|

|

Addendum Agenda - Ordinary

Meeting – Tuesday 26 September 2017

Page

11

|

CL17.272 Pathways

to financial sustainability

HPERM Ref: D17/308897

Group: Finance

Corporate & Community Services Group

Section: Finance

Attachments:

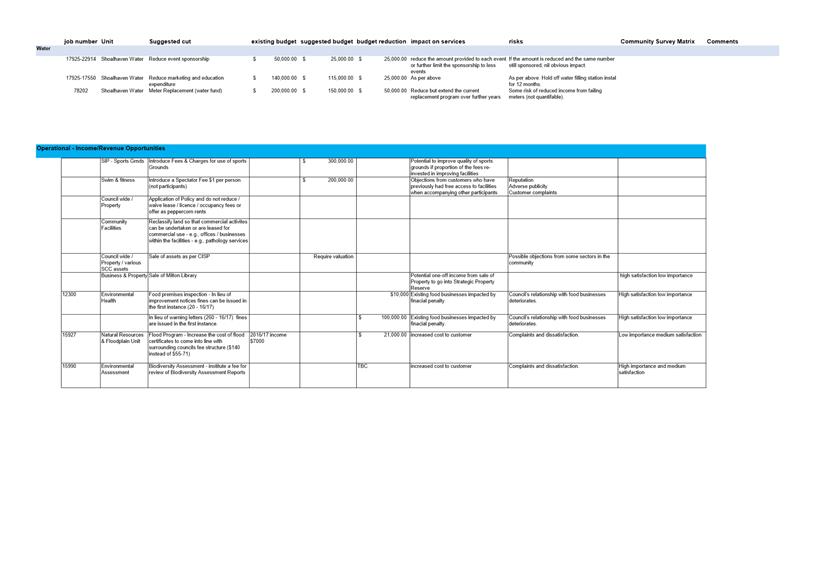

1. Budget cut and

revenue options ⇩

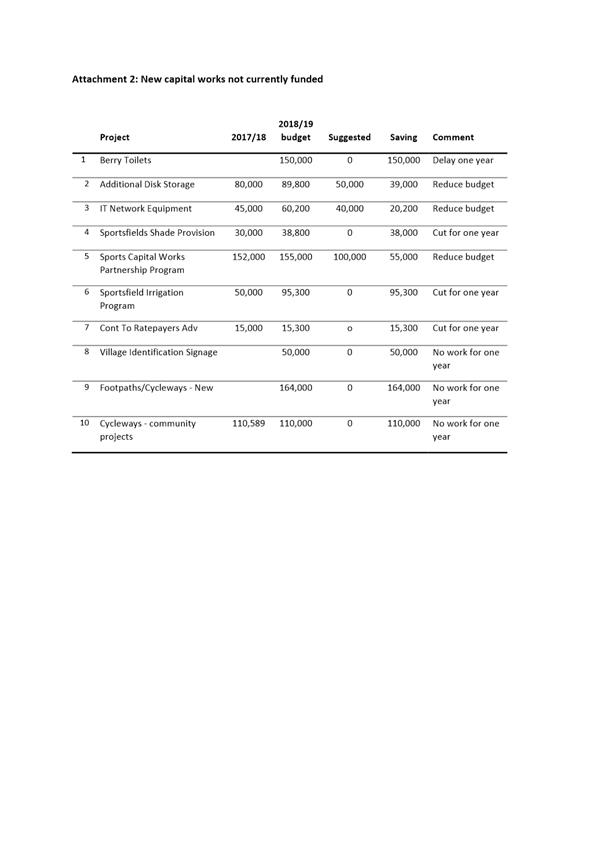

2. New

capital works ⇩

3.

Councillor Presentation: Resources Issues (under separate cover) ⇨

Purpose / Summary

To review and determine

Council’s financial sustainability strategy (FSS) in light of the IPART

decision to only part approve Council’s SRV application.

Council’s FSS must meet

the OLG FFTF benchmarks.

|

Recommendation

That Council

adopt Option 1 which will retain existing services, allow modest

“new” asset spend, move towards meeting all FFTF benchmarks and

stage the further rate increase required over the next three years.

|

Options

1. That Council prepare a revised DP/OP

to reflect the proposed SRV application, under S508A of the Local Government

Act 1993, to retain the 13.2% special variation approved as a one-off increase

in 2017/18 as a permanent increase and for additional special variations

(inclusive of a rate peg of 2.5% pa) of 5% in 2018/19, 5% in 2019/20 and 5% in

2020/21. (This is the recommended option)

Implications: Council will have

the capacity to adequately maintain, renew and replace Council assets and meet

community service expectations. While the application to IPART is for a

multi-year special variation, Council is able to adopt lesser rate increases

each year according to prevailing conditions. Council acknowledges there

will be an impact on ratepayers and will continue to assist members of the

community who experience hardship. Staff will need to revise the Delivery

Program, Operational Plan and Long Term Financial Plan in line with the adopted

recommendations and report back to an extra-ordinary meeting of council for

endorsement prior to public exhibition.

2. Council chooses cost-cutting (service

reductions) and/or revenue raising options from the lists attached to this

report together with a lesser SRV (if needed) in order to achieve

Council’s performance benchmarks

Implications: Each $600K

improvement to Council’s Operating result is roughly equivalent to a 1%

rate increase. Council will need to consider a target for significant

service level adjustments (not related to infrastructure maintenance or

renewal) to maintain a pathway to financial sustainability. Reducing

service levels, in consultation with the community, can manage part of the

funding gap; however, it is likely that Council will continue to operate with

an annual deficit without some form of SRV.

3. Council adopts SRV levels that will

allow it to meet the asset renewal target of 100% by 2026/27 – this

requires rate increases to lock in the current 13.2% increase plus addition of

5% p.a. for the next seven years followed by a 3.4% increase in 2025/26.

Implications:

This is the optimum level for asset management but is likely to attract

substantial public objection because of the higher rate increase required.

4. Council does not adopt the recommendation

(“do nothing”)

Implications: This would be a

financially irresponsible pathway. Council will not meet its operating

performance ratio target over the planning horizon and there will be a

deterioration in the asset renewal ratio. The average cash deficit over

the period amounts to $2.8M pa. which will quickly deplete council cash

reserves. The Operating Deficit starts at $9.2M in 2018/19 and reduces over

time to an average of $3.8M over the planned period. Any decision that

does not meet the Fit for the Future targets increases the risk of some form of

Ministerial direction and discussions would need to be held with the Office of

Local Government to understand the implications.

Background

In February 2017, Council applied to IPART for 13.2%

and 14% general rates income increases for 2017/18 and 2018/19, including known

and projected rate pegs, to fund new infrastructure investment, reduce

infrastructure backlog and improve financial sustainability. Of the

2017/18 proposed increase, 0.2% was to enable Council to take out a loan of $2M

for development of road infrastructure for Verons Estate. IPART approved

a one-year temporary increase of 13.2% for 2017/18 in May 2017. The one

year approval was given as IPART determined Council had not updated and

advertised its Integrated Planning & Reporting documents for its special

variation proposal. In its determination, IPART commented “Overall,

we consider on balance the community was adequately consulted, despite the

IP&R documentation not discussing the full extent of the rate rise.”

As part of the Councillor Budget Workshop held on 31

August 2017, a number of cost cutting and revenue raising initiatives were

discussed. This report provides:

· a number of cost

cutting and revenue options for consideration

· further details

about one of the Long Term Financial Plan scenarios presented at the Workshop

to allow Council to adopt a position on its revenue roadmap over the planning

horizon.

However, it is up to Council to determine its funding

priorities. At the Councillor Budget Workshop, options were discussed to

reduce costs by adjusting service delivery and increase revenue through

additional fees and charges. If adopted, the impact of these changes was

estimated to be $600,000 pa, leaving a funding gap of, approximately, $11.2M

pa, once expected increases to electricity charges and operational costs

associated with the Shoalhaven Indoor Sports Centre are factored into

Council’s Base Case scenario from 2019. While continuation of the

2017/18 special variation as a permanent increase reduces the funding gap to

$4.1M pa, it does not allow Council to adequately address asset renewal

requirements over the 10 year planning horizon - as can be seen in the

following chart:

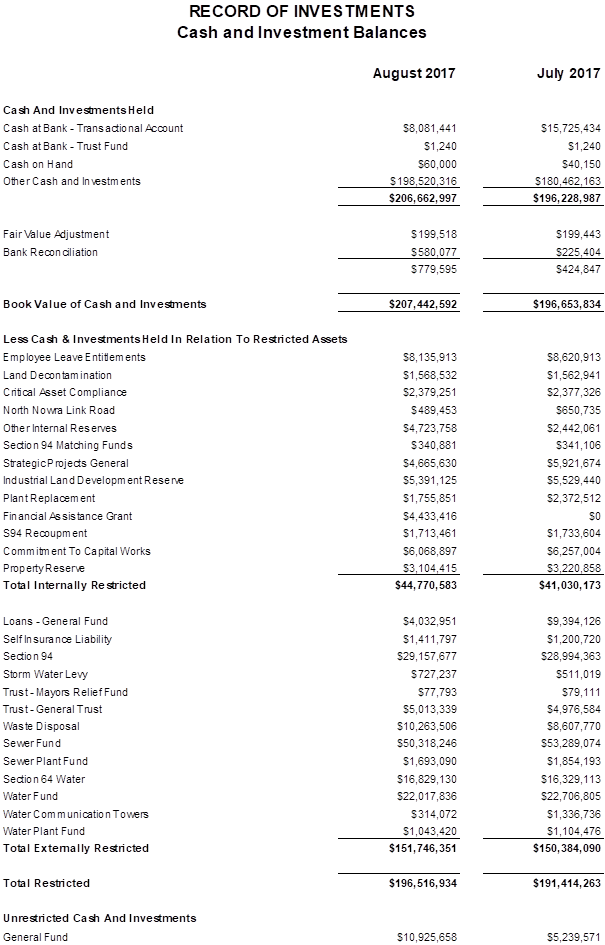

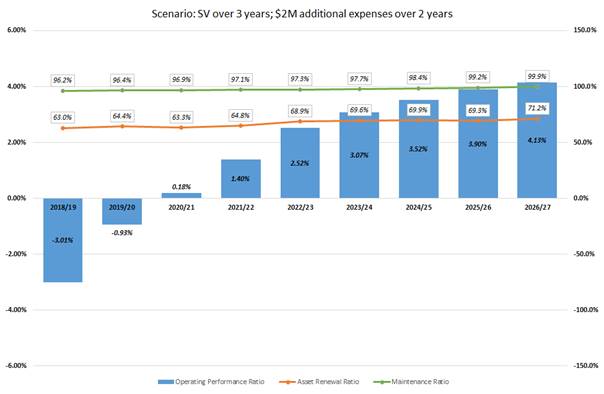

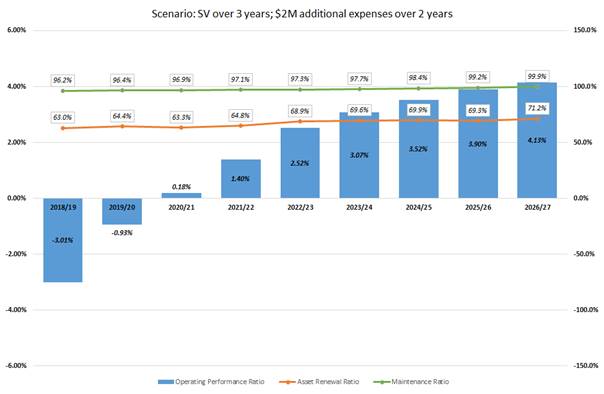

The operating performance ratio exceeds the target of 0% by 2021/22, a

year later than required under Fit for the Future. The asset maintenance

target is 100% and Council moves toward this target over the planning

horizon. An average of $15.5M pa over the planning horizon is needed to bring

the Building and Infrastructure Asset Renewal Ratio up to the benchmark level

of 100%, all other things being equal.

The operating performance ratio exceeds the target of 0% by 2021/22, a

year later than required under Fit for the Future. The asset maintenance

target is 100% and Council moves toward this target over the planning

horizon. An average of $15.5M pa over the planning horizon is needed to bring

the Building and Infrastructure Asset Renewal Ratio up to the benchmark level

of 100%, all other things being equal.

The Base Case contrasts strongly with a scenario where

the 13.2% increase is not retained as a permanent increase to Council’s

rate base:

In this case, Council will not meet its operating

performance ratio target over the planning horizon and there is a deterioration

in the asset renewal ratio.

While this report recommends applying for further

special variation increases over the next three years, a list of cost-cutting

measures and other revenue raising initiatives is presented in this report for

Council’s consideration.

Cost Reduction and Revenue

Increase Actions

There are several actions that would reduce the

reliance on a SRV.

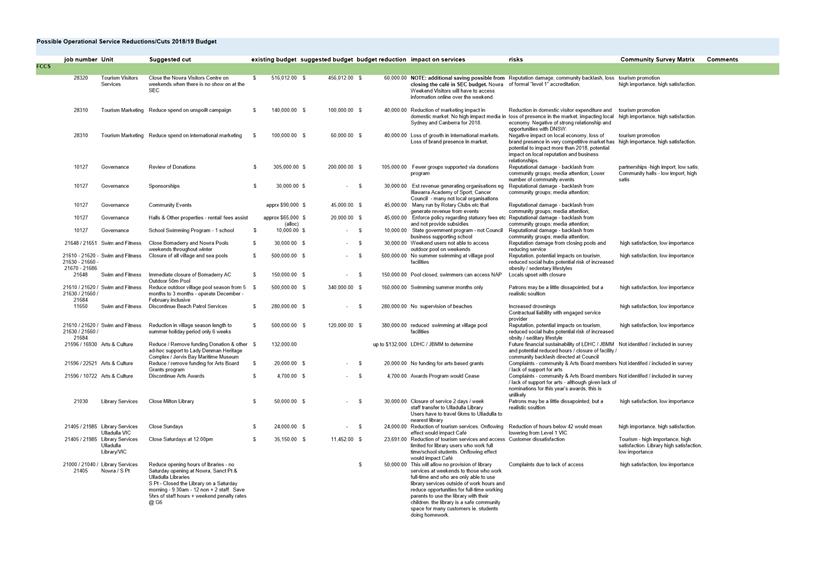

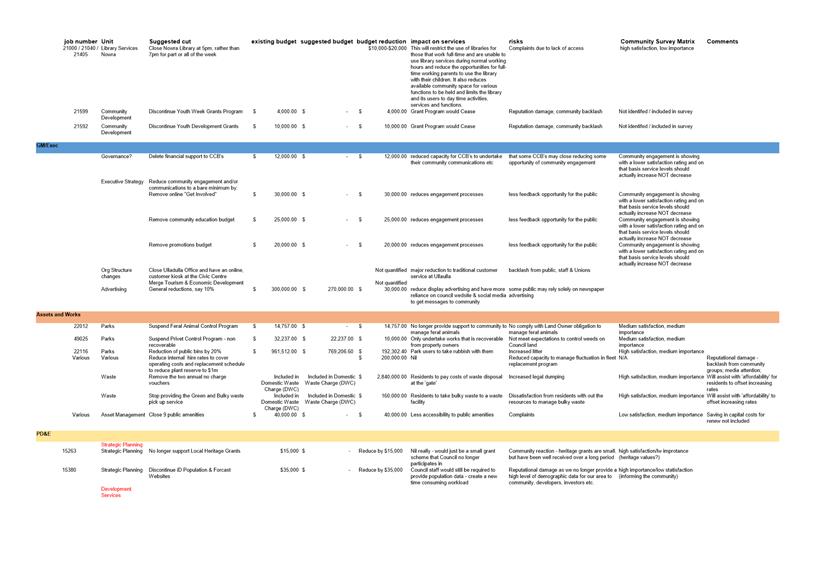

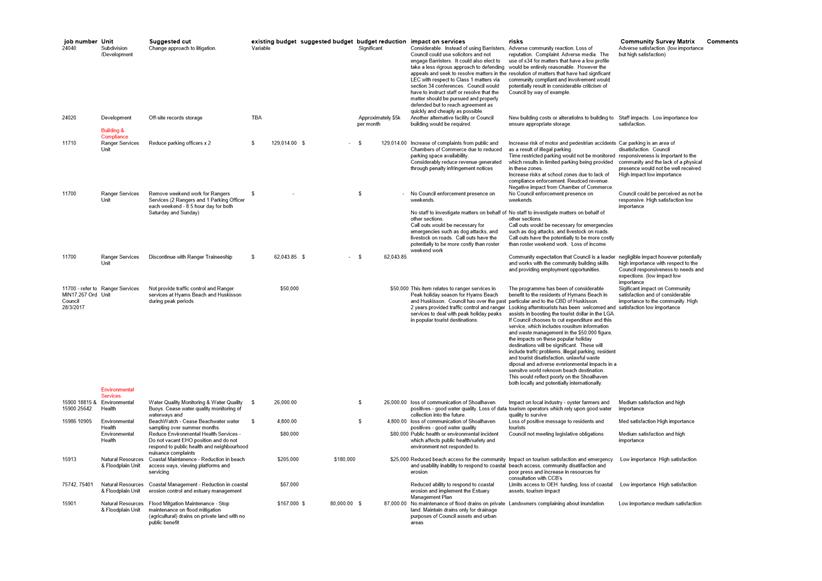

1. Operational service reductions

and revenue opportunities: These are identified at Attachment 1. Option 2

(in Options) requests Council to consider cuts to operational budgets and

increases in revenue to reduce the need for rate rises. Council could

identify a number of cost reductions and revenue increases from this

attachment, however there are some serious outcomes that would arise,

particularly relating to reduced services, increased complaints and

delays. Each $600,000 identified will decrease the need for a rate rise

by approximately 1% and improve the Operating Performance Ratio.

However, benchmarking from the LG

Professionals and PwC report, ‘Local government operational and

management effectiveness report’, Office of Local Government comparative

data and a range of internal indicators, indicate that:

a. Total

administration costs as a percentage of operating costs; and

b. Staffing

levels in corporate services (finance, customer services, IT & HR) and DA

assessment

are

already below industry levels, i.e., staff levels should actually increase in

some areas to meet workloads and community expectations (see section on

Resourcing Issues below).

Further

reductions would lead to staff dissatisfaction and increased turnover, adding

costs for recruitments, reduced productivity and increased absenteeism.

2. Reduce capital expenditure by

removing new, unfunded asset works, including any budgets to produce

masterplans, complete detailed design works and the like. A list of such

works is in Attachment 2 and savings (cuts) up to $750K may be possible. Again,

there are serious implications and community expectations will not be

met. By reducing CAPEX for “new works”, such as new community

pathways etc., it will free up funds for renewal and maintenance works or

simply improve the cash deficit position.

3. Target further operational

productivity improvements. The LTFP includes a salary savings target of

$233,900 in the 2017/18 budget and this is escalated over the forward years in

line with projected award increases. The salary savings target could be

increased to, say, $500,000. To achieve this target requires a deliberate delay

in replacing/recruitments when a vacancy occurs. This results in a loss

of capacity to undertake works, more pressure on other staff members and

potential for service complaints. In addition, savings in non-salary

items (materials and contracts and other expenses) expenditures are budgeted at

the rate peg and below CPI. For the 2016/17 budget, this was quantified

at $1.8M in savings. Substantial “productivity” savings were

also factored into the 2014/15 and 2015/16 budgets as part of the

Transformation Program and further reductions will have a real impact on

operations.

4. Procurement savings. Continue

to budget for savings from procurement. The estimated savings for 2017/18 is

$60K.

There are diminishing returns from tendering activities as

fewer existing contracts are available to be market tested or negotiated as

part of the Illawarra Shoalhaven Joint Organisation (ISJO), together with

Council’s existing use of large panel arrangements. Favourable

price reductions may not be achieved due to changes in exchange rate, utility

costs, interest rate rises, etc.

5. Reduce fees paid to

Councillors. Council currently pays the maximum fees allowable for the

Regional Rural category ($19,310 pa) but could pay a lesser fee (the lowest fee

in the approved range is $8,750 pa) – overall a potential saving of

$94,440. In addition, Council could reduce the travel “mileage”

rate allowance to the same level as the LG Award or ATO rate, as the current

rate is above these.

However, it is arguable that Councillors are not paid enough

in recognition of their workload now, so any reduction would make it more

difficult to attract quality Councillor candidates at the next election and

existing Councillors are less motivated to work as hard.

6. In major corporate cost

reduction programs other measures have included:

a. Salary

& wage freeze – this is not possible under the existing Award

provisions;

b. New technology – contract negotiations are almost

complete with Tech 1 to commence implementation of new systems which will have

a two year completion time frame;

c. Sell underperforming assets – the Ross Report

highlights some opportunities however this will be an involved community

engagement process and early indications have not been supportive;

Resourcing Issues

At a Councillor Briefing (as

part of the senior staff contractual matters committee meeting) on 24 August

2017 (Attachment 3), a number of resource challenges for Council were

identified:

· Increasing

community expectations

· Workload

from a growing local economy and increased development

· Ageing

workforce

· Competitiveness

- ability to attract and retain the right people

· Performance

against service delivery benchmarks

The Briefing identified

approximately $3.8M of ongoing resourcing needs. However, only $2M of

additional expenditure (approx. 50% of needs), phased over two years, is

included in the financial modelling over the planning horizon.

Revenue Options

At the Budget Workshop on 31st

August, three options were explored to increase revenue:

1. Apply

“user pays” principle to a broader range of services provided by

Council; for example, paid parking during peak periods, fees and charges for

the use of sports grounds, spectator fee to access swim and fitness

facilities. The attachment contains further details about the last two

possibilities. Paid parking requires the development of a business case

to ensure that benefits will be greater than the lifecycle cost.

2. Make

a special levy.

The option of an Infrastructure Levy was raised at the

Budget Workshop to address the asset renewal shortfall.

It is noted that a fixed annual charge, under section 501

of the Local Government Act 1993, can only be levied for purposes specified in

the Act and those prescribed by regulation. Under the Act, Council may

impose annual charges only for water, sewerage, drainage and waste

services. Therefore, a levy can only be made and levied legally as either

ad valorem, ad valorem with a base amount or ad valorem and a minimum amount,

and is indistinguishable from making a special rate. A portion of the

special levy that was discussed has been included in the proposed rate increase

for 2018/19 (+1%).

3. Make

a Special Rate

To limit the impact on the community, address some of the

resourcing issues at Council and progress toward the benchmarks for the three

key Fit for the Future indicators (operating performance ratio; building and

infrastructure asset renewal ratio; maintenance ratio), the following

multi-year special variations are proposed:

· 5%

rate increase (including the rate peg of 2.5%) in 2018/19

· 5%

rate increase(including the rate peg of 2.5%) in 2019/20

· 5%

rate increase(including the rate peg of 2.5%) in 2020/21

This means that there will be a cumulative increase of 15.8%

over the 2017/18 rate base (assuming the 13.2% special variation is retained as

a permanent increase), which is 4% lower than council’s original 14% SRV

for 2018/19. The increase will, however, allow Council to meet its Fit

for the Future targets but at a slower rate.

The chart shows the projected impact on the key financial

indicators of this proposal:

To achieve the asset renewal target of 100% by 2026/27,

requires rate increases of 5% pa for the next seven years followed by a 3.4%

increase in 2025/26.

Community Engagement

Community engagement in relation

to proposed special variations has been ongoing since November 2016. If

the recommendations in this Report are adopted by Council, a revised Delivery

Program and Operational Plan, containing an additional chapter detailing the

revisions, together with an updated Long Term Financial Plan, needs to be

prepared for Council to adopt by mid-October 2017.

The community will, then, have

an opportunity to make submissions to Council regarding the setting of rates

for 2018/19 onward as part of the public exhibition of the revised Delivery

Program and Operation Plan 2017/18 in October and November 2017. A report

would be prepared for Council by the end of November 2017 and, if adopted,

would allow Council to notify IPART of its intentions to lodge a special

variations application in December 2017. Council would then need to make

the formal application in February 2018.

The draft DPOP and related

documents will be presented to Council in March 2018 and then placed on

exhibition for 28 days. It is planned that Council will need to adopt the

final DPOP/budget in June 2018. IPART are likely to announce its

determination sometime in May 2018.

Financial Implications

While some cost-cutting options

are possible, many require balancing service delivery levels with community

expectations. Irrespective of the cost-cutting options adopted by

Council, there will remain a funding gap that needs to be addressed by:

· Applying

to IPART to have the one-off increase allowed in 2017/18 as a permanent rate

increase. This reduces the funding gap from $11.2M pa to $4.1M pa

· Pursuing

other revenue initiatives to allow Council to better meet the community’s

asset and infrastructure expectations, address some of the resourcing issues at

Council and progress toward the benchmarks for the three key Fit for the Future

indicators (operating performance ratio; building and infrastructure asset renewal

ratio; maintenance ratio).

Should the recommended option of

additional special variations (inclusive of a rate peg of 2.5%) of 5% over the

next three financial years not be adopted, then other ways of bridging the

funding gap will need to be determined.

Risk Implications

There are substantial risks to

the financial sustainability of Council, if the existing and proposed special

variations are not approved as a permanent increase or Council declines

to identify how it can make budget (service) cuts or raise extra revenue. These

options are set out in Attachments 1 and 2. It would have a significant

detrimental impact on service levels.

If council continues a pathway

of underfunding the identified asset renewal works than the risk of asset

failure, inability to repair defects, or likelihood of more liability/accident

claims will increase.

If

Council choses the “do nothing” option, then the likely

intervention from OLG, at some stage in the future, would increase.