Extra Ordinary Meeting

Meeting Date: Tuesday,

13 June, 2017

Location: Council

Chambers, City Administrative Building, Bridge Road, Nowra

Time: At

conclusion of the Strategy & Assets Committee meeting which commences at

5.00pm

Membership (Quorum - 7)

All Councillors

Please note: Council’s Code of Meeting Practice

permits the electronic recording and broadcast of the proceedings of meetings

of the Council which are open to the public. Your attendance at this meeting is

taken as consent to the possibility that your image and/or voice may be

recorded and broadcast to the public.

Agenda

1. Apologies / Leave of Absence

2. Declarations of Interest

3. Reports

CL17.146..... Community Engagement Report- Integrated Strategic

Plan ........................ 1

CL17.147..... Chapter 1 Integrated Strategic Plan - Community

Strategic Plan - Priorities 4

CL17.148..... Chapter 2 Integrated Strategic Plan- DPOP - Goals

and Actions ................ 9

CL17.149..... Special Rate Variation- IPART Decision ..................................................... 13

CL17.150..... Chapter 3 Integrated Strategic Plan - Revenue

Policy - Making of Rates and Charges ...................................................................................................................... 15

CL17.151..... Swim and Fitness Service Levels - Nowra Aquatic

Park - DPOP Community Engagement Outcomes ............................................................................... 23

CL17.152..... Family Day Care Services - DPOP Community

Engagement Outcomes .. 36

CL17.153..... Chapter 4 Integrated Strategic Plan- DPOP Fees

and Charges................. 39

CL17.154..... Chapter 5 Integrated Strategic Plan-Budget and

Capital Works ................ 45

CL17.155..... Chapter 6 Integrated Strategic Plan - Resourcing

Strategy ....................... 58

|

|

Extra Ordinary

Meeting – Tuesday 13 June 2017

Page

1

|

CL17.146 Community

Engagement Report- Integrated Strategic Plan

HPERM Ref: D17/171856

Group: General

Manager's Group

Section: Executive

Strategy

Attachments:

1. Community Engagement Report Integrated

Strategic Plan (under separate cover) ⇨

Purpose / Summary

To provide a report on the

community engagement process undertaken for the Integrated Strategic Plan and

the feedback received from the community.

|

Recommendation

That Council:

1. Receive the ‘Community

Engagement - Integrated Strategic Plan’ report for Information

2. Advise the community of the outcomes

of the community engagement process

3. Thank the community for their

participation and feedback in the engagement process

|

Options

1. Adopt the recommendation as printed

Implications: This will allow for the community

engagement report to be supported by Council

2. Adopt an alternative recommendation

Background

On the 28th March 2017 Council resolved to:

1. Endorse

the Community Engagement Strategy for the CSP Review

2. Undertake community engagement for four weeks

commencing April 1st 2017

An extensive community

engagement process was undertaken for the Integrated Strategic Plan. Over 200

community members participated in the process in some form either online or

face to face. Over 3000 comments/responses were received from the community.

These have directly influenced the development of the Integrated Strategic

Plan. The methods and tools utilised in the engagement process and the feedback

are provided in detail in Attachment A

The consultation process

conducted from the 10th April until the 27th May 2017

involved two distinct stages. These stages included engagement on:

· Stage 1 -Key

Priorities

· Stage 2- Goals and

Actions (DPOP), Budget and Fees and Charges (including proposed rates

variation)

· Stage 2 (a) Nowra

Pool

· Stage 2(b) Family

Day Care

Purpose of Engagement

The strategy sought to:

· provide all parts

of the community with the opportunity to be informed about and have the

opportunity to be involved in the review of the Community Strategic Plan.

· utilise effective

and innovative communication and community engagement methods to reach our

stakeholders.

· ensure the

Shoalhaven Community Strategic Plan reflects the long-term vision and

priorities of the community.

· seek to engage

with the “hard to reach” where possible to seek a wide range of

community views.

Engagement Methods

Multiple engagement methods including digital and face to face

options were provided throughout the process. The engagement methods and

communication tools utilised in the process are detailed in Attachment A.

A high level of community understanding and awareness of the

project was observed throughout the process.

Results

The community

outlined that key areas of focus for the future are:

· Infrastructure

development (particularly roads)

· Protection of the

environment

· Opportunities for

employment

· Transport

· Pathways and

cycleways

· Green waste

· Tourism (both

management of and attraction to)

· Sustainable

development

· Responsible

governance and communication

The responses

received showed that the top three most important priorities were:

· Continually

improving our road and transport infrastructure

· Showcase and

protect the natural environment

· Manage and plan

sustainable development

· Active healthy and

liveable communities

Full details of the results are found within the Community

Engagement Report provided as Attachment 1 of this report.

Policy Implications

The outcomes of the community

engagement process have directly influenced the:

· Chapter

1- Community Priorities

· Chapter

2- DPOP Actions and Goals

· Resource

allocation in the resourcing strategy

· Budget

priorities and capital works projects

|

|

Extra Ordinary

Meeting – Tuesday 13 June 2017

Page

4

|

CL17.147 Chapter

1 Integrated Strategic Plan - Community Strategic Plan - Priorities

HPERM Ref: D17/171858

Group: General

Manager's Group

Section: Executive

Strategy

Attachments:

1. Chapter 1 -

Integrated Strategic Plan - Our Priorities (under separate cover) ⇨

Purpose / Summary

The purpose of this report is

to:

· Provide

specific detail about the community feedback provided for Chapter 1- Integrated

Strategic Plan- Community Priorities.

Detail the way in which this feedback has influenced the

finalisation of the ChapterSeek Council’s adoption of Chapter 1 of the

Integrated Strategic Plan.

|

Recommendation

That Council endorse Chapter 1 - Integrated Strategic Plan

- CSP - Community Priorities and include additional graphic design elements

following adoption.

|

Options

1. Adopt the recommendation as printed

Implications: This will enable Council to meet the

legislative requirements of the Integrated Planning and Report Framework.

2. Make further amendments to Chapter 1-

Integrated Strategic Plan- CSP- Community Priorities and adopt the amended CSP.

Implications: will depend on the extent of the

changes and any financial or other outcomes.

Background

In accordance with the

Integrated Planning and Reporting Framework, Council is required to have a

Community Strategic Plan that includes the community’s priorities

(objectives) for the next 10 years. The plan is also required to contain

strategies for the next 10 years to meet these priorities. The Integrated

Planning and Reporting Legislation also requires that a community engagement

process is carried out to seek the communities feedback about their priorities

for the future.

This engagement has now been

undertaken and the outcomes of the community’s feedback is detailed

within the Community Engagement Report provided as Attachment 1 to CL17.146 of

this business paper.

As part of this engagement

process the community were asked to review ten priorities which formed a key

component of the CSP. These ten priorities were developed from previous

engagement with the community and discussions with Councillors.

The priorities exhibited

included:

|

Theme

|

|

|

People

|

A city that builds inclusive,

safe and connected communities

Activated communities through

arts, culture and events

Active, healthy liveable

communities

|

|

Place

|

Continually improving our road

and transport infrastructure

Manage and plan sustainable

development and design

Showcase and protect the natural

environment

|

|

Economy

|

Attracting, retaining and

growing business and partnerships

Maintaining an innovative and robust economy and

vibrant

towns and villages

|

|

Stewardship

|

Reliable services that meet

daily community needs

Strong leadership and advocacy

through effective government

|

The feedback received from the

community about the priorities and other aspects of Chapter 1 is detailed in

the commentary below.

Community Feedback – Chapter 1- CSP

Community Feedback- Themes

The community indicated that the themes provided as part of

the engagement (People, Place, Economy and Stewardship) did not have much

meaning. They indicated that they would like additional detail within the

themes to assist in setting the future direction of Council.

Staff Comment/ Proposed Changes

To meet the requirements of the

IP&R framework and the feedback provided by the community it is proposed

for the four themes to be enhanced through additional explanation. This will

provide a more meaningful explanation of the community’s focus/priorities

for the next 10 years and help to improve readability and relevance of the

document.

Several the changes have come

directly from community submissions or words used within comments provided by

the community. The changes are proposed to be as follows:

|

Theme

|

|

|

People

|

Resilient, safe and inclusive communities

|

|

Place

|

Sustainable, liveable environments

|

|

Economy

|

Prosperous communities

|

|

Stewardship

|

Responsible governance

|

Community Feedback

-Priorities

Feedback on the priorities

showed that the community generally accepted all the priorities presented. The

community comments clearly show that the future direction that they envision

for the City and their areas of interest were provided within the priorities

presented. The top three priorities for the community included:

· Continually

improving our road and transport infrastructure

· Manage and plan

sustainable development

· Showcase and

protect the natural environment

Priority 10 - Attracting, retaining and growing business

and partnerships was not considered by the community to be Council’s

responsibility and they did not accept this as a future priority for Council.

However, employment was important and showed clearly through the community

engagement process. This has been addressed in the changes detailed below.

Staff Comment/ Proposed

Changes

Several changes were made to the

priorities to enhance readability of the document and include comments received

from the community. These changes are explained below:

|

Priority exhibited

|

Proposed Change following Community Engagement

|

Reason for Change

|

|

A city that builds inclusive, safe and connected communities

|

Build inclusive, safe and connected communities

|

Simplified, no change to meaning

|

|

Activated communities through arts, culture and events

|

Activate communities through arts, culture and events

|

Active verb, no change to meaning

|

|

Active, healthy liveable communities

|

Support active and healthy communities

|

Action statement, no change to meaning

|

|

Continually improving our road and transport infrastructure

|

Improve and maintain road and transport infrastructure

|

Active verb and maintain added to make it more specific

|

|

Manage and plan sustainable development

|

Plan and manage appropriate and sustainable development

|

Should Plan before we manage, appropriate added to make the priority

more specific

|

|

Showcase and protect the natural environment

|

Protect and showcase the natural environment

|

Protection of the natural environment is more important them

showcasing

|

|

Attracting, retaining and growing business and partnerships

|

Removed

|

3.1 and 3.2 were combined to create one Priority for Prosperous

Communities. Feedback stated that this priority was not seen as

Council’s responsibility

|

|

Maintain an innovative robust economy and vibrant towns and villages

|

Maintain and grow a robust economy with vibrant towns and villages

|

3.1 and 3.2 were combined to create one Priority for Prosperous

Communities

|

|

Reliable services that meet daily community needs

|

Deliver reliable services

|

Wording simplified

|

|

Strong leadership and advocacy through effective government

|

Provide advocacy and transparent leadership through effective

government and administration

|

Additional words to better capture internal Council services

|

|

Strong leadership and advocacy through effective government

|

Inform and engage with the community about the decisions that affect

their lives

|

Feedback requested responsible governance and improved communication

and engagement

|

Community Comment –

Overall CSP chapter

There were several comments received from the community

seeking additional detail to be provided within the CSP chapter. Explanation

about the principles used to develop the document, linkages to state plans and

more defined measures and outcomes were key community comments.

Staff Comment /Proposed

Changes

There are several additional

sections that have been added to the draft chapter following the engagement

process. Additional detail relating to measures, principles and state plans

have been added to the chapter. Additional detail relating to the IP&R

framework has also been added. Review of consistency with the requirements of

the IP& R framework has also been undertaken to further enhance the

chapter.

Additional sections include:

· Inclusion of

further detail within the introduction of the chapter

· Addition of

principles

· Addition of charts

and graphs to explain IP&R framework

· Refinement of

measures and indicators

· Inclusion

of section on state and regional plans

These additions are highlighted in blue within Attachment 1

of this report.

Community Engagement

A comprehensive community engagement process was undertaken

for this Chapter and is detailed within CL17.146 of this business paper.

Policy Implications

The changes highlighted within

this report will impact upon Chapter 1 of the Integrated Strategic Plan and

have been included to further meet the requirements of the IP&R framework

and community needs resulting from the engagement process.

The themes and priorities

featured within this chapter directly influence the goals and actions contained

within the DPOP which is provided as Chapter 2 of the Integrated Strategic

Plan.

This chapter sets the future

direction for council for the next 10 years and clearly outlines the

community’s priorities for the future. This plan is delivered by Council,

but also needs to be delivered by the community, the State Government and other

stakeholders.

The themes and priorities within

the plan and the ways in which these are used to guide the goals and actions of

Council will be reported back to the community through Council’s Annual

Community Report and end of term report.

Financial Implications

Chapter 1 of the Integrated

Strategic Plan sets the direction of Council and identifies the

community’s top priorities. This directly influences Councils budget and

capital works program through the DPOP goals and actions.

|

|

Extra Ordinary

Meeting – Tuesday 13 June 2017

Page

8

|

CL17.148 Chapter

2 Integrated Strategic Plan- DPOP - Goals and Actions

HPERM Ref: D17/175021

Group: General

Manager's Group

Section: Executive

Strategy

Attachments:

1. Chapter 2 -

Integrated Strategic Plan- DPOP-Goals and Actions (under separate cover) ⇨

The purpose of this report

is to:

· Provide

specific detail about the community feedback provided for Chapter 2- Integrated

Strategic Plan- DPOP-Goals and Actions.

Detail the way in which this feedback has influenced the

finalisation of the ChapterSeek Council’s adoption of Chapter 2 of the

Integrated Strategic Plan.

|

Recommendation

That Council adopt Chapter 2-

Integrated Strategic Plan- DPOP- Goals and Actions and include additional

graphic design elements following adoption.

|

Options

1. Adopt the recommendation as printed

Implications: This will enable Council to meet the

legislative requirements of the Integrated Planning and Report Framework.

2. Adopt “Chapter 2- Integrated

Strategic Plan- DPOP- Goals and Actions” with additional additions or

amendments to reflect the priority aims of council.

Implications: The DPOP is to reflect the goals

& actions council wishes to achieve over the next 4 years (broad goals) and

I year (specific actions). Councillors need to ensure that the DPOP reflects

what it wishes to achieve.

Background

In accordance with the

Integrated Planning and Reporting Framework, Council is required to have a

Delivery Program and Operational Plan that includes Council’s activities

for the next four years and activities for the next year. The Integrated

Planning and Reporting Legislation also requires that a community engagement

process is carried out to seek the communities feedback about Council’s

proposed CSP and DPOP.

Council has placed the DPOP on

exhibition for a period of 28 days to seek the community’s feedback on

this document. This year the DPOP has been broken into several separate

chapters to enable the community to clearly understand Council’s future

direction, allocation of budget and the activities that will be undertaken by

Council in the coming years.

The reports provided within this

business paper have also been broken into separate sections to clearly show the

community how their feedback has been received and addressed within each

chapter of the document.

These reports also enable

Council to understand the proposed changes within each chapter resulting from

the engagement process and to consider each of these changes within this

engagement context.

This report provides details of

the feedback received from the community on the actions and goals outlined

within the DPOP – Chapter 2 of the Integrated Strategic Plan. Comments

received from the community about the Budget, Capital works, Fees and Charges

are detailed in following reports contained within this business paper.

Community Feedback –

Chapter 2- DPOP- Goals and Actions

The DPOP needs to reflect

community expectations and be adjusted to acknowledge the feedback received

from the community about their future priorities. To ensure the DPOP was

representative of community feedback received, several internal staff workshops

were held to review and adjust the DPOP - Chapter 2 accordingly.

Each of the comments provided by

the community were reviewed and considered as well as the overall results and

priority allocations. The changes to the community priorities and additions of

detail to the themes was also considered.

Additional changes were also

made to ensure the document was more readable in terms of providing additional

improvements to “Plain English “text. The additions of actions or

goals for areas of community interest that had not been covered were also

included.

The amended draft Chapter 2 is

provided as Attachment 1 to this report. Additions and changes have been

identified within the document in blue.

The proposed changes are

summarised as follows:

· Addition of goals

and actions to meet community feedback

· Significant

rewording of goals and actions to improve readability and community

understanding

· Rewording of goals

and actions to provide consistency throughout the document

· Addition of goals

and actions to meet changes to priorities and themes

· Addition of

further explanation and introduction at the beginning of the chapter

· Internal staff

changes to better reflect business operations

· Consolidation of

goals and actions to reduce overall number

Written Submissions

The community feedback provided as part of the entire

Integrated Strategic Plan engagement process is outlined in detail in Report CL17.146

– Community Engagement of this business paper. Specific submissions

related to this chapter have been provided within this report.

As part of the exhibition process eight (8) external and

internal submissions were received for this chapter. These submissions are

summarised in table 1 below. Copies of each of these submissions, are provided

in the Councillor Information folder. These submissions were addressed within

Chapter 2 through additions and changes to the goals and actions are provided

in Attachment 1.

Table 1: Submission Summary

|

No.

|

|

Submission

|

Response

|

|

1

|

staff

|

Changes to the draft DPOP

document - staff submission

|

Changes made to the document

|

|

2

|

staff

|

Changes to the draft DPOP

document- staff submission

|

Updates made to CSP and DPOP, as requested by Strategic

Planning.

|

|

4

|

staff

|

Additional Goal and Action

added to cover the Disability Inclusion Action Plan

|

Updates made to CSP and DPOP, as requested

|

|

5

|

staff

|

Review and implement Asset

Management Plans for coastal, flood, bushfire, walking tracks and estuary

assets and include climate change risk

assessment and adaptation strategies where possible.

|

Updates made to CSP and DPOP, as requested

|

|

6

|

staff

|

Changes to draft DPOP

document - staff submission

|

Details the changes made to the R,C & C section of the draft DPOP

|

|

7

|

staff

|

DP/OP goal and actions that

will enable the Economic Development Office to actively pursue any

opportunities that may come up through the Smart Cities suite of programs and

other new technologies.

|

Changes made to the document

|

|

8

|

Anonymous

|

The language you have

chosen to use in this ridiculously lengthy document is often biased, vague

and/or meaningless. I have lived and worked in the Shoalhaven for 10 years

and know that the literacy rates for the majority of this area mean that they

are unable to follow your outline. Is this a deliberate attempt to stifle our

voices? Don't pretend you don't know this. If you really want to know what we

think about things ask us in a respectful and meaningful way or don't bother,

for at least we will know where we stand. This is an insult to our

intelligence and a waste of our time and more importantly a missed

opportunity to gain trust and obtain valuable information for our communities

future. And you want us to pay more $$$ for it. Its not the $bill I mind, its

the cowardly way in which you express your entitlement - or rather, dont.

|

Points taken into consideration in review of the draft Integrated

Plan, i.e plain English changes made

|

Community Engagement

A comprehensive community engagement process was undertaken

for this Chapter and is detailed within CL17.146 of this business paper.

Policy Implications

The changes highlighted within

this report will impact upon Chapter 2 of the Integrated Strategic Plan and

have been included to further meet the requirements of the IP&R framework

and community needs resulting from the engagement process.

This chapter sets the future

direction for council for the next 4 years and clearly outlines the

community’s goals and actions for the future.

Financial Implications

Chapter 2 of the Integrated

Strategic Plan sets the direction of Council and the actions to be taken and is

resourced through the Resourcing Strategy, Budget and Capital works program.

|

|

Extra Ordinary

Meeting – Tuesday 13 June 2017

Page

12

|

CL17.149 Special

Rate Variation- IPART Decision

HPERM Ref: D17/172590

Group: General

Manager's Group

Section: Executive

Strategy

Purpose / Summary

To provide Council with the

outcome of the special rate variation to IPART and seek the adopting of a 13.2%

special rate variation for the 2017/18 financial year.

|

Recommendation

Council adopt a Special Rate Variation of 13.2% including

the rate peg of 1.5% for the 2017/18 Financial Year

|

Options

1. Adopt the recommendation as printed

Implications: This will allow Council to apply

these additional funds to high priority maintenance and renewal projects and

other areas as identified in the Special Rate Variation application and the

draft DP/OP that has been exhibited.

2. Adopt an alternative recommendation

Implications: Not approving the Special Rate

Variation or approving a lesser amount, will significantly reduce the on ground

works that will be able to be undertaken in the next 12 months. The

renewal and maintenance works have continuously been identified by the

community as their number one priority for additional action by Council.

Background

At its 1 February 2017

Extraordinary Meeting, Council considered an extensive report following the

community engagement and resolved (MIN17.71) to proceed with a Special Rate

Variation. Subsequently an application was made to IPART to seek approval

for this variation. The application to IPART explained that the SV for a

general rate increase was to cover infrastructure maintenance and renewal,

maintenance of services and to ensure the financial sustainability of the

council. A secondary purpose was to levy a special rate on the Verons

Estate subdivision to pay for necessary road and bushfire safety infrastructureOn

the 9 May 2017, IPART determined Council’s Special Rate Variation

Application and found that:

“After assessing the

council’s application, we decided to allow the special variation in part,

on a one year temporary basis. We have made this decision under section 508(2)

of the Act.”

“We determined that

Shoalhaven City Council may increase its general income in 2017-18 by 13.2%,

including the rate peg of 1.5% that is available to all councils (see Table

1.1). The SV can be retained in the council’s general income base for one

year and is to be removed from the council’s rate base in 2018-19.”

The IPART decision enables

Council to:

· begin its

planned program of infrastructure maintenance and renewal

· continue its

current level of services to the community

· begin

addressing the Verons Estate infrastructure requirements, and

· begin improving

its financial sustainability

The report also stated that:

“The council did not

update its IP&R documents to include the full SV increase sought prior to

applying to IPART. Therefore, we have not approved a permanent increase

in general income. However, the council did demonstrate a clear need for

additional revenue to ensure its financial sustainability and to fund increased

infrastructure maintenance and renewal. Our decision is to allow, on a

temporary basis, the first year of the council’s SV request. This

decision allows the council to continue to execute its Delivery Program in

2017-18 while updating its IP&R documentation and reapplying to IPART in

future years if it wishes for a rate increase to be permanently incorporated in

its general income base.”

The additional income from the

special variation must be used for:

“the purposes of

improving financial sustainability, funding capital expenditure, reducing the

infrastructure backlog and providing the necessary fire safety and road

infrastructure for Verons Estate as outlined in the council’s application

and listed in Appendix A” of the IPART report.

The report also stated that the impact is reasonable given

the council’s existing rate levels, its history of special variations,

the purpose of the special variation and indicators of the community’s

capacity to pay.

Community Engagement

The special rate variation

proposal was the subject of a comprehensive community engagement process.

The methods utilised within this engagement and the feedback received from the

community was provided in the IPART application.

In the report to Council IPART

specified that:

“Council provided

evidence the community is aware of the need for, and extent of, the rate

rise. It used a variety of strategies to inform the community, although

it provided little detail about how the additional revenue would be

spent. There were sufficient opportunities for community feedback, and

the council considered the community’s views”

Financial Implications

The adoption of the Special Rate

Variation will provide Council with an additional $7.1M for the 2017/18

financial year to undertake works/activities as identified in the application.

|

|

Extra Ordinary

Meeting – Tuesday 13 June 2017

Page

14

|

CL17.150 Chapter

3 Integrated Strategic Plan - Revenue Policy - Making of Rates and Charges

HPERM Ref: D17/172616

Group: General

Manager's Group

Section: Executive

Strategy

Purpose / Summary

Provide Council with suggested

responses to the submissions received, as part of the public exhibition of the

draft Integrated Strategic Plan 2027, about Council’s Revenue Policy, so

that rates and charges can be made by Council in accordance with the

legislative requirements of the Local Government Act 1993.

|

Recommendation

That Council resolve to make rates and charges in

accordance with Section 535 of the Local Government Act 1993:

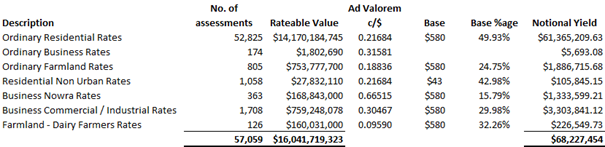

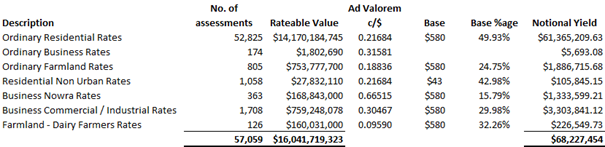

1. Make

an Ordinary Rate, consisting of an ad valorem rate of 0.21684c for each

dollar of rateable land value in addition to a base amount of five hundred

and eighty dollars ($580.00) per rateable assessment, in accordance with

Section 537 of the Local Government Act 1993, on all rateable land

categorised as “Residential”, in accordance with Section 516, for

the period 1 July 2017 to 30 June 2018 and, in accordance with Section

543(1), this rate be named “RESIDENTIAL”.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of five hundred and eighty dollars ($580.00) per rateable assessment

for the “RESIDENTIAL” category will not produce more than 50% of

the total amount payable by the levying of the “RESIDENTIAL” rate

in accordance with Section 537(b) [base amount percentage is 49.93%]

2. Make

an Ordinary Rate, consisting of an ad valorem rate of 0.31581c for each

dollar of rateable land value be made on all rateable land in the City of

Shoalhaven, in accordance with Section 518 of the Local Government Act 1993:

“Land is to be categorised as ‘business’ if it cannot be

categorised as farmland, residential or mining”. Excepting all

rateable land in the sub categories of Commercial/Industrial and Nowra, an

ordinary rate be now made for the period of 1 July 2017 to 30 June 2018 and,

in accordance with Section 543(1), this rate be named “BUSINESS”.

3. Make

an Ordinary Rate, consisting of an ad valorem rate of 0.18836c for each

dollar of rateable land value in addition to a base amount of five hundred

and eighty dollars ($580.00) per rateable assessment, in accordance with

Section 537 of the Local Government Act 1993, on all rateable land

categorised as “Farmland”, in accordance with Section 515, for

the period 1 July 2017 to 30 June 2018 and, in accordance with Section

543(1), this rate be named “FARMLAND”.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of five hundred and eighty dollars ($580.00) per rateable assessment

for the “FARMLAND” category will not produce more than 50% of the

total amount payable by the levying of the “FARMLAND” rate in

accordance with Section 537 (b) [base amount percentage is 24.75%].

4. Make

an Ordinary Rate, consisting of an ad valorem rate of 0.21684c for each

dollar of rateable land value in addition to a base amount of forty three

dollars ($43.00) per rateable assessment, in accordance with Section 537 of

the Local Government Act 1993, on all rateable land in the City of Shoalhaven

which is zoned so as not to permit any building (i.e.; Small Lot Rural

Subdivisions) and categorised as “Residential”, in accordance

with Section 516, sub category “NON-URBAN”, in accordance with

Section 529(2)(b), for the period 1 July 2017 to 30 June 2018.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of forty three dollars ($43.00) per rateable assessment for the

“RESIDENTIAL NON-URBAN” category will not produce more than 50%

of the total amount payable by the levying of the “RESIDENTIAL

NON-URBAN” rate in accordance with Section 537(b) [base amount

percentage is 42.98%].

5. Make

an Ordinary Rate, consisting of an ad valorem rate of 0.66515c for each

dollar of rateable land value in addition to a base amount of five hundred

and eighty dollars ($580.00) per rateable assessment, in accordance with

Section 537 of the Local Government Act 1993, on all rateable land in the

City of Shoalhaven determined to be a centre of activity and categorised as

“Business”, in accordance with Section 518, sub-category

“NOWRA”, in accordance with Section 529(1), for the period 1 July

2017 to 30 June 2018 and, in accordance with Section 543(1), this rate be

named “BUSINESS NOWRA”.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of five hundred and eighty dollars ($580.00) per rateable assessment

for the “BUSINESS NOWRA” sub category will not produce more than

50% of the total amount payable by the levying of the “BUSINESS

NOWRA” rate in accordance with Section 537(b) [base amount percentage

is 15.79%].

6. Make

an Ordinary Rate, consisting of an ad valorem rate of 0.30467c for each

dollar of rateable land value in addition to a base amount of five hundred

and eighty dollars ($580.00) per rateable assessment, in accordance with

Section 537 of the Local Government Act 1993, on all rateable land in the

City of Shoalhaven used or zoned for professional/commercial trade or

industrial purposes, determined to be a centre of activity and categorised as

“Business”, in accordance with Section 518, sub category

“COMMERCIAL/INDUSTRIAL”, in accordance with Section 529(1), for

the period of 1 July 2017 to 30 June 2018.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of five hundred and eighty dollars ($580.00) per rateable assessment

for the “BUSINESS –COMMERCIAL/INDUSTRIAL” category will not

produce more than 50% of the total amount payable by the levying of the

“BUSINESS – COMMERCIAL/INDUSTRIAL” rate in accordance with

Section 537(b) [base amount percentage is 29.98%].

7. Make

an Ordinary Rate, consisting of an ad valorem rate of 0.09590c for each

dollar of rateable land value in addition to a base amount of five hundred

and eighty dollars ($580.00) per rateable assessment, in accordance with

Section 537 of the Local Government Act 1993, on all rateable land

categorised as “Farmland” sub category “DAIRY

FARMERS”, in accordance with Section 515 AND 529(2)(a), for the period

1 July 2017 to 30 June 2018 and, in accordance with Section 543(1), this rate

be named “FARMLAND” sub category “DAIRY FARMERS”.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of five hundred and eighty dollars ($580.00) per rateable assessment

for the “FARMLAND –DAIRY FARMERS” category will not produce

more than 50% of the total amount payable by the levying of the “FARMLAND

– DAIRY FARMERS” rate in accordance with Section 537(b) [base

amount percentage is 32.26%].

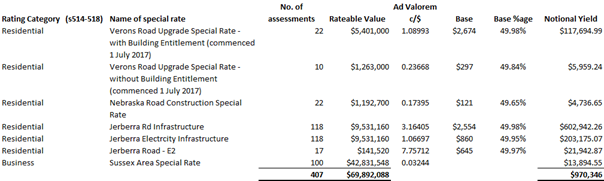

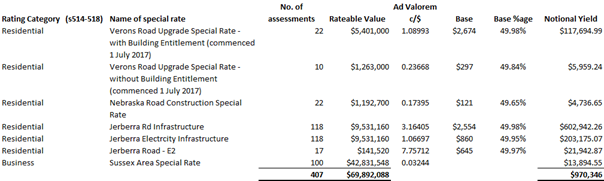

8. Make

a Special Rate, in accordance with Section 538, consisting of an ad valorem

rate of 1.08993c for each dollar of rateable land value in addition to a base

amount of two thousand six hundred and seventy four dollars ($2,674.00), for

the cost of road upgrades required to enable property owners to develop their

allotments in the Veron’s estate. In accordance with Section

495(1), the special rate is to be levied only on those rateable properties

with building entitlement within the Veron’s estate which, in the

opinion of Council, derive special benefit and are subject to this rate, in

accordance with Section 495(2) (a) (b) and (c). The special rate be now

made for the period 1 July 2017 to 30 June 2018 and, in accordance with

Section 543(2), this rate be named “VERON’S ROAD UPGRADE SPECIAL

RATE – WITH BUILDING ENTITLEMENT”.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of two thousand six hundred and seventy four dollars ($2,674.00) per

rateable assessment for the “VERON’S ROAD UPGRADE SPECIAL RATE

– WITH BUILDING ENTITLEMENT” will not produce more than 50% of

the total amount payable by the levying of the “VERON’S ROAD UPGRADE

SPECIAL RATE – WITH BUILDING ENTITLEMENT” in accordance with

Section 537(b) [base amount percentage is 49.98%].

9. Make

a Special Rate, in accordance with Section 538, consisting of an ad valorem

rate of 0.23668c for each dollar of rateable land value in addition to a base

amount of two hundred and ninety seven dollars ($297.00), for the cost of the

road upgrades in the Veron’s estate. In accordance with Section

495(1), the special rate is to be levied only on those rateable properties without

building entitlement within the Veron’s estate which, in the opinion of

Council, derive special benefit and are subject to this rate in accordance

with Section 495(2) (a) (b) and (c). The special rate be now made for

the period 1 July 2017 to 30 June 2018 and, in accordance with Section

543(2), this rate be named “VERON’S ROAD UPGRADE SPECIAL RATE

– WITHOUT BUILDING ENTITLEMENT”.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of two hundred and ninety seven dollars ($297.00) per rateable

assessment for the “VERON’S ROAD UPGRADE SPECIAL RATE –

WITHOUT BUILDING ENTITLEMENT” will not produce more than 50% of the

total amount payable by the levying of the “VERON’S ROAD UPGRADE

SPECIAL RATE – WITHOUT BUILDING ENTITLEMENT” in accordance with

Section 537(b) [base amount percentage is 49.84%].

10. Make

a Special Rate, in accordance with Section 538, consisting of an ad valorem

rate of 0.17395c for each dollar of rateable land value in addition to a base

amount of one hundred and twenty one dollars ($121.00) for the cost

associated with the Nebraska road construction project. In accordance

with Section 495(1), the special rate is to be levied only on those rateable

properties within the Nebraska estate which, in the opinion of Council,

derive special benefit and are subject to this rate in accordance with

Section 495(2) (a) (b) and (c). The special rate be now made for the

period 1 July 2017 to 30 June 2018 and, in accordance with Section 543(2),

this rate be named “NEBRASKA ROAD CONSTRUCTION SPECIAL

RATE”.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of one hundred and twenty one dollars ($121.00) per rateable

assessment for the “NEBRASKA ROAD CONSTRUCTION SPECIAL RATE” will

not produce more than 50% of the total amount payable by the levying of the

“JERBERRA ROAD E2 SPECIAL RATE” in accordance with Section 537(b)

[base amount percentage is 49.98%].

11. Make

a Special Rate, in accordance with Section 538, consisting of an ad valorem

rate of 3.16405c for each dollar of rateable land value in addition to a base

amount of two thousand five hundred and fifty four dollars ($2,554.00) for

the cost associated with the Jerberra road infrastructure project. In accordance

with Section 495(1), the special rate is to be levied only on those rateable

properties within the Jerberra estate which, in the opinion of Council,

derive special benefit and are subject to this rate in accordance with

Section 495(2) (a) (b) and (c). The special rate be now made for the

period 1 July 2017 to 30 June 2018 and, in accordance with Section 543(2),

this rate be named “JERBERRA ROAD INFRASTRUCTURE SPECIAL

RATE”.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of two thousand five hundred and fifty four dollars ($2,554.00) per

rateable assessment for the “JERBERRA ROAD INFRASTRUCTURE SPECIAL

RATE” will not produce more than 50% of the total amount payable by the

levying of the “JERBERRA ROAD INFRASTRUCTURE SPECIAL RATE” in

accordance with Section 53 (b) [base amount percentage is 49.98%].

12. Make

a Special Rate, in accordance with Section 538, consisting of an ad valorem

rate of 1.06697c for each dollar of rateable land value in addition to a base

amount of eight hundred and sixty dollars ($860.00) for the cost associated

with the Jerberra electricity infrastructure project. In accordance

with Section 495(1), the special rate is to be levied only on those rateable

properties within the Jerberra estate which, in the opinion of Council,

derive special benefit and are subject to this rate in accordance with

Section 495(2) (a) (b) and (c). The special rate be now made for the

period 1 July 2017 to 30 June 2018 and, in accordance with Section 543(2),

this rate be named “JERBERRA ELECTRICITY INFRASTRUCTURE SPECIAL

RATE”.

Further, to comply with

Section 500 of the Act, the total amount payable by the levying of the base

amount of eight hundred and sixty dollars ($860.00) per rateable assessment

for the “JERBERRA ELECTRICITY INFRASTRUCTURE SPECIAL RATE” will

not produce more than 50% of the total amount payable by the levying of the

“JERBERRA ELECTRICITY INFRASTRUCTURE SPECIAL RATE” in accordance

with Section 537(b) [base amount percentage is 49.95%].

13. Make

a Special Rate, in accordance with Section 538, consisting of an ad valorem

rate of 7.75712c for each dollar of rateable land value in addition to a base

amount of six hundred and forty five dollars ($645.00) for the cost associated

with the Jerberra Road E2 infrastructure project. In accordance with

Section 495(1) the special rate is to be levied only on those rateable

properties within the Jerberra estate which, in the opinion of Council,

derive special benefit and are subject to this rate in accordance with

Section 495(2) (a) (b) and (c). The special rate be now made for the

period 1 July 2017 to 30 June 2018 and, in accordance with Section 543(2),

this rate be named “JERBERRA ROAD E2 SPECIAL RATE”.

Further, to comply with Section

500 of the Act, the total amount payable by the levying of the base amount of

six hundred and forty five dollars ($645.00) per rateable assessment for the

“JERBERRA ROAD E2 SPECIAL RATE” will not produce more than 50% of

the total amount payable by the levying of the “JERBERRA ROAD E2

SPECIAL RATE” in accordance with Section 537(b) [base amount percentage

is 49.97%].

14. Make

a Special Rate, in accordance with Section 538, consisting of an ad valorem

rate of 0.03244c for each dollar of rateable land value to meet the costs of

business promotions for the Sussex Inlet area and surrounds, in accordance

with Section 495(1), which in the opinion of Council is of special benefit to

the rateable assessments subject to the rate in accordance with Section 495(2)

(a) (b) and (c). The special rate be now made for the period 1 July

2017 to 30 June 2018 and, in accordance with Section 543(2), this rate be

named “SUSSEX AREA SPECIAL RATE”.

15. Make an Annual

Charge for Water Usage and Water Availability, in accordance with Section 502

and 552(1) (a) and (b), for the period 1 July 2017 to 30 June 2018,

comprising a Water Usage Charge of $1.70 per kilolitre for all residential,

commercial and Community Service Obligation categorised properties and a

Water Availability Charge based on water meter size:

|

Size

of Water Meter Service Connection

|

Charge 2017/18

|

|

20

mm (all residential customers)

|

$82.00

|

|

25

mm

|

$129.00

|

|

32mm

|

$211.00

|

|

40mm

|

$330.00

|

|

50mm

|

$515.00

|

|

80mm

|

$1,318.00

|

|

100mm

|

$2,060.00

|

|

150mm

|

$4,635.00

|

|

200mm

|

$8,240.00

|

Properties with multiple water meter service

connections will be levied an availability charge for each connection.

In accordance with Section 552 of the Local Government Act 1993, any vacant

land where the service is available will be levied an availability charge.

The charges be named “WATER USAGE CHARGE”

and “WATER AVAILABILITY CHARGE”, in accordance with Section

543(3).

16. Make an Annual

Charge for Wastewater Usage and Wastewater Availability, in accordance with

Section 502 and 552(3), for the period 1 July 2017 to 30 June 2018,

comprising a Wastewater Usage Charge of $1.60 per kilolitre for all

residential, commercial and Community Service Obligation categorised

properties and a Wastewater Availability Charge based on water meter size:

|

Size

of Water Meter Service Connection

|

Charge 2017/18

|

|

20

mm

|

$830.00

|

|

25

mm

|

$1,161.00

|

|

32mm

|

$1,775.00

|

|

40mm

|

$2,355.00

|

|

50mm

|

$3,320.00

|

|

80mm

|

$6,855.00

|

|

100mm

|

$9,822.00

|

|

150mm

|

$16,922.00

|

|

200mm

|

$26,252.00

|

Properties with multiple water meter service

connections will be levied a wastewater availability charge for each

connection. In accordance with Section 552 of the Local Government Act

1993, any vacant land where the service is available will be levied an

availability charge.

The charges be named

“WASTEWATER USAGE CHARGE” and “WASTEWATER AVAILABILITY

CHARGE”, in accordance with Section 543(3).

17. Make

an Annual Charge for the availability of a Domestic Waste Management Service,

pursuant to Sections 496 and 501 of the Local Government Act 1993, for the

period 1 July 2017 to 30 June 2018, on all rateable properties categorised as

residential for rating purposes and comprising of a building which is deemed

to be a dwelling and located within the defined (urban) waste collection

area.

The amount for the standard residential

domestic waste management service be $333 for one 120 litre mobile garbage

bin (MGB) for landfill waste (weekly service) and one 240 litre MGB for

recycling (fortnightly service).

In accordance with Section

543(3), the charge be named “DOMESTIC WASTE MANAGEMENT CHARGE”.

18. Make

an Annual Charge for a Rural Domestic Waste Collection Service, pursuant to

Sections 496 and 501 of the Local Government Act 1993, for the period 1 July

2017 to 30 June 2018, on rateable properties comprising of a building which

is deemed to be a dwelling and located outside of the defined (urban) waste

collection area, and opt for the rural domestic waste collection service.

The amount for the rural

domestic waste collection service be $333 for one 120 litre mobile garbage

bin (MGB) for landfill waste and one 120 litre MGB for recycling (weekly

service). For a higher annual charge of $584, the 120 litre landfill

bin may be substituted for a 240 litre landfill bin. For a lower annual

charge of $252, the 120 litre landfill bin may be substituted for an 80 litre

landfill bin.

In accordance with Section

543(3), the charge be named “RURAL DOMESTIC WASTE COLLECTION

CHARGE”.

19. Make

an Annual Charge, pursuant to Section 496 of the Local Government Act 1993,

for the period 1 July 2017 to 30 June 2018, of $67.00 per assessment for

administration and new works associated with future provision of domestic

waste management services. The charge to be applied to any domestic

assessments which have any boundary adjacent to a road receiving an urban

domestic waste management service and

1. Does

not have a dwelling situated thereon, or

2. The

closest point of the dwelling is 100 metres or more from the boundary of the

road and the ratepayer chooses not to receive a domestic waste management

service.

In accordance with Section

543(3), the charge be named “NEW WORKS WASTE MANAGEMENT AVAILABILITY

CHARGE”.

20. Make

an Annual Charge for Stormwater Management Services, pursuant to Section 496A

of the Local Government Act 1993, for the period 1 July 2017 to 30 June 2018,

of $25.00 per eligible residential or business rate assessment and $12.50 per

strata assessment. In accordance with Section 543(3), the charge be

named “STORMWATER MANAGEMENT SERVICE CHARGE”.

21. Make

an Interest Rate of 7.5%, pursuant to Section 566(3) of the Local Government

Act 1993, for the period 1 July 2017 to 30 June 2018, being the maximum

interest rate chargeable on overdue rates and charges, accruing daily on a

simple interest basis.

|

Options

1. To endorse the recommendations

for the making of ordinary and special rates and annual charges

Implications: Rates and charges will be adopted as

required by legislation.

2. Not endorse the

recommendations and make rates in accordance with Council’s resolution on

the rate increase to be adopted following their consideration of Report CL17.146

Implications: Finance to update the Long Term

Financial Plan, Delivery Program and Operational Plan (including the 2017/18

Budget and Capital Works) in line with Council’s resolution.

Background

In November 2016, the

Independent Pricing and Regulatory Tribunal (IPART) set the 2017/18 rate peg at

1.5%. To fund asset renewals, reduce its maintenance backlog and improve

financial sustainability, Council applied to IPART for a multi-year Special

Variation, under Section 508(2) of the Local Government Act 1993, of 13.2% in

2017/18 and 14.0% in 2018/19.

The draft Integrated Strategic

Plan 2027 was placed on public exhibition from 28 April 2017 to the 26 May

2017, not being less than 28 days, in accordance with Sections 404(4) &

405(3) of the Local Government Act 1993. On 9 May 2017, IPART approved

only a one-year temporary increase of 13.2% in the rate base due to the failure

of Council to align its Integrated Planning & Reporting (IP&R)

documents with its Special Variation proposal.

Following publication of the

Delivery Program and Operational Plan, in accordance with Section 532 of the

Local Government Act 1993, a submission was made to include a rating structure

in the Integrated Strategic Plan – Revenue Policy that is in line with

both the Special Variation approved by IPART and the latest 2016 land

valuations data. Council has considered the submission and a revised

rating structure for 2017/18 for ordinary and special rates is presented below:

In accordance with Sections 534 and 535 of the Local

Government Act 1993, Council can resolve to make rates and charges for the

2017/18 financial year.

Community Engagement

A comprehensive community engagement process was undertaken

for this Chapter and is detailed within CL17.146 of this business paper.

Policy Implications

The changes highlighted within

this report will impact upon Chapter 3 of the Integrated Strategic Plan 2027

and have been included to further meet the requirements of the IP&R

framework and community needs resulting from the engagement process.

Financial Implications

The adoption of the full Special

Variation approved by IPART in its rating structure will provide Council with

an additional $7.1M for the 2017/18 financial year to fund asset renewals,

reduce its maintenance backlog and improve financial sustainability.

|

|

Extra Ordinary

Meeting – Tuesday 13 June 2017

Page

21

|

CL17.151 Swim

and Fitness Service Levels - Nowra Aquatic Park - DPOP Community Engagement

Outcomes

HPERM Ref: D17/173148

Group: General

Manager's Group

Section: Executive

Strategy

Attachments:

1. Comments -

Winter Swimming Community Engagement Survey - May 2017 ⇩

Purpose / Summary

To provide Council with the results of the survey undertaken

as part of the overall DPOP consultation for Shoalhaven Swim & Fitness

(Bomaderry Aquatic Centre and Nowra Aquatic Park)

|

Recommendation

That Council:

1. Within the Shoalhaven Swim &

Fitness area, maintain the operation of:

a. Bomaderry Aquatic Centre 25 metre

indoor pool – all year

b. Bomaderry Aquatic Centre 50 metre

outdoor pool – all year

c. Nowra Aquatic Park become a seasonal

pool, ie, operate 1 November until 31 March each year – note closing 30

June 2017

d. To be funded within existing 2017/18

budgets and ongoing

2. Receive the results of the survey for

Shoalhaven Swim & Fitness (Bomaderry Aquatic Centre and Nowra Aquatic

Park) for information.

|

Options

Option 1 - As recommended - this will result in Nowra

Aquatic Park closing at end of June

Implications

· Nowra

Aquatic Park will not be available for training squads or recreational swimming

from March to November each year. These groups will need to make use of

the Bomaderry facility as they did previously.

· There

are also costs associated with ‘holding’ the pool in a dormant

state during this period. These will be covered in the projected 2017/18

budget

· Maintains

the previous “level of service” for these facilities

· This

option does not leverage community benefits that could be gained from

investments made in improving Nowra Aquatic Park

Option 2 - Council can choose to open both facilities for

twelve (12) months of the year by reinstating $313,000 subsidy from efficiency

gains.

Implications

· These

costs have not been factored into the 2017/18 draft budget and will either need

to come from a reduction in other areas or increasing the projected budget

deficit.

· Council

needs to form the position that an increase of its operational budget of this

amount is warranted and that the extension of the opening hours of the Nowra

Aquatic Park is the highest priority for these additional funds

· The

community survey results do not provide evidence that increasing service levels

for Swim & Fitness facilities is a high priority;

Option 3 - Consider a transition from the two (2) 50 metre

outdoor pools to a single 50 metre outdoor pool as the Bomaderry 50 metre pool

becomes too expensive to repair / maintain. This would see the

decommissioning of the Bomaderry 50 metre outdoor pool in the next 5 years.

Implications

The implications

will depend on the actual timing and costs of the decommissioning.

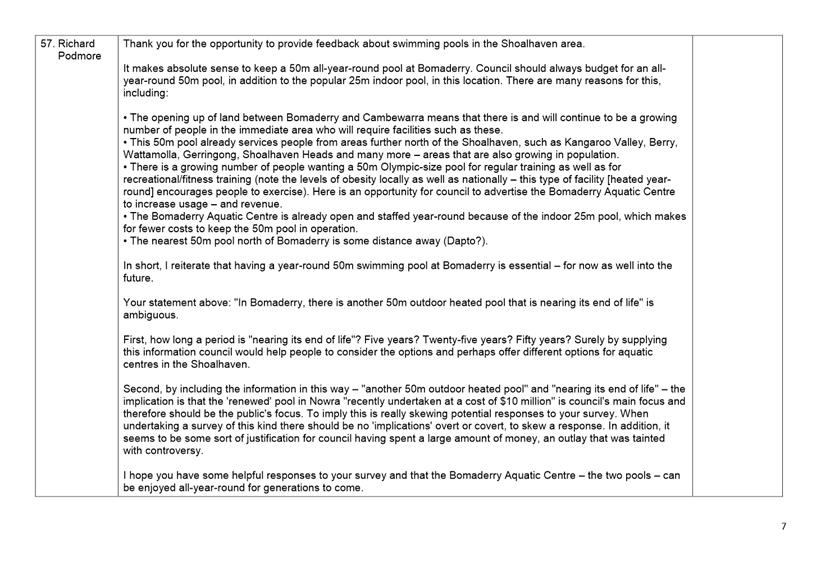

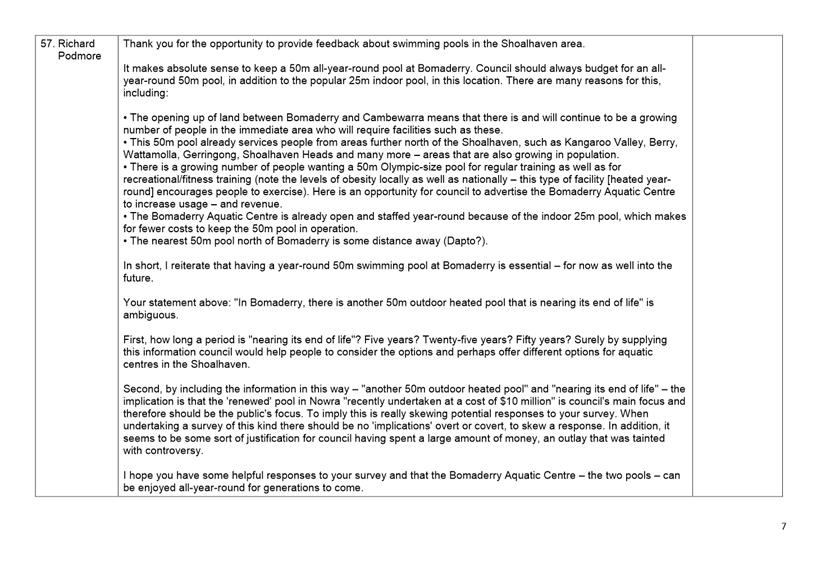

Background

At its meeting held on 28 March

2017, Council made the following resolution (Min17.237):

1. Undertake a comprehensive Community

Engagement Process in plain English to outline the proposed six (6) options for

summer and winter swimming in the northern Shoalhaven (Bomaderry Aquatic Centre

and Nowra Aquatic Park) as outlined in this report. That this

consultation seek the community’s views, including swimming community

members, on which is the preferred option taking into consideration all factors

including service level provision and costs. This be undertaken as part

of the DPOP consultation and be reported back to Council as part of the budget

process.

2. Upon

receipt of the feedback, determine which option of the six considered it will

fund in future budgets.

This resolution was actioned

through the provision of an online survey as part of the DPOP community

engagement process. Hard copy surveys were also provided on request at

all Swim & Fitness Centres and information displays at Council

administration buildings and via the “Get Involved” page on

Council’s website.

As yet, Council has not made a

determination on the future of winter swimming in the northern

Shoalhaven. In considering the future direction of Bomaderry Aquatic

Centre, the condition of the asset and, in light of Council’s recent

adoption of the Bomaderry Nowra Regional Sports & Community Precinct Master

Plan, Council will need to consider transitioning in preparation for

development into the regional hub.

The Master Plan aims to improve

the quality of facilities in the location, by integrating facilities and

improving their utilisation and status for long term sustainability and growth

of active and passive recreation and social activities, co-located to provide a

community and tourism destination.

It should be noted that the

Master Plan does not include a 50 metre outdoor pool and will result in the

closure of the existing Bomaderry Aquatic Centre 50 metre outdoor pool.

Whilst not including timeframes for design or construction, this may assist

Council in providing a transitional pathway towards closure of the Bomaderry 50

metre outdoor pool.

The Bomaderry Aquatic Centre 50

metre outdoor pool has been identified as being near the end of its serviceable

life. Further, there are also works required to be undertaken to the

indoor 25 metre pool and overall amenity of the indoor building

structure. These factors need to be taken into consideration when

considering any extension to historic and future service levels.

All planning and provision

principles/measures clearly indicate it is financially unsustainable to

maintain both the Nowra Aquatic Park and Bomaderry Aquatic Centres, ie, only

3.0 kilometres, two (2) outdoor 50 metre heated pools. The issue of the

oversupply of 50m pools particularly in the northern area of the city was

highlighted in the Community Social Infrastructure Plan (Ross Report).

Therefore, a single outdoor 50

metre pool in the northern Shoalhaven, particularly at least in the winter

months, more than adequately meets the recreational training needs of the

northern Shoalhaven community.

Council may consider a transition

from the two (2) 50 metre outdoor pools to a single 50 metre outdoor pool as

the Bomaderry 50 metre pool becomes too expensive to repair / maintain.

This would see the decommissioning of the Bomaderry 50 metre outdoor pool in

the next five (5) years.

Based on established planning

and provision principles of one (1) local aquatic facility per 10,000 to 40,000

people and one (1) district aquatic facility per 40,000 to 70,000 people, the

provision of one (1) 50 metre swimming pool is meeting the benchmarks and is

capable of servicing and meeting the needs of the northern Shoalhaven community

now and well into the future.

Throughout many Local Government

Areas within NSW, there are few Councils which have invested as much as

Shoalhaven in terms of social infrastructure, specifically aquatic / leisure

facilities. Such large social and financial investments are rarely seen,

even in metropolitan areas with much larger populations.

Community Engagement

An extensive community

engagement process was carried out for the Integrated Strategic Plan,

incorporating both the CSP and DPOP. This project was considered as

Citywide High Impact and, in accordance with the Community Engagement Policy,

sits within the area of Consult, as per the IPA2 spectrum.

Details of the engagement

methods and communication tools used within this process are provided in the

Community Engagement Report - Integrated Strategic Plan – refer

Attachment 1 of CL17.146 of this business paper. Details of the

participation and submissions received, as part of the overall engagement

process, are also provided in the engagement report. Specific engagement

outcomes related to this report are provided below.

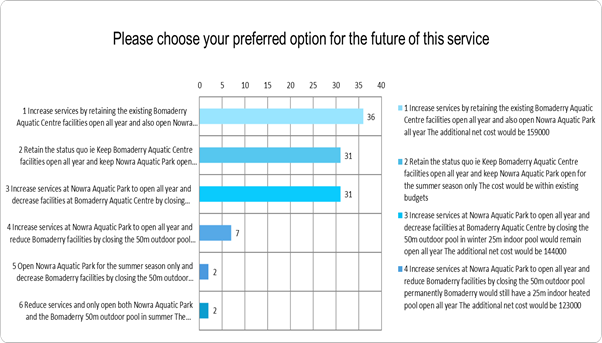

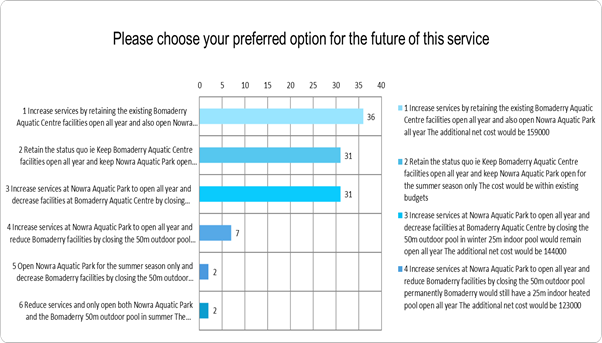

Community Survey

A specific survey on levels of

service and the future of Bomaderry Aquatic Centre and Nowra Aquatic Park was

recently carried out as part of the DPOP community engagement process. A

specific Winter Swimming Survey on the proposed six (6) options was provided,

detailing the impacts of each option and potential costs.

The community was asked to

select their preferred option out of the six (6) options presented. A

section to provide additional comment was also available within the survey.

At present, Council’s

Shoalhaven Swim & Fitness facilities enjoy a patronage of in excess of

700,000 visits per year from a population of approximately 100,000 and 3.3Mil

annual tourists. From this, a total of 109 survey responses were received

City wide during the engagement process. An additional 53 individual

comments were also received which are provided as Attachment 2 to this report.

The very low number of responses

provided were mixed, with Option 1, 2 and 3 featuring as the most preferred

option by those surveyed. A breakdown of the results is provided below:

|

Options - Survey Results Swim and Fitness

|

Number of Responses

|

|

1

|

Increase services by retaining the existing Bomaderry

Aquatic Centre facilities open all year and open Nowra Aquatic Park all year

- ADDITIONAL NET COST $159,000

|

36

|

|

2

|

Retain the status quo, ie, keep Bomaderry Aquatic

Centre facilities open all year and keep Nowra Aquatic Park open for the

summer season only - COST WITHIN EXISTING BUDGETS

|

31

|

|

3

|

Increase services at Nowra Aquatic Park to open all

year and decrease facilities at Bomaderry Aquatic Centre by closing the 50m

outdoor pool in winter 25m indoor pool would remain open all year -

ADDITIONAL NET COST $144,000

|

31

|

|

4

|

Increase services at Nowra Aquatic Park to open all

year and reduce Bomaderry facilities by closing the 50m outdoor pool

permanently Bomaderry would still have a 25m indoor heated pool open all year

- ADDITIONAL NET COST $123,000

|

7

|

|

5

|

Open Nowra Aquatic Park for the summer season only and

decrease Bomaderry facilities by closing the 50m outdoor pool permanently

Bomaderry would still have a 25m indoor heated pool open all year -

ADDITIONAL NET COST $19,000

|

2

|

|

6

|

Reduce services and only open both Nowra Aquatic Park

and the Bomaderry 50m outdoor pool in summer - ADDITIONAL NET COST $50,000

|

2

|

In considering the possible increase of operational budget,

Council needs to be mindful of the very low number of responses to the

survey. These responses should also be seen in relation to the

overwhelming responses from multiple community surveys that the community want

more operational funds spent on roads, parks and building maintenance and

renewals. In considering a possible opening of Nowra Aquatic Park for the

full 12 months, Council should form the opinion that this is the highest

community / Council priority for increasing its operational expenditure.

Financial Implications

Current Financial Position

– Nowra Aquatic Park

Nowra Aquatic Park was

originally budgeted to operate (2016/17 year) for 9 months only with a subsidy

of $496,605. This would have seen the facility close at the end of March

this year. Given the strong summer and efficient management, Nowra Aquatic

Park will remain open until the end of June with its existing budget.

Across all other Shoalhaven Swim

& Fitness facilities (excluding Nowra Aquatic Park), efficiency gains have

already been factored into the next Budget, ie, for the 2017/18 financial

year. This has resulted in a saving of $111,000 (reduced budget

subsidy). It should be noted that this also takes into account wage

increases of 2.4%.

With the proposed transition

from nine (9) to six (6) month operation for the upcoming 2017/18 season and

other operational efficiencies, Nowra Aquatic Park’s Budget has been

reduced by $313,000. This has resulted in a total reduction in the

overall Swim & Fitness Subsidy of $424,000.

It is important to note that, as

Nowra Aquatic Park is only budgeted to operate for six (6) months in the

2017/18 financial year at a subsidy of $84,000, should Council wish to operate

the facility for a full twelve (12) months, an additional $313,000 subsidy will

need to be reinstated from the stated efficiency gains. Operating the NAP

over winter has great operational costs and lower income hence the size of the

budget required.

Financial Implications of the

Recommendation

The recommendation will have no

financial implications as these costs are in the current draft budget.

Financial Implications

– Option 2

Should Council wish to “Increase

services by retaining the existing Bomaderry Aquatic Centre facilities open all

year and open Nowra Aquatic Park all year”, Council will need to fund

an additional six (6) month operation at Nowra Aquatic Park, by reinstating

$313,000 subsidy from efficiency gains as stated above.

As highlighted in the Option 2

Implications, Council needs to form the position that an increase of its

operational budget of this amount is warranted and that the extension of the

opening hours of Nowra Aquatic Park is the highest priority for these

additional funds.

Financial implications

– Option 3

These costs will be totally

dependent on the timing of the decommissioning and the costs associated with

this work, however opening for the next 12 months will require reinstating

$313,000 subsidy from efficiency gains as stated above.

|

|

Extra Ordinary

Meeting – Tuesday 13 June 2017

Page

26

|

|

|

Extra Ordinary

Meeting – Tuesday 13 June 2017

Page

34

|

CL17.152 Family

Day Care Services - DPOP Community Engagement Outcomes

HPERM Ref: D17/173153

Group: General

Manager's Group

Section: Executive

Strategy

Purpose / Summary

The purpose of this report is to provide Council with the

results of the consultation undertaken, as part of the overall Integrated

Strategic Plan engagement process, for Family Day Care.

|

Recommendation

That Council:

1. Receive the results of the survey for

Family Day Care Services for information

2. Continue to work towards meeting the

performance targets to improve services Family Day Care provides and report

back in April 2018 when more clarity around federal funding is available.

|

Options

1. Adopt the recommendation as printed

Implications: The feedback provided by the

community shows that there is ongoing support for this service. The survey also

showed that the community participating in the survey are willing for the

service to be subsidised by Council.

The recommendation is consistent with the approach adopted

by Council in March 2017 and ensures that continued efforts will be made to

meet the performance targets set for this service to deliver this service as

cost neutral to Council and the ratepayers.

2. Adopt an alternative recommendation

Background

On 28th March

2017, Council resolved that:

1. Council receive the report for information on the

consultation process with affected staff, Educators and Families and feedback

regarding potential transfer of the Shoalhaven Family Day Care Service to a

suitable provider for information.

2. Council adopt performance targets to improve

services it provides and report back in April 2018 when more clarity around

federal funding is available.

3. As part of the public exhibition/community

engagement period for the draft 2017/18 DP/OP council specifically gain

feedback on the matter of ‘ratepayer subsidy’ for the FDC service.

4. Council acknowledge that high quality child care

services are a fundamental responsibility of the Federal Government and

acknowledge that the current service of the Family Day Care Service reaches an

exceeding level and congratulate the staff and the educators for that

high-level recognition.

5. Council continue to lobby the Federal Government

for Federal Government support and funding.

This report provides results of

the actions carried out to meet part 3 of MIN17.235.

Community Engagement

An extensive community

engagement process was carried out for the Integrated Strategic Plan,

incorporating both the CSP and DPOP. This project was considered citywide high

impact and in accordance with the Community Engagement Policy sits within area

of consult as per the IPA2 spectrum.

Details of the engagement

methods and communication tools used within this process are provided in the

Community Engagement Report- Integrated Strategic Plan (Attachment 1 of CL17.146

of this business paper). Details of the participation and submissions received

as part of the overall engagement process are also provided in the engagement

report. Specific engagement outcomes related to this report are provided below.

Community Survey

As part of the community

engagement carried out in April/May 2017 for the Integrated Strategic Plan, a

specific survey on the future of the Family Day Care Services was provided.

This survey was available on Council’s online community engagement

platform and was available in hard copy, on request, through Family Day Care

and Council administration centres.

The survey sought a response to

three options, which could be selected if the funding for the service was to

cease. It focused on identifying whether the community supported continued

funding of the service by Council once the Federal funding had ceased, or, the

service to be transferred to another service provider, or a combination of

measures.

The community were asked to

select only one of the options (out of the three (3) options) that they

preferred. A section to provide additional comment was also available within

the survey.

A total of 53 survey responses

were received during the engagement process. An additional 27 individual

comments were also received; these are provided as an Attachment to this

report.

The Option 3: “Council

to continue to subsidise the service and run it at a net loss at an estimated

cost of approximately $136,000 per year” was the preferred option

provided by the survey respondents. This would be a new expense to Council who

will be underwriting the cost of the service once the Federal funding

ceases. A breakdown of the results is provided in table 1 below.

Table 1: Survey Results - Family Day Care

|

If funding ceases, which of the

following is your preferred option for the future of the service?

|

|

Option 1 - Transfer the service to

another provider via an Expression of Interest

|

11

|

|

Option 2- A combination of measures

including increased childcare fees improved administrative and operational

efficiencies and an increased number of educators to make sure the service is

self-funded

|

11

|

|

Option 3- Council to continue to

subsidise the service and run it at a net loss at an estimated cost of

approximately $136,000 per year

|

31

|

Financial Implications

The withdrawal of Federal

funding to assist in the delivery of Family Day Care Services will have

resulting budget implication for Council of at least $136,000 (dependant on

enrolment numbers). The additional funding that will need to be found if

Council is to continue to coordinate this service will increase the overall

operating deficit of Council.

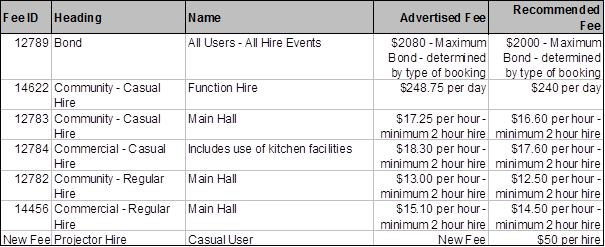

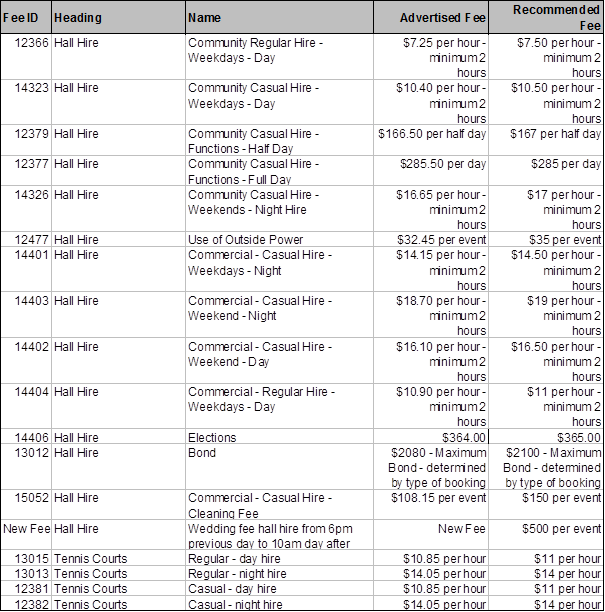

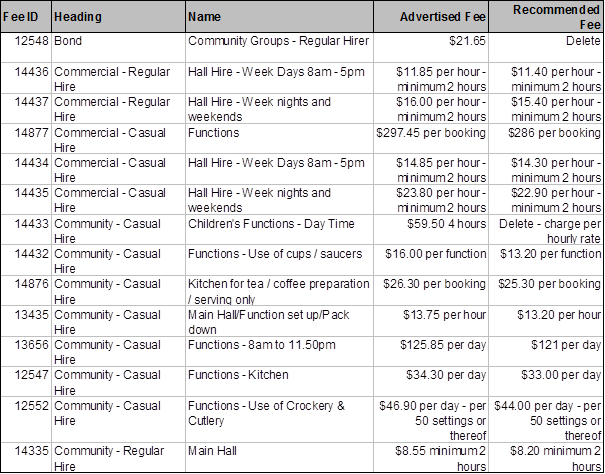

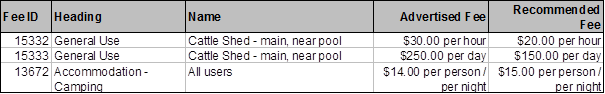

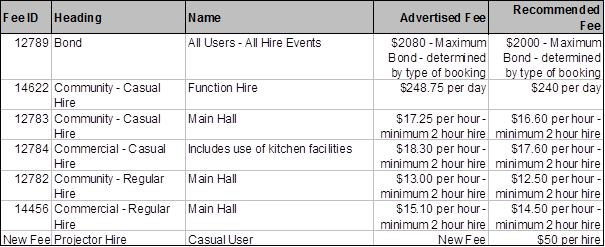

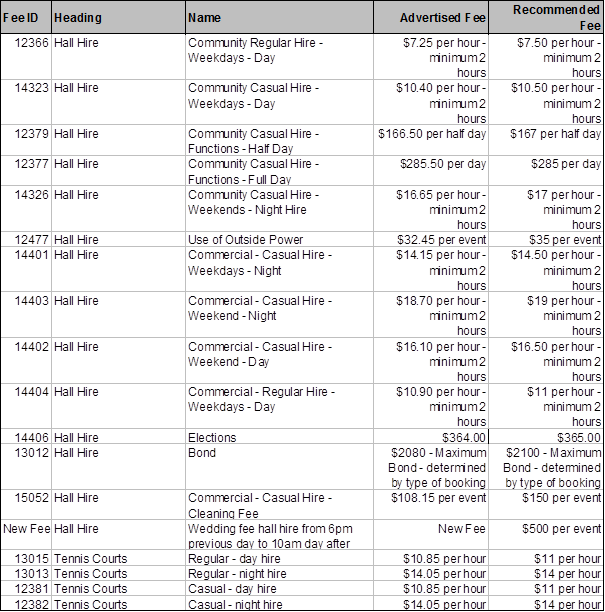

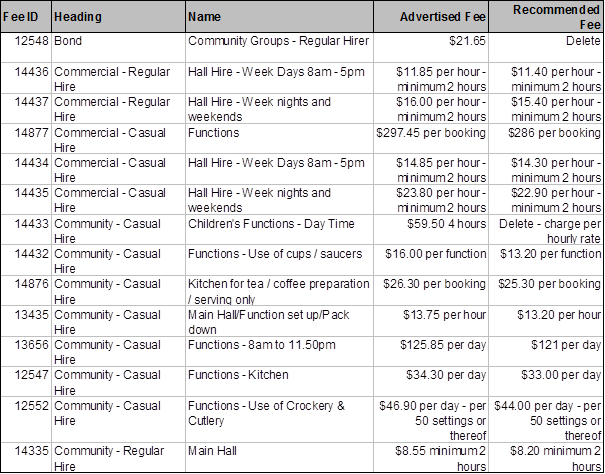

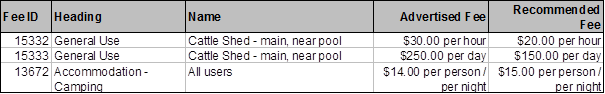

The current direction set by