Ordinary Meeting

Meeting Date: Tuesday,

28 January, 2025

Location: Council

Chambers, City Administrative Building, Bridge Road, Nowra

Time: 5.30pm

Membership (Quorum - 7)

All Councillors

Clr

Patricia White – Mayor

Ward 1 Ward

2 Ward

3

Clr Jason Cox Clr

Ben Krikstolaitis Clr

Denise Kemp

Clr Matthew Norris -

Assist. Deput Mayor Clr Bob Proudfoot Clr

Gilliam Boyd

Clr Peter Wilkins -

Deputy Mayor Clr

Jemma Tribe Clr

Karlee Dunn

Clr

Selena Clancy Clr

Luciano Casmiri Clr

Natalee Johnston

Please note: The proceedings of this meeting (including presentations,

deputations and debate) will be webcast, recorded and made available on

Council’s website, under the provisions of the Code of Meeting

Practice. Your attendance at this meeting is taken as consent to the

possibility that your image and/or voice may be recorded and broadcast to the

public.

Shoalhaven City Council live

streams its Ordinary Council Meetings and Extra Ordinary Meetings. These

can be viewed at the following link

https://www.shoalhaven.nsw.gov.au/Council/Meetings/Stream-a-Council-Meeting.

Statement

of Ethical Obligations

The Mayor and Councillors are

reminded that they remain bound by the Oath/Affirmation of Office made at the

start of the council term to undertake their civic duties in the best interests

of the people of Shoalhaven City and to faithfully and impartially carry out

the functions, powers, authorities and discretions vested in them under the

Local Government Act or any other Act, to the best of their skill and

judgement.

The Mayor and Councillors are also reminded of the

requirement for disclosure of conflicts of interest in relation to items listed

for consideration on the Agenda or which are considered at this meeting in

accordance with the Code of Conduct and Code of Meeting Practice.

Agenda

1. Acknowledgement

of Country

Walawaani (welcome),

Shoalhaven City Council recognises the First Peoples

of the Shoalhaven and their ongoing connection to culture and country. We

acknowledge Aboriginal people as the Traditional Owners, Custodians and Lore

Keepers of the world’s oldest living culture and pay respects to their

Elders past, present and emerging.

Walawaani njindiwan (safe journey to you all)

Disclaimer: Shoalhaven City Council acknowledges and

understands there are many diverse languages spoken within the Shoalhaven and

many different opinions.

2. Moment of

Silence and Reflection

3. Australian

National Anthem

4. Apologies /

Leave of Absence

5. Confirmation

of Minutes

· Ordinary

Meeting - 21 January 2025

6. Declaration

of Interests

7. Presentation of Petitions

8. Mayoral Minute

9. Deputations and Presentations

10. Notices of Motion / Questions on Notice

Notices of Motion / Questions on Notice

CL25.19....... Notice of Motion - Mens Shed Organisations................................................ 1

11. Call Over of the

Business Paper

12. A Committee of the

Whole (if necessary)

13. Committee Reports

Nil

14. Reports

City Performance

CL25.20....... Ongoing Register of Pecuniary Interest Returns

- December 2024............. 2

CL25.21....... Investment Report - December 2024............................................................. 4

CL25.22....... Budget Strategies and Parameters - 2025/26.............................................. 10

City Services

CL25.23....... Update Report - Francis Ryan Reserve Amenities -

Grant Funding........... 16

City Development

CL25.24....... Proposed Submission - Cultural State

Environmental Planning Policy (Cultural SEPP)...................................................................................................................... 20

15. Confidential Reports

Nil

|

|

Ordinary

Meeting – Tuesday 28 January 2025

Page

0

|

CL25.19 Notice

of Motion - Mens Shed Organisations

HPERM Ref: D25/21968

Submitted

by: Clr Bob Proudfoot

Purpose / Summary

The following Notice of Motion,

of which due notice has been given, is submitted for Council’s

consideration.

|

Recommendation

That

Council direct the CEO to:

1. Prepare a historical report on the

evolution of the current financial commitment incurred by the Men’s

Shed organisations regarding leases, licences, rates, garbage collection and

other charges, over at least the past five years.

2. Make

comment on the capacity of Council to provide some form of financial relief

in the future, particularly as Council's own financial position makes a

significant turn for the better.

|

Background

The Men’s Shed

organisations are a vital part of the social and wellbeing benefits experienced

by the many participants in their ranks. Various forms of fundraising

activities occurs across the several groups located within our city, with much

of the proceeds going towards administration costs. The Greenwell Point Men's

Shed people, for example, raise their funds by way of collecting bottles and

cans, converting this to cash, and then passing this onto Shoalhaven City

Council in order to pay for rates and so on.

|

|

Ordinary

Meeting – Tuesday 28 January 2025

Page

0

|

CL25.20 Ongoing

Register of Pecuniary Interest Returns - December 2024

HPERM Ref: D24/531766

Department: Business

Assurance & Risk

Approver: Sara

McMahon, Business Assurance & Risk Manager

Purpose:

To provide Council with the Register

of Pecuniary Interest Returns from newly designated persons lodged with the

Chief Executive Officer for the period of 1 December 2024 to 31 December 2024

as required under Section 440AAB of the Local Government Act 1993 and Part 4.26

of the Code of Conduct.

Summary and Key Points for

Consideration:

Under Section 440AAB of the Local Government Act 1993

and Part 4.26 of the Model Code of Conduct, newly designated persons are

required to complete an Initial Pecuniary Interest Return within 3 months of

becoming a designated person.

Section 440AAB (2) of The

Local Government Act 1993 states:

Returns required to be lodged with the general manager

must be tabled at a meeting of the council, being the first meeting held after

the last day specified by the code for lodgement, or if the code does not

specify a day, as soon as practicable after the return is lodged.

Part 4.26 of the Model Code of

Conduct states:

Returns required to be lodged with the general manager

under clause 4.21(c) must be tabled at the next council meeting after the

return is lodged.

This report is one of a series

of reports of this nature which will be provided throughout the year to align

with the legislative requirements.

Those persons who have submitted

a return within the period in accordance with their obligation to lodge an

initial pecuniary interest return are listed below:

|

Directorate

|

Name

|

Designated Position Start Date

|

Returned

|

|

Councillor

|

Natalee Johnston

|

03/10/2024

|

06/12/2024

|

|

Councillor

|

Selena Clancy

|

03/10/2024

|

17/12/2024

|

|

Councillor

|

Karlee Dunn

|

03/10/2024

|

17/12/2024

|

|

Councillor

|

Peter Wilkins

|

03/10/2024

|

19/12/2024

|

Electronic versions of the disclosure documents (with

relevant redactions) are available on the Council website, in accordance with

requirements under the Government Information (Public Access) Act, 2009.

|

Recommendation

That the report of the Chief

Executive Officer regarding the Ongoing Register of Pecuniary Interest

Returns lodged for the period of 1 December to 31 December 2024 be received

for information.

|

Options

1. That the report

be received for information.

Implications: Nil.

2. That the Council

may seek further information.

Implications: Further

information be provided to Council in future reports in line with the

resolution.

Background

and Supplementary information

This report is being submitted directly to the Ordinary

Meeting due to the requirements under the Code of Conduct and the Local

Government Act 1993.

Internal Consultations

Internal consultation is not

required as the process for Initial Pecuniary Interest forms is governed by the

Local Government Act 1993, the Model Code of Conduct and the Government

Information (Public Access) Act, 2009.

External

Consultations

External consultation is not

required as the process for Initial Pecuniary Interest forms is governed by the

Local Government Act 1993, the Model Code of Conduct and the Government

Information (Public Access) Act, 2009.

Community Consultations

Community consultation is not

required as the process for Initial Pecuniary Interest forms is governed by the

Local Government Act 1993, the Model Code of Conduct and the Government

Information (Public Access) Act, 2009.

Policy Implications

The obligations with respect to

the Pecuniary Interest Returns by designated officers are in accordance with

the Model Code of Conduct and the Government Information (Public Access)

Act, 2009.

Financial Implications

There are no financial

implications for this report.

Risk Implications

A failure of meeting the

obligations with respect to the Pecuniary Interest Returns by a designated

officer leaves Council at risk of non-compliance with legislative requirements,

conflict of interests and limited transparency.

|

|

Ordinary

Meeting – Tuesday 28 January 2025

Page

0

|

CL25.21 Investment

Report - December 2024

HPERM Ref: D25/5253

Department: Finance

Approver: Dane

Hamilton, Acting Director - City Performance

Attachments: 1. Monthly

Investment Review (under separate cover)

2. Statement of Investments

(under separate cover)

Purpose:

The reason for this report is to inform the Councillors and

the community on Council’s investment returns. The report also ensures

compliance with Section 625 of the Local Government Act 1993 and Clause 212 of

the Local Government (General) Regulation 2021, that requires a written report

is provided to Council setting out the details of all funds it has invested.

Summary and Key Points for

Consideration:

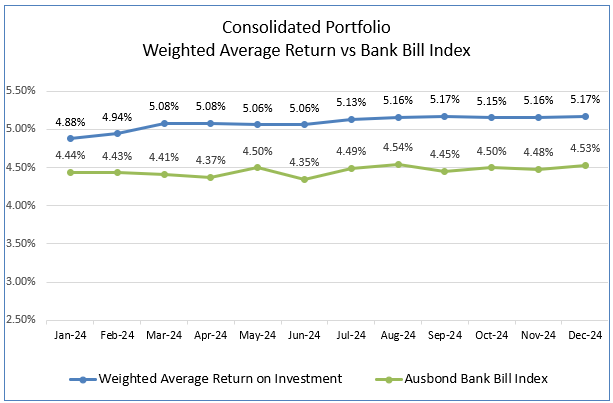

Council’s total Investment

Portfolio returned 5.17% per annum for the month of December 2024,

outperforming the benchmark Aus Bond Bank Bill Index (4.53% p.a.) by 64 basis

points (0.64%).

|

Recommendation

That Council receive the

Record of Investments for the period to 31 December 2024.

|

Options

1. The report of

the record of Investments for the period to 31 December 2024 be received for

information, with any changes requested for the Record of Investments to be

reflected in the report for the period to 31 January 2025.

Implications: Nil

2. Further

information regarding the Record of Investments for the period to 31 December

2024 be requested.

Implications: Nil

Background and Supplementary

information

Investment Portfolio

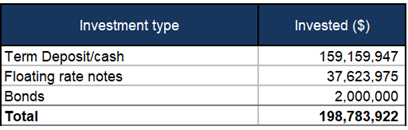

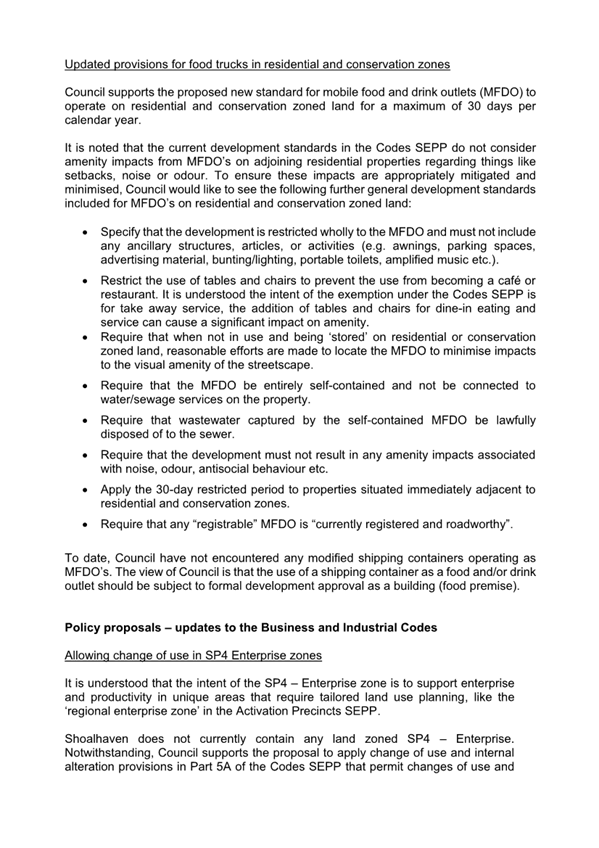

Council’s investment

balance as of 31 December 2024 was $198.78 million and consisted of the

following types of investments.

The details of each investment held

by Council at 31 December 2024 is included in the Statement of Investments at Attachment

2.

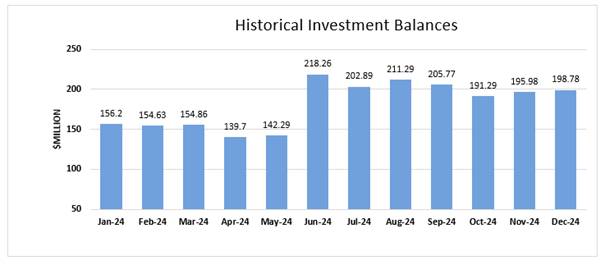

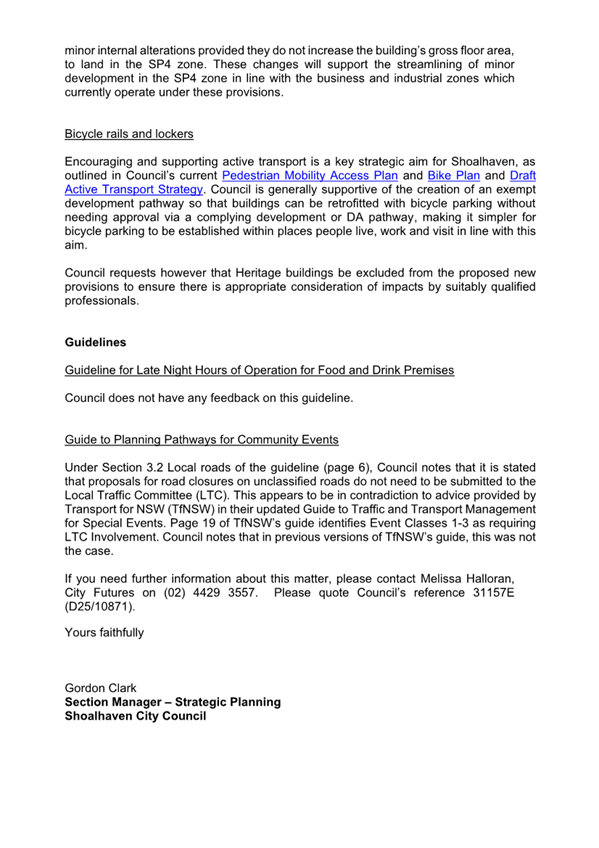

The graph below illustrates

Council’s investments balance on a rolling 12-month basis. Timing

of expenditure and grant monies varies throughout the year which can cause

fluctuations in the overall balance at the end of each month.

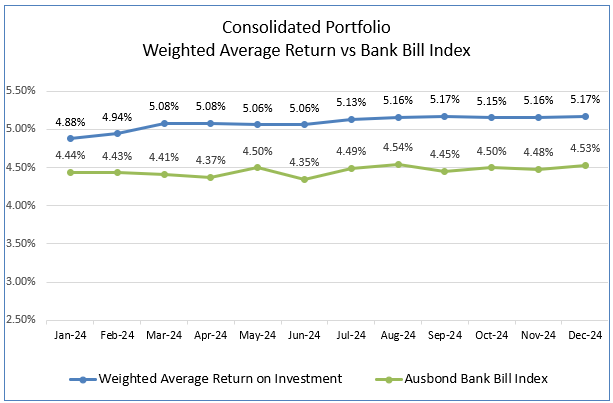

Portfolio Return

For the month of December, the

total investment returns were a positive 5.17% p.a. outperforming Aus bond Bank

Bill Index (4.53%) by 64 basis points.

Investments

Graph 1 below, shows the

performance of Council’s Investment Portfolio against the benchmark on a

rolling 12-month basis.

Graph 1 - Performance

of Council’s Investment Portfolio against the benchmark on a rolling

12 month basis

Investment Interest Earned –

December 2024

Much of Council’s cash is

restricted in its use to specific purposes by external bodies, legislation and

Council resolutions. Interest earned on externally restricted cash must

be allocated to those external restrictions in accordance with

legislation. The two tables below show the allocation of interest to each

applicable Fund.

Table 1 below, shows the

interest earned for the month of December 2024.

Table 1- Interest Earned for the

Month of December 2024

|

Fund

|

Monthly Original Budget

$

|

Actual Earned

$

|

Difference

$

|

|

General

|

296,224

|

483,933

|

187,708

|

|

Water

|

140,754

|

182,466

|

41,713

|

|

Sewer

|

54,485

|

126,933

|

72,448

|

|

Total

|

491,464

|

793,332

|

301,869

|

The interest earned for the month of December, was $793,332

compared to the monthly original budget of $491,464.

Investment Interest Earned -

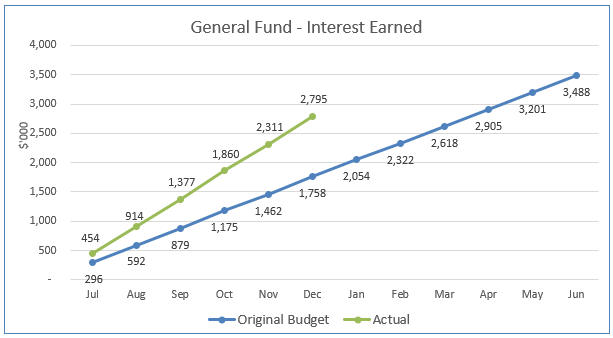

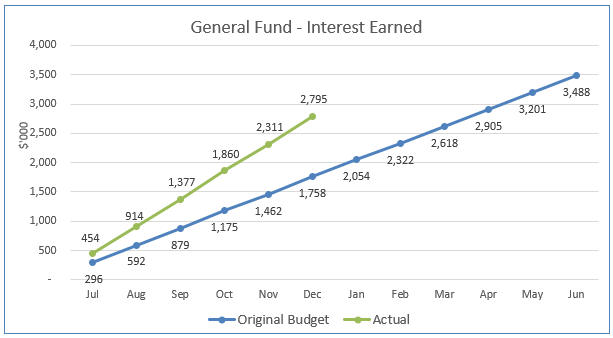

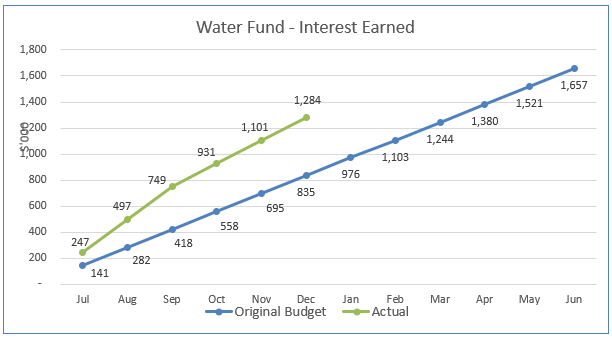

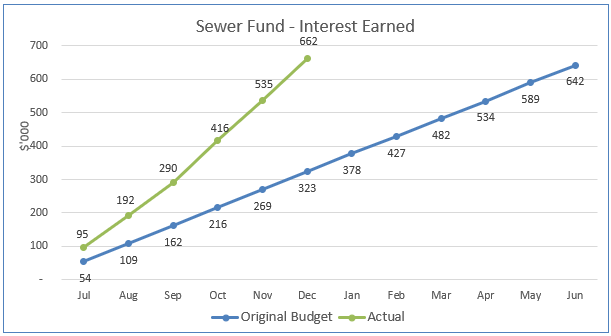

Year to Date

Table 3

below, demonstrates how the actual amount of interest earned year to date has

performed against the 2024/25 budget.

Table 3 - Amount of

interest earned year to date, against the total budget.

|

Fund

|

Total Original Annual Budget

$

|

Actual

YTD

$

|

%

Achieved

|

|

General

|

3,487,804

|

2,794,726

|

80%

|

|

Water

|

1,657,263

|

1,283,501

|

77%

|

|

Sewer

|

641,521

|

661,741

|

103%

|

|

Total

|

5,786,588

|

4,739,968

|

82%

|

The interest earned in the general fund of

$2,794,726 includes interest earned on unspent s7.11 developer contributions

and Domestic Waste Management reserves, which is required to be restricted by

legislation. Interest earned on unspent s7.11 developer contributions is

$754,576 and Domestic Waste Management reserves is $316,126 to the end of

December 2024. This leaves $1,724,024 which is unrestricted however, the amount

of unrestricted interest is only slightly above YTD budget (above budget by

$146,764).

The

cumulative interest earned for the year (July to December)

was $4,739,968 which is 82% of the current full year original budget.

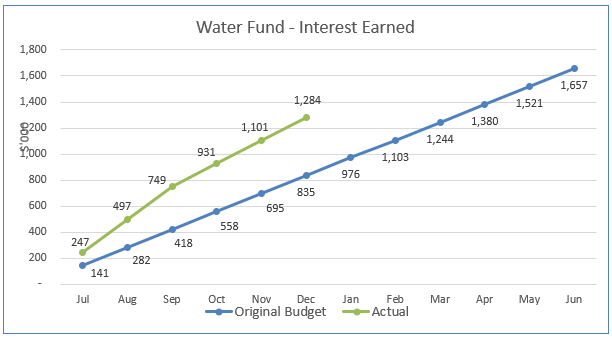

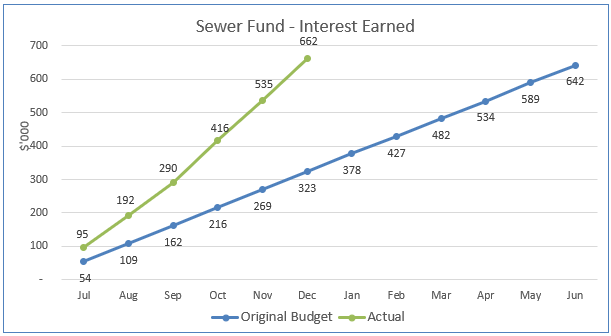

Graph 2

(3 separate graphs) below, illustrates the cumulative interest earned for the

year for each fund (General, Water and Sewer) against budget:

Graph

2 - Cumulative interest earned for the year for each fund against budget.

Internal Consultations

Not applicable.

External Consultations

Council’s investment

advisor, Arlo Advisory Pty Ltd.

Community Consultations

Not applicable.

Policy Implications

All investments have been placed

in accordance with Council’s Investment Policy.

Financial Implications

Council’s return on

investments are exceeding budget and a budgetary adjustment will be made as

part of the December Quarterly Budget Review to reflect current market rates

and interest forecast.

Risk Implications

All investments are placed with

preservation of capital the key consideration to prevent any loss of principal

invested.

Statement by Responsible

Accounting Officer

I hereby certify that the

investments listed in the attached report have been made in accordance with

Section 625 of the Local Government Act 1993, Clause 212 of the Local

Government (General) Regulations 2021 and Council’s Investments Policy

POL22/78.

Katie Buckman Date:

23 January 2025.

|

|

Ordinary

Meeting – Tuesday 28 January 2025

Page

0

|

CL25.22 Budget

Strategies and Parameters - 2025/26

HPERM Ref: D25/19809

Department: Finance

Approver: James

Ruprai, Acting CEO

Purpose:

To seek adoption of the budgeting strategies and economic parameters to

guide the preparation of the draft 2025/26 Budget.

Summary and Key Points for

Consideration:

· The

adoption of a high-level budget strategy and economic parameters by Council

enables staff to prepare the draft budget with an improved level of confidence

that the draft budget, following discussion at budget workshops and ultimately

presented formally for consideration, will meet Council’s expectations.

· The

adoption of a high-level budget strategy and economic parameters by Council

makes the budget preparation more transparent and efficient with strategic

priorities and budget constraints being identified in advance.

· Budgeting

strategies align with Council’s financial sustainability objectives,

ensuring council presents a balance budget with an emphasis on growing

unrestricted cash reserves, and focusing on asset renewal.

· Economic

parameters are set with reference to legislation and publicly available

economic data.

· No

borrowings are proposed for the FY2025/26 budget

|

Recommendation

That Council adopt the

following budgeting strategies and guiding economic parameters for the

preparation of the initial Draft of the 2025/26 Budget to be

considered at future Budget Workshops:

1. Principal budgeting strategies:

a. The

budget will not result in an unrestricted cash deficit

b. Prioritise

funding in the following order:

i. Provide

sufficient funding for all continuing services

ii. Continue

Council’s commitment to asset renewal

iii. Continue

a program of capital improvements to address historic budget shortfalls

c. Maintain

or improve Council’s financial and asset management performance

indicators reported in the annual financial statements

d. Increase Council’s working

funds balance

e. Minimise

carry forwards through substantial completion and long-term planning of the

capital works program

2. Economic parameters for budgeting:

a. Rates

are increased by 12% (including rate peg) assuming Council’s

application for a Special Rate Variation (SRV) is approved by IPART. Should

the SRV not be approved, the 3.8% rate peg is to be applied.

b. User

fees and charges are increased by a minimum of 5%

c. Salaries

and wages are increased by 3%, plus bonus payable, as per the Local

Government (State) Award

d. Superannuation

guarantee is to be increased from 11.5% to 12% in line with legislated

increases

e. Materials

and other expenditures increase by 3%

f. The

capital works program is appropriately set in order to assist in the

management of Council’s financial sustainability challenges and to

ensure there is no reduction in Council’s unrestricted cash balance.

g. Consistent with Council’s Long

Term Financial Plan, no additional loan borrowing borrowings are to be taken

out in FY 2025/26

h. Should the need arise during the

year for additional funding, the following options will be considered:

i. Internal

borrowing opportunities

ii. Asset

rationalisation

3. Repairs to Council’s Road

Network be a primary focus of the initial draft of the Capital Works

Program.

4. Budget

Workshops be scheduled with all Councillors in the preparation of the draft

2025/26 budget which will include consideration of any recommended

re-prioritisation of capital works projects listed in the current Delivery

Program and Operational Plan.

|

Options

1. Adopt the

recommendations

Implications: Management

would proceed to prepare the draft 2025/26 Budget guided by the strategies and

parameters.

2. Amend the

recommendations

Implications: Management would proceed to prepare

the draft 2025/26 Budget guided by the amended strategies and parameters and/or

report back to Council on the financial impacts of the amendments.

Background and Supplementary

information

Proposed Budget

Strategies and Parameters

The adoption of the following principal budgeting strategies

is proposed for the preparation of the draft 2025/26 Budget:

a. The

budget will not result in an unrestricted cash deficit

b. Prioritise

funding in the following order:

i. Provide

sufficient funding for all continuing services

ii. Continue

Council’s commitment to asset renewal

iii. Continue a

program of capital improvements to address historic budget shortfalls

c. Maintain

or improve Council’s financial and asset management performance

indicators reported in the annual financial statements

d. Increase

Council’s working funds balance

e. Minimise

carry forwards through substantial completion and long-term planning of the

capital works program

The following economic parameters are recommended for

adoption.

General Rates Increase

Independent Pricing and

Regulatory Tribunal (IPART) has set the rate peg for the 2025-26 financial year

using the new rate peg methodology. The rate peg applicable to Shoalhaven City

Council for the 2025/26 year is 3.8%.

Council is in the process of submitting an application to

IPART for a 12% (including rate peg) special rate variation. Council approved

the application at the 17 December 2024 Ordinary Meeting. The application is

due for submission to IPART by 3 February 2025. The outcome of IPART’s

decision will be known in May-June 2025.

Recommendation –

Economic Parameter 1

Rates are increased by 12% (including rate peg) should

Council’s SRV application be approved by IPART. If the application is

unsuccessful, rates are increased by the 3.8% rate peg.

User Fees and Charges

A recommendation from the AEC

Financial Sustainability Review (recommendation 1.b) was to:

“Review the pricing for

fees and charges (outside of statutory fees set by the State Government) and

ensure they reflect full cost price for services, as far as it is practical to

do so, without impacting significantly on access to services by the community”.

Given the increases in costs faced by Council, it is

reasonable to increase user fees and changes by an amount more than the rate

peg. In some instances, higher increases may be required. An assessment of

impacts on utilisation and affordability will be assessed in setting the fee or

charge.

Recommendation –

Economic Parameter 2

User fees and charges are increased by a minimum of 5%.

Employee Costs

The Local Government (State) Award was negotiated prior to

30 June 2023. The Award increase for 2025/26 is 3%, plus eligible employees

will be entitled to 0.5% of their salary (as at 30 June 2025) or $1000 from the

first full pay period from 1 July 2025, whichever is greater. Further, that the

superannuation guarantee is due to increase from 11.5% to 12% on 1 July 2025.

Recommendation –

Economic Parameter 3

Salaries and wages are increased by 3%, plus bonus payable,

as per the Local Government (State) Award.

Recommendation –

Economic Parameter 4

Superannuation guarantee is to be increased from 11.5% to

12% in line with legislated increases.

Materials and Other

Expenditure

Annualised CPI, Road, and Heavy

Construction indexes of 5% or more were common over the past three budget

cycles (2022-23 to 2024-25), however more recently published indexes indicate

the rate of cost increases in these areas is falling. A list of the relevant

indexes and their annualised rates are shown below.

|

Annual rate to quarter

|

Sep-2023

|

Dec-2023

|

Mar-2024

|

Jun-2024

|

Sep-2024

|

|

Heavy and civil engineering construction Australia

|

3.50%

|

2.65%

|

3.74%

|

3.41%

|

2.95%

|

|

Road and bridge construction Australia

|

4.83%

|

3.55%

|

4.18%

|

4.01%

|

3.38%

|

|

Road and bridge construction New South Wales

|

5.25%

|

3.74%

|

5.08%

|

5.37%

|

4.34%

|

|

Other heavy and civil engineering construction Australia

|

3.19%

|

2.42%

|

3.59%

|

3.26%

|

2.88%

|

|

CPI

|

5.40%

|

4.10%

|

3.60%

|

3.80%

|

2.80%

|

The most recent CPI and construction indexes show rates

below 3%, however the CPI figure is artificially low due to government

electricity rebates that took effect in that quarter. Further to this, rates of

inflation for the past three years generally exceeded the anticipated growth

rates in costs put forward in the Council’s budgets, so it is likely

historic shortfalls still exist. It is recommended that a 3% increase be

applied to each Material and Other Expenditure item representing a value that

is close to the current inflation rate as well as being the upper level of the

Reserve Bank of Australia’s inflation target of 2-3%

Recommendation –

Economic Parameter 5

Materials and other expenditures increased by 3%

The Capital Budget

General Fund

Improvements to Council’s

capital works planning and delivery have been implemented over the past 18

months. These include the establishment of the Enterprise Project Management

Office (ePMO), system improvements through Project Lifecycle Management (PLM)

software, consolidation of project delivery teams through structural reform,

and improved monitoring and reporting. These improvements resulted in a reduced

capital works program being adopted for 2024/25, and a reduction in capital

carry forwards/revotes from the 2023/24 year.

Council is working to continue

to reduce the capital budget for 2025/26 to ensure:

· Projects committed

can be delivered by the end of June 2025, reducing the amount of capital carry

forwards, and

· Council acts

responsibly and works within its current financial constraints

· Council does not

take on any new debt which was not already factored into the Long Term

Financial Plan

The 2025/26 capital program will

allocate funding based on priorities. Capital works will be categorised into

Categories 0, 1, 2 and 3. These are defined as follows:

· CAT0

o There is a

legal obligation to undertake the work or failure to undertake the work

would result in an unacceptable exceedance of Council’s risk appetite

o Project is

required to meet minimum acceptable obligations for a critical service

· CAT1

o Failure to

undertake project will result in significantly increased likelihood

that minimum levels of service will be compromised, significant

increase in operational costs and increased risk of loss of revenue

· CAT2

o Failure to

undertake project will likely increase operational costs and not arrest

declining service levels

· CAT3

o All other

projects, including discretionary upgrades, proactive renewals and new

assets

Information obtained through the

recent SRV community engagement process identified that improvements to

Council’s road network continues to be the highest priority of the

community. This is consistent with community satisfaction survey results, and

previous SRV consultation processes.

Where possible repairs to

Council’s Road Network be a primary focus of the initial draft of the

Capital Works Program. However, road related projects will be subject to the

same project categorisation as all other capital works projects 9as detailed

above).

Recommendation –

Economic Parameter 6

The capital works program is appropriately set in order to

assist in the management of Council’s financial sustainability challenges

and to ensure there is no reduction in Council’s unrestricted cash

balance.

Recommendation –

Economic Parameter 7

Consistent with Council’s Long Term Financial Plan, no

additional loan borrowing borrowings are to be taken out in FY 2025/26

Additional Funding

There are limited opportunities for Council to obtain other

funding for its budget. In the context of the overall budget, it would be

prudent for Council to consider internal borrowings, and asset rationalisation.

Recommendation –

Economic Parameter 8

Should the need arise for additional borrowings, the

following options will be considered first:

· Internal

borrowing opportunities

· Asset

rationalisation

Councillor workshops

Workshops will be held with all

Councillors during the preparation of the draft operational and capital budgets

including consideration of any recommended re-prioritisation of projects in the

current Delivery Program and Operational Plan.

Workshops will be held throughout March 2025 in anticipation

of presenting the draft budget to Council in late April/early May 2025.

Internal Consultations

Internal consultation has

occurred with the Enterprise Project Management Office, Senior Leadership Team

and Executive Leadership Team.

External Consultations

Nil.

Community Consultations

Nil.

Policy and Statutory Implications

Nil.

Financial Implications

Council is facing a difficult

task in presenting a balanced Draft 2025/26 Budget. Whilst Council has endorsed

an application for a Special Rate Variation for 12% (including rate peg), these

funds are for the purpose of rebuilding council cash reserves, and investment

in essential asset infrastructure renewals. The demand on the funds for

essential asset repairs will significantly outweigh the funding available.

Maximising opportunities to

increase income, in addition to general rates income, and managing inflationary

impacts will assist in achieving the primary strategy of presenting a budget

that does not result in an unrestricted cash deficit.

Risk Implications

Delays in approving budget

strategies and economic parameters, or changes to the approved parameters after

the fact, increases the risk that legislative timelines are not adhered to and

may result in breaches of the Local Government Act 1993.

|

|

Ordinary

Meeting – Tuesday 28 January 2025

Page

0

|

CL25.23 Update

Report - Francis Ryan Reserve Amenities - Grant Funding

HPERM Ref: D25/2292

Department: Technical

Services

Approver: Carey

McIntyre, Director - City Services

Purpose:

The purpose of this report is to

provide Council with an update on the representations made to the New South

Wales Government, Stronger Country Communities Fund Round 4 (SCCF4), and

options for the repurposing of an existing grant for an amenities building at

Francis Ryan Reserve, in accordance with a related resolution (ref.

MIN24.350).

Summary and Key Points for

Consideration:

At the Ordinary Council meeting held on 24 June 2024, Council

considered an interim report in relation to a response to a Notice of Motion

concerning Francis Ryan Reserve amenities grant funding (MIN24.350).

Consistent with the Council’s resolution, staff have

continued to liaise with the Grant Management Office to identify options to

repurpose the funding.

This report provides the Council with an opportunity to

endorse a variation request to the Grant Management Office to repurpose the

funding allowing for upgrades to the existing Francis Ryan Reserve

amenities.

|

Recommendation

That

Council:

1. Receive the Update Report - Francis

Ryan Reserve Amenities Grant Funding, as an update on representations

made to the Grant Management Office - New South Wales Government –

Stronger Country Communities Fund Round 4, in accordance with

MIN24.350.

2. Endorse the submission of a grant

variation request to New South Wales Government – Stronger Country

Communities Fund Round 4 to repurpose the existing funding commitment to

provide for an upgrade of the current Francis Ryan Reserve Amenities.

|

Options

1. Accept the

recommendation as proposed.

Implications: Council

Staff will make a grant variation request to New South Wales Government –

Stronger Country Communities Fund Round 4 to repurpose the existing

funding commitment which will provide for an upgrade of the current Francis

Ryan Reserve Amenities. Any works delivered will need to be retained for a

minimum period of 5 years from project completion.

2. Adopt an alternative

recommendation, directing the CEO to not proceed with a variation request and

make an application to terminate the funding deed.

Implications: Council may

need to return the $159,200 of funding already received from the grant program.

Council‘s risk exposure to project cost escalations would be eliminated,

however this option would not meet the expectations of the

community.

3. Adopt an alternative

recommendation, to be confirmed by Council.

Implications: To be confirmed, pending the outcome

of Council’s deliberations on the matter. Council would need to provide

direction to the CEO via a revised recommendation

Background

and Supplementary information

Grant

Funding

On 21

September 2022, Council executed a funding deed to provide $398,000 toward the

replacement and upgrade of the amenities at Francis Ryan Reserve, Sanctuary

Point of which Council has received the first instalment of $159,000.

The

deliverables of this funding included new changerooms and a new amenities

building to be known as the Bob Proudfoot Pavilion.

At

Ordinary Meeting 25 March 2024 Council made the following resolution.

MIN24.142

That Council endorses placing the Bob Proudfoot

Pavilion construction (unfunded $1.4 million) on pause until the

Council’s financial position improves.

An

interim (update) report was considered at Council’s Ordinary Meeting on

24 June 2024 on the representations made to the

Stronger Country Communities Fund Round 4 (SCCF4) and options for the

repurposing of an existing grant for projects connected with the Francis Ryan

Reserve resulting in the following resolution:

MIN24.350

That Council:

1. Receive

the Interim Report - Response to Notice of Motion - Francis Ryan Amenities

Grant Funding, as an update on representations made to the New South Wales

Government – Stronger Country Communities Fund Round 4, in accordance

with MIN24.316.

2. Direct

the CEO (Director – City Services) to prepare a future report advising on

the repurposing of grant funding from the New South Wales Government –

Stronger Country Communities Fund Round 4, including options following

discussions with the grant administrator.

This

interim report actions recommendation 2 of MIN24.350

by providing an update on the representations made to the New South

Wales Government Stronger Country Communities Fund Round 4 regarding the

repurposing of the funding.

Grant

Management Office Discussions

Council

staff have continued to liaise with the grant management office concerning the

repurposing of the grant funding allocated to Francis Ryan Reserve amenities.

Two

repurposing options had been further discussed which included;

Option

One: Upgrades of the Existing Amenities and Facilities

Option

Two: Sub-surface Field Drainage

The

grant management office has indicated that it would be willing to consider a

variation for Option One: Upgrades of the Existing Amenities and

Facilities which Council believes still meets the key objective of the

grant - Development of new or upgrade of

existing infrastructure to encourage female participation in sport, such as

change rooms and amenities.

Further

advice was provided that the grant management office was unlikely to approve a

variation to repurpose the funding to provide for Option Two - sub-surface

field drainage, as the scope did not align to the original intent of

the approved grant scope which was to construct a new amenities building.

Based on

this advice no further options other than Option One was considered viable

for the purposes of a variation to rescope the project.

Option

One: Upgrades of the Existing Amenities and Facilities

In

consultation with the primary users of the amenities, the St Georges

Basin Rugby League Club, project scoping was undertaken with feasibility

investigations concluding that the grant funding available, together with

$70,000 Council received from an insurance claim related to the fire of the

existing building in 2022, would provide for an upgrade to the existing

building.

Option

Two: Sub-surface Field Drainage

With the

assistance of Council staff, a separate grant application has since been

submitted by the Rugby League Club to provide for sub-surface drainage to the

main field at Francis Ryan Reserve.

Proposed

Variation

Details

of the current grant scope and the proposed scope variation are identified

in Table 1 below.

Table 1 - Current Grant Scope and the Proposed Scope Variation

|

Current Scope

|

Proposed Scope Variation

|

|

Francis

Ryan Reserve, Sanctuary Point - Change Rooms/Amenities Building works to

include:

· Demolition

of existing building

· Site

works

· Construction

of amenities building, which includes:

o Two change rooms

that can be partitioned to create separate change rooms

o Public amenities

including accessible amenities

o Kiosk

o Referee change

room

o Communications

Box

o Fitness

space

o Storage

o Seating

o CCTV

o Covered Viewing

area

o Site Clean

up

· Site

Visit to be completed by DPIRD Economic Development Manager at

Completion

· Evidence

of funding acknowledgment required

|

Francis

Ryan Reserve, Sanctuary Point - Change Rooms/Amenities Building works to

include:

· Building

upgrades within the existing amenities/changerooms at Francis Ryan Reserve,

which includes:

o Two change rooms

that can be partitioned to create separate change rooms

o Upgrade to

existing Public amenities

o Upgrade to

existing Kiosk

o Upgraded shower facilities

o Referee change

room

o Seating

o Covered viewing

area retained

· Site

Visit to be completed by DPIRD Economic Development Manager at

Completion

· Evidence

of funding acknowledgment required

|

The

current program end date for SCCF4 projects identifies that all project works

needing to be completed / finalised by 21 September 2026. A variation request

would also be seeking an extension of time beyond the current approved

date of 31 August 2024.

A

condition of the grant is that Council is to maintain and not to demolish,

eradicate, remove, dispose of or otherwise interfere with (and obtain agreement

from each Approved Community Organisation to do the same) the infrastructure,

facilities or improvements (“assets”) created by the project for 5

years after the completion of a project.

The

replacement of the entire amenities building is currently being considered in

Council’s 10 year plan however if the project is to proceed with the

proposed variation, further reconsideration of funding the construction of the

Bob Proudfoot Pavilion would need to target a period in the latter half of the

10 year plan.

External Consultations

Council‘s

Project Delivery team have worked with both the senior and junior rugby league

clubs utilising the venue to develop concept plans that would see significant

upgrades to the amenities building.

Asset

Planners have actively engaged with the local rugby league clubs to assist

the preparation of a grant application by the club to provide for the

installation of Sub-surface field drainage. Further assistance has also been

provided to the clubs in their efforts to undertake fencing renewals at the

Francis Ryan Reserve.

Financial Implications

If a re-purposing variation is approved by the Grant

Management Office the remaining funding to be received of $238,800 will be

spilt in equal second and third instalments of $119,400, with the third

instalment provided on project completion.

Risk Implications

Council may be exposed to the

following risks in relation to this project:

· If the

funding body does not approve a repurposed variation request Council may

need to return all, or part, of the $159,000 in funding that Council has

already received on signing of the grant deed.

· Construction

cost escalations or latent conditions during construction works ( additional

costs that were always in existence, but which are revealed on commencement)

may increase the cost of any works to the existing building.

There is no further budget identified to fund any

overspends on the project. Initial

scoping of the achievable works for the available budget has included a 25%

contingency to reflect the risks of working with the existing structure.

|

|

Ordinary

Meeting – Tuesday 28 January 2025

Page

0

|

CL25.24 Proposed Submission - Cultural State Environmental

Planning Policy (Cultural SEPP)

HPERM Ref: D24/534685

Department: Strategic

Planning

Approver: Bruce

Gibbs, Acting Director - City Development

Attachments: 1. Draft

Submission - Cultural State Environmental Planning Policy ⇩

Purpose:

This report seeks

Council’s endorsement of a draft submission for provisions to the NSW

Department of Planning, Housing and Infrastructure (DPHI) on proposed changes

to the planning system to be implemented via a Cultural State Environmental

Planning Policy (Cultural SEPP) that aims to support a more vibrant 24-hour

economy.

Summary and Key Points for

Consideration:

· DPHI

is seeking feedback on an Explanation

of Intended Effect (EIE) for the SEPP that proposes changes to the

planning system to support more creative, hospitality and cultural uses

contributing to the 24-hour economy.

· The

proposed planning rule changes relate to current planning pathways for

entertainment uses, events, outdoor dining, food trucks, bicycle parking and

minor internal alterations and change of use. Guidelines for late night

hours of operation for food and drink premises and community events have also

been prepared for comment.

· The

aims of the proposed SEPP are supported ‘in principle’, however

there are some recommended additional inclusions, matters of concern and

aspects of the proposed changes that require consideration/clarification and a

draft submission has been prepared by staff for Council’s consideration

and endorsement.

|

Recommendation

That

Council:

1. Endorse and finalise the draft

Submission on the Explanation of Intended

Effect (EIE) for a proposed Cultural State

Environmental Planning Policy (Cultural SEPP) at Attachment 1 and

submit it to the NSW Department of Planning Housing and Infrastructure.

2. Receive a further report at the

appropriate point on the progression or outcome of the proposed reforms.

|

Options

1. As recommended.

Implications: This is the

preferred option and will enable Council to finalise its submission on the

proposed planning reforms. The aims of the SEPP are supported ‘in

principle’; however, the submission highlights a range of matters or

concerns that require clarification before proposed changes are made to

planning rules.

2. Make changes to

the draft submission and submit it.

Implications: This will

depend on the nature of any changes, noting that the due date for submissions

is 7 February 2025.

3. Do not make a

submission.

Implications: The opportunity to provide relevant

feedback and advocate on this matter will not be taken. This is not the

preferred option.

Background and Supplementary

information

DPHI released an Explanation of Intended Effect (EIE)

outlining proposed changes to the planning system aimed at creating a more

vibrant 24-hour economy in NSW, while supporting businesses and

communities. The SEPP proposes legislative changes to existing planning

instruments and forms part of the NSW government’s Vibrancy

Reforms.

The draft legislation or policy instruments to enact the

proposed changes have not been released for comment at this stage, and may not

be.

The EIE exhibition period

commenced on 15 November 2024 and concludes 7 February 2025. A draft submission

has been prepared by Council staff (see Attachment 1) and will be

finalised/submitted inclusive of any amendments made by Council.

Draft Submission

The relevant proposed changes in

the EIE and the matters raised in the draft submission are summarised below:

|

Policy

Proposal

|

Proposed

change

|

Council

staff response

|

|

Current

Planning Pathways

|

Expand non-refusal standards

in Clause 5.20 Standards that cannot be used to refuse

consent—playing and performing music of the Standard Instrument LEP

to include unlicensed venues and entertainment uses other than live music

(e.g. comedy / theatre).

|

Support for proposed

change as non-refusal standards apply only where the council is satisfied

that noise can be managed and minimised to an acceptable level.

|

|

Introduce new model conditions

of consent for entertainment uses to provide more consistency and

certainty.

|

Support in principle.

Request clarification -

that capacity numbers will continue to be determined by Council.

Recommendation - that

acoustic treatment model condition be expanded and an Impact Management Plan

model condition added.

|

|

Events

|

Allow more development through

the Exempt and Complying Development Codes SEPP (Codes SEPP) by increasing

the numerical standards for temporary structures (e.g. signs, booths, stages)

used at events.

|

Recommendation - DPHI

seek the advice of accredited professionals to determine what (if any)

increases to the current numerical standards might be appropriate.

Recommendation –

the Codes SEPP specify that isolated music and/or camping style events over

flood or bushfire prone land, or that require emergency egress via flood or

bushfire prone land, must be subject to a DA process.

Recommendation - that

development standards in the Codes SEPP be expanded to minimise impacts to

facilities during use.

Recommendation - that a definition of

‘Community Events’ be included in the Codes SEPP to aid clarity

and certainty.

|

|

Support events at major

precincts

|

Not applicable to Shoalhaven

|

|

Vivid Sydney

|

Not applicable to Shoalhaven

|

|

Allow temporary extended

trading hours for unlicensed businesses during special events (e.g.

festivals, agricultural shows) in line with the current provisions for

licenced venues.

Amend the definition of

‘special events’ to include events of local significance.

|

Support proposed changes

to planning controls.

Recommendation - that

Council is specified as the responsible authority for the nomination of

events to be declared a special event of local significance and the

applicable geographic area where the extended trading hours will apply for

such events to ensure certainty and transparency for the community.

|

|

Support events in town halls

and other Council facilities through amending planning or zoning controls.

|

Key barriers to use of

Councils town halls and other facilities noted including limitations due to

heritage status of assets and availability of funding to undertake facility

repair and upgrades.

Recommendation - that

new planning mechanisms be developed and appropriate funding provided to

address these barriers.

|

|

Outdoor

dining and food trucks

|

Permit the following via an

exempt development pathway through the Codes SEPP:

· Low

impact outdoor live performances at venues.

· Outdoor

dining patron increases.

|

Support in principle

subject to the following additional recommended requirements:

· Better

specification of what constitutes ‘low impact’.

· Require

a new council planning approval where businesses are seeking to hold events

outdoors frequently (and so attract more patrons).

· Specify

requirements for how outdoor patron capacities are calculated where not

included in an existing consent.

|

|

Extend existing exempt

development pathways for outdoor dining to farm gate premises.

|

Support for the amendment

as it will make it easier for outdoor dining to take place at farm gate

premises in line with other venues where dining takes place.

Note: Council

previously raised concerns about the Agritourism Planning Reforms when they

were first introduced.

|

|

Restrict the operation of mobile

food and drink outlets (MFDO’s) in residential and conservation zones

to a maximum of 30 days a year and investigate measures for food businesses

using shipping containers.

|

Support the proposed

new development standard.

Recommendation that

additional standards be developed to further minimise the impacts of

MFDO’s in residential and conservation zones, including restricting the

use of ancillary structures (e.g. tables and chairs).

Recommendation that

shipping containers used as a food and/or drink outlets should be subject to

formal development approval as a building (food premise).

Note: The proposed

provisions will not interfere/conflict with the application of

Council’s Management

of Mobile Food Vending Vehicles on Council Owned or Managed Land policy

(2016).

|

|

Changes

to the Business and Industrial Codes in the Codes SEPP

|

Allow a change of use and

minor internal alterations in the SP4 Enterprise zone in line with the

current provisions for business and industrial zones.

|

Shoalhaven does not currently

contain any land zoned SP4.

General support for the

amendment as it will facilitate the streamlining of minor development.

|

|

Create an exempt development

pathway so that all types of buildings can be retrofitted with bicycle

parking without needing approval via a complying development or DA pathway.

|

General support for new

exempt development pathway in line with Councils priority to encourage and

support active transport (as outlined in Council’s current Pedestrian

Mobility Access Plan and Bike

Plan and Draft

Active Transport Strategy).

Recommendation that

heritage buildings are excluded from the exempt pathway.

|

|

Guideline

|

Purpose

|

Council

staff response

|

|

Guideline

for Late Night Hours of Operation for Food and Drink Premises

|

Assist consent authorities

make decisions regarding new

development or modification

applications for the extended trading hours of a food and drink premises

located more than 500 metres from homes (known as an ‘extended trading

hours application’).

|

No feedback.

|

|

Guide

to Planning Pathways for Community Events.

|

Provide information about the

planning pathways available for community events on public land or those that

involve street closures.

|

Recommendation that the

guide be updated to reflect requirements set out in Transport for NSW (TfNSW)

Guide to Traffic and Transport Management for Special Events.

|

Internal Consultations

The draft Submission was

prepared with the assistance of staff in the City Development and City Services

Directorates.

External Consultations

No external organisations or

experts have been consulted given that this is related to a matter being

exhibited for comment by DPHI.

Community Consultations

Shoalhaven’s Business

Chambers and recipients of the NSW Government’s Uptown

Grant Program funding located within Shoalhaven were notified of the

exhibition of the EIE and advised to direct any submissions and enquiries to

DPHI.

Policy Implications

Should

the proposed changes be implemented, amendments will be made to the Shoalhaven

LEP 2014 (via the Cultural SEPP, no Planning Proposal will be required).

Relevant Sections of Council and the community will need to be made aware of

these changes to ensure adherence to any new standards.

Financial Implications

Should the proposed changes be

made, there may be an additional resourcing burden for Council to monitor

compliance for specific proposals, for example ensuring MFDOs are keeping to

the proposed new cap of 30 days of operation per calendar year in residential

and conservation zones and ensuring outdoor live music performances are meeting

noise requirements.

Risk Implications

There is potential that future

changes to current planning controls by DPHI via the Cultural SEPP could lead

to confusion within the community who are accustomed to the current development

standards and established procedures. This can be mitigated through ensuring

any changes that come into effect are appropriately communicated by DPHI and

Council to local stakeholders.

|

|

Ordinary

Meeting – Tuesday 28 January 2025

Page

0

|

|

|

Ordinary

Meeting – Tuesday 28 January 2025

Page

0

|

Local Government act 1993

Chapter

3, Section 8A Guiding principles for councils

(1)

Exercise of functions

generally

The

following general principles apply to the exercise of functions by councils:

(a) Councils should provide strong

and effective representation, leadership, planning and decision-making.

(b) Councils should carry out

functions in a way that provides the best possible value for residents and

ratepayers.

(c) Councils should plan

strategically, using the integrated planning and reporting framework, for the

provision of effective and efficient services and regulation to meet the

diverse needs of the local community.

(d) Councils should apply the

integrated planning and reporting framework in carrying out their functions so

as to achieve desired outcomes and continuous improvements.

(e) Councils should work

co-operatively with other councils and the State government to achieve desired

outcomes for the local community.

(f) Councils should manage

lands and other assets so that current and future local community needs can be

met in an affordable way.

(g) Councils should work with

others to secure appropriate services for local community needs.

(h) Councils should act fairly,

ethically and without bias in the interests of the local community.

(i) Councils should be

responsible employers and provide a consultative and supportive working

environment for staff.

(2) Decision-making

The

following principles apply to decision-making by councils (subject to any other

applicable law):

(a) Councils should recognise

diverse local community needs and interests.

(b) Councils should consider social

justice principles.

(c) Councils should consider the

long term and cumulative effects of actions on future generations.

(d) Councils should consider the

principles of ecologically sustainable development.

(e) Council decision-making should

be transparent and decision-makers are to be accountable for decisions and

omissions.

(3) Community participation

Councils

should actively engage with their local communities, through the use of the

integrated planning and reporting framework and other measures.

Chapter

3, Section 8B Principles of sound financial management

The

following principles of sound financial management apply to councils:

(a) Council spending should be responsible and

sustainable, aligning general revenue and expenses.

(b) Councils should invest in responsible and

sustainable infrastructure for the benefit of the local community.

(c) Councils should have effective financial

and asset management, including sound policies and processes for the following:

(i) performance management

and reporting,

(ii) asset maintenance and

enhancement,

(iii) funding decisions,

(iv) risk management practices.

(d) Councils should have regard to achieving

intergenerational equity, including ensuring the following:

(i) policy decisions are made

after considering their financial effects on future generations,

(ii) the

current generation funds the cost of its services

Chapter

3, 8C Integrated planning and reporting principles that apply to councils

The

following principles for strategic planning apply to the development of the

integrated planning and reporting framework by councils:

(a) Councils should identify and prioritise key

local community needs and aspirations and consider regional priorities.

(b) Councils should identify strategic goals to

meet those needs and aspirations.

(c) Councils should develop activities, and

prioritise actions, to work towards the strategic goals.

(d) Councils should ensure that the strategic

goals and activities to work towards them may be achieved within council

resources.

(e) Councils should regularly review and

evaluate progress towards achieving strategic goals.

(f) Councils should maintain an

integrated approach to planning, delivering, monitoring and reporting on

strategic goals.

(g) Councils should collaborate with others to

maximise achievement of strategic goals.

(h) Councils should manage risks to the local

community or area or to the council effectively and proactively.

(i) Councils should make appropriate

evidence-based adaptations to meet changing needs and circumstances.