Ordinary Meeting

Meeting Date: Tuesday,

25 March, 2025

Location: Council

Chambers, City Administrative Building, Bridge Road, Nowra

Time: 5.30pm

Membership

(Quorum – 7)

Clr

Patricia White – Mayor

Ward 1 Ward

2 Ward

3

Clr Jason Cox Clr

Ben Krikstolaitis Clr

Denise Kemp

Clr Matthew Norris -

Assist. Deput Mayor Clr Bob Proudfoot Clr

Gillian Boyd

Clr Peter Wilkins -

Deputy Mayor Clr

Jemma Tribe Clr

Karlee Dunn

Clr

Selena Clancy Clr

Luciano Casmiri Clr

Natalee Johnston

Please note: The proceedings of this meeting (including presentations,

deputations and debate) will be webcast, recorded and made available on

Council’s website, under the provisions of the Code of Meeting

Practice. Your attendance at this meeting is taken as consent to the

possibility that your image and/or voice may be recorded and broadcast to the

public.

Shoalhaven City Council live

streams its Ordinary Council Meetings and Extra Ordinary Meetings. These

can be viewed at the following link

https://www.shoalhaven.nsw.gov.au/Council/Meetings/Stream-a-Council-Meeting.

Statement

of Ethical Obligations

The Mayor and Councillors are

reminded that they remain bound by the Oath/Affirmation of Office made at the

start of the council term to undertake their civic duties in the best interests

of the people of Shoalhaven City and to faithfully and impartially carry out

the functions, powers, authorities and discretions vested in them under the

Local Government Act or any other Act, to the best of their skill and

judgement.

The Mayor and Councillors are also reminded of the

requirement for disclosure of conflicts of interest in relation to items listed

for consideration on the Agenda or which are considered at this meeting in

accordance with the Code of Conduct and Code of Meeting Practice.

Agenda

1. Acknowledgement

of Country

Walawaani (welcome),

Shoalhaven City Council recognises the First Peoples

of the Shoalhaven and their ongoing connection to culture and country. We

acknowledge Aboriginal people as the Traditional Owners, Custodians and Lore

Keepers of the world’s oldest living culture and pay respects to their

Elders past, present and emerging.

Walawaani njindiwan (safe journey to you all)

Disclaimer: Shoalhaven City Council acknowledges and

understands there are many diverse languages spoken within the Shoalhaven and

many different opinions.

2. Moment of

Silence and Reflection

3. Australian

National Anthem

4. Apologies /

Leave of Absence

5. Confirmation

of Minutes

· Ordinary

Meeting - 11 March 2025

6. Declaration

of Interests

7. Presentation of Petitions

8. Mayoral Minute

9. Deputations and Presentations

10. Notices of Motion / Questions on Notice

Notices of Motion / Questions on Notice

CL25.82....... Notice of Motion - Native Plants for New

Citizens................... 1

11. Call Over of the

Business Paper

12. A Committee of the

Whole (if necessary)

13. Committee Reports

CL25.83....... Report of the Financial Review Panel - 18

March 2025.......... 2

FR25.11....... Grant Funding Policy & Procedures

FR25.12....... Loan Program Policy & Procedures

14. Reports

CEO

CL25.84....... Report Back - Fleet & Plant Accountability

and Transparency - New Vehicle Purchases 2024.................................................. 6

CL25.85....... Report Back - AEC Financial Sustainability

Review - Actions Taken to Reduce FBT Liability............................................... 16

City Performance

CL25.86....... Ongoing Register of Pecuniary Interest Returns -

February 2025........................................................................................ 19

CL25.87....... ALGA Annual Conference 2025 - National General

Assembly................................................................................................ 21

CL25.88....... Investment Report - February 2025....................................... 25

City Services

CL25.89....... Proposed Licence to the NRMA Electric Highways

Pty Ltd over Part Lot 20 DP 801794 Berry Street, Nowra................. 32

CL25.90....... Grant of Easement for Padmount Substation and

Restriction on the Use of Land - Part Lot 227 DP 257580 & Part Lot 330 DP

41314, Ulladulla............................................................... 37

CL25.91....... Creation of Asset Protection Zone (APZ) over

Council unmade road adjoining Lot 15 DP 249575 - 13 Ringbalin Crescent,

Bomaderry............................................................. 41

CL25.92....... Expression of Interest outcome - Thurgate Oval

Bomaderry Amenities Building.................................................................. 46

CL25.93....... Tender - Road Rehabilitation – CH3497 to

CH6849 Illaroo Rd, North Nowra/Bangalee/Tapitallee.......................................... 50

City Development

CL25.94....... Reconciliation Action Plan - Adoption.................................... 53

CL25.95....... Development Contributions Refund Request -

DA24/1312 - 45 Wedgetail Street, Badagarang............................................... 57

Shoalhaven Water

CL25.96....... Payment of Shoalhaven Water Dividend 2023-2024

Financial Year Results........................................................................... 62

15. Confidential Reports

Reports

CCL25.5...... Tenders - West Nowra Material Recovery Facility -

Design, Supply and Install Water Tanks

Local Government Act - Section 10A(2)(d)(i) - Commercial information

of a confidential nature that would, if disclosed prejudice the commercial

position of the person who supplied it.

There

is a public interest consideration against disclosure of information as

disclosure of the information could reasonably be expected to reveal

commercial-in-confidence provisions of a contract, diminish the competitive

commercial value of any information to any person and/or prejudice any

person’s legitimate business, commercial, professional or financial

interests.

CCL25.7...... Tender - Road Rehabilitation – CH3497 to

CH6849 Illaroo Rd, North Nowra/Bangalee/Tapitallee

Local Government Act - Section 10A(2)(d)(i) - Commercial

information of a confidential nature that would, if disclosed prejudice the

commercial position of the person who supplied it.

There is a public interest

consideration against disclosure of information as disclosure of the

information could reasonably be expected to reveal commercial-in-confidence

provisions of a contract, diminish the competitive commercial value of any

information to any person and/or prejudice any person’s legitimate

business, commercial, professional or financial interests.

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

CL25.82 Notice

of Motion - Native Plants for New Citizens

HPERM Ref: D25/116235

Submitted

by: Clr Gillian Boyd

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That Council provide an endemic plant (tubestock) to each

of the new citizens that are invested with Australian Citizenship at each

Citizenship Ceremony hosted by Shoalhaven City Council.

|

Background

Shoalhaven City Council

regularly hosts Citizenship ceremonies for local residents who become eligible

for Australian Citizenship. Eligible applicants for Citizenship must make a

pledge of commitment to Australia at these ceremonies to become full citizens

and therefore entitled to enrol to vote.

For most migrants this ceremony

is their final step in the long and expensive path to citizenship. Currently at

these ceremonies new citizens receive a ‘showbag’ of documents

including their Citizenship Certificate, their oath, the printed words to the

National Anthem and an Australian Electoral Commission enrol-to-vote

information sheet amongst other tokens of citizenship selected by the host

organisation.

Providing tubestock plants that

are indigenous to the Shoalhaven such as Jervis Bay Grevillea (Grevillea

macleayana) or Ulladulla beacon (Meleleuca hyperificolia), once planted, would

be a fitting memento of the conferring of their citizenship. These plants can

be obtained by Council for free or at minimal cost from Milton Rural Landcare

nursery in Ulladulla or from the SCC Landcare nursery at Culburra Beach.

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

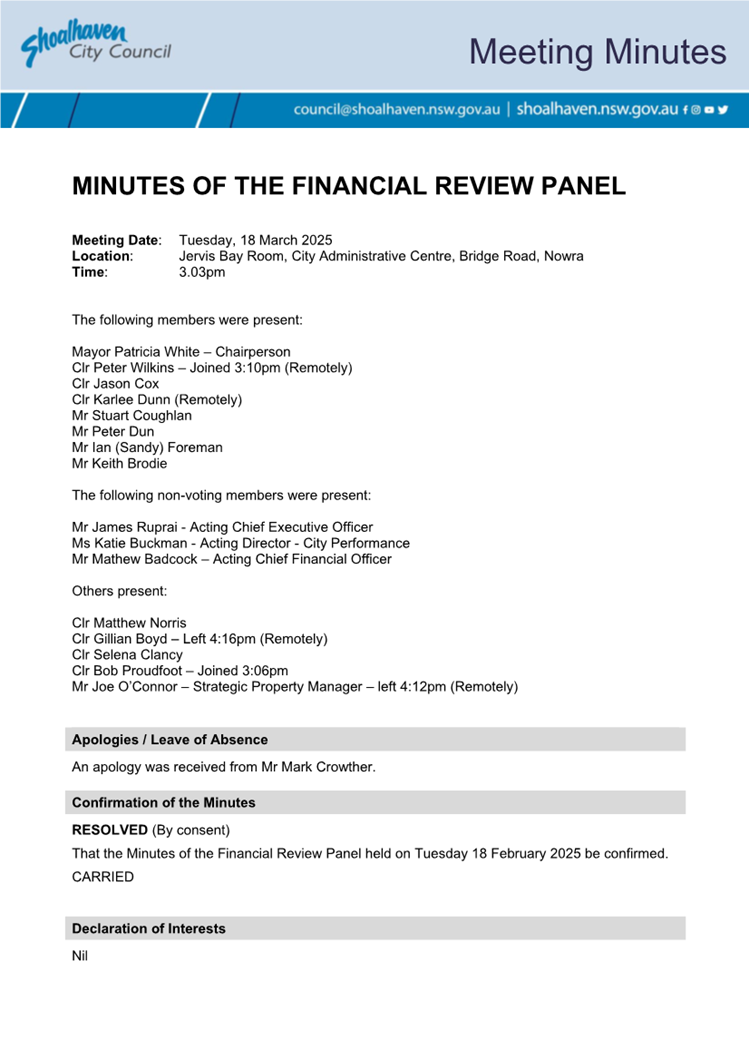

CL25.83 Report

of the Financial Review Panel - 18 March 2025

HPERM Ref:

D25/119264

Attachments: 1. Financial

Review Panel 18 March 2025 - Minutes ⇩

|

FR25.11 Grant Funding Policy

& Procedures

|

HPERM Ref: D25/100840

|

|

Recommendation

That

Council, as recommended by the Financial Review Panel, review its Grant

Funding Policy & Procedures to ensure alignment with its DPOP &

Resourcing Strategy.

|

|

FR25.12 Loan Program Policy &

Procedures

|

HPERM Ref: D25/100878

|

|

Recommendation

That

Council, as recommended by the Financial Review Panel, review its Loan

Borrowing Policy & Procedures to reflect its approach to borrowing in its

Resourcing Strategy.

|

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

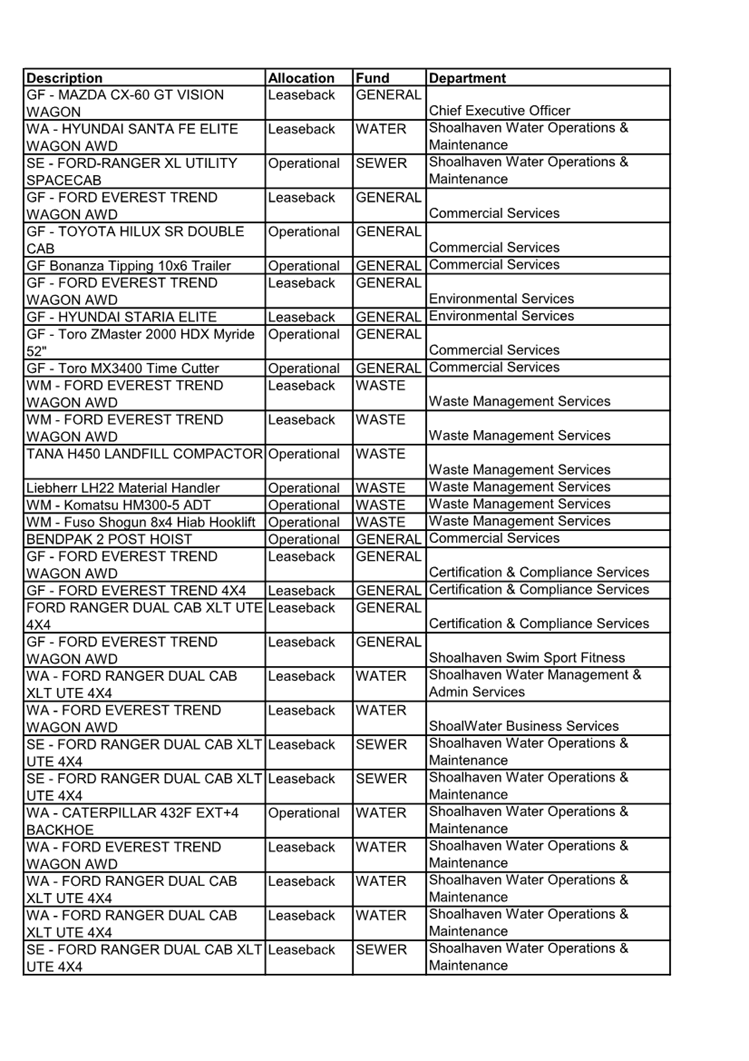

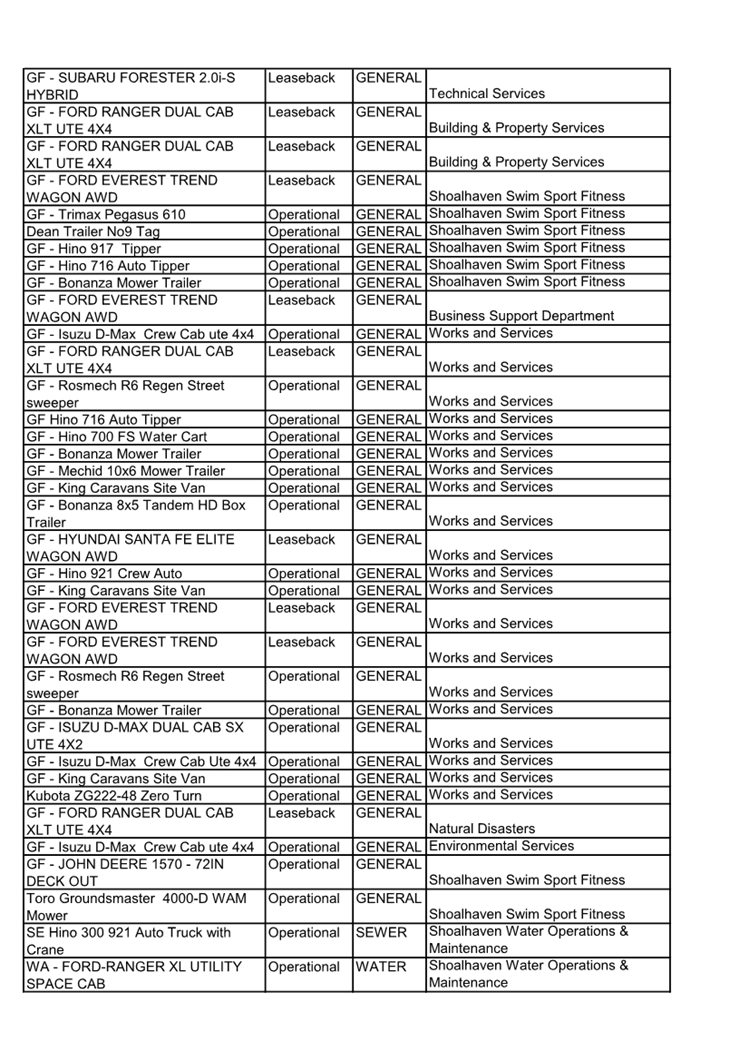

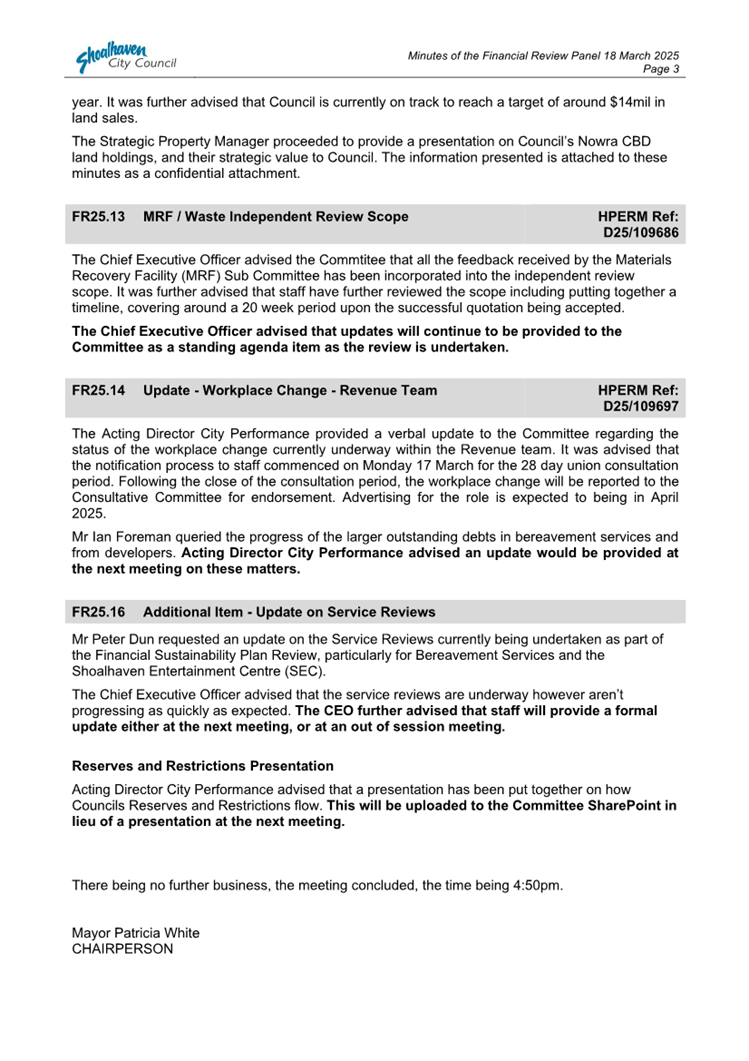

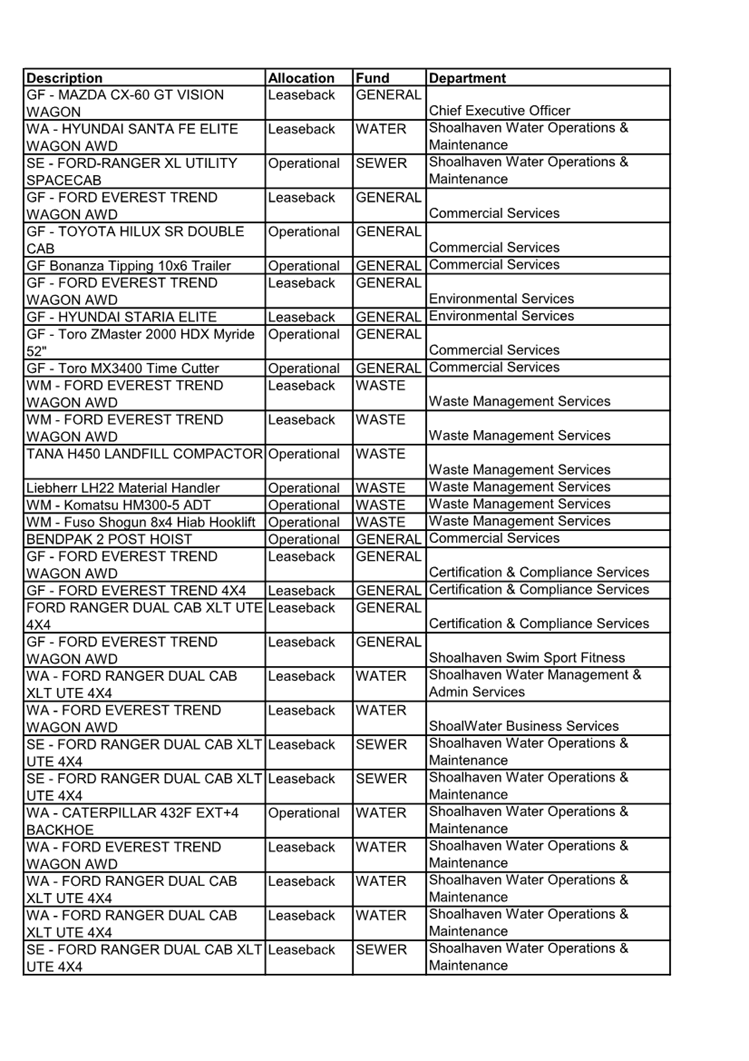

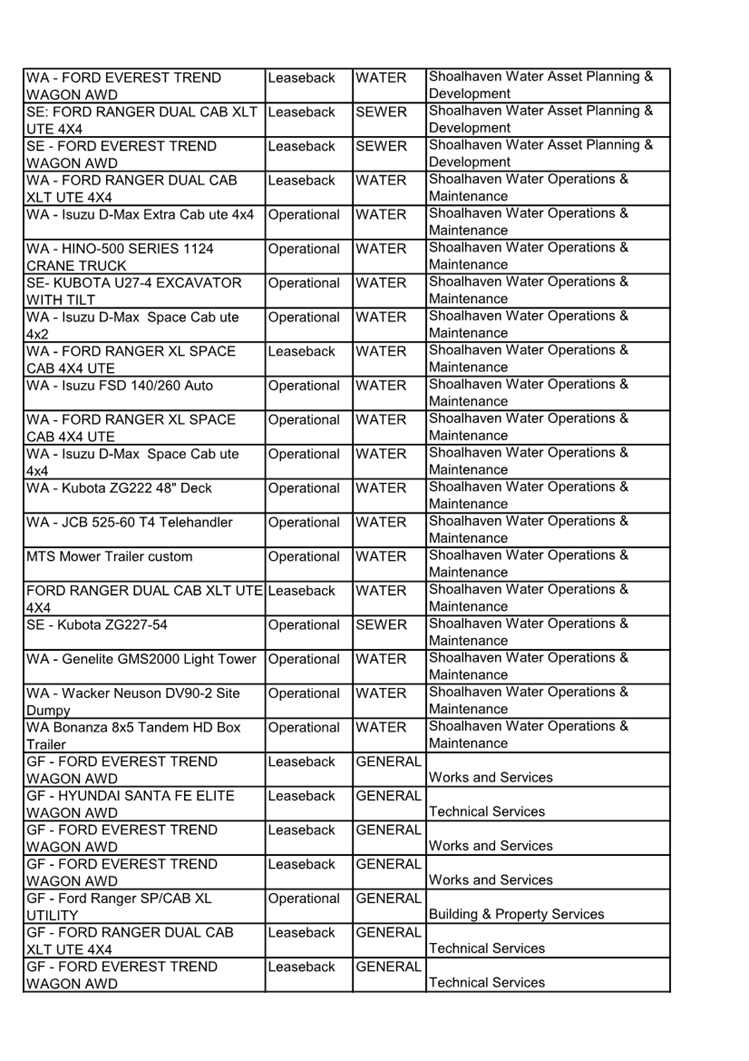

CL25.84 Report

Back - Fleet & Plant Accountability and Transparency - New Vehicle

Purchases 2024

HPERM Ref: D25/104613

Department: Financial

Sustainability

Approver: Lauren

Buckingham, Project Manager - Financial Sustainability

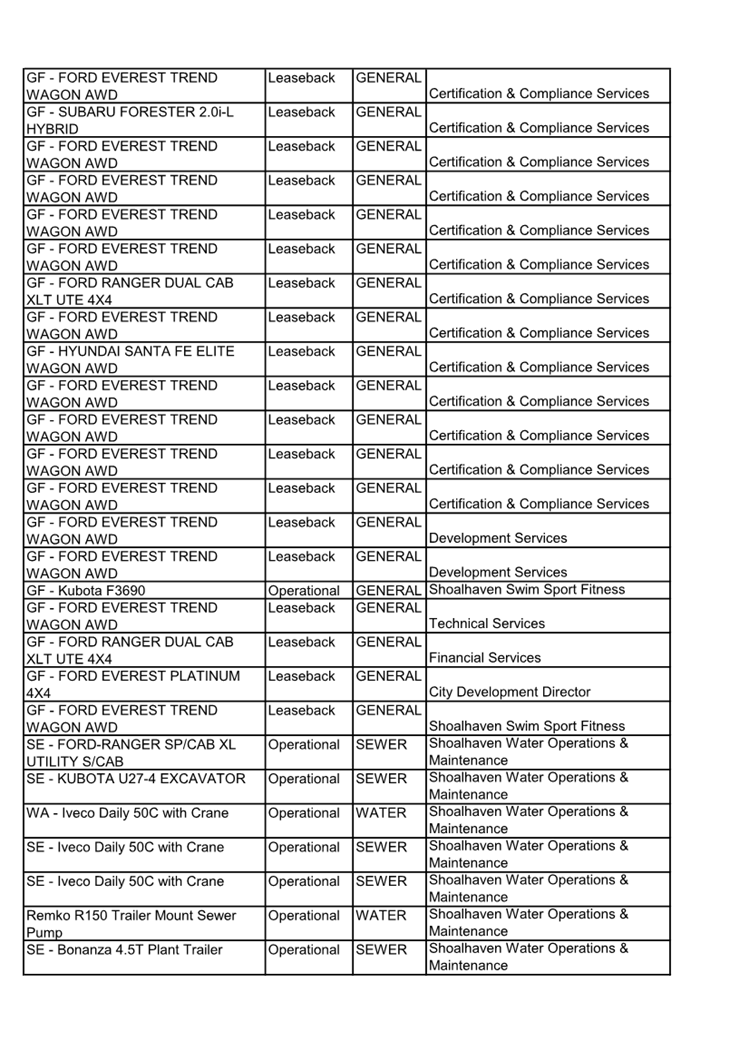

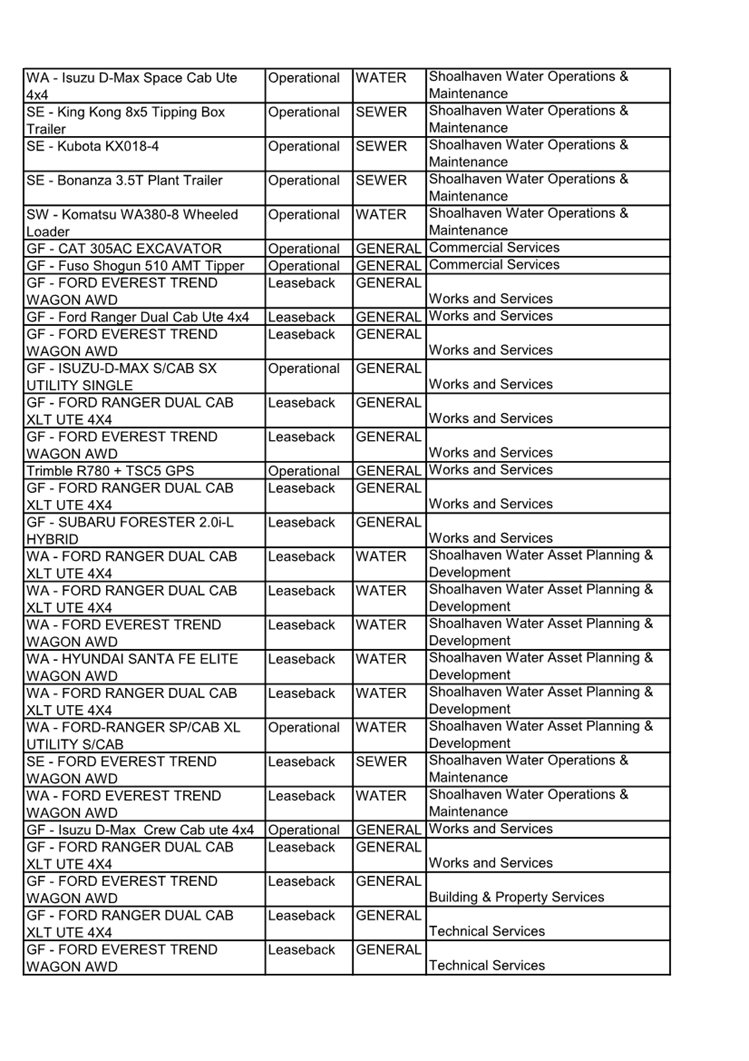

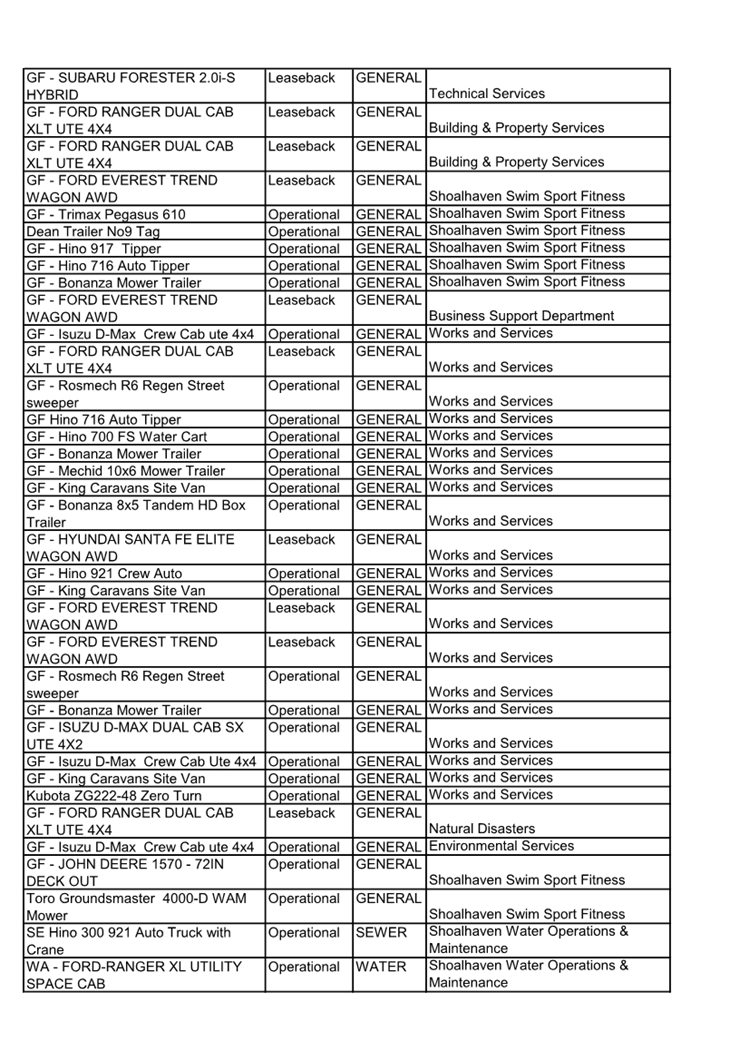

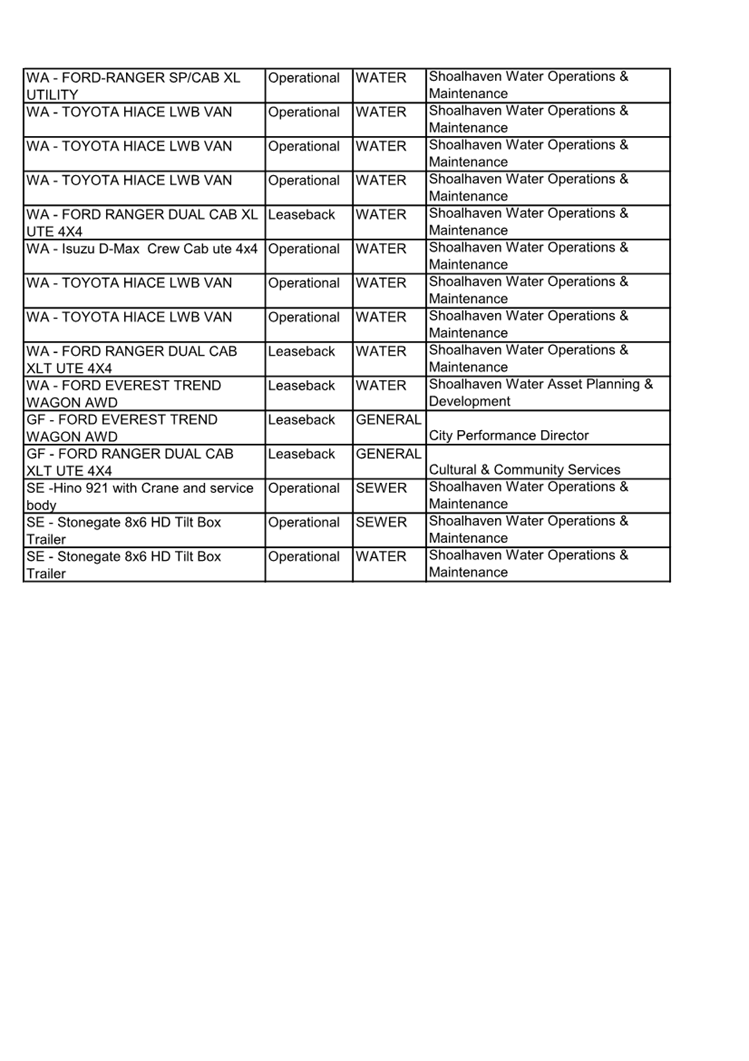

Attachments: 1. 2024

Plant and Fleet Purchases ⇩

Purpose

The purpose of this report is to

address MIN25.63

resolved by Council at its Ordinary Meeting on 25 February 2025 to publish a

list of new vehicle purchases in 2024. The report identifies the type and

model of vehicle purchased, and the allocation and purpose of the vehicle

purchases.

Summary and Key Points for

Consideration

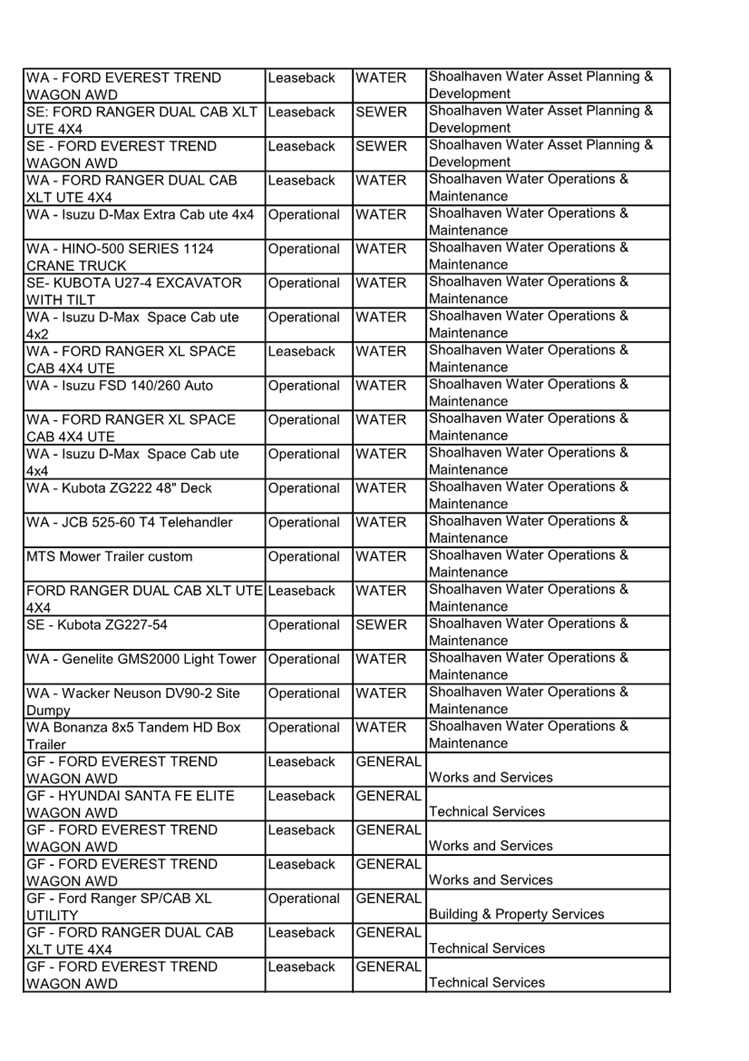

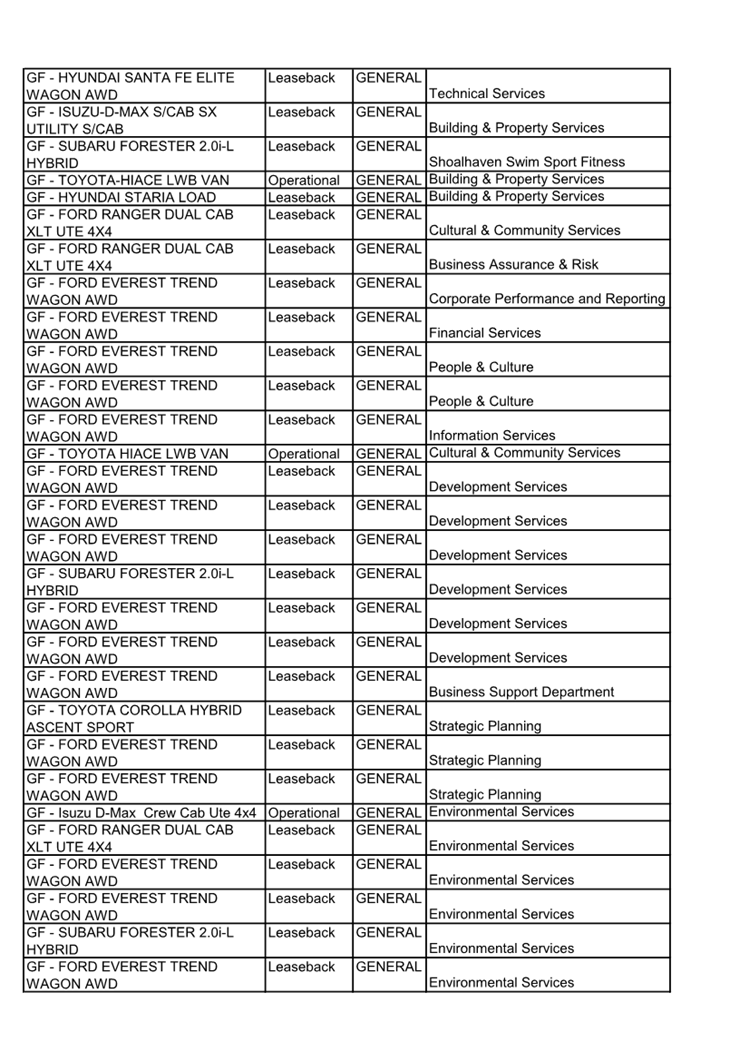

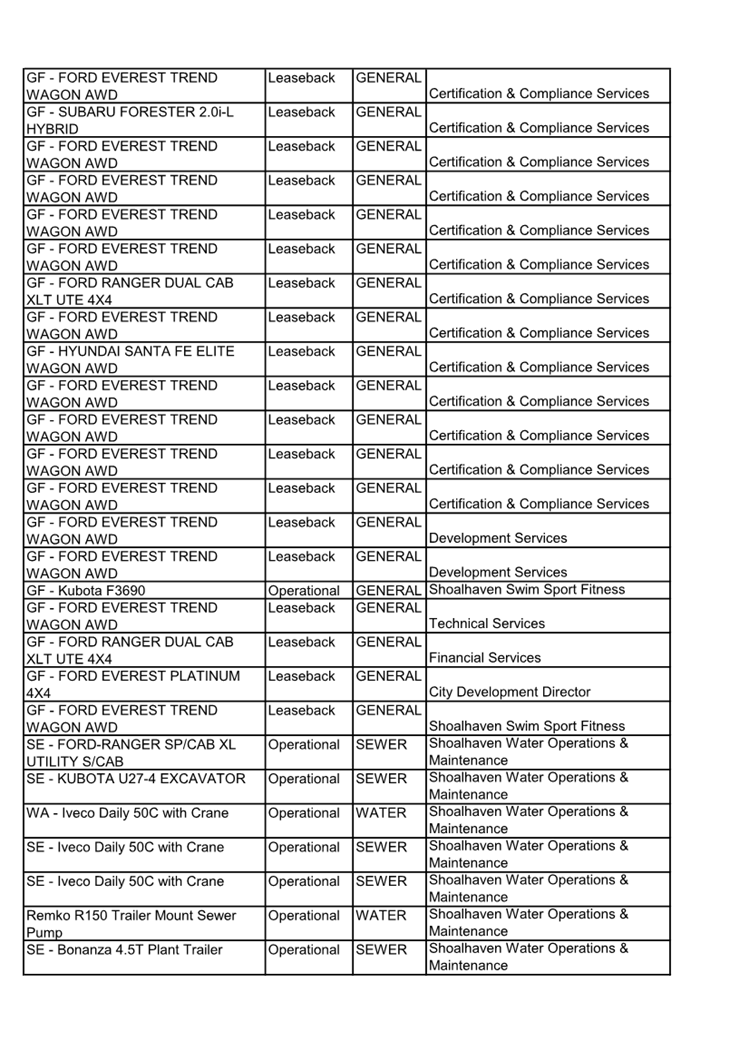

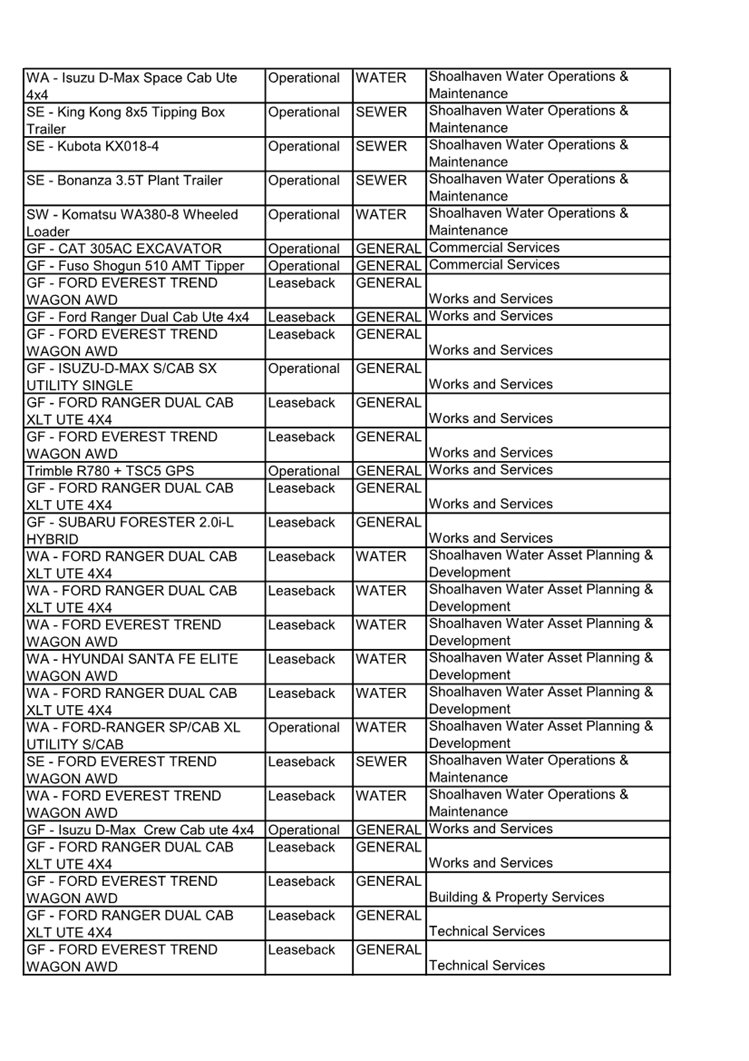

Council manages a plant and

fleet portfolio, to enable the provision of services and public

infrastructure. In 2024, Council purchased 193 plant and fleet assets

– including heavy plant, small plant and passenger vehicles. The

list of purchases is provided in attachment 1.

|

Recommendation

That

Council receive this report in response to MIN25.63

resolved on 25 February 2025 Ordinary Meeting to report back on new vehicles purchased in 2024.

|

Options

1. As recommended.

Implications: The report will be received for

information.

2. The Council

resolve an alternate course of action.

Implications: Any implications of an alternate

resolution would need to be considered.

Background and Supplementary

information

Council manages a plant and

fleet portfolio, to enable the provision of services and public infrastructure.

Council’s plant and fleet assets are classified as:

· Heavy

plant – such as trucks, excavators and rollers, support the critical

operation and maintenance of Shoalhaven’s road network, water and sewer

network, and waste services infrastructure.

· Small

plant – such as mowers, whipper snippers and trailers, to enable the

maintenance of Shoalhaven’s vast green spaces and sports fields.

· Passenger

vehicles – classified as operational vehicles (enabling operational staff

to perform the duties of their position such as Rangers, Water Meter Readers

and Works and Services crews) and leaseback vehicles (cars provided through a

leaseback arrangement for a combination of business and personal use. These

vehicles are also made available to other staff to use throughout the business

day ensuring all staff have access to a safe, reliable vehicle for

Council-related travel).

Each category of plant and fleet asset has a defined

replacement schedule, which is set to optimise the useful life of the asset and

to maximise the resale value of the asset.

Each financial year, budget is allocated to fund the

replacement of plant and fleet assets, as per the 10-year plant and fleet

replacement program.

Replacement of plant and fleet assets are funded through the

following reserves, based on the operational use of the asset:

· General

fund plant reserve

· Water

fund plant reserve

· Sewer

fund plant reserve

· Waste

budget and reserve

In 2024, Council purchased 193 plant and fleet assets, listed

in attachment 1 - 2024 plant and fleet purchases.

The summary of the purchases are:

· 84

were operational vehicles (39 general fund, 41 water and sewer funds, and 4

waste services)

· 109

were leaseback vehicles (82 general fund, 25 water and sewer funds, and 2 waste

services). 2024 saw a higher number of leaseback vehicles delivered due

to delays in vehicle shipments that were ordered in 2022 and 2023 but not

fulfilled until 2024 (73 vehicles).

· 172

of the total 193 plant and fleet purchases were replacement of existing assets,

and 21 were new assets. Of the new assets (10 was general funded, 9 were

water and sewer funded, 2 were funded by waste services)

In November 2024, the Executive

Leadership Team adjusted the replacement schedule on passenger vehicles from

replacing every 2 years to a 3-year replacement schedule. This change

will have a positive impact on Council’s long term financial plan, as

passenger vehicles purchased less often will result in a reduced annual demand

for capital funds.

At the Ordinary Council Meeting

on 11 March 2025, Council was presented with an update report on the

Plant and Fleet Service Review (CL25.75)

which referred to a list of project deliverables highlighted in the AEC report

and a status update on each deliverable. Additional strategies aimed at

reducing plant and fleet costs are also being implemented in conjunction with

the AEC report items.

Internal Consultations

The Mechanical and Fleet

Services team engages with internal customers in Works and Services, Shoalhaven

Water, Swim Sport & Fitness, and Waste Services to confirm future fleet and

asset requirements and to ensure operational teams are equipped to deliver

critical services for the Shoalhaven. The Enterprise Project Management

Office (ePMO) and Finance are then engaged with the proposed plant and fleet

capital budget requirement through the development of the draft budget.

External Consultations

No external consultation

occurred for this report.

Community Consultations

No community consultation

occurred for this report.

Policy and Statutory Implications

Council has a procurement policy

prescribing the process and financial delegations. For fleet assets, Fleet

staff use the NSW State Government panel for the supply of light passenger and

commercial vehicles, and the Local Government Procurement panel for some plant

and equipment. They also use RFQ’s for other plant and equipment.

Financial Implications

The total cost to Council for

the procurement for the 193 fleet assets in 2024 was $15,070,521.62. This

includes $1,380,000.00 for the new Tana Landfill Compactor for West Nowra Waste

Operations, and $7,947,486.00 in operational plant and vehicles. The remaining

amount funded leaseback vehicles.

Risk Implications

Financial – Council

requires an effective plant and fleet function to deliver a wide range of

critical infrastructure and services to the community. The timely

replacement of plant and fleet as per the defined schedule is important to

avoid increasing service costs and to preserve resale value. Annual plant

and fleet procurement as per the replacement schedule is critical to achieve an

effective ongoing operation.

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

CL25.85 Report

Back - AEC Financial Sustainability Review - Actions Taken to Reduce FBT

Liability

HPERM Ref: D25/104616

Department: Financial

Sustainability

Approver: Lauren

Buckingham, Project Manager - Financial Sustainability

Purpose:

This report addresses MIN25.65

resolved by Council at its Ordinary Meeting on 25 February 2025 to report back

to Council what actions have been taken to date to reduce Council’s FBT

liability.

Summary and Key Points for

Consideration:

Council’s Fringe Benefits

Tax (FBT) expense has increased from $111,000 in 2019-20 to $789,000 in

2023-24. This increase is due to the specification of vehicles being

purchased, and additional vehicles provided under a leaseback arrangement.

In 2024, Council engaged AEC

Group Ltd (AEC) to complete a service review on the plant and fleet

operations. As part of the service review, AEC recommended that Council

take action to remove or minimise the FBT liability through a review of leaseback

contributions paid by staff.

In November 2024, the Executive

Leadership Team approved an increase of the leaseback fees by approximately 10%

(vehicle dependent) in accordance with the Local Government (State) Award

2023. The fee increases have been considered by the Consultative

Committee and became effective from 1 March 2025. The increase in fees

will generate an extra $118,144 in post-tax employee contributions annually,

helping to reduce the dollar value of the benefit provided by Council and the

associated FBT liability.

An annual review process has

been reinstated to review leaseback contributions. Further increases in

leaseback fees of around 10% in future years will be considered, with the aim

to increase fees to a level that negates Council’s FBT liability.

Any future increases will need to be approved by the Executive Leadership Team

and considered by the Consultative Committee closer to their adoption.

|

Recommendation

That

Council receive this report in response to MIN25.65

resolved on 25 February 2025 Ordinary Meeting to report back what actions

have been taken to date to reduce Council’s FBT liability.

|

Options

1. As recommended.

Implications: The information will be received for

information.

2. The Council requests further

information or action from the Acting CEO with respect to the topic.

Implications: Additional information will be

provided in a subsequent report to the Council.

Background and Supplementary information

Council provides a range of

fringe benefits to staff in respect to their employment and these benefits are

an essential element of attracting and retaining quality staff in a competitive

market.

The main fringe benefit provided

to staff is cars provided through a leaseback arrangement for a combination of

business and personal use. These vehicles are also made available to other

staff to use throughout the business day ensuring all staff have access to a

safe, reliable vehicle for Council-related travel.

Council’s FBT liability

has increased over the past four years due to:

1. The specification of

vehicles being purchased has increased, and the number of vehicles provided

under a leaseback arrangement has also increased.

2. A whole of life cost

method was introduced in late 2020 to determine the types and specifications of

vehicles on the selection list with a staged roll out.

3. Indications were that

the projected savings made through increased vehicle resale prices and fuel

efficiency would offset increases in FBT. After the implementation of this

model:

a. COVID19 impacted the

vehicle market with delays in delivery and sales of vehicles, increasing

scheduled turnover times.

b. Vehicles sold at the

2-year mark held their resale price as estimated.

c. Vehicles that were sold

at the 3-year mark had considerable decrease in resale prices.

d. Driver preference for

specific make and models, being Ford Ranger and Everest, impacting resale

prices when consolidated for sale at turnover times.

e. The price of diesel

increased significantly which impacted on the whole of life cost of owning

vehicles.

f. Leaseback fees

remained unchanged during this period.

The steps Council has taken to

address the increase in FBT and ensure that the whole of life cost is

beneficial to Council include:

1. Reduce market risks by

broadening the selection list, thereby driving diversification of

vehicles.

2. Increasing leaseback

fees by approximately 10% (vehicle dependent) in accordance with the Local

Government (State) Award 2023. The fee increases have been considered by

the Consultative Committee and became effective from 1 March 2025. The increase

in fees will generate an extra $118,144 in post-tax employee contributions

annually, helping to reduce the dollar value of the benefit provided by Council

and the associated FBT liability.

3. An annual leaseback fee

review process has been reinstated, with the next review scheduled for November

2025. Further increases in leaseback fees of around 10% in future years will be

considered, with the aim to increase fees to a level that continues to reduce

Council’s FBT liability. Any future increases will need to be

approved by ELT and considered by the Consultative Committee closer to their

adoption.

Internal Consultations

To implement the recommendations

from the plant and fleet service review, the Plant and Fleet Working Group were

consulted and made a recommendation to the Executive Leadership Team. The

Consultative Committee were consulted, as the increase in weekly leaseback

contribution has an impact on staff. Leaseback holders were then advised

of the change to the weekly leaseback contribution in January 2025.

External Consultations

AEC were engaged to complete the

plant and fleet service review, under the financial sustainability project.

Community Consultations

No community consultation

occurred for this report.

Policy and Statutory Implications

Council’s Motor Vehicle

Policy has been amended with the updated vehicle list and new weekly leaseback

fee schedule.

Financial Implications

The actions taken to date to

reduce Council’s FBT liability will generate an extra $118,144 in

post-tax employee contributions annually, helping to reduce the dollar value of

the benefit provided by Council and the associated FBT liability.

Action in future years through

an annual review of the leaseback contribution will continue to reduce the FBT

expense incurred. The next review is scheduled for November 2025.

Risk Implications

If future and ongoing action is

not taken, there is a risk that Council will not achieve the required outcome

for financial sustainability.

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

CL25.86 Ongoing

Register of Pecuniary Interest Returns - February 2025

HPERM Ref: D25/44232

Department: Business

Assurance & Risk

Approver: Katie

Buckman, Acting Director - City Performance

Purpose:

To provide Council with the Register

of Pecuniary Interest Returns from newly designated persons lodged with the

Chief Executive Officer for the period of 1 February 2025 to 28 February 2025

as required under Section 440AAB of the Local Government Act 1993 and Part 4.26

of the Code of Conduct.

Summary and Key Points for

Consideration:

Under Section 440AAB of the Local Government Act 1993

and Part 4.26 of the Model Code of Conduct, newly designated persons are

required to complete an Initial Pecuniary Interest Return within 3 months of

becoming a designated person.

Section 440AAB (2) of The

Local Government Act 1993 states:

Returns required to be lodged with the general manager

must be tabled at a meeting of the council, being the first meeting held after

the last day specified by the code for lodgement, or if the code does not

specify a day, as soon as practicable after the return is lodged.

Part 4.26 of the Model Code of

Conduct states:

Returns required to be lodged with the general manager

under clause 4.21(c) must be tabled at the next council meeting after the

return is lodged.

This report is one of a series

of reports of this nature which will be provided throughout the year to align

with the legislative requirements.

Those persons who have submitted

a return within the period in accordance with their obligation to lodge an

initial pecuniary interest return are listed below:

|

Directorate

|

Name

|

Designated Position Start Date

|

Returned

|

|

City Development

|

Thomas South

|

09/12/2024

|

3/02/2025

|

|

City Development

|

Jason Higgs

|

16/11/2024

|

5/02/2025

|

|

City Development

|

Joshua Simpson

|

16/12/2024

|

12/02/2025

|

Electronic versions of the disclosure documents (with

relevant redactions) are available on the Council website, in accordance with

requirements under the Government Information (Public Access) Act, 2009.

|

Recommendation

That the report of the Chief

Executive Officer regarding the Ongoing Register of Pecuniary Interest

Returns lodged for the period of 1 February 2025 to 28 February 2025 be

received for information.

|

Options

1. That the report

be received for information.

Implications: Nil.

2. That the Council

may seek further information.

Implications: Further information be provided to

Council in future reports in line with the resolution.

Background and Supplementary

information

This report is being submitted directly to the Ordinary

Meeting due to the requirements under the Code of Conduct and the Local

Government Act 1993.

Internal Consultations

Internal consultation is not

required as the process for Initial Pecuniary Interest forms is governed by the

Local Government Act 1993, the Model Code of Conduct and the Government

Information (Public Access) Act, 2009.

External Consultations

External consultation is not

required as the process for Initial Pecuniary Interest forms is governed by the

Local Government Act 1993, the Model Code of Conduct and the Government

Information (Public Access) Act, 2009.

Community Consultations

Community consultation is not

required as the process for Initial Pecuniary Interest forms is governed by the

Local Government Act 1993, the Model Code of Conduct and the Government

Information (Public Access) Act, 2009.

Policy Implications

The obligations with respect to

the Pecuniary Interest Returns by designated officers are in accordance with

the Model Code of Conduct and the Government Information (Public Access)

Act, 2009.

Financial Implications

There are no financial

implications for this report.

Risk Implications

A failure of meeting the

obligations with respect to the Pecuniary Interest Returns by a designated

officer leaves Council at risk of non-compliance with legislative requirements,

conflict of interests and limited transparency.

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

CL25.87 ALGA

Annual Conference 2025 - National General Assembly

HPERM Ref: D25/51159

Department: Business

Assurance & Risk

Approver: Katie

Buckman, Acting Director - City Performance

Purpose:

To consider Councillor voting

delegates, attendance and motions for submission to the following conferences

to be held in Canberra ACT.

· Regional

Development and Cooperation Forum – Tuesday 24 June 2025

· ALGA

Annual Conference 2025 – National General Assembly – Wednesday 25

June to Friday 27 June 2025

Summary and Key Points for

Consideration:

The Regional Development and Cooperation

Forum and ALGA Annual Conference 2025 – National General Assembly

scheduled for Tuesday 24 June to Friday 27 June 2025 in Canberra ACT are

considered relevant to local government. Information in relation to the

conference can be found on the ALGA website

Costs associated with the

conference are estimated as follows:

· Registration

– National General Assembly – $979 (early bird closing 23 May 2025)

$1095 Non-early bird

· Registration

– Regional Development and Cooperation Forum – $279

· Official

functions (optional) – Dinner $179

· Travel,

accommodation and out of pocket expenses – not yet determined

An option available to Council

is to define the number of Councillors attending the conference and for Council

to determine the appropriate Councillors authorised to attend. This

option is presented having regard to the increase in Councillor expenses in

recent years, so that Council may pro-actively control this area of expenses

when appropriate.

The

Conferences commences at 9.00am Tuesday 24 June and concludes at 5.30pm Friday

27 June 2025. The following Council Business is scheduled within the period of

the conferences:

|

Recommendation

That

1. Council notes the details of the

following conferences to be held in the National Convention Centre, Canberra,

ACT.

a. Regional Development and Cooperation

Forum – Tuesday 24 June 2025

b. ALGA Annual Conference 2025 –

National General Assembly - Tuesday 24 June to Friday 27 June 2025.

2. Councillor [insert name" ] be determined as the Council voting

delegate for the conference and Councillor [insert

name" ] as alternate delegate should the voting delegate not be

in attendance.

3. Council

endorse the motions contained within the report be submitted for inclusion in

the ALGA Annual Conference 2025 – National General Assembly.

|

Options

1. As per the

recommendation.

Implications: The attendance and nominated voting

delegate (and alternate) representing Council will be confirmed, together with

the endorsement of the motions proposed in the report for submission for

consideration and debate at the Annual Forum.

2. That Council

limit the number of Councillors attending the conference given the

Council’s current financial position.

Implications: This would allow the Council to limit the

expenditure related from attendance to a level the Council considers

appropriate:

Should the Council wish to pursue that approach the following

alternate motion wording is provided:

That

1. Council

notes the details of the ALGA Annual Conference 2025 – National General

Assembly scheduled for Tuesday 24 June to Friday 27 June 2025 in Canberra

ACT. Authorises nominated Councillors to attend the conference and such

attendance be deemed Council Business.

2. Council

limit the attendance to the Conference to [the Councillor Voting Delegates only

OR to X number of Councillors OR the following Councillors]

3. Councillor

[insert name" ] be determined as

the Council voting delegate for the conference and Councillor [insert name" ] as alternate delegate

should the voting delegate not be in attendance.

3. That Council not

approve Councillor attendance at the Conference.

Implications: Should the Council determine not to appoint

Councillors to fill the voting delegate roles available, there is a risk of not

having the full representation and benefit of the Shoalhaven’s views

considered at the conference and limited advocacy for those motions proposed by

this Council.

4. The Council

formulate and endorse additional motions raised during the Ordinary Meeting for

submission.

Further motions can be proposed on the floor of Council to

be included in the submissions; however, the wording will need to meet the

criteria set and the Council will need to endorse the wording as final.

Background and Supplementary

information

It is

recommended that Council authorises nominated Councillors to attend the

conference as Council business.

Each Council

is provided the opportunity for one voting delegate. It is recommended that the

Council determine its nominated voting delegate for the conference by

resolution and an alternate is also to be nominated to fill in for the delegate

if required.

Motions

ALGA has called for the

submission of motions. Councils are encouraged to formulate motions submitted

in terms of the current policy statements.

Councils are also encouraged to

submit motions online as early as possible and before the deadline of 11.59pm

on Monday 31 March 2025.

Councillors and the Executive

Leadership Team were requested via the Councillor Portal and email to suggest

motions in accordance with the criteria and deadlines to be submitted for

inclusion in this report.

To date the motions received

are:

MOTION 1

Title – Taxation

Revenue of Federal Assistance Grants

Motion – This

National General Assembly calls on the Australian Government to restore the

taxation revenue of Federal Assistant Grants to a full 2% and that this

adjustment occur over a five-year period.

Category –

Financial Sustainability

Why is This a National Issue

– Over the past 40 years successive governments have reduced the

percentage of taxation revenue being paid in favour of a CPI amount. This has

meant that the Government has pocketed for its own purposes revenue which

should’ve gone to Local Government. This has undoubtedly led to

significant financial stress in the Local Government sector.

Background

Federal Assistance Grants have

been a fixture of Local Government funding since 1974. The grant is paid to

Local Governments via their State or Territory Grants Commissions according to

an agreed formula set by the Federal Government.

Over the past 40 years,

successive governments have reduced the percentage of taxation revenue being

paid in favour of a CPI amount. It is worth noting, the last time these grants

were equal to 1% of Commonwealth taxation revenue was 1996.

This means the Government has

received revenue for its own purposes, which should’ve been received by

Local Government. This has undoubtedly led to significant financial stress in

the Local Government sector.

Increasing the taxation revenue

to 2%, would help address the financial stress currently faced by Local

Governments ensuring they can continue to provide vital services to their

communities. This is because these Grants are untied, meaning that Local

Governments can use this funding to address local issues and priorities.

MOTION 2

Title – Financial Assistance via Services

Australia

Motion – That this General Assembly calls

on the Federal Government to provide adequate financial assistance, via

Services Australia, to eligible ratepayers (Pension and Low-Income

earner’s) to assist with payments of council and water rates.

Financial assistance should be provided at an amount, or

percentage, that reflects current level of rates and should be delivered via a

more efficient and cost-effective mechanism, than is currently used.

Category – Financial Sustainability

Background

Currently, a rebate for council and

water rates is available to eligible pensioners. Pensioners who hold a

pensioner concession card, DVA Gold Card (TPI and EDA), and widow/ widowers who

are entitled to income support, may apply for this rebate. The rebate does not

extend to low-income earners.

This rebate has not increased in

the last 13 years. The current cost of living crisis and an increase in rates

over this period has seen the benefit of this rebate erode.

There is a need to provide

additional financial support to seniors, pensioners, and low-income earners

across our communities, particularly during the cost-of-living challenge

currently facing our country.

Internal Consultations

Internal consultation is not

required as attendance at this conference fall within the current adopted

Council Members – Payment of Expenses and Provision of Facilities Policy.

Councillors and the Executive

Leadership Team were communicated with via the Councillor Portal and numerous

emails expressing the criteria and deadlines for motions to be included within

the report for resolution and submission.

External Consultations

Internal consultation is not

required as attendance at this conference falls within the current adopted

Council Members – Payment of Expenses and Provision of Facilities Policy.

Community Consultations

Internal consultation is not

required as attendance at this conference falls within the current adopted

Council Members – Payment of Expenses and Provision of Facilities Policy.

Policy and Statutory Implications

The current Council Members

– Payment of Expenses and Provision of Facilities Policy limits

attendance at conferences to three per annum per councillor exclusive of any

conference arranged by either the State or National Local Government Associations.

Council has recently considered

an alternate policy which is currently on public exhibition.

Financial Implications:

Funds are available for

Councillors to attend this conference.

Risk Implications

Should the Council determine not

to appoint Councillors to fill the voting delegate roles available, there is a

risk of not having the full representation and benefit of the

Shoalhaven’s views considered at the conference and limited advocacy for

those motions proposed by this Council.

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

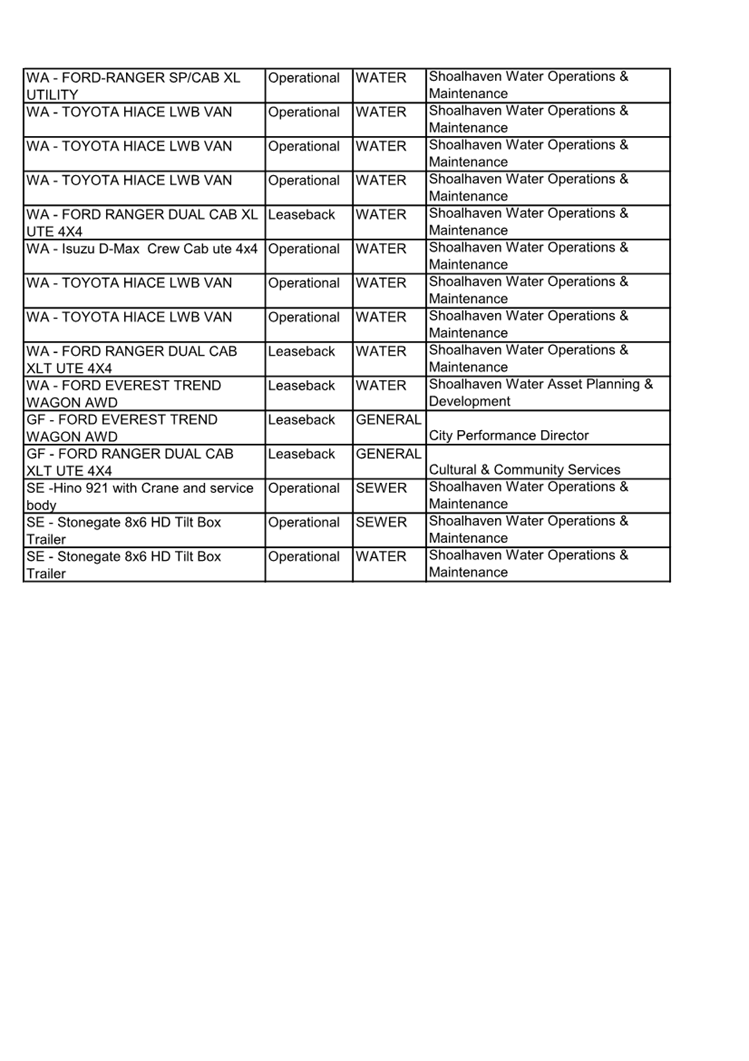

CL25.88 Investment

Report - February 2025

HPERM Ref: D25/100142

Department: Finance

Approver: James

Ruprai, Acting CEO

Attachments: 1. Monthly

Investment Review - February 2025 (under separate cover)

2. Statement of Investments

(under separate cover)

Purpose:

The reason for this report is to inform the Councillors and

the community on Council’s investment returns. The report also ensures

compliance with Section 625 of the Local Government Act 1993 and Clause 212 of

the Local Government (General) Regulation 2021, that requires a written report

is provided to Council setting out the details of all funds it has invested.

Summary and Key Points for

Consideration:

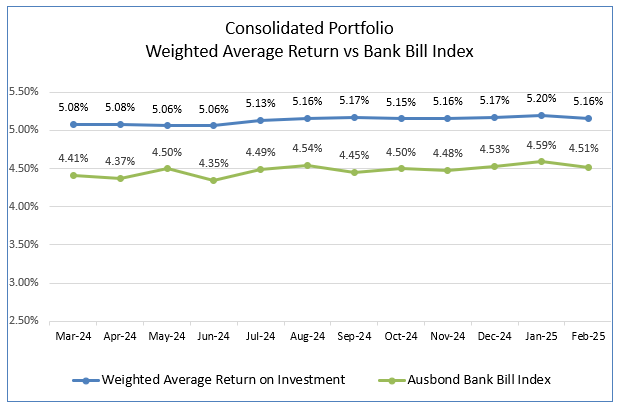

Council’s total Investment

Portfolio returned 5.16% per annum for the month of February 2025,

outperforming the benchmark Aus Bond Bank Bill Index (4.51% p.a.) by 65 basis

points (0.65%).

|

Recommendation

That Council receive the

Record of Investments for the period to 28 February 2025.

|

Options

1. The report of

the record of Investments for the period to 28 February 2025 be received for

information, with any changes requested for the Record of Investments to be

reflected in the report for the period to 31 March 2025.

Implications: Nil

2. Further

information regarding the Record of Investments for the period to 28 February

2025 be requested.

Implications: Nil

Background and Supplementary

information

Investment Portfolio

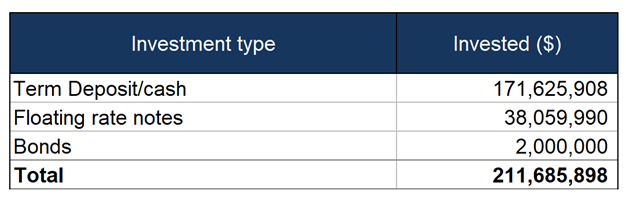

Council’s investment

balance as of 28 February 2025 was $211.68 million and consisted of the

following types of investments.

The details of each investment held

by Council on 28 February 2025 is included in the Statement of Investments at Attachment

2.

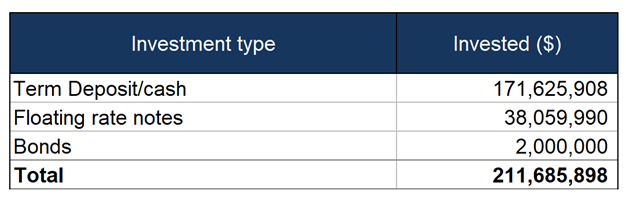

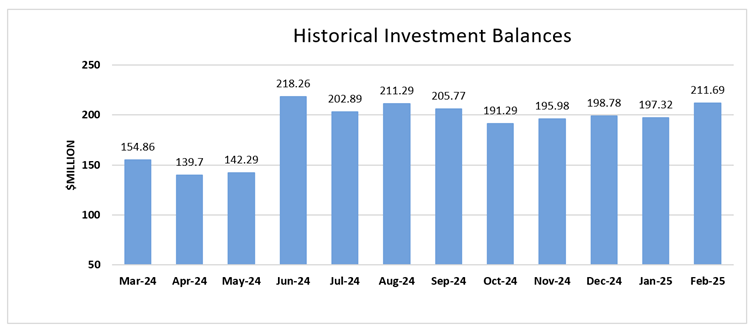

The graph below illustrates

Council’s investments balance on a rolling 12-month basis. Timing

of expenditure and grant monies varies throughout the year which can cause

fluctuations in the overall balance at the end of each month. The increase

to the investment portfolio at the end of February is predominately due to the

3rd quarterly rates instalments being due by the end of February.

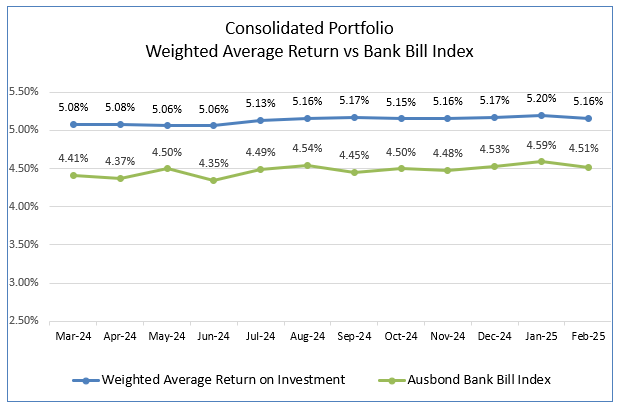

Portfolio Return

For the month of February, the total investment returns were a

positive 5.16% p.a. outperforming Aus Bond Bank Bill Index (4.51%) by 65 basis

points.

Investments

Graph 1 below, shows the performance of Council’s

Investment Portfolio against the benchmark on a rolling 12-month basis.

Graph 1 - Performance

of Council’s Investment Portfolio against the benchmark on a rolling

12 month basis

Investment Interest Earned –

February 2025

Much of Council’s cash is restricted in its use to

specific purposes by external bodies (e.g., specific purpose unspent grants),

legislation (e.g., developer contributions, domestic waste management, water

and sewer funds) and Council resolutions (i.e., internally restricted

reserves). Interest earned on externally restricted cash must be

allocated to those external restrictions in accordance with legislation.

The two tables below show the allocation of interest to each applicable Fund.

Table 1 below, shows the interest earned for the

month of February 2025.

Table

1 - Interest Earned for the Month of February 2025

|

Fund

|

Monthly Revised Budget

$

|

Actual Earned

$

|

Difference

$

|

Adjustment $

|

|

General

|

453,338

|

423,816

|

-35,523

|

173,339

|

|

Water

|

166,256

|

159,733

|

-6,523

|

-224,392

|

|

Sewer

|

112,884

|

111,119

|

-1,765

|

51,053

|

|

Total

|

738,478

|

694,667

|

-43,811

|

-

|

The interest earned for the month of February, was $694,667

compared to the monthly revised budget of $738,478. The average rates on

term deposits dropped compared to where they were in January in response to the

rate cut from the Reserve Bank of Australia.

Adjustment to interest income allocation between Funds

Interest income is allocated proportionately across the

different Funds of Council, based on the overall cash investment portfolio

balance of each Fund. The cash and investment portfolio balance of each

Fund changes each month, and this is continually monitored. An adjustment

is required on the allocation of interest income between the Funds at the end

of February to reflect the cash and investment portfolio balances for each

Fund. The total interest income earned to the end of February remains

unchanged, however there was an over allocation to the Water Fund of $224,392

in previous months and this has been corrected at the end of February. The over

allocation to the Water Fund has been reallocated to the General ($173,339) and

Sewer Funds ($51,053) and is represented in the actual year-to-date figures

below for each Fund.

Investment Interest Earned -

Year to Date

Table 2

below, demonstrates how the actual amount of interest earned year to date has

performed against the 2024/25 budget.

Table 2 - Amount of interest earned year to date,

against the total budget

|

Fund

|

Revised Total Annual Budget 1

$

|

Actual

YTD

$

|

%

Achieved

|

|

General

|

5,987,804

|

3,972,606

|

66%

|

|

Water

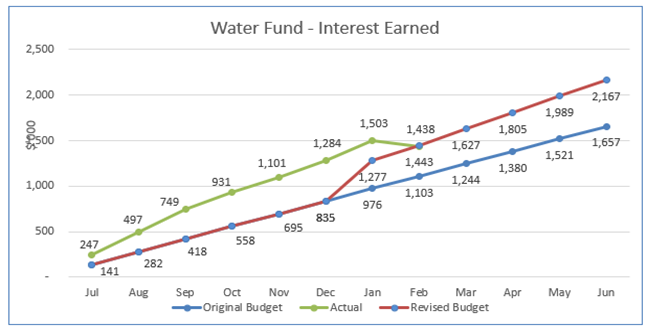

|

2,167,263

|

1,437,870

|

66%

|

|

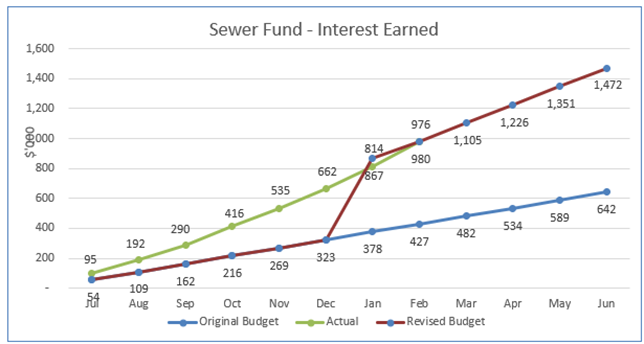

Sewer

|

1,471,521

|

976,280

|

66%

|

|

Total

|

9,626,589

|

6,386,756

|

66%

|

1 As

part of the December Quarterly Budget Review, it was resolved to increase the

annual budget for interest income by $3.8M. This is because the interest

rates on investments are higher than originally forecast and Council is earning

more interest than originally budgeted.

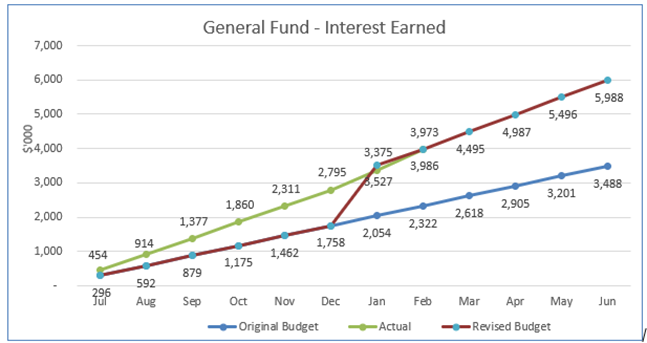

The interest earned in the general fund of

$3,792,606 includes interest earned on unspent s7.11 developer contributions

and Domestic Waste Management reserves, which is required to be restricted by

legislation. Interest earned on unspent s7.11 developer contributions is

$1,072,604 and Domestic Waste Management reserves is $316,126 to the end of

February 2025. This leaves $2,583,877 which is unrestricted.

All returns on investments above budget on

externally restricted Funds must be allocated to those Funds in accordance with

legislation. Externally restricted surplus funds will be allocated to the

respective external reserve to help fund future capital works included in the

long-term financial plan. Any returns on investments above budget on

unrestricted Funds will be used to replenish internal reserves which are

currently funding costs incurred and spent on grant funded projects awaiting final

acquittal.

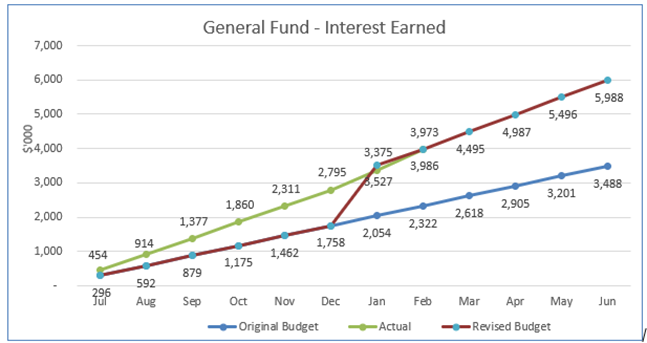

The cumulative interest earned for the

year (July to February) was $6,386,756 which is 66%

of the current full year revised total annual budget.

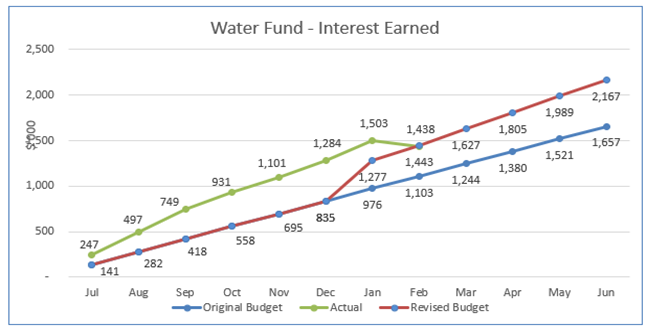

Graph 2 (3 separate graphs) below,

illustrates the cumulative interest earned for the year for each fund (General,

Water and Sewer) against budget:

Graph 2 - Cumulative interest earned for the year for

each fund against budget

Internal Consultations

Not applicable.

External Consultations

Council’s investment

advisor, Arlo Advisory Pty Ltd.

Community Consultations

Not applicable.

Policy Implications

All investments have been placed

in accordance with Council’s Investment Policy.

Financial Implications

Council’s return on

investments is exceeding budget and a budgetary adjustment will be made as part

of the December Quarterly Budget Review to reflect current market rates and

interest forecast.

Risk Implications

All investments are placed with

preservation of capital the key consideration to prevent any loss of principal

invested.

Statement by Responsible

Accounting Officer

I hereby certify that the

investments listed in the attached report have been made in accordance with

Section 625 of the Local Government Act 1993, Clause 212 of the Local

Government (General) Regulations 2021 and Council’s Investments Policy

POL22/78.

Katie Buckman Date:

20 March 2025

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

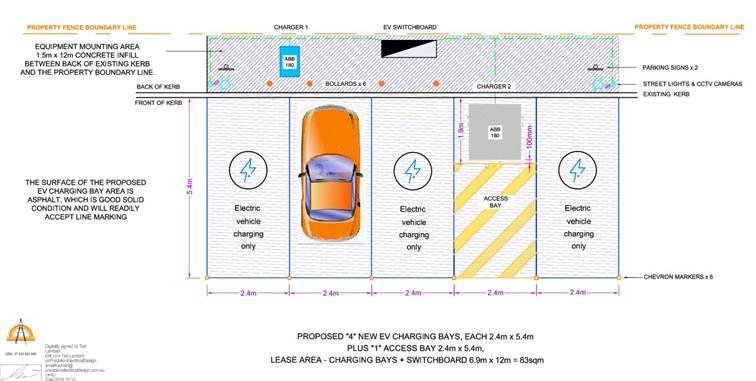

CL25.89 Proposed

Licence to the NRMA Electric Highways Pty Ltd over Part Lot 20 DP 801794 Berry

Street, Nowra

HPERM Ref: D24/500032

Department: Buildings

& Property Services

Approver: Kevin

Norwood, Acting Director - City Services

Purpose:

The purpose of this report is to request a resolution from

Council to enter into a licence with NRMA Electric Highways Pty Ltd (the NRMA) over

part of Lot 20 DP 801794 Berry Street, Nowra for the provision of an electric

vehicle charging station.

Summary and Key Points for

Consideration:

· The

land is classified as operational land and Council can enter a proposed

five-year licence with an additional five-year option.

· Council

resolution is required to determine the grant of the proposed licence on the

basis the annual rent exceeds $5,000 per annum.

|

Recommendation

That

Council:

1. Enter into a five-year licence with

an additional five-year option over part of Lot

20 DP 801794 Berry Street, Nowra with NRMA

Electric Highways Pty Ltd for the purpose of

the provision of an electric vehicle charging station, with the commencing

rent being $6,000 excluding GST per annum, increased annually by CPI.

2. Authorise

for the Common Seal of the Council of the City of Shoalhaven to be affixed to

any documentation requiring to be sealed and delegate to the CEO and other

delegated officers, authority to sign any documentation necessary to give

effect to this resolution.

|

Options

1. Resolve as

recommended.

Implications: The NRMA will be able to install and

maintain an electric vehicle charging station at Berry Street, Nowra.

2. Not resolve as

recommended.

Implications: The electric vehicle charging station

will not be able to be installed.

Background and Supplementary

information

Council has identified 20 initial locations across the

Shoalhaven where Electric Vehicle (EV) fast charging could be explored as part

of a submission under the NSW Expression of Interest to host fast EV charging

sites. Locations were selected with consideration to their proximity to the

optimal zones identified in the NSW EV Fast Charging Master Plan, as well as

adequate parking provision, safety, and public lighting considerations.

These

locations were listed by the NSW government for all interested Charge Point

Operators (CPOs) to contact Council. Council received interest from several

CPOs for a number of these sites and provided non-binding letters of support

for several CPOs to apply for fast charging grants across some sites.

Berry

Street, Nowra was one of the locations identified as being suitable for the

installation of an EV charging station. The proposed site was exhibited on

Council’s Get Involved page in December 2024 to determine if the site

would be supported by the community. The site was widely supported by 85% of 86

survey respondents.

Council

has previously endorsed the EV charging facility at 85 South Street, Ulladulla.

The Berry Street site is the second facility being proposed on Council land in

the LGA.

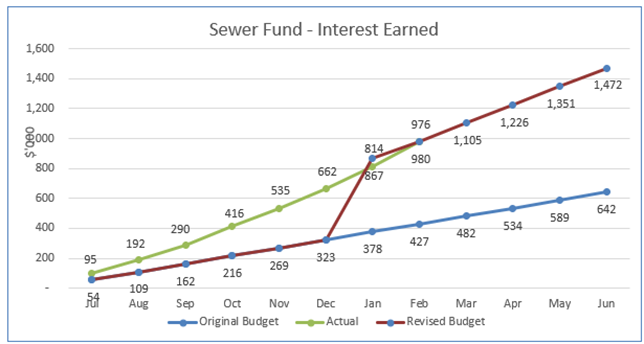

The proposed EV chargers located

at Berry Street, Nowra will be accessible to all EV drivers and will host four

DC fast chargers, including two 180kW ABB Terra DC chargers capable of charging

an EV to 80% in 20 minutes (subject to vehicle specifications and competing

power load). The chargers will be operated and maintained by the NRMA. Figure 1

below is an indicative image of the layout of the proposed EV charging station.

Figure 1: Indicative EV Charging

Station layout

The Berry Street carpark contains 149 vehicle

parking spaces. As per Figure 2 below, the proposal (licenced area) highlighted

in orange will occupy 3% of the total number of spaces for the public.

Figure 2: Proposed location of EV Charging

Station

Licence

The NRMA requires a licence from

Council to install, operate and maintain the EV charging station. The estimated

cost to the NRMA for the installation is in the order of $750,000.

The NRMA will install two 180kW

ABB Terra DC chargers as well as an upgrade to the existing electricity

pad-mount substation. The NRMA are requesting a ten-year term licence due

the investment. The proposed licence term is for five years with an additional

five-year option.

Internal review of Berry Street, Nowra confirms there are no short to medium term plans to redevelop the

site.

Valuation

Council engaged a certified

practicing valuer to undertake a valuation of Berry Street, Nowra. It was

determined that the market rental value (ground rental) is $520 (excluding GST)

per carparking space per annum.

The

total area to be licenced including charging bays (carparking spaces) and

switchboard area is 83m2 which has an assessed market value of $3,320

excluding GST per annum.

The NRMA has offered an annual

licence rental of $6,000 excluding GST per annum for the first year increased

annually by CPI which is acceptable as it is above the assessed valuation.

Internal Consultations

Internal consultation has

included Asset Program Planning Manager, Manager Works & Services, Manager - Environmental Services, and Lead - Environmental Projects

& Sustainability.

The internal consultation raised no

overarching objection to the proposal. It has been advised that the EV proposal

will result in the net loss of one car parking space, noting that the Berry

Street car park is a high demand area. It would be the best outcome for zero

car parking spaces to be lost to facilitate the EV charging proposal. However,

this is not possible on the basis of the restricted curtilage of the site. The

loss of one car parking space is not considered detrimental to the overall

function of the car park and general availability of car parking for the

public. The proposed EV charging spaces will result in a continual turnover of

vehicles based on the estimated 30 minutes charging time per vehicle. The

existing Berry Street carpark currently designates a total of 81 x 2-hour car

parking spaces and as a result the EV charging allocation is considered

appropriate and on balance the creation of the new EV charging opportunity for

the public outweighs the loss of one vehicle parking space.

External Consultations

Council engaged a certified

practicing valuer to determine the market rental value of the proposed licenced

area.

Community Consultations

In

December 2024, community consultation was undertaken around a proposed EV

charging station at Berry Street, Nowra. Community consultation is required

under the EV Charging Station policy. The results of the consultation indicate

that the community is supportive of EV charging station at this site.

- over

the one-month exhibition period for the Berry Street site, Council received 86

survey submissions on the proposal.

- 85%

of the respondents were supportive of the EV charging station being installed.

- 65.2%

of respondents drove an electric vehicle.

- 15.7%

of respondents drove a standard vehicle but were interested in purchasing an

electric vehicle in future.

- submissions not in support of EV charging

on the site were based on the project being funded by Council. As Council is

not incurring any cost with this proposal, it is reasonable to summarise that

the EV proposal was overwhelmingly supported with community consultation.

Policy Implications

Council’s EV Charging Stations on Public Land Policy is the primary policy which outlines the

requirements for the provision of EV charging stations on public land. The

installation of EV charging infrastructure on public land must comply with this

Policy and Council’s Occupation of Council Owned or Managed Land Policy.

The

proposed licence is consistent with these policies.

Financial Implications

Council is not incurring any

cost with this proposal. The cost of the installation of the EV charging

station and all associated infrastructure and signage is the responsibility of

the NRMA. The NRMA will undertake all repairs and maintenance and will be

responsible for removing all assets at the end of the Licence term.

Risk Implications

It is normal practice to allow

for an interest in land in the form of a licence. Council’s interests

have been considered and there is minimal risk associated with the recommended

new licence agreement.

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

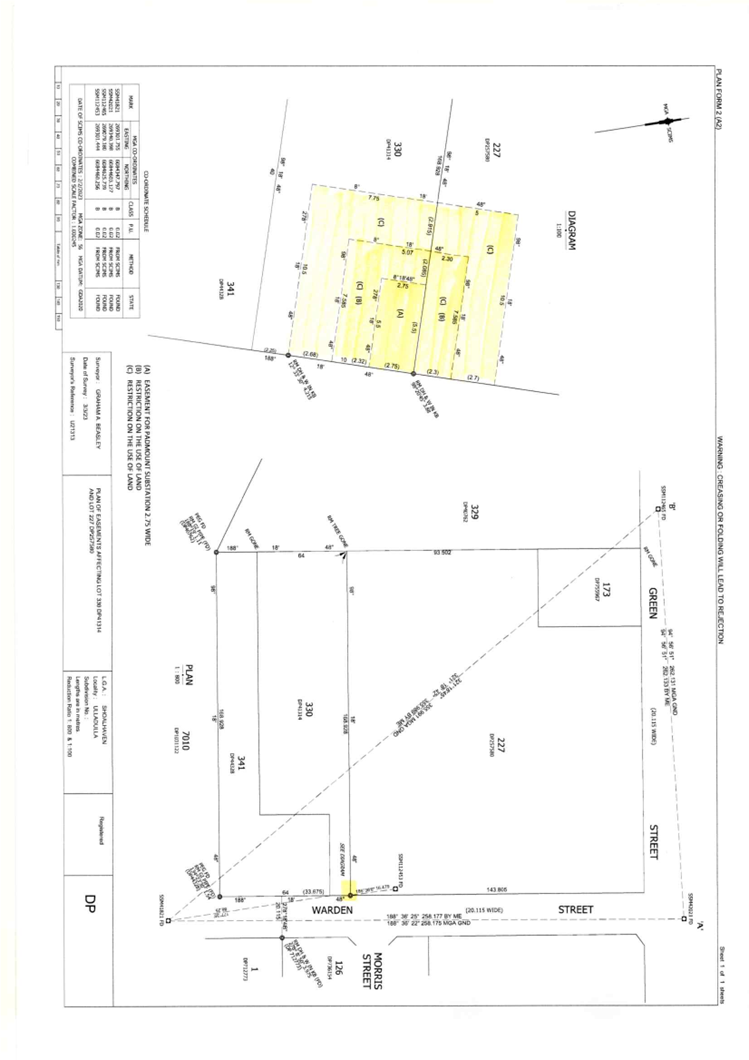

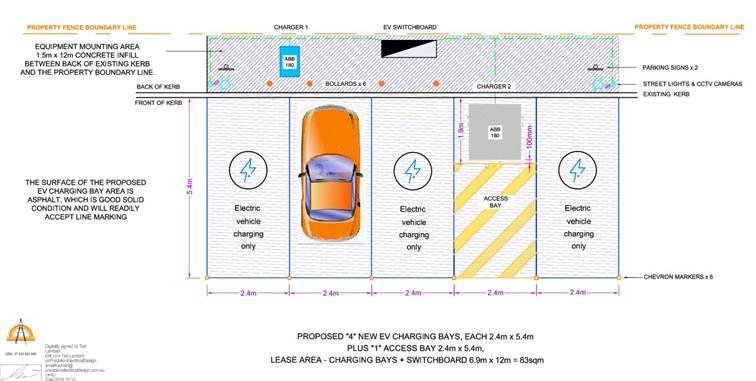

CL25.90 Grant

of Easement for Padmount Substation and Restriction on the Use of Land - Part

Lot 227 DP 257580 & Part Lot 330 DP 41314, Ulladulla

HPERM Ref: D25/58379

Department: Building

& Property Services

Approver: Kevin

Norwood, Manager - Shoalhaven Swim Sport & Fitness

Attachments: 1. Plan

of Easement - Lot 227 DP 257580 and Lot 330 DP 41314 ⇩

Purpose:

The purpose of this report is to

seek Council approval to the grant of an Easement for a padmount substation and

the creation of a Restriction on the Use of Land in favour of Endeavour Energy

over Council-managed Crown land comprised in Lot 227 DP 257580 and Lot 330 DP

41314 at Ulladulla, as shown on Attachment 1.

Summary and Key Points for

Consideration:

· Pursuant

to Section 3.22(1)(a) of the Crown Land Management Act 2016, Council, as

Crown Land Manager, must manage the land as if it were community land under the

Local Government Act 1993.

· Pursuant

to Section 46(1)(a) of the Local Government Act 1993, Council may grant

easements for public utilities and works over community land.

· To

support the planned future upgrades at the Ulladulla Leisure Centre and the

tennis court clubhouse, a new padmount substation is required for the

additional electrical load. Endeavour Energy requires an easement for ongoing

maintenance.

· Council resolution

is required to grant an Easement for a padmount substation and the creation of

a Restriction on the Use of Land, under s377 of the Local Government Act

1993.

|

Recommendation

That

Council:

1. Grant an Easement for padmount

substation (15.125m2 area) and the creation of a Restriction on the Use of

Land in favour of Endeavour Energy over Lot 227 DP 257580 and Lot 330 DP

41314 (Ulladulla Leisure Centre), Ulladulla.

2. Authorise

the Common Seal of the Council of the City of Shoalhaven affixed to any

document required to be sealed and delegate authority to the Chief Executive

Officer to sign any documentation necessary to give effect to this

resolution.

|

Options

1. Resolve as

recommended.

Implications: The new padmount substation will

support the future planned upgrades of the Ulladulla Leisure Centre. The

occupation of the land will be formalised by registered survey plan and Section

88B Instrument benefiting Endeavour Energy.

2. Not resolve as

recommended.

Implications: The current electrical supply is

insufficient to support the proposed new loadings associated with the future

planned upgrades to the Ulladulla Leisure Centre. Consequently, these future

planned upgrades cannot be carried out.

Background and Supplementary

information

To support the planned upgrades

to the Ulladulla Leisure Centre and the tennis court clubhouse, a new padmount

substation is required for the additional electrical load. Endeavour Energy

will need easements for ongoing maintenance once the substation is constructed.

Proposed Works

The current gas heating system

is nearing end of life, new electric heat pumps for pool heating will be

installed to replace the existing system. The current electrical supply is

insufficient to support the proposed new loadings associated with the future

planned upgrades. There is also future concept designs to provide a splash pad

at Ulladulla Leisure Centre which will require electrical upgrades.

A padmount substation is

necessary to support the proposed new loadings. Council has engaged a

third-party to design the electrical infrastructure, and a Level 1 electrician

will construct the substation. This substation will service the Ulladulla

Leisure Centre, including the proposed planned upgrades, and the Ulladulla

Tennis Courts to support their future proposed clubhouse.

Once construction is complete,

Endeavour Energy will take ownership of the substation for ongoing maintenance.

To formalise this, Endeavour Energy requires an easement for access and

occupation.

Easement

Endeavour Energy requires a

2.75m wide Easement for padmount substation and corresponding Restriction on

the Use of Land over Lot 227 DP 257580 and Lot 330 DP 41314. Both lots are

Crown land, and Council is the Crown Land Manager. To grant the electricity

easement to Endeavour Energy, Shoalhaven City Council must be noted in Schedule

2 of the Certificate of Title for both parcels of land as the Crown Land

Manager. This is following direction from Crown Lands.

As the substation is required by

Council, all costs associated with the creation of the easement will be payable

by Council. Upon registration of the notation on title, the easement can be

granted to Endeavour Energy, at zero compensation.

The proposed padmount location will not impact any

operational part of the property.

Internal Consultations

Swim, Sport & Fitness has

been consulted throughout the process.

External Consultations

Crown Lands have been consulted

and have expressed their support for this proposal.

An Aboriginal Land Claim has

been lodged over Lot 227 DP 257580 and Lot 330 DP 41314. In November 2023,

Shoalhaven City Council wrote to the New South Wales Aboriginal Land Council

(NSWALC) to seek a written ‘non-objection’ to this proposal. The

NSWALC consulted with the Ulladulla Local Aboriginal Land Council (ULALC), and

on 16 January 2024, both the NSWALC and ULALC provided their written

‘non-objection’ to the proposal.

Council’s Native Title

Manager conducted an assessment to determine the native title status and ensure

the act of granting an easement was valid under the Native Title Act (Cwlth)

1993. The assessment was completed, and a referral was sent to the native

title holders on 21 December 2023. No comments were received.

Community Consultations

Council can grant an estate (the

proposed easement) in respect of community land. The proposed grant of easement

will be advertised in accordance with the Local Government Act 1993 and

if no submissions are received, the easement will be created on title.

Policy and Statutory Implications

Council’s Development

and/or Disposal of Council Lands Policy (POL22/47) has been observed.

Financial Implications

Costs associated with creation

of the easement and plan registration costs will be funded from Council’s

existing budget. The estimated cost to create and register the easement is

$6,500. There is zero compensation associated with the creation of the easement

on the land.

Risk Implications

Council’s interests have

been considered and there is minimal risk associated with the recommended grant

of the easement.

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

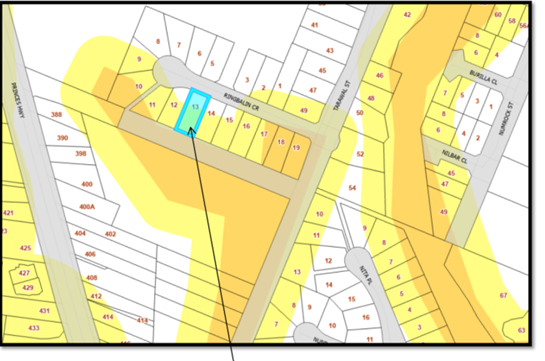

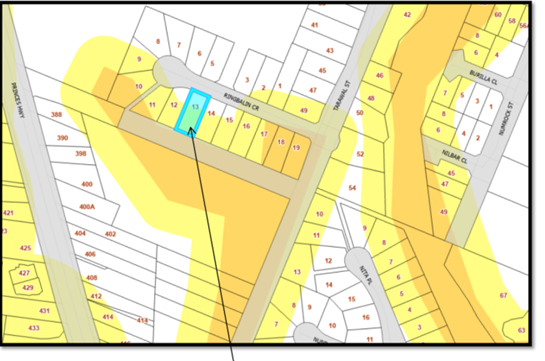

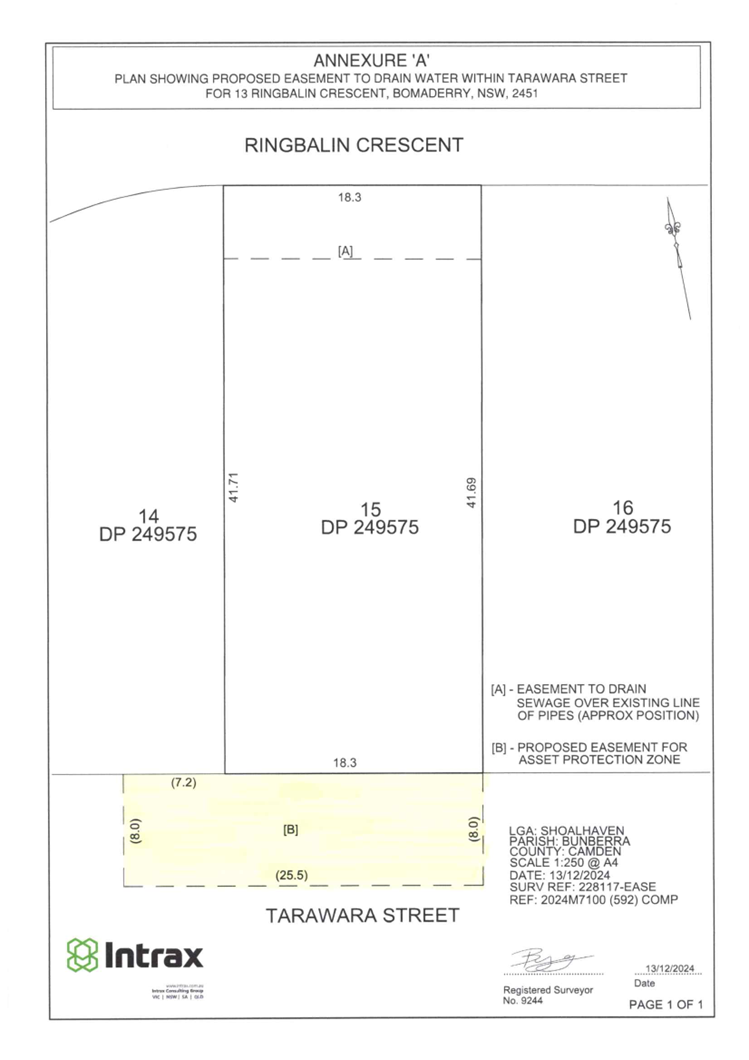

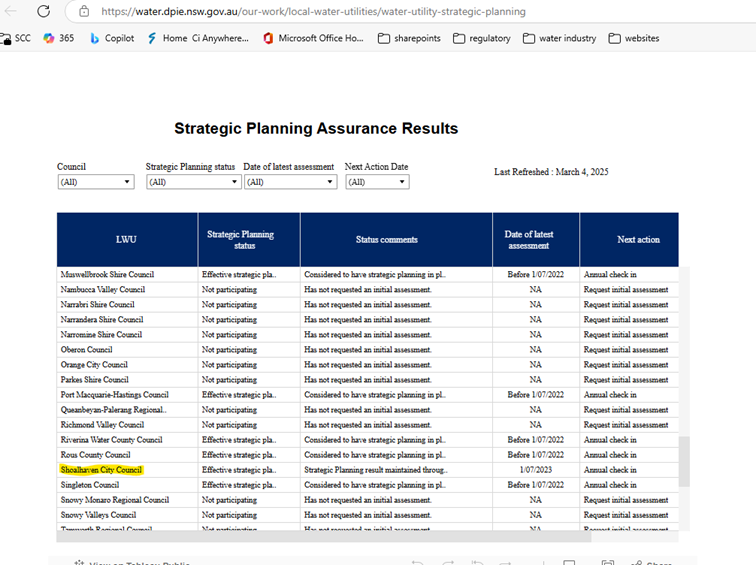

CL25.91 Creation

of Asset Protection Zone (APZ) over Council unmade road adjoining Lot 15 DP

249575 - 13 Ringbalin Crescent, Bomaderry

HPERM Ref: D25/67661

Department: Building

& Property Services

Approver: Kevin

Norwood, Manager - Shoalhaven Swim Sport & Fitness

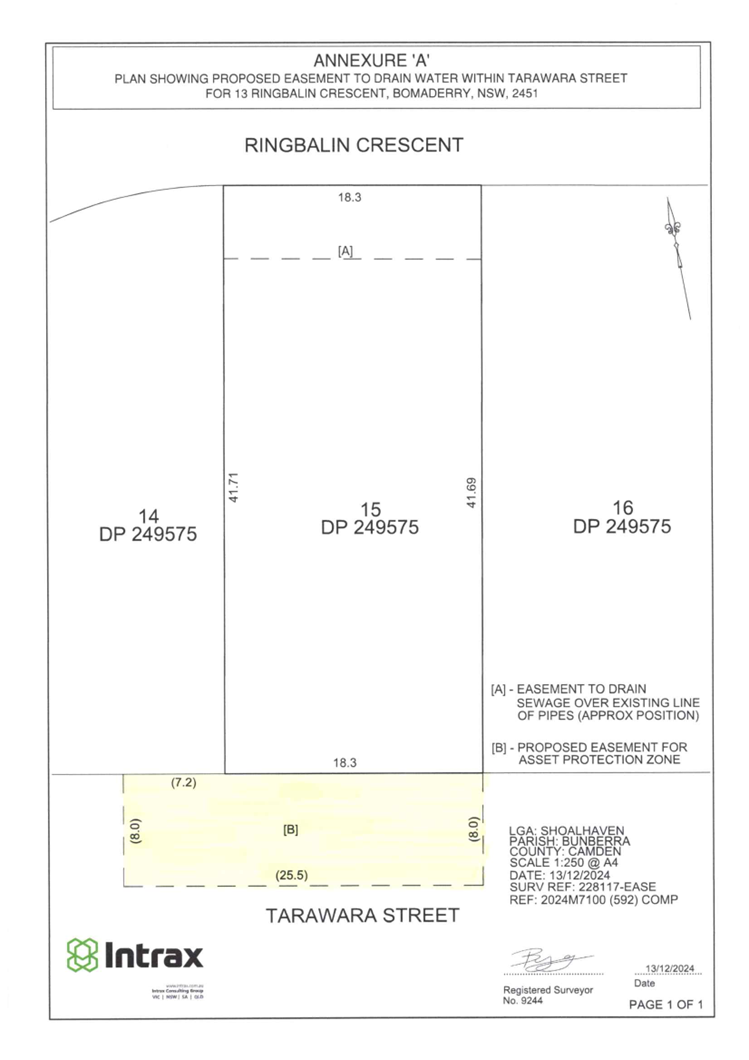

Attachments: 1. Proposed

APZ over Council unmade road ⇩

Purpose:

The reason for this report is to

seek a resolution from Council to create an Asset Protection Zone (APZ) over

Council unmade road. The APZ is to benefit Lot 15 DP 249575, 13 Ringbalin

Crescent, Bomaderry as shown on Attachment 1.

Summary and Key Points for

Consideration:

· The

proposed development on No.13 Ringbalin Crescent has been identified as being

on Bushfire Prone Land, necessitating compliance with development standards in

accordance with the Planning for Bushfire Protection 2019.

· The

creation of an Asset Protection Zone will reduce the Bushfire Attack Level

(BAL) to BAL-29, meeting the requirements of the Planning for Bushfire

Protection 2019.

· An

Asset Protection Zone can be established over an unmade road in accordance with

the provisions of the Conveyancing Act 1919.

· A

Council resolution is required for the grant of an easement on Council land

under s377 of the Local Government Act 1993.

|

Recommendation

That

Council:

1. Approve the creation of an Asset

Protection Zone (APZ) over Council’s unmade road adjoining the southern

boundary of Lot 15 DP 249575, 13 Ringbalin Crescent, Bomaderry, as shown in

Attachment 1 (D25/81072), by way of the positive covenant in accordance with

the provisions of the Conveyancing Act 1919.

2. Require that the landowners of Lot

15 DP 249575 indemnify Council against any loss, injury or damages incurred

whilst on Council owned land and undertaking the activities defined in the

APZ Management Plan and pay all costs, fees and charges (including legal)

associated with the creation of the positive covenant.

3. Authorise

the Common Seal of the Council of the City of Shoalhaven to be affixed to any

document required to be sealed and delegate authority to the Chief Executive

Officer to sign any documentation necessary to give effect to this

resolution.

|

Options

1. Resolve as

recommended.

Implications: Creation of the APZ will reduce the

determined Bushfire Attack Level (BAL) of the proposed development from Flame

Zone to BAL-29 in accordance with the requirements of the Planning for Bush

Fire Protection 2019. The APZ is required to facilitate the proposed

development on Lot 15 DP 249575, 13 Ringbalin Crescent, Bomaderry under

DA24/1782.

2. Not resolve as

recommended.

Implications: The proposed development on Lot 15 DP

249575 may not be able to proceed as the APZ is necessary to create a

defendable space and is part of a range of measures that provide an appropriate

level of safety for occupants of the dwelling at a level consistent with that

required by Planning for Bushfire Protection 2019. The development

application may be refused.

Background and Supplementary

information

Council is in receipt of a

Development Application (DA) for a secondary dwelling at 13 Ringbalin Crescent,

Bomaderry DA24/1782). The proposed development is within bushfire prone land

(Shown in figure 1.), necessitating compliance with development

standards in accordance with the Planning for Bushfire Protection 2019

(‘PBP 2019’).

Figure

1: Bushfire Prone Land Mapping

A Bushfire Assessment Report was

subsequently prepared, identifying the need for an Asset Protection Zone (APZ)

to reduce the Bushfire Attack Level (BAL) to BAL-29. The APZ will consist of an

inner protection area, provided by the maintained yard and garden within the

development area (Lot 15), as well as an 8-metre wide separation from the

remnant vegetation within the unmade Council road reserve, by way of a positive

covenant.

The development application

seeks to establish the 8m APZ over the Council unmade road to comply with the

requirements of the Bushfire Assessment Report and PBP 2019, as shown in

Attachment 1.

The subject area of unmade road

is currently included in Council’s Bushfire Mitigation area (Shown in figure

2). With maintained area 6m width from adjoining residential properties.

However, land included as a Bushfire Mitigation Area cannot be considered

managed land or an APZ for the purposes of a development assessment under the Environmental

Planning & Assessment Act 1979, as there is no guarantee that this land

will be managed in perpetuity or that it will be managed to an APZ standard.

Figure

2: Shoalhaven City Council’s Annual Bushfire Mitigation Program

mapping, including the proposed development (marked blue).

The establishment of an APZ

would obligate the benefited landowner to manage the APZ area in perpetuity,

adhering to the standards outlined in the PBP 2019. This would alleviate the

maintenance burden on Council.

To achieve the 8m wide APZ, some

vegetation that is not considered significant – i.e., not hollow-bearing

or threatened species - may be removed. An arborist report or threatened

species report for the removal of such vegetation is not required as part of

the development assessment.

Internal Consultations

A referral was made to internal

stakeholders regarding the proposed creation of the APZ. No objections were

received.

Environmental Services raised no

objections to the removal of vegetation necessary to achieve the required

APZ.

External Consultations

As part of the development

application, a referral was sent to the NSW Rural Fire Service. NSW Rural Fire

Service has no objection to the proposed development, provided that the APZ is

established and maintained for the life of the development.

Community Consultations

There is no statutory obligation

to undertake community consultation, as this is considered an operational

matter.

Policy and Statutory Implications

The proposed creation of the APZ

has been processed in accordance with Council’s policy Creation of an

Asset Protection Zone (APZ) over Council Owned or Managed Land

(POL22/103).

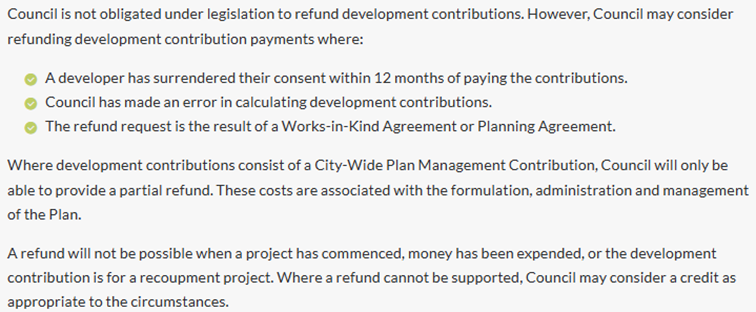

Financial Implications

The creation of the positive

covenant will incur no cost to Council. The landowner of the benefiting lot

will be responsible for all costs associated with the creation of the APZ.

Ongoing maintenance of the APZ will also be the responsibility of the landowner

of the benefiting lot.

Additionally, the proponent will

pay Council’s APZ Approval Fee as outlined in Council’s Fees &

Charges.

Risk Implications

There is no financial risk to

Council, as all costs associated with the creation of the positive covenant and

ongoing maintenance will be borne by the landowner of the benefiting lot. Council’s

interests have been considered and there is minimal risk associated with

proposed APZ creation.

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

|

|

Ordinary

Meeting – Tuesday 25 March 2025

Page

0

|

CL25.92 Expression

of Interest outcome - Thurgate Oval Bomaderry Amenities Building

HPERM Ref: D25/69924

Department: Buildings

& Property Services

Approver: Kevin

Norwood, Acting Director - City Services

Purpose:

The purpose of this report is to

advise Council on the outcome of an Expression of Interest (EOI) process for

part the use of the amenities building at Thurgate Oval Bomaderry. Council

resolved 12 August 2024 (MIN24.440) in part to “1. Direct the CEO (or her delegate) to undertake an EOI process to

seek to lease the building located at Lot 21, Sec 27, DP2886, Bomaderry, known

as Thurgate Oval.”

Summary and Key Points for

Consideration:

· Bomaderry

Lions Club Inc. has been seeking a facility for the storage of their goods and

equipment.

· On

26 February 2024 Council resolved (MIN24.95) “That Council receive a

full report on the Bomaderry Lions proposal for storage access at Thurgate

Oval.”

· On

6 May 2024 a report was tabled by Director City Services (CL24.121) outlining

the Bomaderry Lions Club needs, potential sites and pathway to realise a

community group occupation of a preferred site under licence. Council resolved

(MIN24.247) “That Council receive the report regarding the Bomaderry

Lions proposal for storage access at Thurgate Oval.”

· On

12 August 2024 Council resolved (MIN24.440) in part “Direct the

CEO (or her delegate) to undertake an EOI process to seek to lease the building

located at Lot 21, Sec 27, DP2886, Bomaderry, known as Thurgate Oval.”

· An

Expression of Interest for the use and occupation of Thurgate Oval amenity

building was undertaken from 9 October 2024 to 19 November 2024.

· Only

one proposal was received with the EOI process, being from Lions Club of

Bomaderry Nowra Inc.

· Council

resolution is sought to the determination of the EOI based on the Council

resolution 26 February 2024 (MIN24.95).

|

Recommendation

That

Council

1. Accept the Expression of Interest

received from Lions Club of Bomaderry Nowra

Inc. (ABN 60 564 676 485) for the use of the Thurgate Oval amenities building

for storage, located over part Lot 21 Sec 27 DP2886 and part Lot 9 DP544734)

being Council owned community land, off Bowada Street Bomaderry and as shown

in Figure 1 of this report.

2. Subject to proposed licence

advertising as required under s47A of the Local Government Act 1993 and if no

objections are received to the proposed licence from that process, that

Council enter a five-year licence with Lions

Club of Bomaderry Nowra with annual gross

rental of $1,000 per annum (excluding GST) which includes part building

insurance (changeroom area) under licence.

3. Apply annual rent increases in line

with the Consumer Price Index (All Groups Sydney).

4. Delegate

authority to the Chief Executive Officer to sign the necessary documentation

to give effect to this resolution.

|

Figure

1 – Thurgate Oval amenities

building over Lot 21 Sec 27 DP 2886 and

Lot 9 DP544734

Options

1. Resolve as

recommended

Implications: Council will secure a suitable

premises for the Lions Club of Bomaderry Nowra Inc. and their work in the

community will be able to continue.

2. Seek opportunity

for alternate tenancy

Implications: If Lions Club of Bomaderry Nowra Inc.

do not secure a new licence at this location, they will need to secure an

alternate location. Council will need to undertake a new Expression of Interest

process.

Background and Supplementary

information

Lots 21 Sec

27 DP 2886 and Lot 9 DP544734 (off Bowada St ,Bomaderry) is community land

owned by Council. On the site is an amenities building incorporating

changerooms and two toilets. Thurgate Oval is situated to the east of the

amenities building and is currently used as a dog exercise park. The building

has been the subject of arson and repeated acts of vandalism over the years and

has remain closed since the repair after the fire.

The

Lions Club of Bomaderry Nowra Inc. is an amalgamated club originally founded in

1959 and has provided uninterrupted community service since. The Club raises

most of their income by catering at community events and distribute the revenue

throughout the community.

If successful with the EOI