Ordinary Meeting

Meeting Date: Monday,

24 June, 2024

Location: Council

Chambers, City Administrative Building, Bridge Road, Nowra

Time: 5.30pm

Membership (Quorum - 7)

All Councillors

Please note: The proceedings of this meeting (including presentations,

deputations and debate) will be webcast, recorded and made available on

Council’s website, under the provisions of the Code of Meeting

Practice. Your attendance at this meeting is taken as consent to the possibility

that your image and/or voice may be recorded and broadcast to the public.

Shoalhaven City Council live

streams its Ordinary Council Meetings and Extra Ordinary Meetings. These

can be viewed at the following link

https://www.shoalhaven.nsw.gov.au/Council/Meetings/Stream-a-Council-Meeting.

Statement

of Ethical Obligations

The Mayor and Councillors are

reminded that they remain bound by the Oath/Affirmation of Office made at the

start of the council term to undertake their civic duties in the best interests

of the people of Shoalhaven City and to faithfully and impartially carry out

the functions, powers, authorities and discretions vested in them under the

Local Government Act or any other Act, to the best of their skill and

judgement.

The Mayor and Councillors are also reminded of the

requirement for disclosure of conflicts of interest in relation to items listed

for consideration on the Agenda or which are considered at this meeting in

accordance with the Code of Conduct and Code of Meeting Practice.

Agenda

1. Acknowledgement of Country

2. Moment of Silence and Reflection

3. Australian National Anthem

4. Apologies / Leave of Absence

5. Confirmation of Minutes

· Ordinary

Meeting - 3 June 2024

· Extra

Ordinary Meeting - 11 June 2024

6. Declaration

of Interests

7. Presentation

of Petitions

8. Mayoral

Minute

Mayoral Minute

MM24.19..... Mayoral Minute - Margie Sheedy Memorial................................................... 1

MM24.20..... Mayoral Minute - Condolence Motion - Franco

Palmieri............................... 2

MM24.21..... Mayoral Minute - Condolence Motion - Martin Gaffey................................... 3

MM24.22..... Mayoral Minute - Condolence Motion - Alan Stephenson

OAM.................... 4

9. Deputations and Presentations

10. Call Over of the Business Paper

11. A Committee of the Whole (if necessary)

12. Committee Reports

Nil

13. Reports

CEO

CL24.175..... Financial Sustainability Productivity and

Efficiency Report........................... 5

City Performance

CL24.176..... Shoalhaven Australia Day Awards Program - Moving

Forward.................. 10

CL24.177..... Local Government Remuneration Tribunal -

Determination of Councillor and Mayoral Fees 2024/2025............................................................................................ 30

CL24.178..... Investment Report - May 2024..................................................................... 36

City Futures

CL24.179..... Delivery Program Operational Plan, Budget 2024/25

- Exhibition Outcomes 41

CL24.180..... Proposed Submission - NSW Parliamentary Inquiry:

Historical Development Consents (Zombie Developments)............................................................................... 65

CL24.181..... Proposed Sale of 77 Princess Street Berry................................................. 71

CL24.182..... Reclassification and Rezoning of Muir House - 10

Prince Alfred St Berry.. 76

City Services

CL24.183..... Licence to Bomaderry Australian Football Club

Incorporated - Pavilion Clubhouse - Artie Smith Oval Bomaderry......................................................................... 81

CL24.184..... Proposed Policy Update - Management of Mobile

Food Vending Vehicles on Council Owned or Managed Land............................................................................. 85

CL24.185..... Tenders - Management & Operation Comerong

Island Ferry Service........ 87

City Development

CL24.186..... Protection of Bushland Along the Old Wool Rd

Heritage Track, St Georges Basin...................................................................................................................... 89

CL24.187..... Membership Application - Southern Coastal

Management Program Advisory Committee.................................................................................................... 92

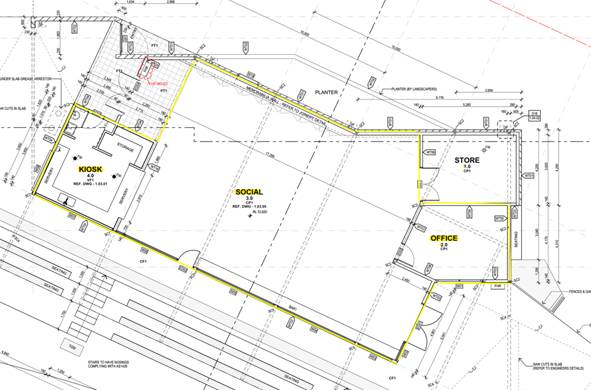

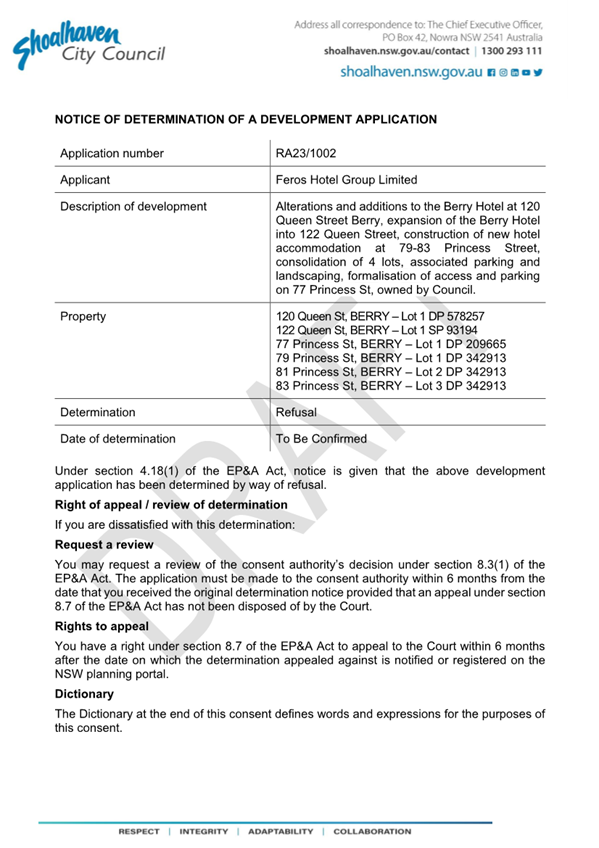

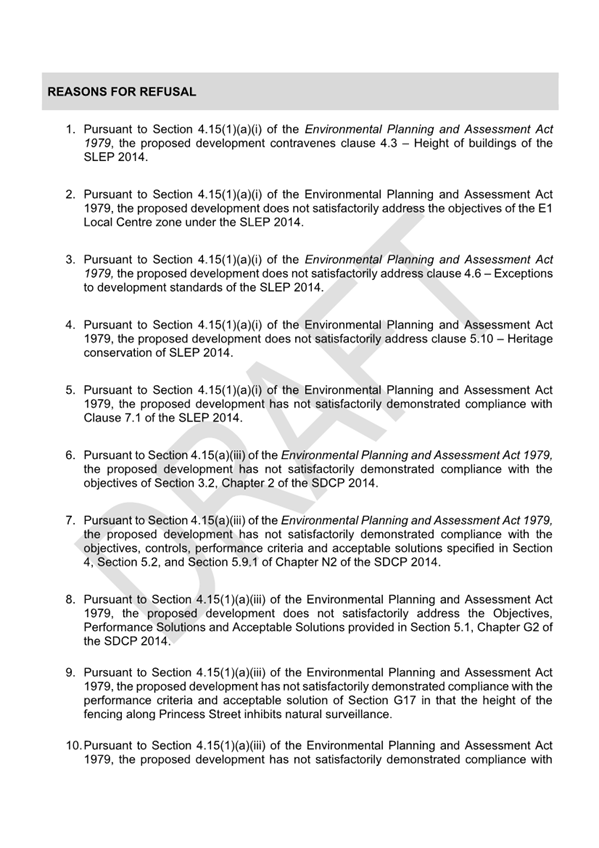

CL24.188..... Regional Application No. RA23/1002 – Berry

Hotel - 120-122 Queen St and 77-83 Princess St Berry.......................................................................................... 93

City Lifestyles

CL24.189..... Membership Appointment - Arts Advisory Committee............................... 100

CL24.190..... Membership Appointment - Youth Advisory Committee............................ 102

CL24.191..... Interim Report - Response to Notice of Motion -

Francis Ryan Amenities Grant Funding....................................................................................................... 104

Shoalhaven Water

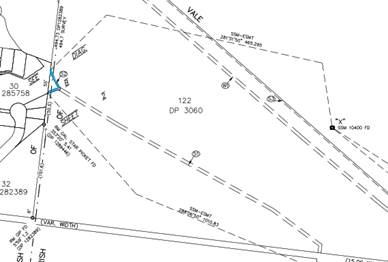

CL24.192..... Acquisition of Easement - Sewer Purposes - Lot

122 DP 3060 Moss Vale Rd Badagarang................................................................................................ 108

14. Notices of Motion / Questions on Notice

Notices of Motion / Questions on Notice

CL24.193..... Rescission Motion - CL24.170 - Notice of Motion -

Removal of 77 Princess Street, Berry from Land Sales Strategy Program.................................................. 110

CL24.194..... Notice of Motion - CL24.170 - Removal of 77

Princess Street, Berry from Land Sales Strategy Program....................................................................................... 111

CL24.195..... Notice of Motion - Projects Funded Following

Declared Natural Disasters 112

CL24.196..... Question on Notice - Budget Shortfall / Natural

Disasters......................... 113

CL24.197..... Question on Notice - The Need for Greater Control

of Dog Risks............ 115

15. Confidential Reports

Reports

CCL24.19.... Tenders - Management & Operation Comerong

Island Ferry Service

Local Government Act - Section 10A(2)(d)(i) - Commercial

information of a confidential nature that would, if disclosed prejudice the

commercial position of the person who supplied it.

There is a public interest

consideration against disclosure of information as disclosure of the

information could reasonably be expected to reveal commercial-in-confidence

provisions of a contract, diminish the competitive commercial value of any

information to any person and/or prejudice any person’s legitimate

business, commercial, professional or financial interests.

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

MM24.19 Mayoral

Minute - Margie Sheedy Memorial

HPERM

Ref: D24/199479

|

Recommendation

That Council:

1. Undertake the necessary steps for

public consultation to re name the Ulladulla Sea Pool the “Margie

Sheedy Sea Pool” in honour of Margie Sheedy.

2. Or if renaming of the pool is not

supported by the community, that Council install a suitable memorial in the

form of a plaque or a bench seat in honour of Margie at the pool.

|

Details

Earlier this year I had the pleasure

of writing a Mayoral Minute to congratulate Margie on being awarded a Medal of

the Order of Australia (OAM) for her outstanding fundraising achievements,

dedication, and support for the Shoalhaven community.

Unfortunately, a short time later

Margie passed away, and we acknowledged this in a subsequent Mayoral Minute.

Margie was a much loved, vibrant and

colourful member of the Milton Ulladulla community, and great friend to many

people. She spent her lifetime dedicated to fundraising and bringing a smile

and absolute joy to so many.

Margie was a fierce supporter of the

Ulladulla Sea Pool and played pivotal role in advocacy when Council once

considered closing this asset. Margie would be seen daily at the sea pool and

will be fondly remembered by many other swimmers if this was their only point

of contact with her.

Margie was always complimentary and

appreciative of Council staff, and befriended many of them as she frequented

the pool so much, colloquially the pool is known to many locals as

Margie’s Sea Pool.

Across the Shoalhaven there are very

few recreational assets named after inspirational women, and Marg was

definitely one.

In light of this, I feel it

appropriate and befitting that Council consider renaming the Ulladulla Sea Pool

after Margie Sheedy, a lasting memorial of such a well known and loved local

character. Ahead of this minute Margie’s family have been contacted and

have given their agreement to the public consultation going forward and

understand that the consultation does not mean the pool will automatically be

renamed.

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

MM24.20 Mayoral

Minute - Condolence Motion - Franco Palmieri

HPERM

Ref: D24/246408

|

Recommendation

That Council writes to Sue Palmieri expressing condolences

with the passing of Franco Palmieri.

|

Details

Franco Palmieri was a highly respected Shoalhaven resident, an

active member the Ulladulla SES and Ulladulla Men’s Shed and had an

extensive network of friends.

Franco had a long and successful career in the hospitality

industry which saw him, and Sue move to Milton where Franco worked at the

Mollymook Golf Club for a time and made many friends there.

He became a member of the Ulladulla SES and Milton Ulladulla Men's

Shed and was always on-site day or night preparing meals making sure that the

SES team were well fed, whether it was for monthly meetings, training sessions,

call outs, fires or floods.

Franco was proud of the SES and was proud to wear their uniform,

Sue and the family have been presented with Franco’s helmet and an

Australian Flag and I know the unit will miss him very much.

Members of the Ulladulla Men’s Shed will also miss Franco,

he was a great friend to many and a great support with many of their IT issues.

Franco was renowned for his hospitality, generosity and kindness,

he leaves behind his much-loved wife Sue and their children Sara and Christian,

and will be sadly missed by all who knew him.

Farewell to another great community member.

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

MM24.21 Mayoral

Minute - Condolence Motion - Martin Gaffey

HPERM

Ref: D24/246930

|

Recommendation

That

Council notes the passing of Martin Gaffey, and writes to the Gaffey family

to express Council’s sincere condolences.

|

Details

It is with great sadness that we

acknowledge the passing of Martin Gaffey, who passed away on 26 April 2024.

Martin

Gaffey, a resident of Erowal Bay, made significant contributions both as a

teacher and within the NSW Rural Fire Service (RFS) community. During his

teaching tenure at St John's the Evangelist High School in Nowra, Martin

positively influenced the lives of students with his dedication and passion for

education.

Martin's commitment to community

service led him to join the NSW RFS at the Erowal Bay Brigade, where he served

as Deputy Captain before being promoted to Senior Deputy Captain. He later

transferred to the Crossroads Brigade, renamed Vincentia Brigade, where he

became a Life Member due to his outstanding contributions.

Throughout his RFS career,

Martin held crucial leadership roles such as Deputy Group Officer and Group

Captain for the Group 3 area. He played a pivotal role in the District's Senior

Leadership Team, contributing to local strategies and serving on Incident

Management Teams. Martin was also involved in the RFS Aviation Branch and

volunteered on numerous deployments, demonstrating his unwavering commitment to

public safety.

Martin's dedication to training

and skills development was evident not only in his firefighting career but also

in his role as an educator. His legacy of compassionate service, leadership,

and kindness will be remembered by the Shoalhaven community and beyond.

On behalf of the Shoalhaven

Community, Councillors, and Staff, we extend our heartfelt condolences to the

Gaffey family during this difficult time. Martin’s profound impact and

lasting contributions will be cherished by all who had the privilege of knowing

him.

|

|

Ordinary Meeting

– Monday 24 June 2024

Page

0

|

MM24.22 Mayoral

Minute - Condolence Motion - Alan Stephenson OAM

HPERM

Ref: D24/247530

|

Recommendation

That Council notes the passing of Mr Alan Stephenson OAM and

expresses our condolences to his wife Michelle and daughter Kim.

|

Details

Alan Stephenson was best known

as Mr Orchid, there was not much Alan didn't know about these often elusive

plants with his speciality being Australian natives.

He was awarded an OAM in 2019

for his contributions to the preservation and understanding of Australian

orchids and, although not a trained botanist he was highly regarded and the

experts often relied on his superior expertise and knowledge.

Alan's life work resulted in the

conservation of many areas that would otherwise have been bulldozed and the

rare and critically endangered species contained within these areas gone,

extinct.

His book Orchids of the

Shoalhaven is on the book shelves and in the backpack’s of many

people across the Shoalhaven, Alan took most of the photos in the book himself,

and many of these photos also grace the walls of homes in the area.

Alan was recognised by the

Australian Orchid Foundation and even has the Nowra found orchid, Corunastylis stephensonii, named after

him.

Alan was a passionate man, who cared deeply for the

environment, he was loved by many for his contributions and will be deeply

missed, I was proud to call him a friend.

On behalf of Shoalhaven City Council Councillors and staff,

we extend our condolences to Alan’s wife Michelle and daughter Kim.

|

|

Ordinary Meeting

– Monday 24 June 2024

Page

0

|

CL24.175 Financial

Sustainability Productivity and Efficiency Report

HPERM Ref: D24/238496

Department: Financial

Sustainability

Approver: Robyn

Stevens, Chief Executive Officer

Reason for Report

The purpose of this report is to inform the Councillors and

the community of the productivity and efficiency actions that have been taken

to improve Council’s financial sustainability from March to May 2024.

|

Recommendation

That

Council:

1. Receive the productivity and

efficiency report for the period from March to May 2024.

2. Note the actions taken during the

quarter that have supported Council’s financial sustainability.

3. Note that the organisation’s

top priority is to address the current financial sustainability challenges,

and there is significant work in progress to realise recurrent savings in the

next financial year.

4. Note that future productivity and

efficiency reports will align to the Quarterly Budget Review timeline to

enable reporting on achievements realised in the quarter.

|

Options

1. The productivity

and efficiency report for the period from March to May 2024 be received for

information.

Implications: Nil

2. Further

information regarding action taken during the quarter to improve

Council’s financial sustainability be requested.

Implications: Any changes or additional matters can

be added to future reports.

Background

The

financial sustainability productivity and efficiency report provides a summary

of actions taken to address Council’s financial sustainability challenge

in the last quarter.

In

January 2024, Council resolved under MIN24.44 to apply financial efficiencies

and savings in the organisation commencing immediately and ongoing over the

next four years. A report is to be provided to the Council every quarter to

outline efficiencies and savings, with a savings target of $5 million per year.

The report also addresses the AEC report recommendation

(CL23.420) to report to Council on a quarterly basis the progress in achieving

efficiency and implement process to track the achievement of the productivity

and efficiencies target.

To review detailed project activity, please refer to the monthly

financial sustainability reports that have been presented to Council during the

quarter:

· March

2024 (CL24.68)

· April

2024 (CL24.95)

· May

2024 (CL24.117)

Improved financial management

– FY2024/25 budget process

A bottom-up budget process was

adopted in building the FY2024/25 operational and capital budgets. This

approach provides a realistic budget that is reflective of the cost incurred to

deliver our current services at the current agreed service level. It also

ensures all costs required to meet legislative requirements are adequately

budgeted for. This results in a draft 2024/25 operating deficit which is larger

than Council’s previous budget, however, is in line with the historical

actual results achieved by Council.

Council has reduced its reliance

on borrowing, with no unrestricted general fund borrowings proposed to be drawn

down for works in FY2024/25.

In preparing for the FY2024/25 budget, Council’s

enterprise Project Management Office (ePMO) ran an improved capital budget

process, where all candidate projects were assessed on their readiness and

criticality. The proposed total capital works program for FY2024/25 is

$126.9m, which is a $61.3m reduction from the FY2023/24 capital program

($188.2m) adopted in June 2023. The capital works program is reflective

of Council’s delivery capacity, taking into account financial and

staffing resources. It is reflective of previous years capital spend and

provides the community with a realistic expectation as to what capital projects

will be delivered in FY2024/25.

Reducing costs – pausing

capital projects

13 significant projects were

paused during the quarter. The estimated total project cost to deliver

the 13 capital projects was $105 million. The majority of the projects did not

have a funding source identified for the full cost of the project (unfunded

totalled $65 million across the 13 projects).

Pausing projects resulted in previously accepted grant

monies being returned to their respective funding bodies, as well as a

reduction in Council’s budget FY2023/24 loan borrowings of $2.5m, and

further reductions in anticipated future year borrowings.

Reducing costs – staffing

Council resolved under

MIN24.44 to consider placing a staffing freeze on all recruitment positions

except where the Executive Management Team (EMT) determines whether the

position is required or to be filled by internal recruitment to provide a career

path for existing staff.

A process was established under

the financial sustainability project, where the EMT review each vacancy and any

new positions to determine if and when they’re required to fulfill

operational, regulatory or required service level.

As a result of this process,

there is a notable decrease in the number of roles being advertised (1 Feb to

28 May 2023: 105 vacancies advertised, 1 Feb to 28 May 2024: 69 vacancies

advertised). This represents a 34% reduction in recruitment in 2024

compared with the same period last year. EMT have declined or placed on

hold 46 recruitments during this period, resulting in reduced staff costs.

In consultation with

Councillors, the CEO has commenced a review of staff costs to identify

opportunities for efficiencies. The outcome of the review will be shared

in a future quarterly report.

Reducing costs – increased

cost controls

Under the financial

sustainability project, increased cost control has been established to improve

the financial position of Council. Since March 2024, all Managers were

asked to do the following to contain costs within the FY2023/24 financial year,

including:

· No

new tenders

· No

discretionary spending

· No

consultants or contractors unless approved by Director

· No

overtime or leave in lieu unless necessary (such as emergency response)

· Work

with teams to reduce leave balances

· Manage

budgets closely with no over-spends

Forecasting FY2024 year end results, the General Fund

operating expenses are on track to be 0.46% below the adopted budget ($232M

actuals vs. $233M budget, favourable). This is due to reduced spending on

materials and services.

Reducing costs – other

efficiency ideas

Throughout May, all department

managers were tasked with identifying cost savings and revenue generating

initiatives that will contribute to the savings target. As part of this

ideas generation, staff submitted 284 ideas for consideration:

· 156

budget reduction ideas

· 85

revenue generation ideas

· 43

general business improvement ideas (may lead to efficiencies but no direct

financial benefit identified)

These ideas have been triaged,

and classified as:

· 119

progress immediately

· 114

business case or workplace change impact assessment needed

· 51

future considerations

As efficiency ideas are implemented, they will be reported

in this report and adjustment made to Council’s budget through the

quarterly budget review process.

Reducing debt – land sales

Under Council’s financial

sustainability project, a review was undertaken of Council-owned property that

could be sold to assist with the financial situation. As a result,

investigations have been done across Council’s land portfolio to identify

land for immediate sale and those to be further investigated for potential sale

or maintained for future strategic land use. Multiple sites that are operational

and community land require further investigation, rezoning and

reclassification.

The properties subject to the

investigation are included on Council website under “Property Sales

Program”.

On 8 April 2024 Council resolved

to sell nine properties of land immediately and proceed with the investigation

of another 15 properties that could include rezoning or reclassification to

enable their sale to assist with the current financial situation. All

properties identified for potential sale are to be investigated for underuse or

being surplus to the needs of the Council and community.

Land valuations will be done by

professional Property Valuers and property sales will be managed by independent

real estate agents who will engage in a competitive sales campaign to ensure

the best sale price. Council has conservatively estimated the land sales

proceeds to be $15M, and this has been accounted for in the draft FY2024/25

budget. Council has budgeted to use these proceeds as follows:

· $5.375M

to fund capital works

· $9.625M

to repay existing debt

This strategy is discussed in

CL24.118 Draft Delivery Program Operational Plan and Budget 2024-25 - Public

Exhibition which was presented to, and endorsed by, Council on 6 May 2024.

$7.2 million in revenue from land sales is expected to be

received in June 2024, and this will be formally reported in the next quarterly

productivity and efficiency report.

Financial Implications

Overview of reporting process

This report will track progress

against the $5 million per annum savings target, by recording the financial

sustainability initiatives that have resulted in a reduction in Council’s

operational expenditure or an increase in Council’s revenue.

Savings realised will be tracked separately for recurring savings/income and

one-off savings, as the one-off savings do not count towards the savings

target.

Recurrent savings

Recurring savings will

permanently reduce Council’s operating budget by the amount of savings

found and will reduce Council’s structural deficit. New or

increased income streams will increase Council’s total revenue

expectation in the budget.

As operational savings are

identified through the Financial Sustainability Review project, and these

savings are resolved by Council and ready for implementation, the operating

budget will be revised at each Quarterly Budget Review (QBR) process with the

savings being quarantined with the expectation they are used to rebuild

Council’s unrestricted cash position, assist in funding future capital

works, or assist with the repayment of Council borrowings.

The recurrent savings

performance will be reported as per the following example:

|

Initiative

|

Saving/Income

|

Reported

|

Amount

|

|

e.g.1

Reduced opening hours at a facility

|

Saving

|

FY25 QBR1

|

-$40,000

|

|

e.g.2

A new fee for a service previously not charged

|

Income

|

FY25 QBR1

|

+$25,000

|

|

Recurrent

productivity and efficiency TOTAL

|

|

|

$65,000

|

The recurrent savings report

will be cumulative, with the newly realised efficiencies added each quarter.

One-off savings

One-off savings are identified

efficiencies that can only be saved in the current year but will need funding

for future years. One-off savings help to improve Council’s cash

position by not spending the budget in the current year, however it doesn’t

help to fix Council’s structural deficit.

The one-off savings will be

reported as per the following example:

|

Initiative

|

Saving/Income

|

Realised

|

Amount

|

|

e.g.1

Land sales realised (MIN24.179)

|

Income

|

June FY24

|

+$15,000,000

|

|

e.g.2

Reduced community donations FY25 only (MIN24.150)

|

Saving

|

FY25 QBR1

|

-$20,000

|

|

One-off

productivity and efficiency TOTAL

|

|

|

$15,020,000

|

March 2024 – May 2024

report

Recurrent saving realised:

Many initiatives are underway

that will realise recurrent savings in the next 12 months, however no recurring

savings have been found in the current quarter March – May 2024. It

is expected that the next quarterly report will report on savings that will be

realised in the first quarterly budget review for financial year 2024-25.

This report will be for the period June – August 2024, and will be

reported to Council in November 2024 (after election caretaker period and in

line with QBR1 reporting).

One-off savings:

|

Initiative

|

Saving/Income

|

Realised

|

Amount

|

|

Pause

capital projects

|

Saving

|

FY24 QBR3

|

-$90,000,000 (total project

cost excluding grant funding)

|

|

Reduced

department spending (no discretionary spending, holding vacancies)

|

Saving

|

FY24 QBR3

|

-$1,700,000

|

|

One-off

productivity and efficiency TOTAL

|

|

|

$91,700,000

|

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

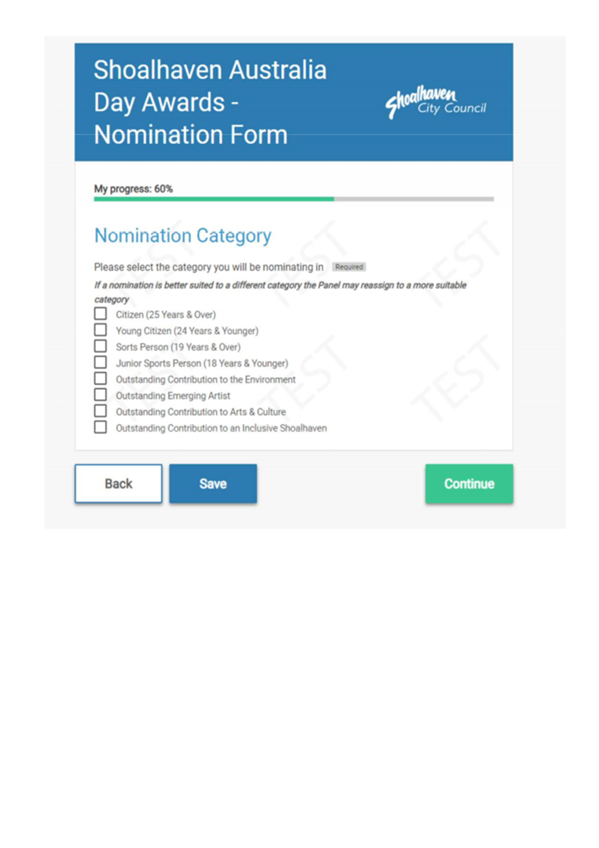

CL24.176 Shoalhaven

Australia Day Awards Program - Moving Forward

HPERM Ref: D24/196524

Department: Business

Assurance & Risk

Approver: Kerrie

Hamilton, Director City Performance

Attachments: 1. Australia

Day Awards 2024 - Nominations Form ⇩

2. Australia

Day Awards - Guidelines and Criteria ⇩

3. Draft - Online Nomination

Form ⇩

Reason for Report

For Council to provide direction on any changes to the

Shoalhaven Australia Day Awards program following the briefing of Councillors

held on 2 May 2024.

|

Recommendation

That

Council provides direction on how to proceed with the future Shoalhaven

Australia Day Awards and advise of any changes they wish to make to the

Awards program.

|

Options

1. Adjust the

Shoalhaven Australia Day Awards program for 2025 and future Award arrangements

as the Council considers appropriate.

Implications: Council

will need to provide direction within the resolution of any changes /

amendments to be made. Corresponding amendments will be made to the Australia

Day Awards – Guidelines and Criteria. Councillors indicated at the

briefing in May that they would propose relevant changes when considering this

report.

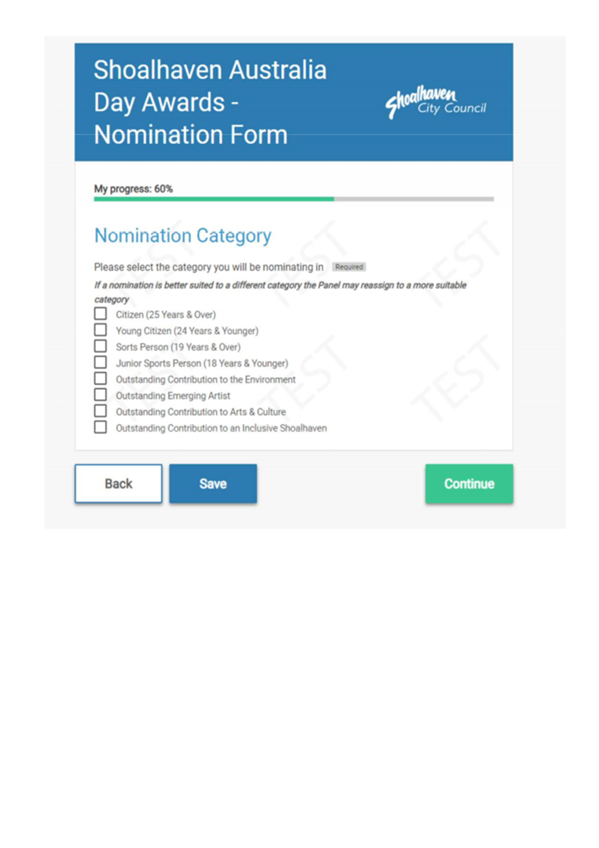

The following are possible aspects of the Awards program

Council may wish to consider making to changes to:

· Award categories

· Name and date of

the Awards

· The nomination

form

· The Judging Panel

· Communications

strategy

2. Continue with

the Australia Day Awards in its current format for 2025 and the Australia Day

Awards – Guidelines and Criteria be endorsed without amendment (Attachment

3).

Implications: Council

will commence the application process and promote the Awards as done the

previous year.

Background

On 2 May 2024 Council received a briefing

in response to the below resolution (MIN23.437):

“That

Council proceed with the 2024 Australia Day Awards as per the status quo with

adjustments to the award categories to be determined at a future Councillor

Briefing for the 2025 Australia Day Awards.”

This resolution related to the report to Council on 14

August 2023 (Agenda - 14 August 2023), which sought Council’s direction

on the future of the Shoalhaven Australia day Awards and any changes to the

program.

At the briefing, Councillors were provided with information

regarding the current Awards program, the outcomes of the 2024 Awards, feedback

from other Councils on their Awards programs and potential ways forward. The

following are the key aspects of the Awards program:

Awards Categories

In the 2019 Australia Day Awards the number of Award

categories increased to 8, these categories included:

1. Citizen (25 and over)

2. Young Citizen (24 and under)

3. Sports Person (19 and over)

4. Junior Sports Person (18 and under)

5. Outstanding Contribution to Environment Award

6. Outstanding Contribution to an Inclusive Shoalhaven

Award

7. Outstanding Contribution to Arts & Culture Award

8. Outstanding Emerging Artist

In 2018 only the first 6 of those categories were used and in

2017 only the first 4. The increase of categories was the result of an approach

to combine separate award ceremonies and categories to achieve greater

interest. Though the intention was to achieve greater interest, as the previous

report and the Councillor briefing outlined, the number of nominations in

general has decreased over recent years, as the following 7 year trend

reflects:

· 2018 – 38 nominations

· 2019 – 37 nominations

· 2020 – 23 nominations

· 2021 – 17 nominations

· 2022 – 20 nominations

· 2023 – 28 nominations

· 2024 – 28 nominations

In addition to decreasing nominations, it should be noted by

Councillors that some of the categories listed above have received little to no

nominations over the past couple of years.

The following is a list of nominations for each category from

2018:

|

Category

|

2024

|

2023

|

2022

|

2021

|

2020

|

2019

|

2018

|

|

Citizen Award

|

9

|

12

|

2

|

6

|

6

|

11

|

17

|

|

Young Citizen

|

5

|

2

|

0

|

3

|

2

|

4

|

2

|

|

Outstanding Contribution to an Inclusive Shoalhaven Award

|

5

|

11

|

2

|

3

|

3

|

8

|

5

|

|

Outstanding Contribution to Environment Award

|

4

|

1

|

5

|

1

|

1

|

2

|

6

|

|

Outstanding Emerging Artist Award

|

0

|

1

|

3

|

0

|

1

|

2

|

N/A

|

|

Outstanding Contribution to Arts & Culture Award

|

2

|

2

|

1

|

2

|

3

|

10

|

N/A

|

|

Sports Person Award

|

2

|

0

|

2

|

0

|

0

|

1

|

3

|

|

Junior Sports Person

|

1

|

3

|

5

|

0

|

7

|

4

|

5

|

It is worth noting

that in 2024, an incentive was provided to nominators to go in a draw to win a

Holiday Haven gift Voucher valued at $500 in order to increase nominations.

Additional funds were spent to increase awareness in 2024 however, the numbers

declined or remained the same for many categories.

Reducing the number of categories may increase the prestige

of the Awards and make the criteria simpler for those nominating. Council

could, for example, reduce the categories to the following five:

1. Citizen

2. Young Citizen

3. Sports Person

4. Outstanding Contribution to Environment Award

5. Outstanding Contribution to Arts & Culture Award

This option is also reflected by other NSW Councils, which

have a lower number of categories:

Kiama (4 Categories): Citizen Award, Young Citizen (24 years or under), Senior

Citizen (65 years or over), Community Group of the Year

Bega (3 Categories): Citizen Award, Young Citizen (24 years or under), Senior

Citizen (65 years or over)

Newcastle (5 Categories): Citizen

of the Year, Young Citizen (30 years or under), Senior Citizen (60 years or

over), Community Group of the Year, Freeman of the City

Name & Date of Awards

The name and date of the Awards was another aspect of the

program discussed with Councillors at the briefing on 2 May. Councillors were

advised that in September 2023, neighbouring Council, Kiama decided to present

the Awards in August as part of Local Government Week and rename the program

Kiama Local Government Awards. We are advised that rationale behind this

decision is as follows:

“The

suggestion to forgo the Australia Day Awards in 2024 and have Kiama Local

Government Awards at another time is in a desire to foster a more inclusive and

diverse celebration of our national identity. We acknowledge that January

26th is a date that has different meanings for different Australians. While it

represents the establishment of British settlement in Australia for some, it is

also a day of reflection and mourning for others, as it marks the beginning of

significant hardships for Indigenous Australians. In response to this diversity

of perspectives, it is important to create an inclusive Australia Day

celebration that respects and acknowledges the full spectrum of our community's

views. Therefore, we have decided to redirect our efforts toward community-led

events and a citizenship ceremony to unite our community while fostering a

spirit of inclusivity. We (as Council) are the arbiters of the awards, we

felt that this valuable recognition would be better placed within Local

Government Week, the first week of August.”

An alternative to current award arrangement council includes

rebranding to The Shoalhaven Community Awards and/or

changing the timing of the awards so that they are held:

· During Volunteers week (May)

· Or during Local Government Week (first

week in August)

· Continue to be held on a day close to

Australia day.

Other NSW Councils that have amended their approach in this

way and have advised that this reinvigorated their awards are:

· Byron Bay Shire

· Lake Macquarie Council

· Eurobodalla

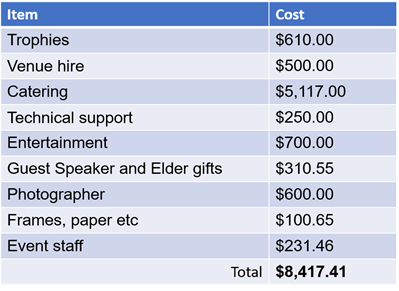

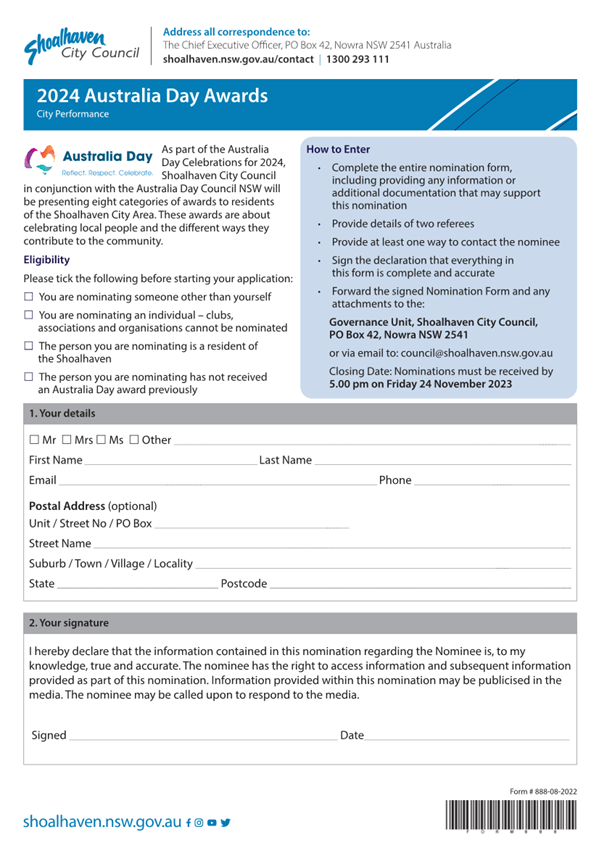

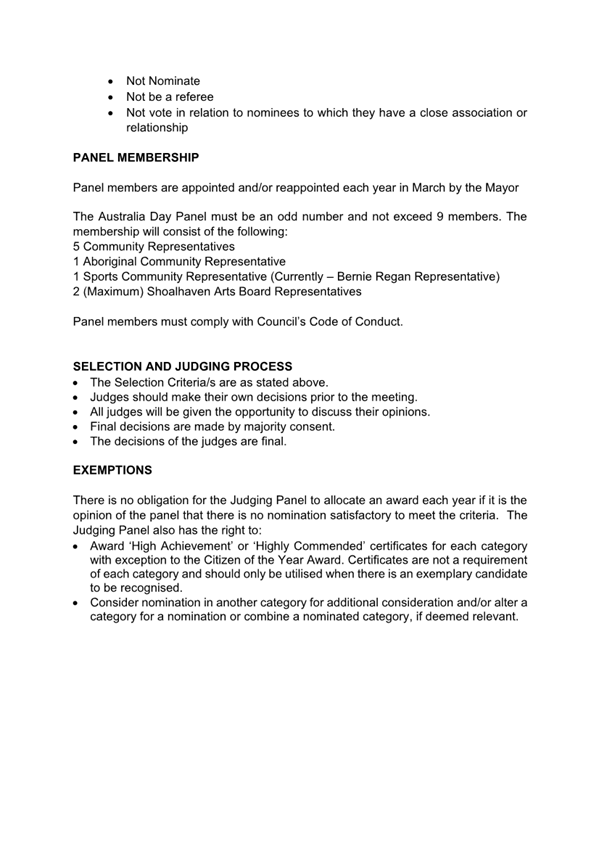

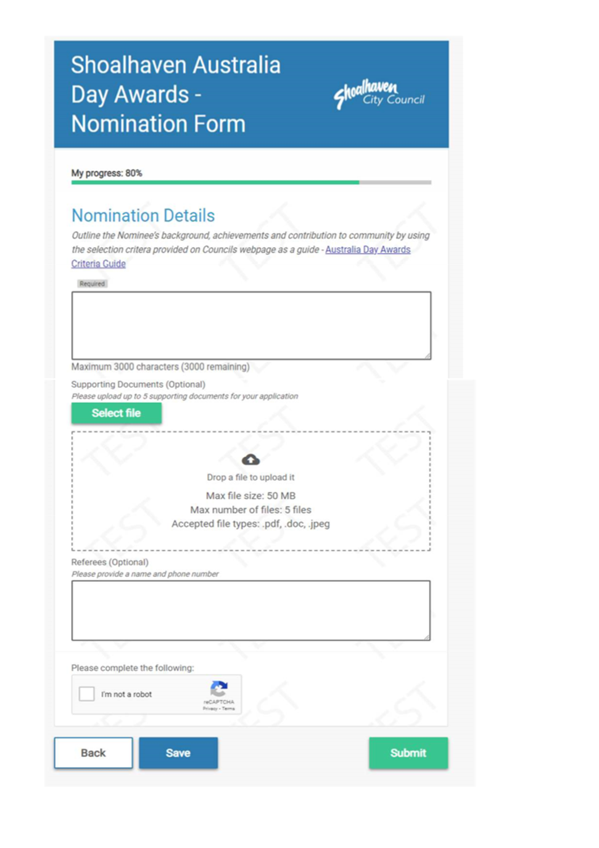

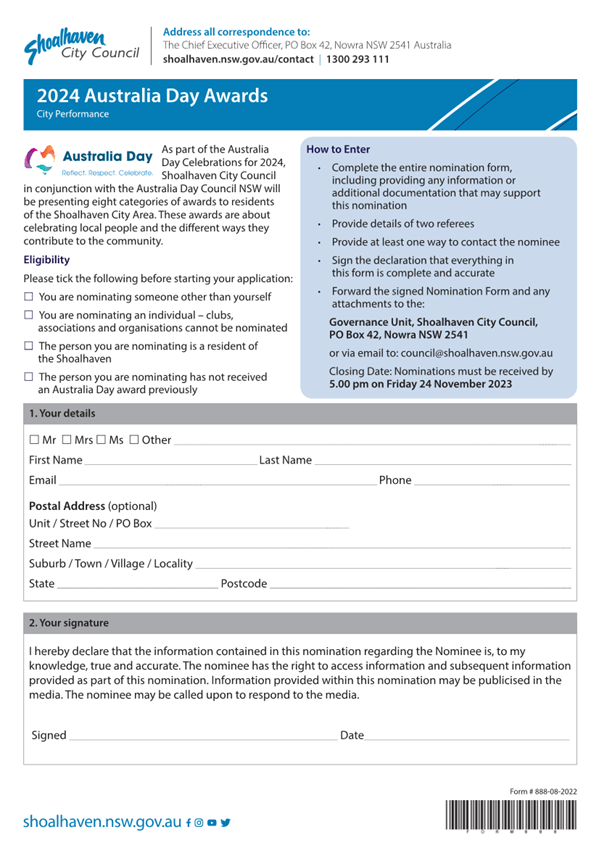

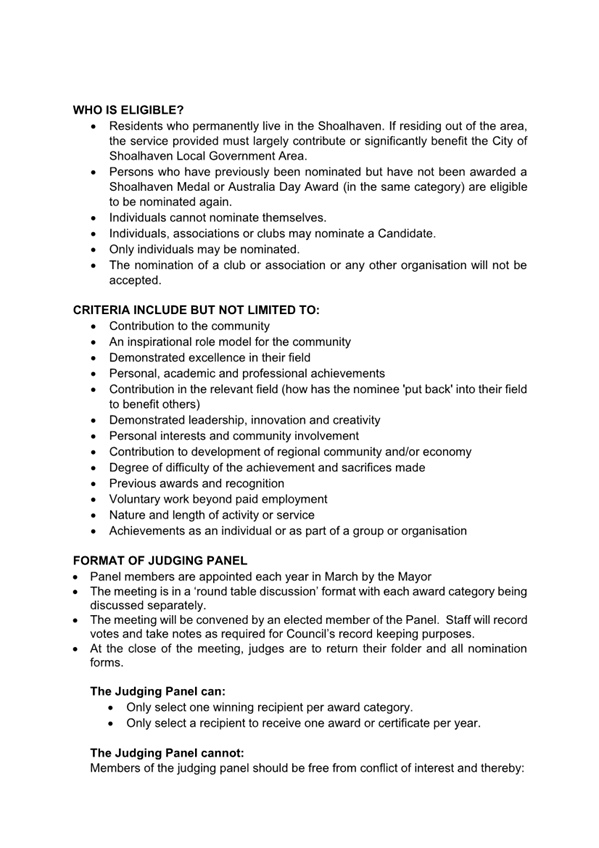

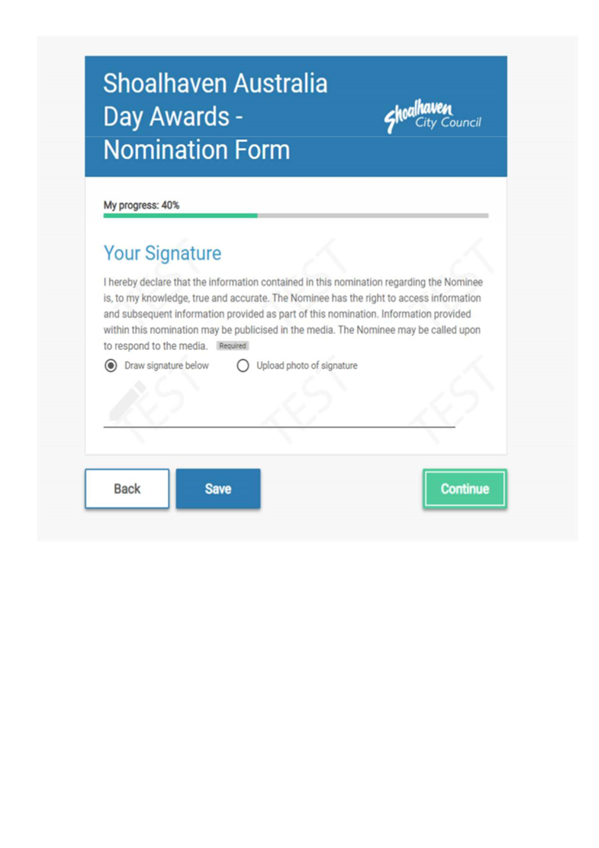

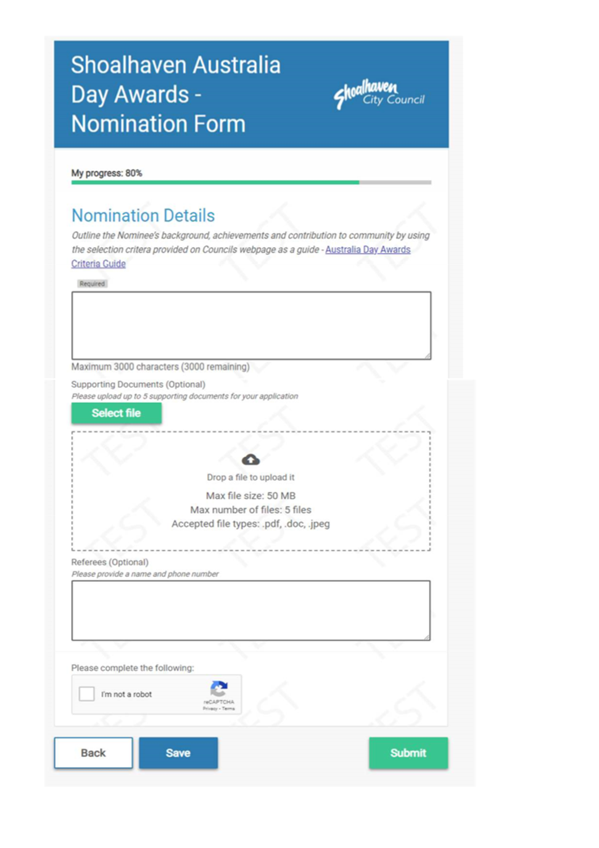

Nomination Form

Feedback was received from Councillors that the nomination

form could be more accessible and less onerous for members of the community to

complete. A copy of the 2024 nomination form can be found at Attachment 1.

The 2024 Nomination form was reduced from the 2023 Nomination form by:

· Removing the residential address field

· The postal address field was deemed as

optional.

· The selection criteria were refined from 13 points down to 7

points.

If Councillors were to make any changes, it should be kept in

mind that staff do require certain information to be provided to be able to

deem an application eligible as do the Judging Panel to make an informed

decision in the Awards process, such as:

· Contact details of the nominee – this allows staff to confirm the

nominee accepts the nomination and consents to participate in the process (as a

number of nominees have declined to accept the nomination) and to enable an

invitation to the Awards ceremony to be sent.

· Contact details of the nominator – this allows staff to contact the

nominator in cases where further/updated information is required or to notify

them of a nominee declining to accept the nomination and to enable an

invitation to the Awards ceremony to be sent.

· Detailed nomination outlining the nominee’s background,

achievements, and contribution to community – this allows the Judging Panel to

make informed decision about the appropriate category and appropriately assess

and compare nominations to identify those who have made the most significant

impacts to the Shoalhaven.

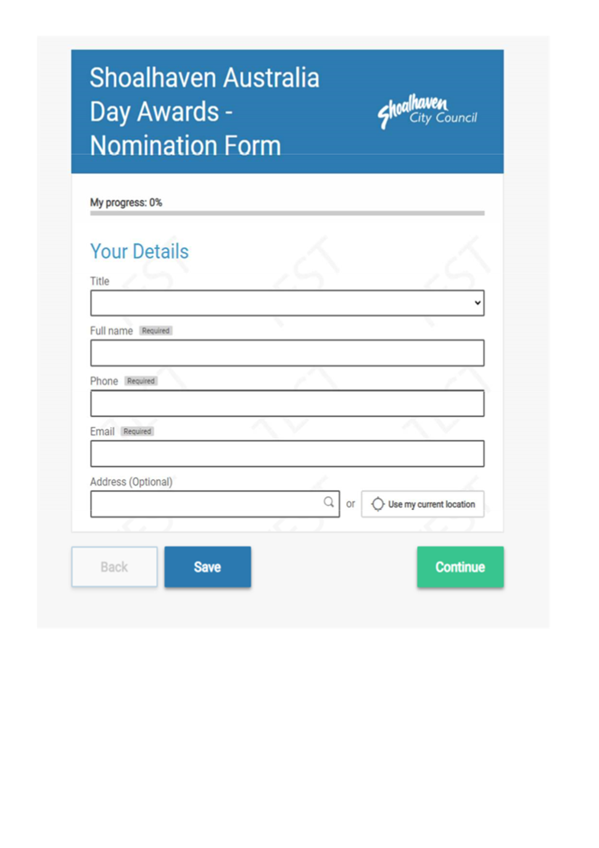

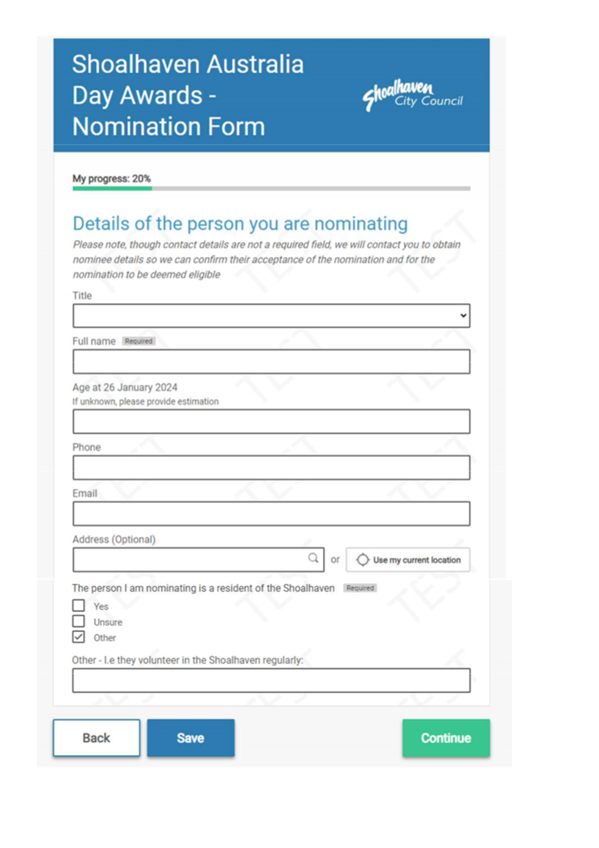

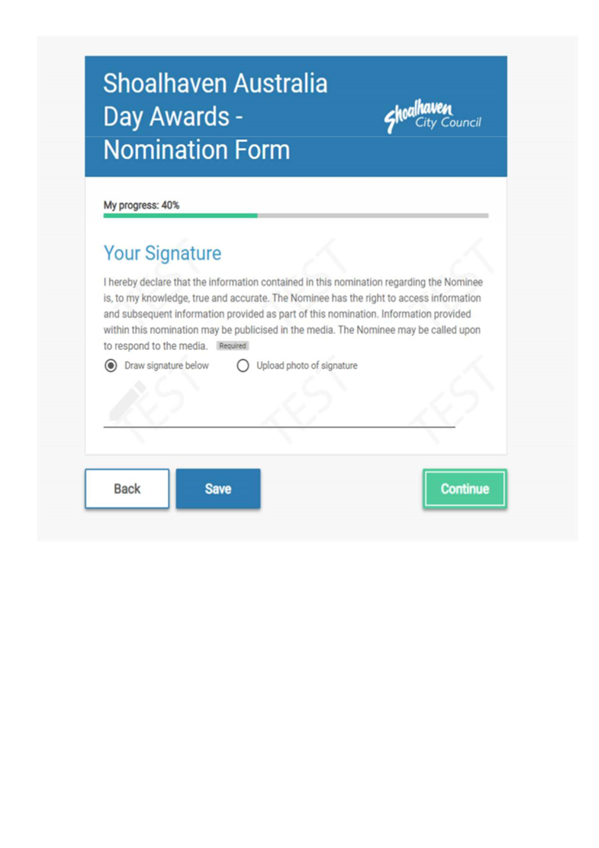

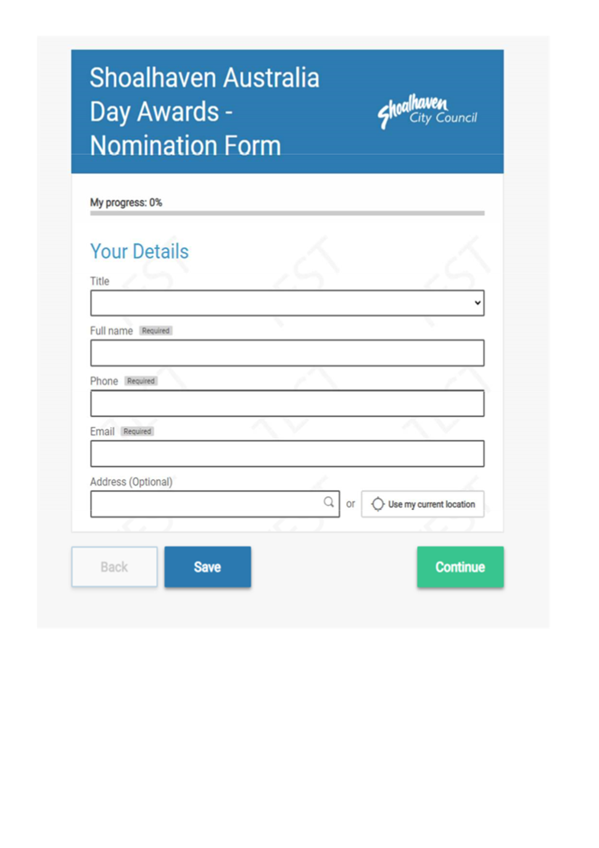

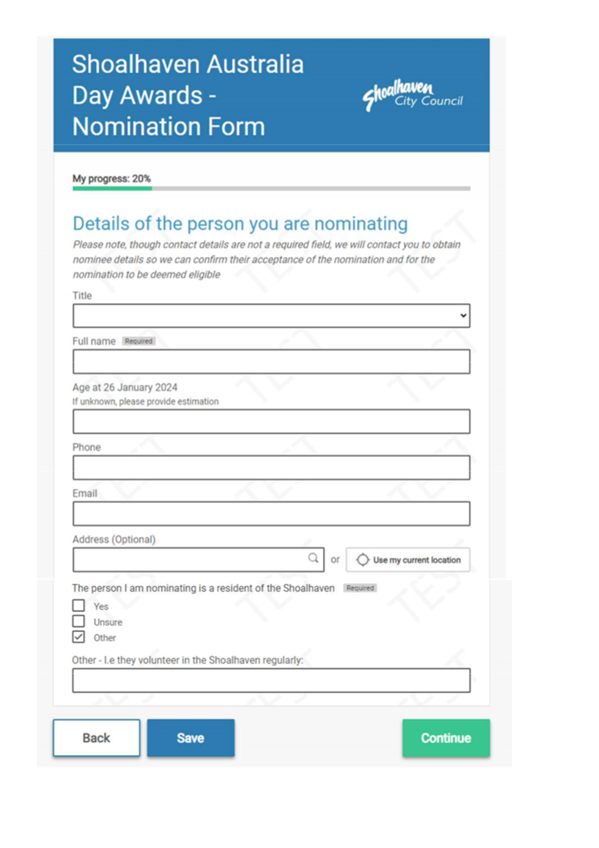

Staff are currently working on a more accessible form to be

provided in an online format

and to allow users to save their progress as they go, leave the webpage, and

return at a later time before submitting the completed form. This was an issue

identified during the last submission process.

An example of the updated form and webpage are at Attachment

3. This webpage and online form are designed to minimise the fields

required to be completed in the form by providing important information

regarding eligibility and the process that will follow, ahead of seeking

community members to complete the form.

The current information requested on the drafted form is

considered essential to running the program and retaining a sense of prestige

for nominations by calling our community to make meaningful nominations.

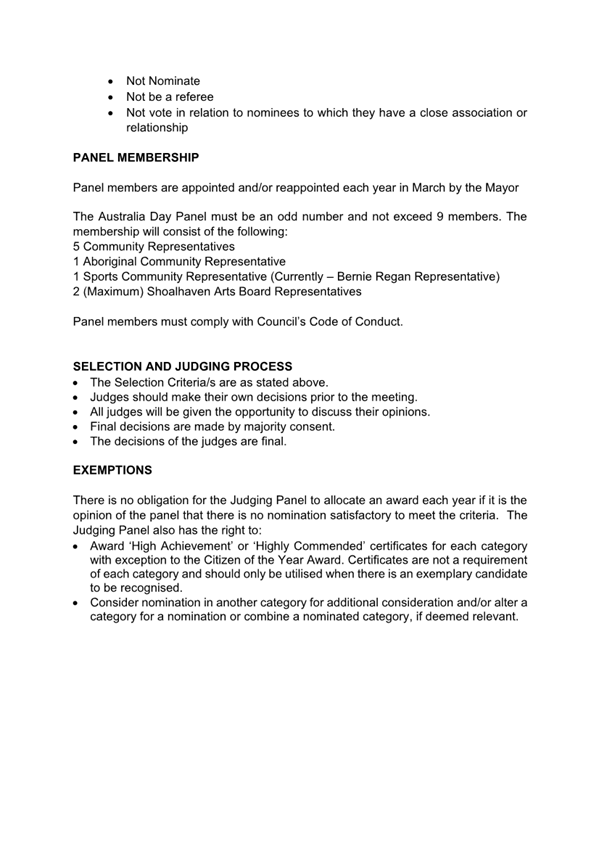

The Judging Panel

The current format and the role of the Judging Panel can be

found in the Australia Day Awards Guidelines and Criteria (Attachment 2).

Panel members are appointed and/or reappointed each year in

March by the elected Mayor of the Council during that term. The Australia Day

Panel must be an odd number and not exceed 9 members.

The Judging Panel for the 2025 Awards is yet to be confirmed,

as membership will be considered and confirmed by the newly elected Mayor in

October 2024.

Policy Implications

The Australia Day Awards

Guidelines and Criteria in their current format are attached to this report (Attachment

2). Any amendments that are made will be reflected in the Australia Day

Awards Guidelines and Criteria prior to nominations opening.

Community

Engagement

The process of promoting the

Awards generally commences in September, after the information on the

application forms is updated for the upcoming year.

This year’s awards were

promoted across social media platforms (paid advertising), Council’s

website, Council’s networks (I.e. CCB’s, sport groups, art groups

and Council Committees), and via printed flyers/posters. It is worth noting

that despite choosing not to advertise via newspapers and radio networks, which

add a significant cost, we achieved the same number of nominations in 2024 and

2023, and more community engagement on our platforms. The results of the

community engagement from the latest 2024 Australia Day Awards are as follows:

· Total Get

Involved page visits: 1.21k

· Document

downloads: 55

· FAQ visits:

117

· Nominations

received through the Get Involved engagement platform: 23

Media contribution

· Social

media:42.9%

· Council

newsletter: 19%

· Radio: 14.3%

· Website:

12.8%

· Electronic

Direct Mail Marketing :9.5%

All incoming applications are

acknowledged on receipt. Upon applications closing, a Judging Panel meeting is

arranged for the review of the applications and subsequent determination of the

winners.

Trophies, certificates and

invitations are arranged for the event in addition to booking a facility and

arranging catering. The event is held in January close to Australia Day each

year with the location alternating each year between Nowra and Ulladulla.

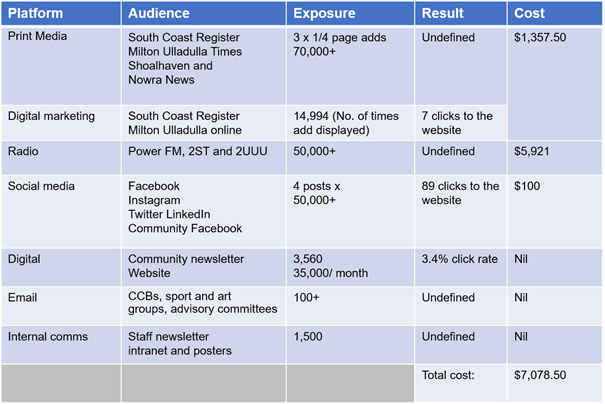

Financial Implications

The

promotion campaign for the 2024 Awards ran from 13September - 24 November 2023.

The details and financial cost of the 2024 Awards campaign was as follows:

|

Platform

|

Audience

|

Exposure

|

Result

|

Cost*

|

|

Council website

|

Homepage banner

Get Involved page

|

45,000/month

1,200 total visits

|

23 nominations via Get Involved

|

Nil

|

|

Print

|

A5 flyers

Posters

Printed nomination forms

|

Admin building

Ulladulla Service Centre

Libraries

Indoor Sports Centre

|

5 nominations via the paper form

|

$500

|

|

Social media

|

Facebook (26k followers)

Instagram (4.5k followers)

LinkedIn

Community Facebook

|

2 paid FB posts

4 x Organic FB & IG posts

|

180 clicks to the website

25k reach

|

$100

|

|

Digital

|

Community newsletter

|

3,699 subscribers

|

52.6% open rate

9% click rate

21 clicks on article

|

Nil

|

|

Email

|

CCBs, sport

and art groups, advisory committees

|

100+

|

Undefined

|

Nil

|

|

Media release

|

Media and news outlets in

the Shoalhaven

|

113 subscribers

|

Undefined

|

Nil

|

|

Internal comms

|

Staff newsletter (Sep edition)

|

1,500

|

Undefined

|

Nil

|

|

|

|

Total cost:

|

$600

|

*Cost does not include staff time

The total cost of the 2024

Awards Ceremony event was:

|

Item

|

Cost

|

|

Trophies

|

$728.00

|

|

Venue hire

|

$2660.00

|

|

Ambassador accommodation & gift

|

$257.45

|

|

Catering

|

$5126.00

|

|

Technical support

|

$1098.00

|

|

Entertainment

|

$200.00

|

|

Emcee & Elder

|

$1505.00

|

|

Photographer

|

$770.00

|

|

Frames, paper etc

|

$100.00

|

|

Event staff

|

$400.00

|

|

Total

|

$12,844.45

|

Total

spent for the 28 Nominees for the Australia Day Awards 2024 - $13,444.45

It is worth noting that

$2,051.46 was saved on the total cost of the Australia Day 2024 Awards as

compared to 2023. These savings were primarily made in the promotions campaign,

as can be seen in comparison to last year’s report:

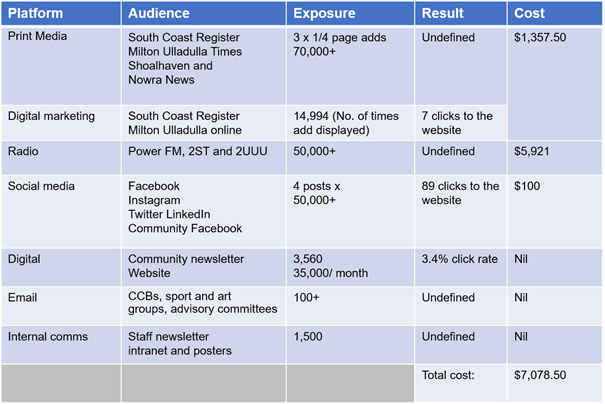

The details and financial

cost of the 2023 Awards campaign was as follows:

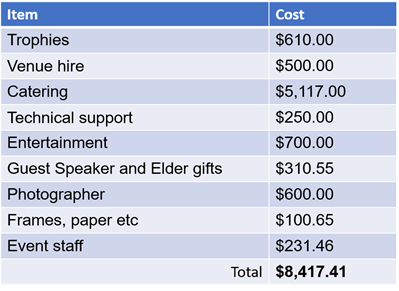

The

total cost of the 2023 2024 Awards Ceremony event was:

Total spent for the 28

Nominees for the Australia Day Awards 2023 - $15,495.91

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

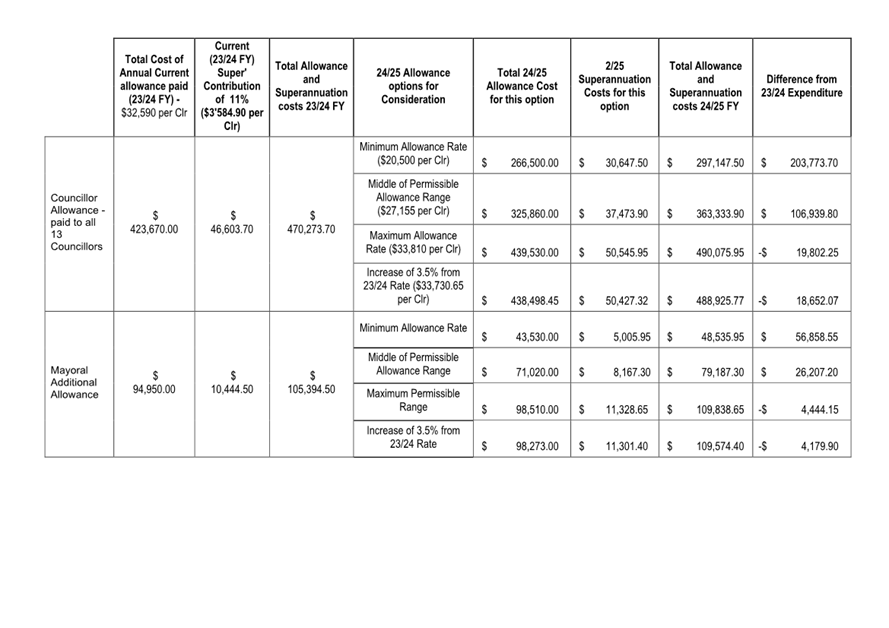

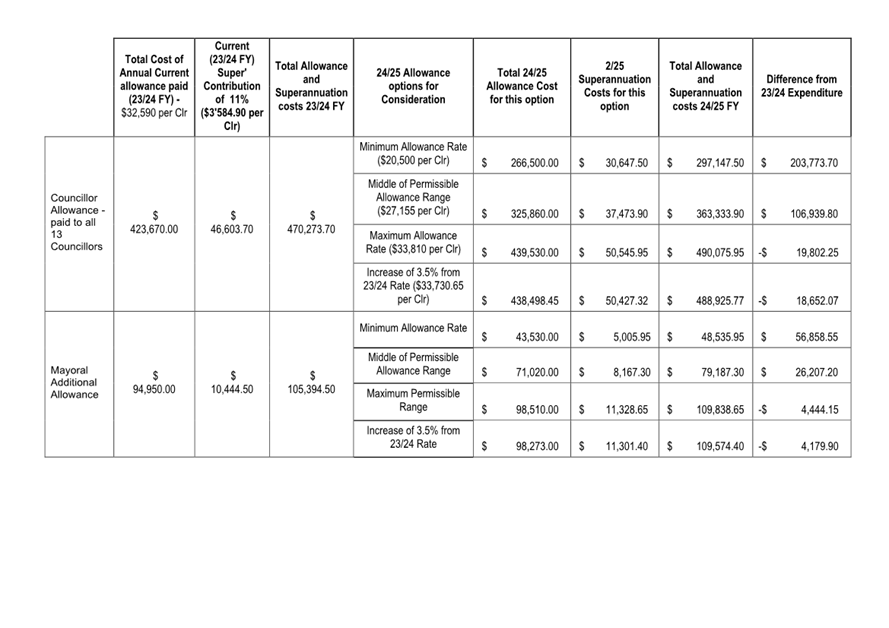

CL24.177 Local

Government Remuneration Tribunal - Determination of Councillor and Mayoral Fees

2024/2025

HPERM

Ref: D24/202291

Department: Business

Assurance & Risk

Approver: Kerrie

Hamilton, Director City Performance

Attachments: 1. Local

Government Remuneration Tribunal - Annual Determination 2024 2025 (under

separate cover) ⇨

2. Councillor & Mayoral Fees

Options ⇩

Reason for Report

The reason for this report is to enable elected Councillors

to note and consider the attached determination from the Local Government

Remuneration Tribunal, and to adopt the fees payable to the Mayor and

Councillors for the 2024/2025 financial year.

|

Recommendation

That

Council:

1. Note the Local Government Remuneration

Tribunal’s Annual Report and Determination dated 29 April 2024.

2. Adjust

the Councillor Fee payable to Councillors from 1 July 2024 to 30 June 2025 to

an amount between $20,500 (minimum) and $33,810 (maximum) and for the

Mayoral Additional Fee between $43,530 (minimum) and $98,510 (maximum).

3. Determine that the additional

Mayoral fee (in full, or in part), not be paid directly to the Deputy Mayor

when the Deputy Mayor is required to act in the position of Mayor during

periods of approved leave.

|

Options

1. As Recommended

Implications: This will adjust the Fees for

Councillors and Additional Mayoral Fee to an amount proposed by the elected

Council which is within the permissible range determined by the remuneration

tribunal for the 2024/2025 financial year and retain the provision of superannuation

to Councillors. This allows the Council to adopt an amount considered

appropriate given the current financial position of the Council.

2. As recommended

with amendment to Part 3 of the Recommendation which allows the payment of a

full or part of the Mayoral Fee to the Deputy Mayor.

Wording for the resolution to bring this into effect may

be worded as follows:

“ 3. Pay [Insert relevant percentage] of the

Additional Mayoral Fee to the Deputy Mayor when the Deputy Mayor is required to

act in the position of Mayor during periods of approved leave of a duration of

28 days or more.”

Implications: During extended periods of absence,

the Deputy Mayor will be paid the amount set be the resolution and payments to

the Mayor would be reduced by the equivalent amount.

3. An alternative

recommendation

Implications: Not known. Any decision of the

Council would be required to reflect the requirements outlined in the Local

Government Act and Regulations and be within the range of payable payments

outlined by the Local Government Remuneration Tribunal.

Background

The Local Government

Remuneration Tribunal has determined an increase of 3.75% to Mayoral and

Councillor fees for the 2024/2025 financial year, with effect from 1 July 2024.

Councillors’ Fees

Section 241 of the Local

Government Act 1993 (the Act) requires the Tribunal to determine each year

the maximum and minimum amounts of annual fees payable during the following

year to Mayors and Councillors. Section 248 and 249 of the Act require Councils

to fix and pay an annual fee based on the Tribunal’s determination.

The relevant provisions of the

Act are outlined below:

248

Fixing and payment of annual fees for councillors

(1) A

council must pay each councillor an annual fee.

(2) A council

may fix the annual fee and, if it does so, it must fix the annual fee in

accordance with the appropriate determination of the Remuneration Tribunal.

(3) The

annual fee so fixed must be the same for each councillor.

(4) A council

that does not fix the annual fee must pay the appropriate minimum fee

determined by the Remuneration Tribunal.

249 Fixing

and payment of annual fees for the mayor

(1) A

council must pay the mayor an annual fee.

(2) The annual fee

must be paid in addition to the fee paid to the mayor as a councillor.

(3) A council may

fix the annual fee and, if it does so, it must fix the annual fee in accordance

with the appropriate determination of the Remuneration Tribunal.

(4) A council that

does not fix the annual fee must pay the appropriate minimum fee determined by

the Remuneration Tribunal.

(5) A council may

pay the deputy mayor (if there is one) a fee determined by the council for such

time as the deputy mayor acts in the office of the mayor. The amount of the fee

so paid must be deducted from the mayor's annual fee.”

Councils are to fix Councillor

and Mayoral fees for financial year based on the Tribunal’s

Determination. The level of fees paid will depend on the category which is

applied to the Council. If a Council does not fix a fee, the Council must pay

the minimum fee determined by the Tribunal.

The Determination of the

Tribunal is that Councils in the Regional Strategic Area Category may fix the

2024/2025 annual fee for Councillors between $20,500 (minimum) and $33,810

(maximum). The Mayoral Additional Fee has been set at between $43,530 (minimum)

and $98,510 (maximum). The Council may set any figure for the fees within this

range.

The Councillor and Mayoral fee

adoption is distinct and separate to the payment of expenses and provision of

facilities to Councillors. The Mayoral Fee is an amount paid to the Mayor in

addition to the Councillor Fee.

The Councillor and Mayoral Fees

overtime have increased significantly since financial year 2015/2016 up until

the current financial year. The historical fee allowances are shown below.

|

2015/16

|

$18,380 Councillors

$40,090 Mayoral

Additional Fee

|

|

2016/17

|

$18,840 Councillors

$41,090 Mayoral

Additional Fee

|

|

2017/18

|

$19,310 Councillors

$42,120 Mayoral

Additional Fee

|

|

2018/19

|

$19,790 Councillors

$43,170 Mayoral

Additional Fee

|

|

2019/2

|

$20,280 Councillors

$44,250 Mayoral Additional

Fee

|

|

2021/22

|

$24,320 Councillors

$53,250 Mayoral

Additional Fee

|

|

2022/23

|

$25,310 Councillors

$62,510 Mayoral

Additional Fee

|

|

2023/24

|

$32,590 Councillors

$94,950 Mayoral

Additional Fee

|

The setting of an appropriate level of fees within the permissible

range is a matter for the Council to consider and determine.

Payment for the Deputy Mayor

Section 249(5) of the Act allows

Council to elect to pay the Deputy Mayor a fee when acting in the office of the

Mayor. The amount of the fee must be deducted from the Mayor’s annual

fee.

The matter of the Deputy Mayoral

Fee is one for consideration and determination by the Council. Suggested

wording is provided as option 2 in this report should it be considered that

such determination is required. It is recommended that such payment should be a

matter that the Council would consider at a time when an extended absence of

the Mayor is approved.

Superannuation for

Councillors

On 16 May 2021, legislation was

passed in the NSW Parliament to introduce superannuation payments for

Councillors in NSW. The Local

Government Amendment Act 2021 addressed a longstanding inequity in

Local Government by providing Councils with the option to make superannuation

payments to Mayors and Councillors in addition to their annual fees from July

2022. This decision was made after a lengthy campaign to acknowledge the

contribution of Councillors.

The relevant amendment to the

Act states:

Section 254B Insert after section 254A—

254B Payment for superannuation contributions for

councillors

1) A Council may make

a payment (a superannuation contribution payment) as a contribution to a

superannuation account nominated by a Councillor, starting from the financial

year commencing 1 July 2022.

2) The amount of a

superannuation contribution payment is the amount the Council would have been

required to contribute under the Commonwealth Superannuation Legislation as

superannuation if the Councillor were an employee of the Council.

3) A superannuation

contribution payment is payable with, and at the same intervals as, the annual

fee is payable to the Councillor.

4) A Council is not

permitted to make a superannuation contribution payment—

a) unless the Council

has previously passed a resolution at an open meeting to make superannuation

contribution payments to its Councillors, or

b) if the Councillor

does not nominate a superannuation account for the payment before the end of

the month to which the payment relates, or

c) to the extent the

Councillor has agreed in writing to forgo or reduce the payment.

5) The Remuneration

Tribunal may not take superannuation contribution payments into account in

determining annual fees or other remuneration payable to a Mayor or other

Councillor.

6) A person is not,

for the purposes of any Act, taken to be an employee of a Council and is not

disqualified from holding civic office merely because the person is paid a

superannuation contribution payment.

7) A superannuation

contribution payment does not constitute salary for the purposes of any Act.

8) Sections 248A and

254A apply in relation to a superannuation contribution payment in the same way

as they apply in relation to an annual fee.

9) In this

section—

- Commonwealth superannuation

legislation means the Superannuation Guarantee (Administration) Act 1992 of the

Commonwealth.

- Superannuation account means an account for superannuation

or retirement benefits from a scheme or fund to which the Commonwealth

Superannuation Legislation applies.

The wording of the legislation

sets out that the Council may elect to either provide a Superannuation Payment

at the rate set out in the Superannuation Guarantee or not provide a

superannuation payment. The superannuation payment is calculated on the Fees

paid to Councillors (and for the Mayor the additional Mayoral Fee in addition

to the Councillor Fee). Any amounts reimbursed to Councillors in the form of

expense payments under the Council Members Payment of Expenses and Provision of

Facilities Policy are not related to the superannuation calculation.

Council resolved at its Ordinary

Meeting of 7 February 2022 (MIN22.270) to provide a Superannuation Payment to

Councillors.

In accordance with the

Superannuation Guarantee the rate of superannuation for the 2024/2025 Financial

year will be 11.5%. It is considered that it is appropriate for Council

to maintain a Superannuation arrangement for Councillors, however the Council

may resolve to not make superannuation contributions at any time.

Community Engagement

Council is not required to

undertake community consultation in relation to the adoption of the fee

amendment determination process, as it is based on a published report and the

process undertaken by the Tribunal.

Financial Implications

Current fees (2023/2024

FY) paid to Shoalhaven City Councillors and Mayor

|

CATEGORY

|

Councillor

Annual Fee

|

Mayor

Additional Fee*

|

|

Regional

Strategic Area

|

$ 32,590

|

$ 94,950

|

Proposed fees to Shoalhaven City

Councillors and Mayor 2024/2025 financial year:

2024/2025 Determination -

Pursuant to Section 241 of Fees for Councillors and Mayors.

|

CATEGORY

|

Councillor

Annual Fee

|

Mayor

Additional Fee*

|

|

Minimum

|

Maximum

|

Minimum

|

Maximum

|

|

Regional

Strategic Area

|

$20,500

|

$33,810

|

$43,530

|

$98,510

|

*This fee must be paid in addition to the fee paid to the

Mayor as a Councillor/Member (s429 (2)).

Any additional costs to the

Council arising from the resolution of this matter will be identified and

funded at each of the quarterly budget reviews in the 2024/2025 financial year.

A range of options for the Council are costed in Attachment 2.

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

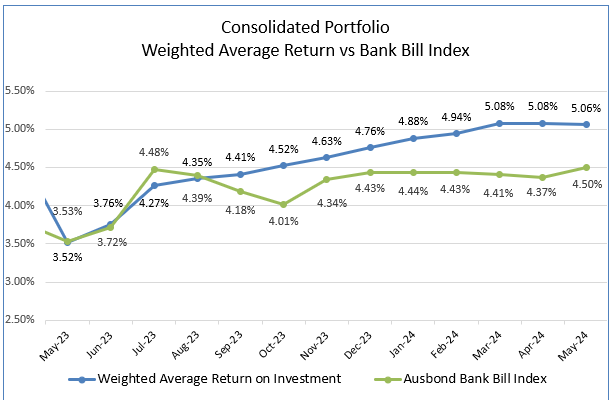

CL24.178 Investment

Report - May 2024

HPERM Ref: D24/236897

Department: Finance

Approver: Kerrie

Hamilton, Director City Performance

Attachments: 1. Shoalhaven

Monthly Investment Report - May 2024 (under separate cover) ⇨

Reason for Report

The reason for this report is to inform the Councillors and

the Community on Council’s investment returns. The report also ensures

compliance with Section 625 of the Local Government Act 1993 and Clause 212 of

the Local Government (General) Regulation 2021, that requires a written report

is provided to Council setting out the details of all funds it has invested.

|

Recommendation

That Council:

1. Receive the Record of Investments

for the period to 31 May 2024.

2. Note that Council’s total

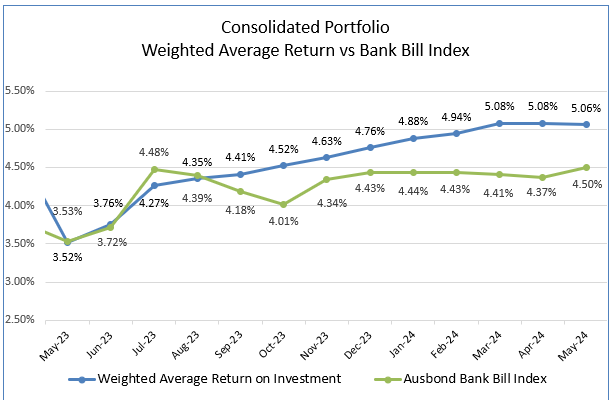

Investment Portfolio returned 5.06% per annum for the month of May 2024,

outperforming the benchmark AusBond Bank Bill Index (4.50% pa) by fifty-six

basis points (0.56%).

|

Options

1. The report on the Record of Investments for the period to

31 May 2024 be received for information.

Implications: Nil

2. Further

information regarding the Record of Investments for the period to 31 May 2024

be requested.

Implications: Nil

3. The report of the

record of Investments for the period to 31 May 2024 be received for

information, with any changes requested for the Record of Investments to be

reflected in the report for the period to 30 June 2024.

Implications: Nil

Background

Please refer to the attached monthly reports provided by

Council’s Independent Investment Advisor, Arlo Advisory Pty Ltd (formally

Imperium Markets Pty Ltd).

Portfolio Return

The

investment returns were a stable 5.06% p.a. in May 2024, outperforming the

benchmark AusBond Bank Bill Index (4.50% p.a.) by fifty-six basis points

(0.56%).

The Reserve Bank of Australia left interest rates unchanged

at 4.35% at its May meeting.

Investments

Graph 1 below, shows the

performance of Council’s Investment Portfolio against the benchmark on a

rolling 12-month basis.

Graph

1 - Performance of Council’s Investment Portfolio against the benchmark

on a rolling 12 month basis

Investment

Interest Earned – May 2024

Table 1

below, shows the interest earned for the month of May 2024.

Table 1- Interest Earned for the Month of May 2024

|

Fund

|

Monthly Revised Budget

$

|

Actual Earned

$

|

Difference

$

|

|

General

|

281,333

|

303,005

|

21,672

|

|

Water

|

87,989

|

164,792

|

76,803

|

|

Sewer

|

56,904

|

63,790

|

6,886

|

|

Total

|

426,226

|

531,587

|

105,362

|

The interest earned for the

month of May, was $531,587 compared to the monthly revised budget of $426,226.

Investment Interest Earned -

Year to Date

Table 2

below, demonstrates how the actual amount of interest earned year to date has

performed against the total budget.

Table 2 - Amount of interest earned year to date,

against the total budget.

|

Fund

|

Revised Total

Annual Budget

$

|

Actual

YTD

$

|

%

Achieved

|

|

General

|

3,312,464

|

3,369,705

|

101.73%

|

|

Water

|

1,036,000

|

1,832,647

|

176.90%

|

|

Sewer

|

670,000

|

709,412

|

105.88%

|

|

Total

|

5,018,464

|

5,911,763

|

117.80%

|

The

cumulative interest earned for the year (July to May)

was $5,911,763 which is 117.80% of the current full year revised budget.

Graph 2

(3 separate graphs) below, illustrates the cumulative interest earned for the

year for each fund (General, Water and Sewer) against budget:

Graph 2 - Cumulative interest

earned for the year for each fund against budget.

Graph 2 - Cumulative interest

earned for the year for each fund against budget.

Cash and Restricted Assets, Restricted Asset Movements

and Liquidity Indicators

As at 30

June 2023, Council had spent $35M in grants spent in advance. In accordance

with Council's adopted Liquidity Contingency Plan, internal restrictions were

utilised to fund the grants spent in advance.

Since 30

June 2023 and up to 31 May 2024, Council received $26M of the outstanding

grants spent in advance balance.

Statement

by Responsible Accounting Officer

I hereby certify that the

investments listed in the attached report have been made in accordance with

Section 625 of the Local Government Act 1993, Clause 212 of the Local

Government (General) Regulations 2021 and Council’s Investments Policy.

Katie Buckman Date:

24 June 2024

|

|

Ordinary

Meeting – Monday 24 June 2024

Page

0

|

CL24.179 Delivery

Program Operational Plan, Budget 2024/25 - Exhibition Outcomes

HPERM Ref: D24/210280

Department: Corporate

Performance & Reporting

Approver: Robyn

Stevens, Chief Executive Officer

Attachments: 1. Draft

Delivery Program Operational Plan and Budget 2024-25 - Post Exhibition (under

separate cover) ⇨

2. Draft

Fees and Charges 2024-25 - Part 1 - Post Exhibition (under separate cover) ⇨

3. Draft Fees and Charges

2024-25 - Part 2 - Post Exhibition (under separate cover) ⇨

Reason for Report

The purpose of this report is to

seek Council’s adoption of the 2024/25 Delivery Program and Operational

Plan, Budget and Fees & Charges.

The report provides a summary and comments related to the

outcomes of the public exhibition process undertaken from 8 May to 10 June

2024.

|

Recommendation

That

having considered the submissions received as part of the exhibition process

for the Draft Delivery Program and Operational Plan 2024/25 including Budget,

Capital Works Program and Fees and Charges, Council:

1. Adopt the 2024/25 Delivery Program

and Operational Plan and Budget inclusive of the following

changes:

a. Updates to DPOP Actions and KPIs as

outlined in this report

b. Revision of the capital works

listing as outlined in Attachment 1.

c. Note that the budget reflects

Council’s current service offerings, service levels and organisational

structure. As savings are identified, endorsed, and implemented, they can be

reliably measured. Once reliably measured, adjustments will be made to the

budget at each quarter budget review to recognise the recurrent, and/or one

off savings achieved.

2. Adopt the 2024/25 Fees and Charges

Part 1 and Part 2 with the following changes:

a. Added new interment services levy as

announced by Cemeteries and Crematoria NSW (CCNSW)

b. Amended regulated Development

Application fees as announced by the Department of Planning, Housing and

Infrastructure

c. Rectified Holiday Haven Van

Occupancy Annual Fee with an additional line ‘All Other Parks’ -

$7,907 (incl. GST)

d. Rectified Effluent Removal Charges

for Properties with Bi-Weekly service

3. Resolve to make the following rates

and charges in accordance with Section 535 of the Local Government Act 1993,

inclusive of a 4.50% rate-peg increase as per and Section 506 of the Local

Government Act 1993:

a. Make an Ordinary Rate, consisting of

an ad valorem rate of 0.09923c for each dollar of rateable land value in

addition to a base amount of seven hundred and sixty dollars ($760.00) per

rateable assessment, under Section 537 of the Local Government Act 1993, on

all rateable land categorised as “Residential”, in accordance

with Section 516, for the period 1 July 2024 to 30 June 2025 and, in

accordance with Section 543(1), this rate be named “RESIDENTIAL”.

Further,

to comply with Section 500 of the Act, the total amount payable by the

levying of the base amount of seven hundred and sixty dollars ($760.00) per

rateable assessment for the “RESIDENTIAL” category will not

produce more than 50% of the total amount payable by the levying of the

“RESIDENTIAL” rate in accordance with Section 537(b) [base amount

percentage is 49.94%].

b. Make an Ordinary Rate, consisting of

an ad valorem rate of 0.09923c for each dollar of rateable land value in

addition to a base amount of fifty dollars ($50.00) per rateable assessment,

in accordance with Section 537 of the Local Government Act 1993, on all

rateable land which is zoned so as not to permit any building (i.e.; Small

Lot Rural Subdivisions) and categorised as “Residential”, in

accordance with Section 516, sub category “NON-URBAN”, in

accordance with Section 529(2)(b), for the period 1 July 2024 to 30 June

2025, and in accordance with Section 543(1), this rate be named

“RESIDENTIAL NON-URBAN”.

Further,

to comply with Section 500 of the Act, the total amount payable by the

levying of the base amount of fifty dollars ($50.00) per rateable assessment

for the “RESIDENTIAL NON-URBAN” category will not produce more

than 50% of the total amount payable by the levying of the “RESIDENTIAL

NON-URBAN” rate in accordance with Section 537(b) [base amount

percentage is 37.92%]

c. Make an Ordinary Rate, consisting of

an ad valorem rate of 0.19932c for each dollar of rateable land value, in

accordance with Section 518 of the Local Government Act 1993: “Land is

to be categorised as ‘business’ if it cannot be categorised as

farmland, residential or mining”. Excepting all rateable land in the

subcategories of Commercial/Industrial, Nowra, and Major Retail Centres, an

ordinary rate be now made for the period of 1 July 2024 to 30 June 2025 and,

in accordance with Section 543(1), this rate be named “BUSINESS”.

d. Make an Ordinary Rate, consisting of

an ad valorem rate of 0.51600c for each dollar of rateable land value in

addition to a base amount of seven hundred and sixty dollars ($760.00) per

rateable assessment, in accordance with Section 537 of the Local Government

Act 1993, on all rateable land determined to be a centre of activity and

categorised as “Business”, in accordance with Section 518,

sub-category “NOWRA”, in accordance with Section 529(2)(d), for

the period 1 July 2024 to 30 June 2025 and, in accordance with Section

543(1), this rate be named “BUSINESS - NOWRA”.

Further,

to comply with Section 500 of the Act, the total amount payable by the

levying of the base amount of seven hundred and sixty dollars ($760.00) per

rateable assessment for the “BUSINESS - NOWRA” subcategory will

not produce more than 50% of the total amount payable by the levying of the

“BUSINESS - NOWRA” rate in accordance with Section 537(b) [base

amount percentage is 16.75%].

e. Make an Ordinary Rate, consisting of

an ad valorem rate of 0.17380c for each dollar of rateable land value in

addition to a base amount of seven hundred and sixty dollars ($760.00) per

rateable assessment, in accordance with Section 537 of the Local Government

Act 1993, on all rateable land used or zoned for professional/commercial

trade or industrial purposes, determined to be a centre of activity and

categorised as “Business”, in accordance with Section 518, sub

category “COMMERCIAL/INDUSTRIAL”, in accordance with Section

529(2)(d), for the period of 1 July 2024 to 30 June 2025 and, in accordance

with Section 543(1), this rate be named “BUSINESS -

COMMERCIAL/INDUSTRIAL”.

Further,

to comply with Section 500 of the Act, the total amount payable by the

levying of the base amount of seven hundred and sixty dollars ($760.00) per

rateable assessment for the “BUSINESS –

COMMERCIAL/INDUSTRIAL” category will not produce more than 50% of the

total amount payable by the levying of the “BUSINESS –

COMMERCIAL/INDUSTRIAL” rate in accordance with Section 537(b) [base

amount percentage is 31.33%].

f. Make an Ordinary Rate,

consisting of an ad valorem rate of 0.72930c for each dollar of rateable land

value in addition to a base amount of seven hundred and sixty dollars

($760.00) per rateable assessment, in accordance with Section 537 of the

Local Government Act 1993, on rateable land Lot 2 DP 874730 determined to be

a major retail centre and categorised as “Business”, in

accordance with Section 518, sub category “MAJOR RETAIL CENTRE -

NOWRA”, in accordance with Section 529(2)(d), for the period of 1 July

2024 to 30 June 2025 and, in accordance with Section 543(1), this rate be

named “BUSINESS - MAJOR RETAIL CENTRE - NOWRA”.

Further,

to comply with Section 500 of the Act, the total amount payable by the

levying of the base amount of seven hundred and sixty dollars ($760.00) per

rateable assessment for the “BUSINESS – MAJOR RETAIL CENTRE -

NOWRA” category will not produce more than 50% of the total amount

payable by the levying of the “BUSINESS – MAJOR RETAIL CENTRE -

NOWRA” rate in accordance with Section 537(b) [base amount percentage

is 0.96%].

g. Make an Ordinary Rate, consisting of

an ad valorem rate of 0.35130c for each dollar of rateable land value in

addition to a base amount of seven hundred and sixty dollars ($760.00) per

rateable assessment, in accordance with Section 537 of the Local Government

Act 1993, on rateable land Lot 1 DP 1182358 determined to be a major retail

centre and categorised as “Business”, in accordance with Section

518, sub category “MAJOR RETAIL CENTRE - VINCENTIA”, in

accordance with Section 529(2)(d), for the period of 1 July 2024 to 30 June

2025 and, in accordance with Section 543(1), this rate be named

“BUSINESS - MAJOR RETAIL CENTRE - VINCENTIA”.

Further,

to comply with Section 500 of the Act, the total amount payable by the

levying of the base amount of seven hundred and sixty dollars ($760.00) per

rateable assessment for the “BUSINESS – MAJOR RETAIL CENTRE -

VINCENTIA” category will not produce more than 50% of the total amount

payable by the levying of the “BUSINESS – MAJOR RETAIL CENTRE -

VINCENTIA” rate in accordance with Section 537(b) [base amount

percentage is 1.85%]

h. Make an Ordinary Rate, consisting of

an ad valorem rate of 0.07520c for each dollar of rateable land value in

addition to a base amount of one thousand and twelve dollars ($1,012.00) per

rateable assessment, in accordance with Section 537 of the Local Government

Act 1993, on all rateable land categorised as “Farmland”, in

accordance with Section 515, for the period 1 July 2024 to 30 June 2025 and,

in accordance with Section 543(1), this rate be named “FARMLAND”.

Further,

to comply with Section 500 of the Act, the total amount payable by the

levying of the base amount of one thousand and twelve dollars ($1,012.00) per

rateable assessment for the “FARMLAND” category will not produce

more than 50% of the total amount payable by the levying of the

“FARMLAND” rate in accordance with Section 537 (b) [base amount

percentage is 32.99%].

i. Make an Ordinary Rate,

consisting of an ad valorem rate of 0.03970c for each dollar of rateable land

value in addition to a base amount of one thousand one hundred and forty-four

dollars ($1,144.00) per rateable assessment, in accordance with Section 537

of the Local Government Act 1993, on all rateable land categorised as

“Farmland”, in accordance with Section 515, sub category

“DAIRY FARMERS”, in accordance with Section 529(2)(a), for the

period 1 July 2024 to 30 June 2025 and, in accordance with Section 543(1),

this rate be named “FARMLAND - DAIRY FARMERS”.

Further,

to comply with Section 500 of the Act, the total amount payable by the

levying of the base amount of one thousand one hundred and forty-four dollars

($1,144.00) per rateable assessment for the “FARMLAND – DAIRY

FARMERS” category will not produce more than 50% of the total amount

payable by the levying of the “FARMLAND – DAIRY FARMERS”

rate in accordance with Section 537(b) [base amount percentage is 49.96%].

j. Make a Special Rate, in

accordance with Section 538, consisting of an ad valorem rate of 0.38260c for

each dollar of rateable land value in addition to a base amount of two

thousand six hundred and seventy-four dollars ($2,674.00), for the cost of

road upgrades required to enable property owners to develop their allotments

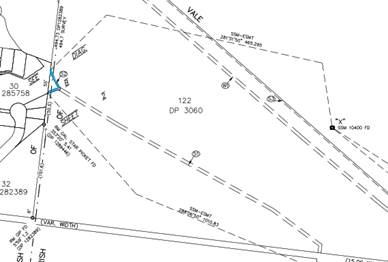

in the Verons Estate. In accordance with Section 495(1), the special rate is