, including the Proposed Special Rate Variation,

Mayor’s Giving Tree, opening of the Huskisson Mangrove Boardwalk, and

completion of Kangaroo Valley Natural Disasters Landslip Road repairs, with VIP

and media attendance.

· Implemented

financial sustainability initiatives, such as the Enterprise Project Management

Officer (ePMO), Grants program review, and regular budget management engagement

with the Senior Leadership Team.

Requires

Attention

Table 2 below outlines

the five Action items that have been reported as ‘requires

attention’ at 31 December 2024. Full performance comments are in the

attached report and remedial actions have been reported to senior management.

Table 2: DPOP Actions

rated as ‘requires attention’ as at 31 December 2024.

|

Ref.

|

Action

|

Quarter 2 Comment (summary)

Full comments in attached report

|

|

1.1.06.01

|

Implement an inspection

regime required to ensure the satisfactory operation of on-site sewage management

systems for the maintenance of public and environmental health

|

Environmental Health

Officers undertook 433 inspections of on-site sewage management systems in

quarter 2 and issued 343 approvals to operate. While the team have met and

exceeded their required inspection targets, the additional time required to

follow up non-compliant systems and undertake administrative tasks has meant

that the program continues to run behind schedule with approximately 1,566

properties due for inspection before the end of FY 24/25.

|

|

2.2.01.01

|

Finalise the local

planning documents to guide the development of the Moss Vale Road North Urban

Release Area

|

Public Exhibition of

detailed Draft Development Control Plan Chapter and Infrastructure Funding

Options Paper for the Urban Release Area concluded in September 2024. Range

of resulting dialogue occurred with relevant NSW Government agencies,

Infrastructure providers and landowner /developers. Council briefing to

discuss next steps and landowner liaison to be rearranged and matter to be

reported to Council for formal consideration.

|

|

2.2.01.03

|

Preparation of a new

local infrastructure contributions scheme and governance framework

|

Work continued on the

preparation of the new Local Infrastructure Contributions Scheme

(Contributions Plan) for Shoalhaven. Progress reports provided to Council's

Executive Leadership Team to enable consideration of resourcing and other

requirements to enable this key project to progress to finalisation in a

timely manner. The infrastructures projects review and basic needs

analysis is now complete. Work to determine new infrastructure list is close

to completion. However, overall timeframes have slipped due to other

competing priorities.

|

|

2.3.03.03

|

Implement water quality

monitoring program of Shoalhaven's estuaries, lakes, rivers and beaches to

ensure the cleanliness of waterways for public and environmental health

|

8 catchments were

sampled during quarter 2.

Sampling was also

undertaken for Environmental Protection Licenses. Beachwatch Commenced at 11

beaches in December. Budget cuts have reduced funding for the

maintenance/replacement of water quality monitoring equipment. Without this

funding this equipment with be unable to be replaced resulting in the end of

the water quality monitoring program.

|

|

3.1.03.01

|

Promote the Shoalhaven

as a diverse region with a focus on off-season visitation

|

Shoalhaven Visitor

economy had an increase in spend to $1.42 billion and increase in total

nights by 9%. However, total visitors dropped by 12% and a lack of budget for

campaigns and leads to industry saw a drop of 3% year on year of unique

visitors to shoalhaven.com and reduced engagement across all channels.

Off-season campaign development is underway with reduced budget for Autumn

Wellness and Winter Foodie. The team is seeking funds from State and Federal

bodies to assist with the shortfall in off-season marketing resources.

|

On

Hold

Table 3 below, outlines

the six Action items that have been reported as ‘on hold’ as at 31

December 2024. Full performance comments are in the attached report and

remedial actions have been reported to senior management.

Table 3: DPOP Actions

rated as ‘on hold’ as at 31 December 2024.

|

Ref.

|

Action

|

Quarter 2 Comment (summary)

Full comments in attached report

|

|

1.1.03.03

|

Work with community to

foster an inclusive Shoalhaven where everyone has equitable access to

opportunities and continue to deliver priorities from the Disability

Inclusion Action Plan

|

Due to staff vacancies the team have not had capacity

to deliver on all actions.

|

|

1.2.02.02

|

Staged implementation of

Shoalhaven Entertainment Centre's Strategic Business and Marketing Plan

|

Shoalhaven Entertainment Centre's Strategic Business

and Marketing Plan is on hold due to reduced resources.

|

|

1.2.03.01

|

Work with community to

improve the recognition, protection and celebration of the diverse community,

history and cultural heritage of the Shoalhaven

|

Due to staff vacancies the team have not had capacity

to deliver on all actions.

|

|

4.1.01.02

|

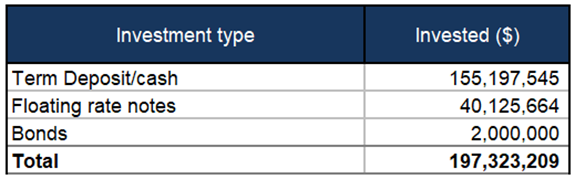

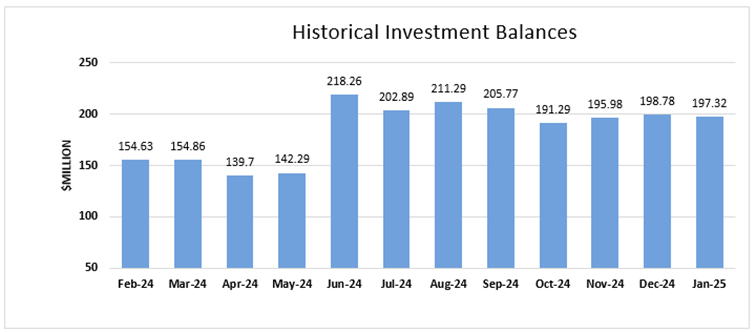

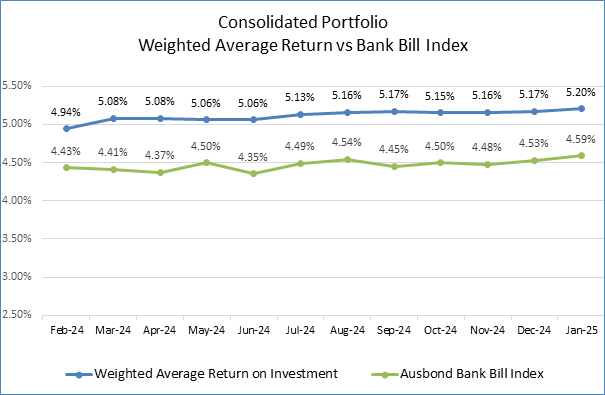

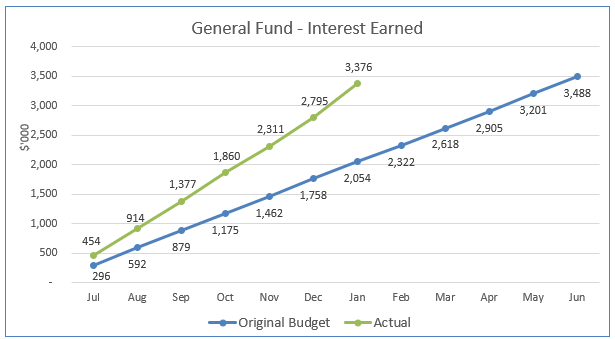

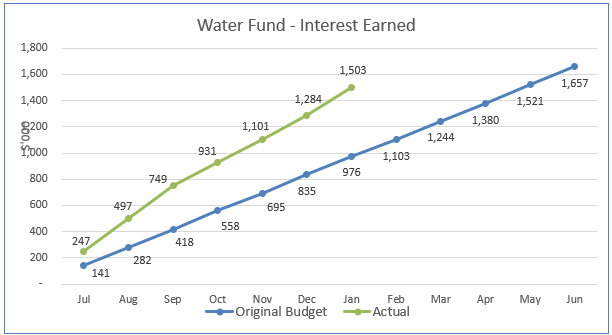

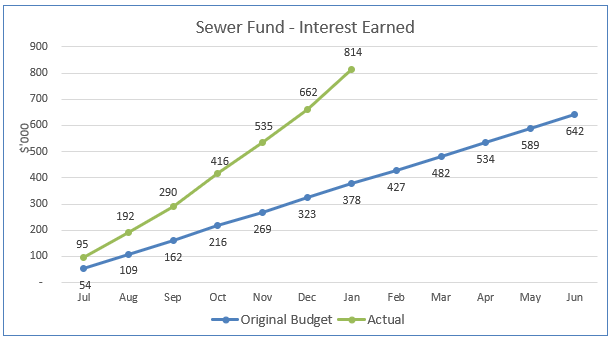

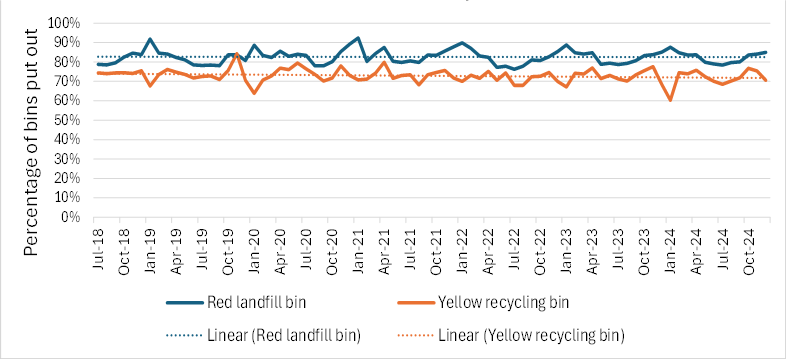

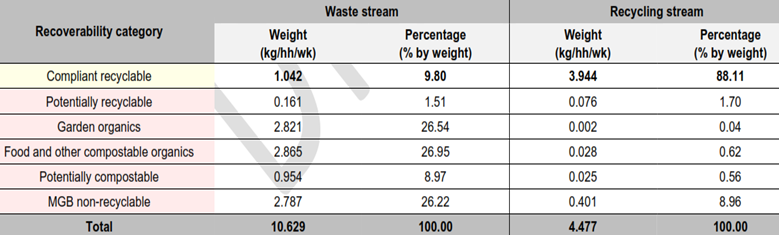

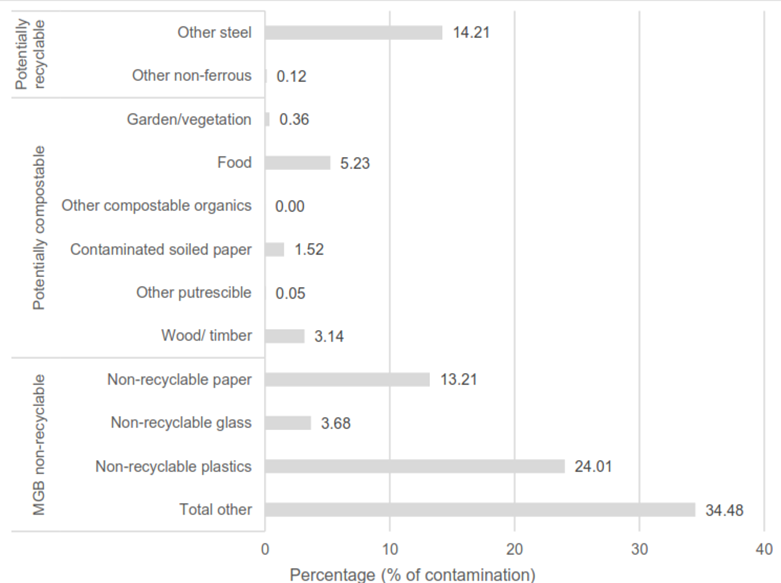

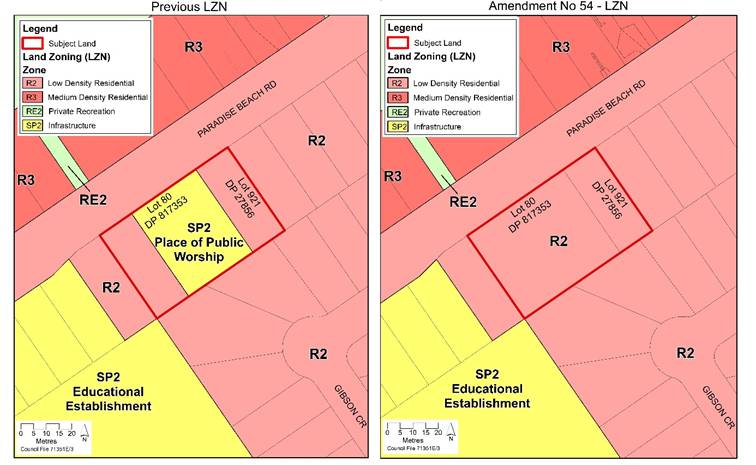

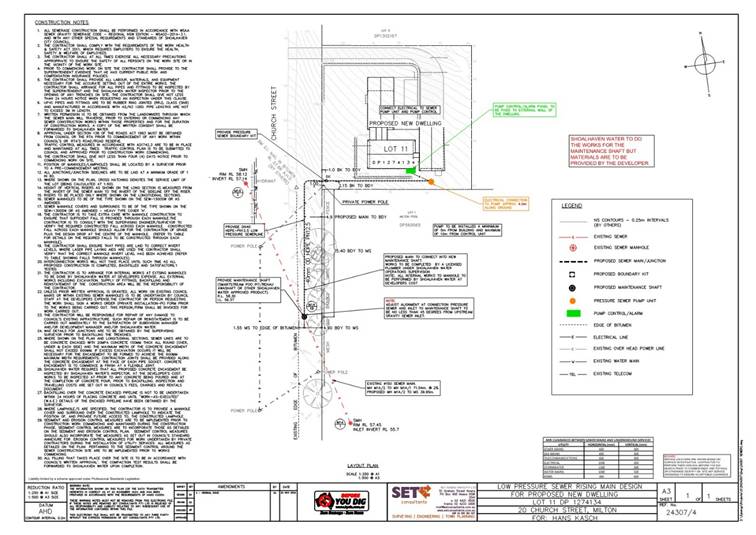

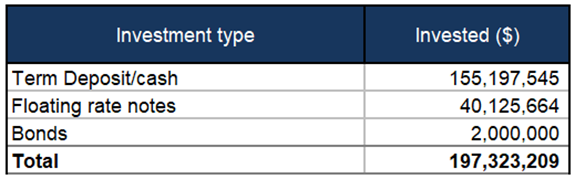

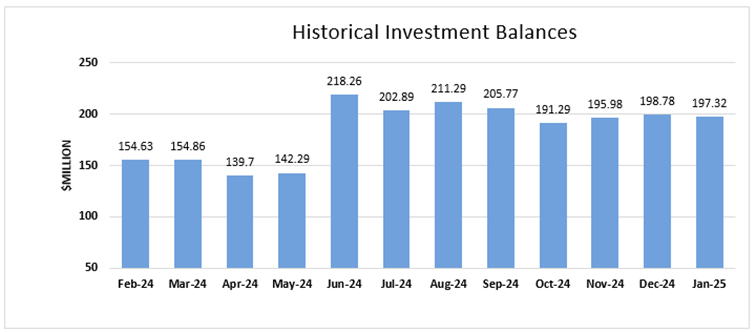

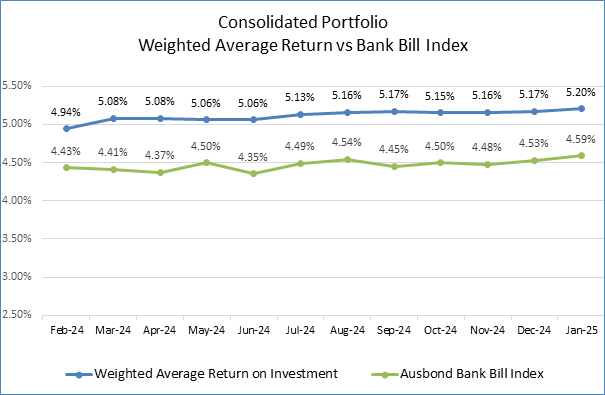

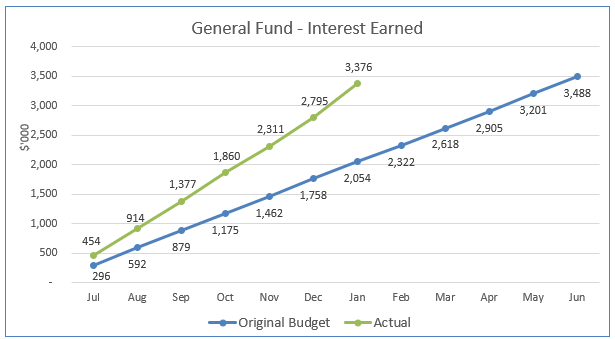

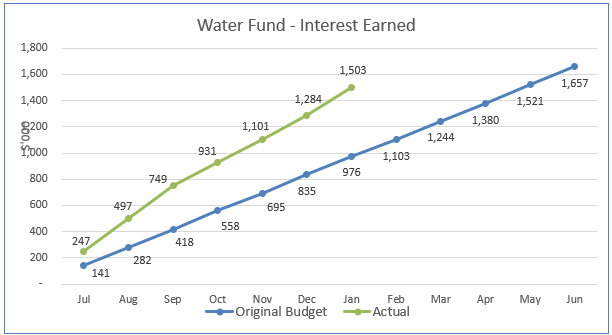

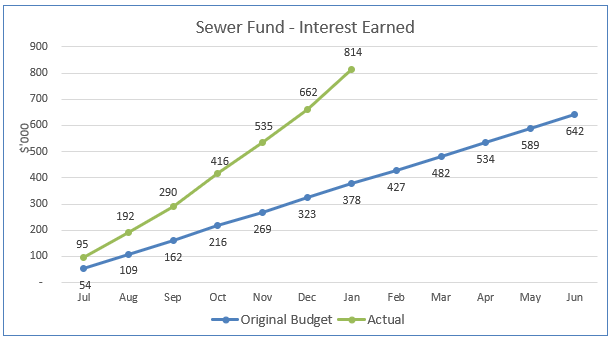

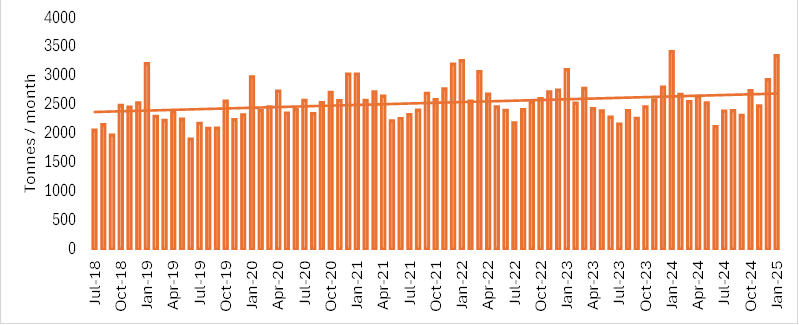

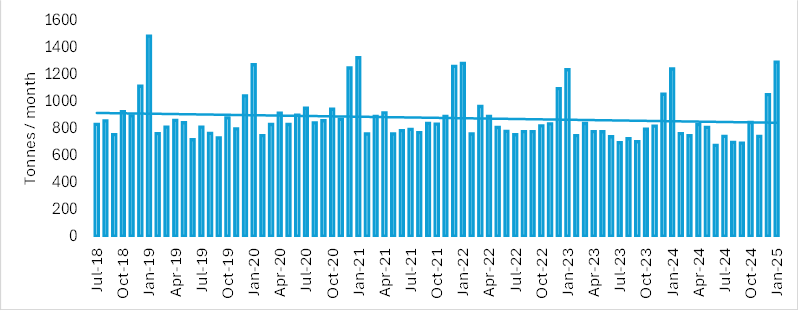

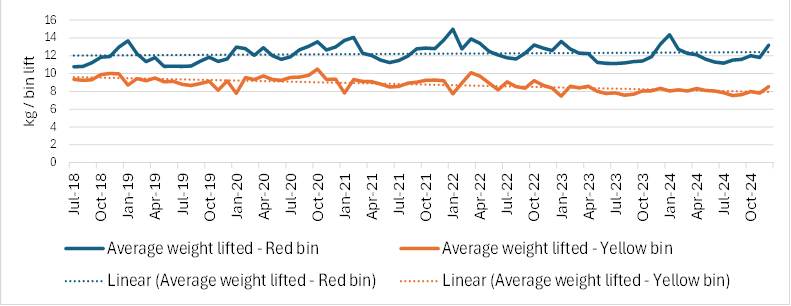

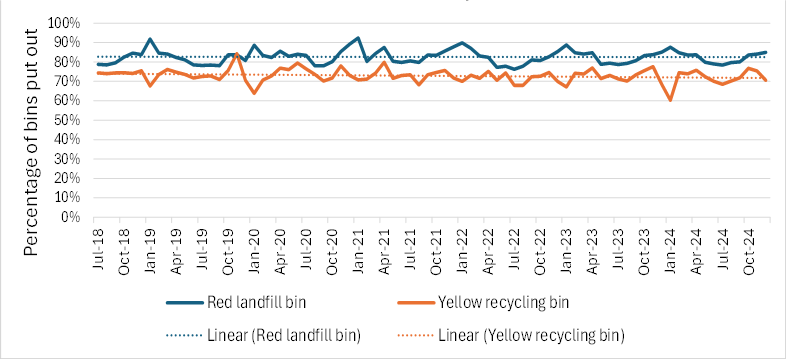

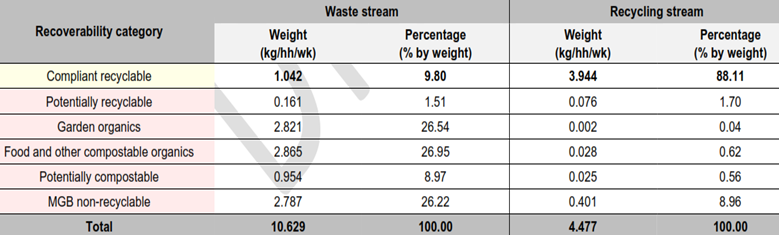

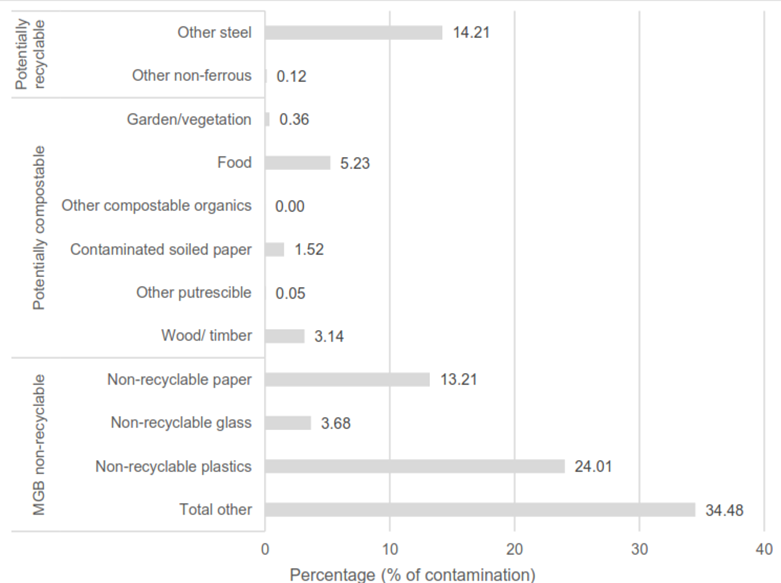

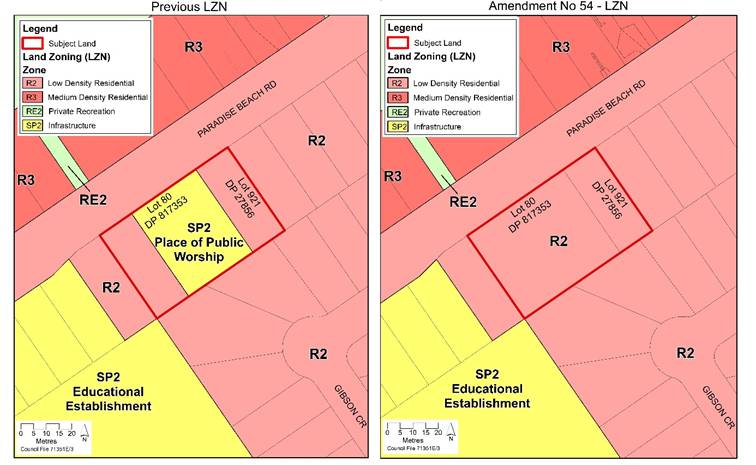

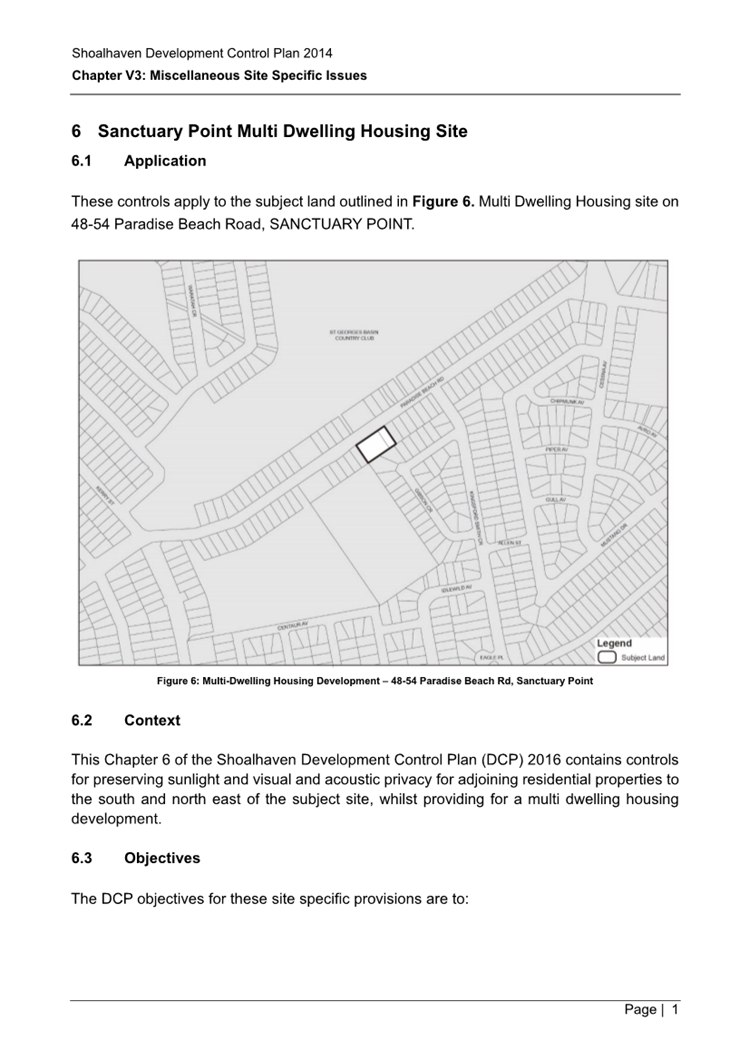

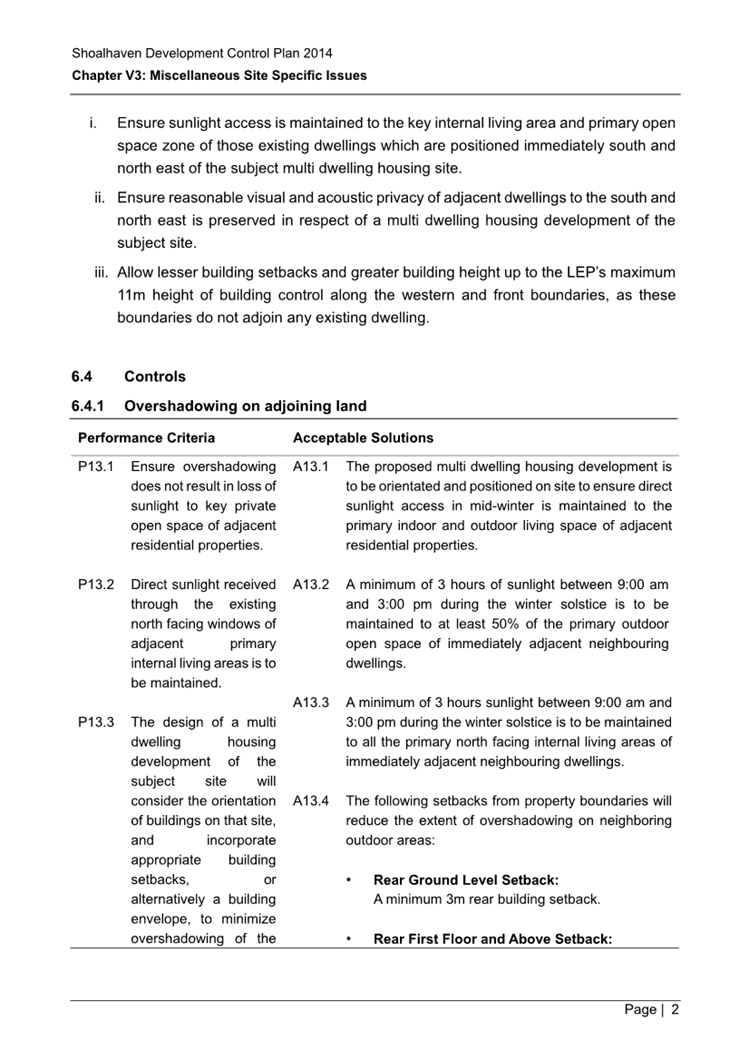

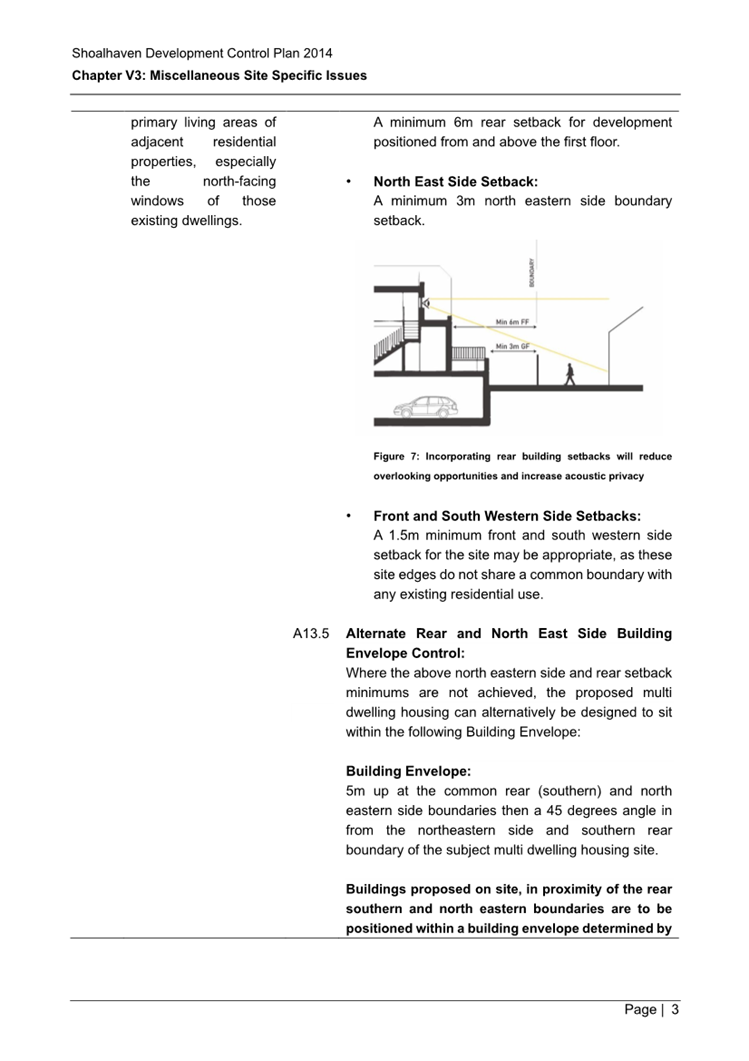

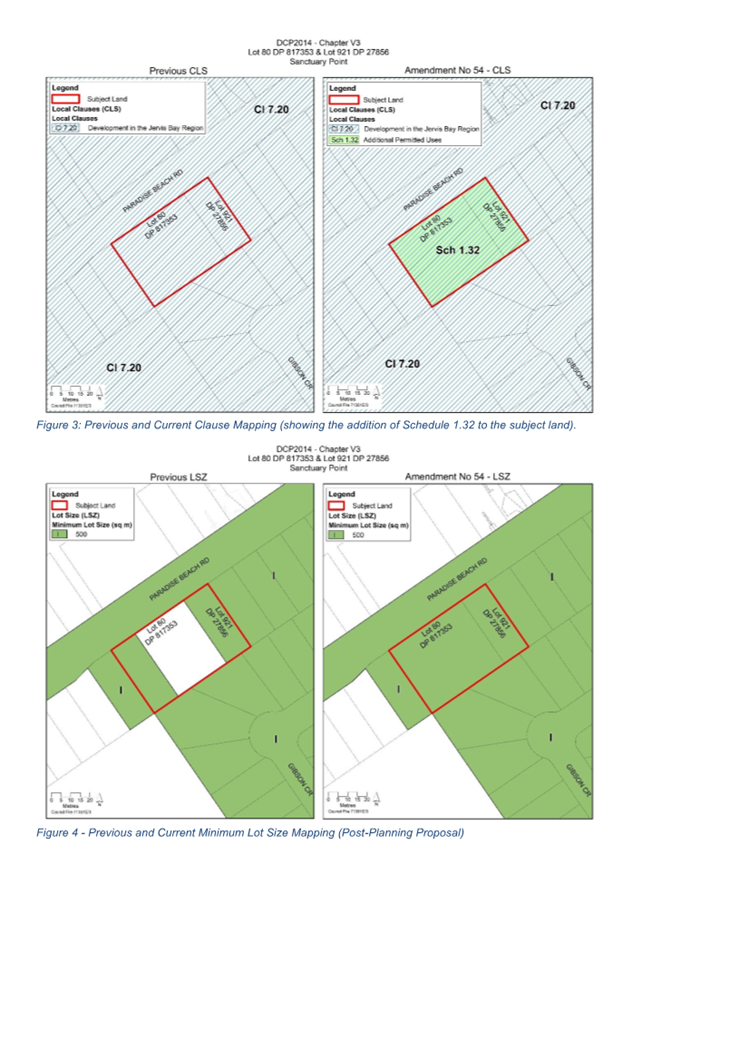

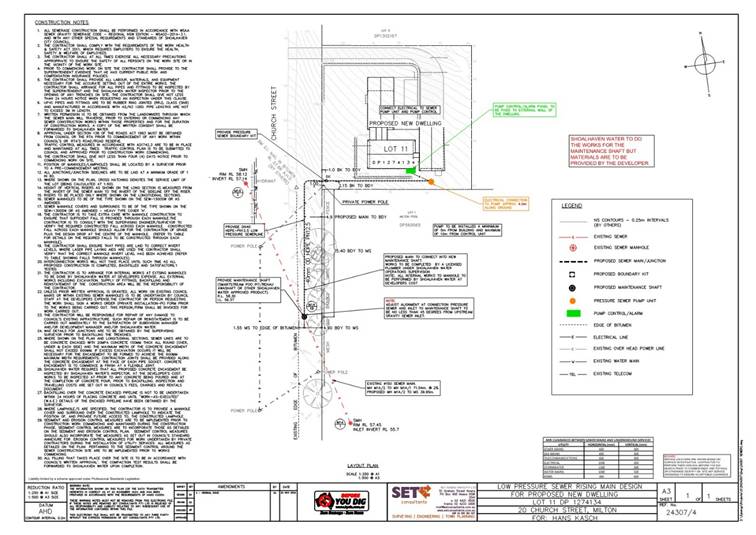

Run 'Voice of the