|

|

Ordinary Meeting – Tuesday 04 October 2016 Page 2 |

Ordinary Meeting

Meeting Date: Tuesday, 04 October, 2016

Location: Council Chambers, City Administrative Building, Bridge Road, Nowra

Attachments (Under Separate Cover)

Index

8. Reports

CL16.17 Investment Report - August 2016

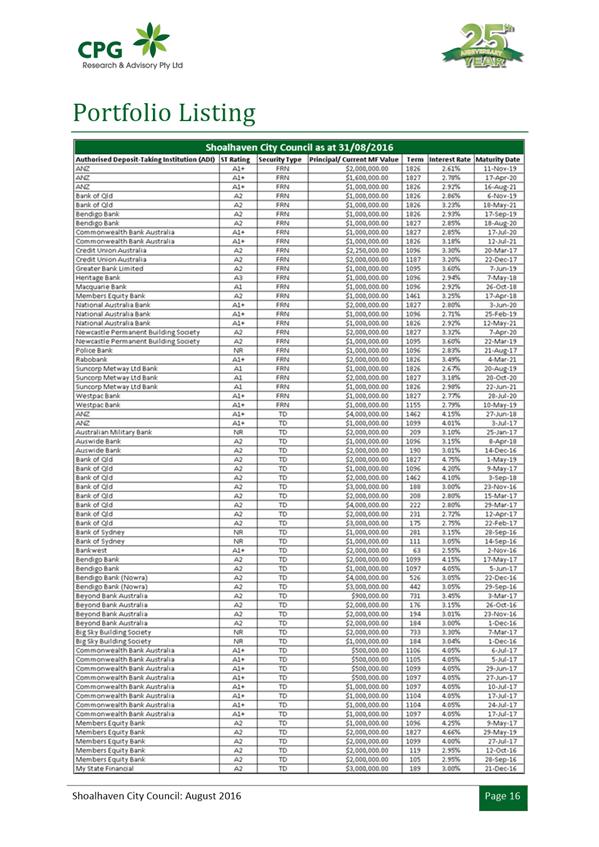

Attachment 1... Monthly Investment Report - August 2016............................. 2

CL16.19.... Review of the Local Government Rating System

Attachment 1... Issues Paper......................................................................... 19

Attachment 2... Council Response to Issues Paper....................................... 97

Attachment 3... Draft Report on Recommendations................................... 107

Attachment 4... Councils Response to the Recommendations................... 267

CL16.30.... Public Engagement - Recycling & Waste Transfer Facilities

Attachment 1... Kioloa Waste Facility........................................................... 279

Attachment 2... Sussex Inlet Waste Facility................................................. 302

Attachment 3... Lake Conjola Waste Transfer Facility................................. 349

Attachment 4... Callala Waste Facility.......................................................... 375

Attachment 5... Berry Waste Transfer......................................................... 426

Attachment 6... Kangaroo Valley Waste Transfer........................................ 475

Attachment 7... Bendalong Waste Transfer................................................. 501

Attachment 8... Service Review Executive Summary................................ 524

CL16.37 Emergency Overflow Storage Facilities - Sewage Pumping Stations - Various Locations - REF

Attachment 1... Review of Environmental Factors (REF) Report............... 542

Attachment 2... REF Annexure 1 - Plans - Sewage Pumping Stations....... 633

Attachment 3... REF Annexure 2 - SLEP Mapping..................................... 663

Attachment 4... REF Annexure 3 - Aboriginal Due Diligence...................... 674

Attachment 5... REF Annexure 4 - Threatened Species Assessment......... 732

|

|

Ordinary Meeting – Tuesday 04 October 2016 Page 97 |

|

IPART Level 15, 2-24 Rawson Place SYDNEY NSW 2000 |

Council Reference: 8923E (D16/136903)

Your Reference: Rating Review

Attention: IPART

Review of Issues Paper for the Review of Local Government Rating System

List of Issues on which comment is requested.

Taxation Principles

1. Do you agree with our proposed tax principles? If not, why?

Yes Council agrees with the proposed principles of taxation:

· Efficiency – given they are a wealth tax on land or property values

· Equity – given they are based on the property value, therefore increase with greater land value or implied greater wealth.

· Simplicity – they are easily understood, they are difficult to avoid, as property is immovable

· Sustainability, they are enduring and should grow with economic development.

· Competitive neutrality should be maintained as

Councils have the ability to establish rates based on levels of service and

based on similar amounts in like business areas.

They are reasonably stable, visible and accountable.

Assessing the current method for setting rates

2. What valuation method should be used as the basis for determining the ad valorem amounts in council rates? Should councils be given more choice in selecting valuation method, as occurs in other states, or should a valuation method continue to be mandated?

The valuation method currently in use ie unimproved land value (UCV), does not adequately cover undeveloped land and land with multi-story buildings. To cover for these examples and other development / property or rating anomalies the capital improved value (CIV) may be a better basis for rates calculations, and is more readily understood by the public.

The use of CIV adding value to a number of issues is raised throughout this paper.

Important to note that if the same valuation method is not mandated then neighbouring councils may implement very different models for their ratepayers and hence drive behaviours across council borders, causing competitive neutrality issues, along with inequities and inconsistencies, particularly when comparing the basis of rates for different council areas.

The negative in using a CIV is a possible detrimental impact on investment within the Local Government area.

3. Should councils be required to use the Valuer General’s property valuation services, or should they also be able to use a private valuation firm (as occurs in Victoria and Tasmania)?

Most valuations are done by local firms on behalf of the Valuer General, so making a change to who can do these valuations may not make a significant difference to the work being carried out. Given that most of these valuations are now a desk top review, as opposed to field work, a review of the costing structure might also be timely. In conjunction with this more regulation over the increases to valuation might be opportune to keep these within a “rate peg” structure. Any objections to valuations would still need to go through the Valuer General Department.

4. What changes (if any) should be made to the Local Government Act to improve the use of base and minimum amounts as part of the overall rating structure?

The use of a base or minimum rate ensures that all rate payers are paying the same amount to cover public good or those which provide collective benefits ie parks, roads etc.

However the maximum of 50% towards base rate could be more flexible in terms of allowing a slightly higher proportion of rates to be collected as a base to cover public goods provided and less reliance on the ad valorem driving incremental income which is based on the wealth of the landowner. Ie if land values go up higher in one area over another there will be a greater shift in rates, with a higher ad valorem.

But overall no significant issues to this remaining as is.

5. What changes could be made to rating categories? Should further rating categories or subcategories be introduced? What benefits would this provide?

There are a couple of issues with rating categories which needs to be addressed:

a. Currently bed and breakfast, serviced apartments and holiday accommodation is rated within either the business or the residential rating category, depending upon whether the definitions can be established. However to have clarity or further definitions around these type properties would benefit when trying to rate these dwellings, therefore a separate category/ies for Bed and Breakfast/Serviced Apartments/Holiday accommodation is recommended, with clarity around the definitions to enable ease of definition and therefore rating. Some of the criteria which could be used in determining these type dwellings would be:

I. The property is advertised for use

II. They have 3 beds or more available for use

III. They are utilised for more than 100 nights per year

IV. They are registered as business with an ABN

V. They can be managed or owned

VI. Links to the ATO data for level of income ie over $20,000 from these type activities.

These properties would be rated within this category in the first instance and then have an option to appeal if they can prove they are residential or business

b. Everything that does not fall into the Residential, Farming or Mining categories falls by default into the Business category, however some things do not fit within this category ie grave sites, jetties, non-descript small parcels of land of low value would be unfairly rated if a base or minimum rate were to be applied. Another category for low value, low usage land would improve equity of these ratings.

c. The Centre of Activity wording for the basis of a rate sub category can also cause issues as some categories would be better placed being based on the type of activity or population as opposed to where they are located, eg industrial properties might be scattered in a number of different locations within the Local Government area as opposed to one location, therefore 2 (or more) sub categories would be required, as opposed to one for the like type businesses.

d. The Rural Residential Rate Sub Category causes a lot of confusion with ratepayers and councils alike particularly with the definition surrounding the restriction on land size and occupation conditions. Either the conditions need to be reviewed and amended or this Sub Category should be removed.

e. There could be some merit to a “vacant land” category also, (only applied if UCV is maintained and Developer Allowances removed) to allow a lower rate to be charged where land is not in use. However, this may increase speculative holding of lands, and may increase incentives to hold lands and by default discourage development.

f. The Mining category should be expanded to allow for types of mines other than that of metalliferous and coal (including sand mining).

g. Separate categories for Crown land/Reserves, Defence, Private Schools / Universities or Government Organisations which may be valued at a subsidised level to other rating categories. Much of this land would need to have new valuations done by the Valuer General, as currently many of these properties are not valued. Rates should be charged at full commercial rates where the State/Federal Government are operating commercial activities eg State Forests.

h. A full review of the criteria defining non rateable properties is required as Section 555 & 556 are outdated and onerous. Ie a building occupied by a teacher or caretaker, land belonging to a school being a government school or a non – government school, land belong to a public benevolent institution or charity particularly given the current concerns with CHP’s having such a large impact on council revenue etc etc

6. Does the current rating system cause any equity and efficiency issues associated with the rating burden across communities?

With the current system and the proposed merger of councils one of the key issues raised has been the level of rates in one LG area to the other merger proposal area. This is obviously driven by the level of service provided in each council, along with differing land values in each Local Government area. However there will be significant issues when trying to bring the two disparate systems together into one rating system.

Given that the Shoalhaven is a major tourist attraction during the summer season, Council spends significant monies during these months to cater for tourists, at the expense of local rate payers. This is not something which can be fixed through the rating system, however Grant funding from State and Federal Government (currently via FAGS) should cater for this cross subsidisation.

7. What changes could be made to current rate pegging arrangements to improve the rating system, and, in particular, to better streamline the special variation process?

In terms of the rate peg the IPART calculations for the Local Government Cost Index do not take into consideration key variations to costs within specific Councils, see examples below for Shoalhaven City Council:

a. The award increase for wages will be 2.8% for 2016/17. The LGCI used 2.4%

b. Step changes for employees were not considered which are 2.5% for approx. 50% of the employee base ie an additional 1.25% increase in wages

c. Contracted electricity increases at a maximum of 27% over the next three years. The LGCI used a reduction of 6.6%

d. The requirements to maintain expenditure on roads and infrastructure at 3% incrementally year on year, as well as try to increase the overall maintenance carried out across Council. The LGCI used 1.3% for Road, footpath, kerbing, bridge and drain building materials

e. Increases in depreciation due to revaluation of assets, which can add millions to Council’s cost structure, thereby affecting the operating result before capital grants, which is one of the key measures for Fit for the Future.

f. Emergency Services Levy at 1.5%, whereas the increase for Shoalhaven for Emergency services was $811k, an increase of 79% on the out year budget.

It would be more beneficial to allow Councils to make the calculation as to what the rate peg should be, taking into account Council specific costs and then putting a proposal to IPART to approve the recommended adjustment to rates.

Perhaps a template to capture this data would be appropriate for comparative purposes with other Councils. The requirement to submit this document might only apply if the increase to be requested is over a certain threshold ie > 2% of average household income.

With regard to Special Rate Variations, there are a number of factors to consider – there is considerable effort involved in applying for a special rate variation from both a Council and an IPART perspective, a simpler approach is required.

If a Council has included the Special Rate into their IP&R documentation, held community consultation and the increase is within the 2% of average household income then there should be no need for further approval, as covered above.

If the increase is above this amount the process could be streamlined to the following:

a. Confirmation the proposed rate increase is included in IP&R documentation

b. Confirmation that community consultation has been carried out

c. Completion of the Local Government Cost Index (LGCI)

d. Acceptance of proposal by IPART

8. What changes could be made to the rating system to better encourage urban renewal?

By utilising Capital – Improved Value, it may assist mums and dads and Developers until developments are up and running or homes completed, as they would be rated on land value which will be lower than the improved value. Administering this process could be difficult although some suggestions are:- at practical completion of the project or occupancy certificate (interim or final) stage for a residential dwelling or when bins are being ordered for a property a CIV is requested from the VG or Council apply a higher ad valorem rate to vacant land (no base rate) or two valuations are granted for vacant land with the second valuation being a proposed valuation for a developed site based on surrounding CIV which the property owner could have the option of objecting to based on VG criteria for objections.

Incentives might be better placed in the contributions plan for Developers.

9. What changes could be made to the rating system to improve council’s management of overdue rates?

Agree the current process of accumulating interest at 8.5% does deter somewhat from speeding up collections. It also is a constant issue with rate payers the high level of interest charged. The rate is so far out of alignment to current interest rates also, given that returns from banks on large investments are in the high 3’s.

The recent increases in legal costs to take overdue rates through court are as a deterrent for Councils.

Any pensioner deferral policies in place also make it difficult to manage debts.

One area for improvement would be coordinating with Centrelink to take rates payments out of all pensions before payment to the individual. This would speed up collection processes, spread payments out for pensioners and reduce outstanding. If this were to happen, a review of the current cost per transaction would need to be carried out, given that the current charge is .90 cents per transaction per month.

Another ongoing issue for Council is electronic serving of rates notices, this needs to be addressed in any changes to the rating system, such that the guidelines are very clear. This should by default speed up delivery and payment of rates if using electronic means and be more cost effective based on the increasing cost of postal services.

Assessing exemptions, concessions and rebates

10. Are the land uses currently exempt from paying council rates appropriate? If a current exemption should be changed, how should it be changed? For example, should it be removed or more narrowly defined, should the level of government responsible for providing the exemption be changed, or should councils be given discretion over the level of exemption?

All properties categorised as residential or business and occupied should be rateable regardless of ownership as ALL such properties utilise Council services, and in some cases provide a greater drain on Council resources than rateable properties. See below examples of issues with the current arrangement which need to be addressed to relieve the burden on local ratepayers within the LG area.

a. Defence land being non rateable where there is significant impact on local infrastructure, eg the Beecroft Weapons Range in Currarong, NSW (Land holding of $2.8m). Defence are carrying out works within the range which results in substantial road activity by large truck and trailer combinations. This causes the condition of the road to deteriorate, requiring Council to allocate funds for its repair. Defence should work with Councils in areas of substantial activity to devise a long term plan to upgrade roads and maintain them accordingly. To upgrade roads to cater for increased activity would possibly be funded by Grant funding, however from an ongoing perspective Defence should be accountable for paying rates to maintain the road quality. This area is also a tourist site and attracts large numbers of tourists to the area who utilise (but do not pay for) Council resources.

b. Burrill Lake Tourist Park is owned by Royal Australian Navy Central Canteen Board. They have been receiving non rateable status from at least 2002. The current land value on the property is $1,500,000. Although the park gives priority to Defence Force personal the park is very popular with the general public and is regularly booked to capacity generating presumably very high returns . The returns from this investment are taken out of the community and result in increased rates for local residents. Any Commercial enterprises, regardless of owner should be rateable.

c. Department of Housing currently does not gain exemptions from rating, however when they vest these properties to Community Housing Organisations, these organisations are requesting non-rateability, although the houses are being used for the same or similar purpose. This issues revolve around the definition of benevolent associations, but from a Council perspective to change these properties from rateable to non-rateable would impact significantly on Councils rating income. Regardless of ownership these properties should continue to be rateable.

d. From a Department of Housing perspective also they only pay rates when the property in question in occupied. They are very quick to let us know when a property has no tenants but not so quick informing Council when a new tenant has been placed in the property. This results in less revenue for Council. There is no incentive to turn these properties over quickly, so the rateable/non rateable status should not exist.

e. For private schools to be non-rateable they must not be operating commercial activities, where they do have commercial operations than they should be rated accordingly.

f. Land uses for religious or charitable purposes, if there is a portion of their operations which are profit generating then they should pay rates for this portion.

g. Oyster farmers have the ability to earn income from commercial operations so should not be exempt from paying rates. The value of their properties need to be included in the Capital Value and rates charged accordingly.

h. Private hospitals and Universities both are commercial operations, so should not be exempt from paying rates, but perhaps are charged under another category at a lower rate.

i. National Parks and Crown hold vast areas of land in the Shoalhaven area and need to be rated even if at a reduced rate.

11. To what extent should the exemptions from certain state taxes (such as payroll tax) that councils receive be considered in a review of the exemptions for certain categories of ratepayers?

No comment

12. What should the objectives of the pensioner concession scheme be? How could the current pensioner concession scheme be improved?

The financial contribution from Councils to support this scheme increases as the population of the Local Government area ages. The effect on this is further burden on less tax payers, so is neither sustainable nor equitable.

In addition to these limitations, the Council Rebate for water and sewer is a fixed concession for eligible pensioners jointly funded by the NSW State Government and Local Councils. The rebate a pensioner in an area not serviced by Sydney Water or Hunter Water is based on the following as contained within the Local Government Act:

• 50% of a water charge up to a maximum $87.50 concession

• 50% of a sewerage charge up to a maximum $87.50 concession

So an eligible pensioner in these areas can receive a maximum of $175 off their total water and sewer charges.

These maximum available concessions have been in place for many years, without any adjustments. Therefore, as water and sewerage bills have increased in real terms over time, pensioner rebates decline in value relative to the total water and sewerage bills.

Councils contribute 45% of these concession costs, through lost income to the water and sewer funds.

The pensioner rebates for eligible Sydney Water customers are calculated in a different way, and are far greater. Those rebates are 100% of the water access charge and 83% of the sewer access charge. These rebates are funded from the state government as CSOs. It is noted that in the 2008 IPART pricing determination for Sydney Water, the following was stated by IPART:

“IPART considers that customer-impact mitigation is primarily the responsibility of the Government as part of its broader social policy. IPART recommends that the Government evaluates the current suite of social programs, along with the enhancements proposed by Sydney Water in its initial submission, to ensure that appropriate measures are in place to assist financially disadvantaged customers………………………

The Pension Rebate should be increased with CPI or in line with the Rate Peg and should only apply to aged pensioners or those on disability pensions, therefore not include unemployed or sole parents unless asset tested.

Freezing existing rate paths for newly merged councils

13. We have interpreted the rate path freeze policy to mean that in the four years after a merger, the rating path in each pre-merger council’s area will follow the same trajectory as if the merger had not occurred. Do you agree with this interpretation?

Yes we agree with that interpretation. The issue is where one interprets the starting point of the trajectory from. The current information stated publically indicates the starting point is if an IPART SRV has already been approved. This is not the starting point of the trajectory for the rating path. If a Council has undertaken the necessary planning, has consulted with the community, included the proposed rate increases in their DPOP and their Fit for the Future applications then these rate increases are clearly on the Council’s rating path and should be permitted in the merged Council. These strategies included a Special rate over 2 years to achieve the desired outcomes. These had been communicated to the community as part of the Delivery Program from 2015/16. However, these plans seem to have been totally ignored from an OLG/IPART perspective and in their place the OLG/IPART have reverted to plans from 2014/15. If Council is to merge or not then the trajectory from 2015/16 plans should allowed to be followed.

Below is a diagrammatic of the process followed and the point at which the process has been aborted.

![]()

14. Within the rate path freeze period, should merged council’s be permitted to apply for new special variations:

· For Crown Land added to the rating base?

· To recover amounts that are “above the cap” on development contributions set under the Environmental Planning and Assessment Act 1979?

· To fund new infrastructure projects by levying a special rate?

Yes, no further comment.

15. Are there any other situations where merged councils should be able to apply for new special variations within the rate path freeze period?

Merged Councils should also be able to apply for a new special variation under the additional scenarios below:

a. If it was in their Long Term Financial Plans and community consultation had been previously carried out

b. If it is for new infrastructure projects where a special rate is required to be levied ie paper subdivisions

c. If an extraordinary situation arises that requires Council to take immediate action to increase the rating base ie a natural disaster or community or global crisis, where funds need to be raised to rebuild infrastructure.

d. In circumstances where a local community wants an additional service and is prepared to pay an additional special rate – i.e. Sussex Canal development area to pay a special rate to replace Jetty fees.

16. During the rate path freeze period, should merged councils only be able to increase base amounts and minimum amounts each year by the rate peg (adjusted for any permitted special variations)?

No, pre-merged Councils should still have the ability to make changes within each individual councils rating structure to account for reallocation of service costs, or more equitable distributions of the rating burden within each of the individual councils. These type changes are made on an annual basis within an individual council and this process should not be stymied.

If a revaluation occurs during the “freeze” period, which for Shoalhaven Council it will then dependent upon how the land values are affected, the current rating structure may need to be reallocated to maintain a fairer rating system.

17. During the rate path freeze period, should merged councils be able to allocate changes to the rating burden across rating categories by either:

a. Relative changes in the total land value of a rating category against other categories within the pre-merger council area, or

b. The rate peg (adjusted for any permitted special variants)?

See response to question 16. above.

18. Do you agree that the rate path freeze policy should act as a ‘ceiling’, so councils have the discretion to set their rates below this ceiling for any rating category?

Agree but don’t see this as a practical option for our Council, given the deficits we will be running if a special rate is not permitted. The current rating path trajectory includes a SRV rate increases of at least 7.5%

19. What other discretions should merged councils be given in setting rates during the rate freeze period?

If Councils advance in their merger proposal and start to bring the disparate rating systems onto one system, then Councils should be able to start aligning rates for the two councils into the one structure earlier than the expiration of the “freeze” period.

Council should also be permitted to include any catch-up from previous rating years into their rating base.

20. We considered several options for implementing the rate path freeze policy. Our preferred option is providing the Minister for Local Government with a new instrument-making power. What are your views on this option and any other options to implement the rate path freeze policy?

Preferred option would be the one:

a. With the least administration requirement

b. Which can happen in the shortest timeframe

c. One which can be reverted back easily if/when required.

Establishing new, equitable rates after the 4-year freeze

21. Should changes be made to the LG Act to better enable a merged council to establish a new equitable system of rating and transition to it in a fair and timely manner? If so, should the requirement to set the same residential rate within a centre of population be changed or removed?

Being able to levy rates within a centre of population will allow Councils to levy rates on two or more distinct pre-merged council areas, so this requirement should be acceptable although not mandatory as it may be more practical to base the rates on like type activities or use which would be more flexible and reduce the need for multiple categories.

22. Should approved special variations for pre-merger councils be included in the revenue base of the merged council following the 4-year rate path freeze?

Yes any special variations approved either prior to the merger or after the merger should be included in the revenue base for the merged council. These increases should only apply to the Council which had them in their plans.

23. What other rating issues might arise for merged councils after the 4-year rate path freeze period expires?

Aligning rates from the two disparate councils will require significant consultation and if a decision is made to align the rates into one residential rate as opposed to two rates for the separate centres of population, then one rate goes up and the other down and if this is the case then a full review of service levels would also be required in both LG areas.

If two different residential rates prevail then the argument will always be there with regard to the different levels of service provided.

Any review of the services provided by either council with a view to include, eliminate or modify services will be a costly and time consuming exercise, given that a lot of community consultation will have to be undertaken. A poor decision by council will have a very negative effect on the ratepayers which will reflect badly on the new council.

If you need further information about this matter, please contact Pamela Gokgur, Corporate & Community Services Group on (02) 4429 3322. Please quote Council’s reference 8923E (D16/136903).

Yours faithfully

Pamela Gokgur

Chief Financial Officer

12/05/2016

|

|

Ordinary Meeting – Tuesday 04 October 2016 Page 267 |

ATTACHMENT D – COUNCILS RESPONSE TO THE RECOMMENDATIONS

The Review of the Local Government Rating System

Feedback in terms of the 34 draft recommendations which have come out of the Draft report on the Local Government Rating System, are below. Where Council is in agreement with the recommendation – minimal comment is made. Where Council thinks there are other issues to consider, comments have been made to state Councils position.

Recommendations

1. Councils would be able to choose either the Capital Improved Value, based on its market value (ie land value plus capital improvements) or Unimproved Value method to set a property’s rates. A council’s maximum general income should not change as a result of the valuation method they choose.

a. This recommendation is in line with Councils Submission to the review and is a much more equitable approach

b. It caters for undeveloped land, strata property and multi-story building issues

c. However may impact on investment within the Local Government area, as rates increase when capital constructions are carried out.

d. AGREE

2. Minimums amounts should be removed from the rate structure, as councils would have the option to use CIV there would be no need to retain this fixed rate component in the system. Section 497 of the Local Government Act 1993 (NSW) should be amended to remove minimum amounts from the structure of a rate, and Section 548 of the Local Government Act 1993 (NSW) should be removed.

a. Council does not currently utilise Minimum rates and therefore is not impacted by this recommendation

b. Given the changes to the Valuation method and also the inclusion of new categories for land, this inferior method of recovering fixed costs would no longer be required.

c. It will simplify the rating structure

d. AGREE

3. Councils’ general income would increase (outside the rate peg) in line with the growth in CIV which arises from new development in their area. The growth in rates revenue outside the rate peg should be calculated by multiplying a council’s general income by the proportional increase in Capital Improved Value from supplementary valuations.

a. This would allow rates to increase to match costs of new development

b. Councils Income would increase in line with the increase in rateable properties

c. Would not impact on rates per household

d. Special Rates would only be required when increases in service levels are required or for major infrastructure projects

e. AGREE

4. The Local Government Act 1993 (NSW) should be amended to allow councils to levy a new type of special rate for new infrastructure jointly funded with other levels of Government. This special rate should be permitted for services or infrastructure that benefit the community, and funds raised under this special rate should not:

- Form part of a Council’s general income permitted under the rate, nor

- Require councils to receive regulatory approval from IPART

a. More information is required on how this would work and what would be required if not a Special Rate Variation.

b. AGREE in principle

5. Section 511 of the Local Government Act 1993 (NSW) should be amended to reflect that, where a council does not apply the full percentage increase of the rate peg (or any applicable Special Variation) in a year, within the following 10 year period, the council can set rates in a subsequent year to return it to the original rating trajectory for that subsequent year.

a. This would increase flexibility in setting rates and effectively increase the catch-up period to be 10 years rather than a 2 year period.

b. AGREE

6. Council’s would have the option to set different residential rates to reflect differences in access, demand or costs across their area. The Local Government Act 1993 (NSW) should be amended to remove the requirement to equalise residential rates by “centre of population”. Instead, councils should be allowed to determine a residential subcategory, and set a residential rate, for an area by:

- a separate town or village, or

- a community of interest

a. This recommendation is in line with Councils Submission to the review and is a much more equitable approach, particularly for Merger Councils

b. It allows for different residential rates for new developments as opposed to established suburbs or for different levels of service in disparate villages.

c. AGREE

7. An area should be considered to have a different “community of interest” where it is within a contiguous urban development, and it has different access to, demand for, or costs of providing council services or infrastructure relative to other areas in that development. New Councils, formed by the recent mergers, would also be able to choose to keep existing rate structures where there are different communities of interest, or equalise residential rates and transition to the new rates over time.

a. This was highlighted as an issue as part of Councils submission, so this approach will allow a smoother transition for merged councils

b. AGREE

8. The Local Government Act 1993 (NSW) should be amended so, where a council uses different residential rates within a contiguous urban development, it should be required to:

- ensure the highest rate structure is no more than 1.5 times the lowest rate structure across all residential subcategories (ie, so the maximum difference for ad valorem rates and base amounts is 50%), or obtain approval from IPART to exceed this maximum difference as part of the Special Variation process, and

– publish the different rates (along with the reasons for the different rates) on its website and in the rates notice received by ratepayers.

a. Council sees no issue with this recommendation

b. AGREE

9. At the end of the 4-year rate path freeze, new councils should determine whether any pre-merger areas are separate towns or villages, or different communities of interest.

- In the event that a new council determines they are separate towns or villages, or different communities of interest, it should be able to continue the existing rates or set different rates for these pre-merger areas, subject to metropolitan councils seeking IPART approval if they exceed the 50% maximum differential. It could also choose to equalise rates across the pre-merger areas, using the gradual equalisation process outlined below.

- In the event that a new council determines they are not separate towns or villages, or different communities of interest, or it chooses to equalise rates, it should undertake a gradual equalisation of residential rates. The amount of rates a resident is liable to pay to the council should increase by no more than 10 percentage points above the rate peg (as adjusted for permitted Special Variations) each year as a result of this equalisation. The Local Government Act 1993 (NSW) should be amended to facilitate this gradual equalisation.

a. Shoalhaven City Council are not affected by this recommendation

b. AGREE in principle

10. Sections 555 and 556 of the Local Government Act 1993 (NSW) should be amended to:

- Exempt land of the basis of use rather than ownership, and to directly link the exemption to the use of the land, and

- Ensure land used for residential and commercial purposes is rateable unless explicitly exempted.

a. This is a good start to correcting the inequities currently in place around exemptions, both result in private benefit and therefore should not be eligible for exemptions at all

b. A pro-rata approach to rates is a fairer model

c. We need further clarity around Defence and the types of activities they carry out on currently exempt land, these activities can have a detrimental impact on council services and there is no recovery, resulting in higher rates for all other rate payers.

d. Making non rateable properties now rateable should be reflected in an overall increase in Council income, rather than having to be built in with no increase, resulting in a reduction of rates to all other ratepayers.

e. AGREE to part of the recommendation but there are specific areas which are still unclear and the restriction on an increase to the Councils income should not be part of the recommendation.

11. The following exemptions should be retained in the Local Government Act 1993 (NSW):

- Section 555(e) Land used by a religious body occupied for that purpose

- Section 555(g) Land vested in the NSW Aboriginal Land Council

- Section 556(o) Land that is vested in the mines rescue company, and

- Section 556(q) Land that is leased to the Crown for the purpose of cattle dipping.

a. Section 555(g) applies only to vacant land so should not apply to land that is being used for a commercial or residential purpose.

b. AGREE

12. Section 556(i) of the Local Government Act 1993 (NSW) should be amended to include land owned by a private hospital and used for that purpose.

a. Agree to this change, as long as the land used is not for commercial purposes, if however the land is used for Commercial purposes than it should be rateable.

b. Clarity may also be required for Nursing Homes linked to Private and Public Hospitals.

c. CLARITY required.

13. The following exemptions should be removed:

- Land that is vested in, owned by, or within a special or controlled area for, the Hunter Water Corporation, Water NSW or the Sydney Water Corporation (Local Government Act 1993 (NSW) section 555(c) and section 555 (d))

- Land that is below the high water mark and is used for the cultivation of oysters (Local Government Act 1993 (NSW) section 555(h))

- Land that is held under a lease from the Crown for private purposes and is the subject of a mineral claim (Local Government Act 1993 (NSW) section 556(g)), and

- Land that is managed by the Teacher Housing Authority and on which a house is erected (Local Government Act 1993 (NSW) section 556(p))

a. Shoalhaven City Council does have some oyster leases that would be rateable if this exemption is removed

b. AGREE

14. The following exemptions should not be funded by local councils and hence should be removed from the Local Government Act and Regulation

- Land vested in the Sydney Cricket and Sports Ground Trust (Local Government Act 1993 (NSW) section 556(m))

- Land that is leased by the Royal Agricultural Society in the Homebush Bay area (Local Government (General) Regulation 2005 reg 123(a))

- Land that is occupied by the Museum of Contemporary Art Limited (Local Government (General) Regulation 2005 reg 123(b)), and

- Land comprising the site known as Museum of Sydney (Local Government (General) Regulation 2005 reg 123(c)).

- The State Government should consider whether to fund these local rates through State taxes.

a. Shoalhaven City Council are not impacted by this recommendation.

b. AGREE

15. Where a portion of land is used for an exempt purpose and the remainder for a non-exempt activity, only the former portion should be exempt, and the remainder should be rateable.

a. This was part of Shoalhaven City Councils submission

b. Clarity around how will this be audited

c. AGREE in principle

16. Where land is used for an exempt purpose only part of the time, a self-assessment process should be used to determine the proportion of rates payable for the non-exempt use.

a. More detail is required on appeals to assessments/audits.

b. Clarity required around the method of self-assessment and how this will work.

c. AGREE in principle

17. A Council’s maximum general income should not be modified as a result of any changes to exemptions from implementing our recommendations.

a. The recommendation includes a statement that “Removing some exemptions means that rates would go down for ordinary ratepayers”; however if exemptions increase one would assume that rates would go up for ordinary ratepayers, is this correct.

b. Council’s position is that regardless of changes in categories the current base rate and ad valorem would not change and any changes to rateability would be picked up in either less revenue or additional revenue.

c. DISAGREE with this

18. The Local Government Act 1993 (NSW) should be amended to remove the current exemptions from water and sewerage special charges in section 555 and instead allow councils discretion to exempt these properties from water and sewerage special rates in a similar manner as occurs under section 558(1).

a. No issues from a Shoalhaven Water perspective

b. AGREE

19. At the start of each rating period, councils should calculate the increase in rates that are the result of rating exemptions. This information should be published in the council’s annual report or otherwise made available to the public.

a. To allow this to be calculated we would need to maintain a register to record the land values of the exempt properties along with the rating category applicable if there was no exemption.

b. This will increase the administrative burden

c. DISAGREE

20. The current pensioner concession should be replaced with a rate deferral scheme operated by the State Government.

- Eligible pensioners should be allowed to defer payment of rates up to the amount of the current concession, or any other amount as determined by the State Government

- The liability should be charged interest at the State Government’s 10-year borrowing rate plus an administrative fee. The liability would become due when property ownership changes and a surviving spouse no longer lives in the residence.

a. This recommendation needs more information on how this scheme would operate ie:

i. Clarity around who would be responsible for what components and when these concessions would be “reimbursed” is required?

ii. In which books will the interest from deferred rates sit?

iii. The draft is unclear whether the reference to ‘liability’ is the State Government or Council. Will the State be providing payments of the deferred rates to councils or will they simply be paying interest? Or is the interest to be charged to the pensioner or Council? If the State does not pay Council the amount of the deferred rates what happens to the interest charged by Council?

iv. Would this information then need to go on the Section 603 certificates, as it will ultimately be a debt to the property?

v. How will this debt be communicated from the Office of State Revenue to Council

vi. This would slow the Section 603 certificate process down considerably

vii. Would/could this be managed by a caveat on the property?

b. From a Water perspective, the recommendation has not made reference to the water and sewer concession. As water and sewerage charges are directly necessary for the provision of this essential service, it is not recommended that it be treated in the same manner as the general rate.

c. Submissions to the LG Act review have previously been made to alter the method of calculating the concession for eligible pensioners in respect of water and sewerage charges. The concession available being allowed on the basis of 50% of a charge should be removed to ensure the concession can be applied efficiently and in a manner understood by concession holders.

d. AGREE in principle to the NSW Government fully funding the rebate scheme but further detail required, particularly with regards to impacts on Council’s cash flow and operating result.

21. Section 493 of the Local Government Act 1993 (NSW) should be amended to add a new environmental land category and a definition of “Environmental Land” should be included in the LG Act.

a. This would replace the “Residential – Non Urban” category which Council currently has in place

b. This would allow a reduced charge against this land, the use of which is restricted.

c. AGREE with the change

22. Section 493, 519 and 529 of the Local Government Act 1993 (NSW) should be amended to add a new vacant land category, with subcategories for residential, business, mining and farmland.

a. As part of Council’s submission it was highlighted that there was a need for a vacant land category

b. However Council did raise issues of speculative holding of land by developers, if they had lower rates for vacant land ie this may lower development

c. However if rates on vacant land are made higher it might encourage development and urban renewal but is not consistent with taxation principles when assessing the level of council services provided. As per the recommendations guidelines should be introduced to ensure these rates are not excessive.

d. AGREE in principle but very aware of the implications for ratepayers and getting the balance correct.

23. Section 518 of the Local Government Act 1993 (NSW) should be amended to reflect that a council may determine by resolution which rating category will act as the residual category.

- The residual category that is determined should not be subject to change for a 5 year period

- If a council does not determine a residual category, the Business Category should act as the default residual rating category.

a. At present the business category acts as the default location for all properties difficult to classify.

b. Most of these properties fall into the definitions of jettys, burial plots etc

c. The introduction of choice will allow greater flexibility

d. The introduction of a vacant land sub category will assist in this area more than a choice of residual category.

e. AGREE in principle.

24. Section 529 (2)(d) of the Local Government Act 1993 (NSW) should be amended to allow business land to be subcategorised as “industrial” and or “commercial” in addition to centre of activity.

a. This was covered in Council’s submission, particularly with regard to the current restriction of having to use a “centre of activity” for subcategorization

b. This will assist with equitable allocations based on the level of service provided in the two different types of business activities.

c. AGREE

25. Section 529 (2)(a) of the Local Government Act 1993 (NSW) should be replaced to allow farmland subcategories to be determined based on geographic location.

a. Council had not requested changes in this area in its submission, as this level of subcategorization is not required

b. A further categorisation by geographic area may assist if like farming enterprises are centred around different locations but this may not always be the case

c. A subcategorization based on farmland type might be a better indication of intensity of usage eg dairy farmers, wineries etc

d. NOT REQUIRED

26. Any difference in the rate charged by Council to a mining category compared to its average business rate should primarily reflect differences in the council’s costs of providing services to the mining properties.

a. No mining properties in the Shoalhaven, so Council are not impacted

b. AGREE in principle

27. Councils should have the option to engage the State Debt Recovery Office to recover outstanding council rates and charges.

a. It is unclear how this would operate in practical terms

b. There are some concerns about the recovery rate of 75% of all debt through the SDRO, Council currently recovers 94.5% of all debt

c. How would this debt be transferred or will factoring arrangements be put in place?

d. There are substantial volumes of debt which council currently chases up, what would be the cost if these debts were transferred to the SDRO, or would this all be recovered as part of the debt?

e. What time limit would be put in place before a debt would be transferred to the SDRO?

f. What would be the mechanism to ensure that debts with the SDRO are shown as part of the Section 603 process and recovered when properties are sold.

g. When the SDRO negotiates flexible payment plans will they take into consideration that instalments fall every 3 months. Council would not want an extended payment period which would then lead to the ratepayer accruing more overdue rates and again be subject to debt recovery action.

h. The idea is worth considering but does need more detail to allow Councils to make an informed decision.

28. The existing legal and administrative process to recover outstanding rates should be streamlined by reducing the period of time before a property can be sold to recover rates from five years to three years.

a. AGREE – this would improve recovery times for outstanding rates

29. All councils should adopt an internal review policy, to assist those who are late in paying rates, before commencing legal proceedings to recover unpaid rates.

a. Councils Hardship Policy does allow ratepayers to apply for hardship and put payment plans in place to pay off outstanding Debt

b. Council will not take any further action if payment plans are maintained

c. Council will waive interest if payment plans are met

d. Council has a hardship committee which reviews any hardship applications and what plans are put in place for payment

e. This committee always takes a lenient view to ratepayers who are genuine in terms of their circumstances.

f. DISAGREE – the internal review policy should be part of the Hardship and Debt Recovery Policies

30. The Local Government Act 1993 (NSW) should be amended or the Office of Local Government should issue guidelines to clarify that councils can offer flexible payment options to ratepayers.

a. Clarity around the Local Government Act 1993 (NSW) would be beneficial

b. Council does currently offer flexible options to ratepayers, but it would be good if this were consistent with the Act or Local Government Guidelines.

c. It would also be beneficial for all other payment options and garnishee arrangements to be covered in the LG Act.

d. AGREE

31. The Local Government Act 1993 (NSW) should be amended to allow councils to offer a discount to ratepayers who elect to receive rates notices in electronic formats eg via email.

a. This would result in a saving to Council of approximately $4 per ratepayer, so any discount offered would be minimal

b. Clarity around issuing electronic notices needs to be covered as part of the Local Government Act 1993 (NSW) review. Particularly where services such as BPay View are used. This service sends an SMS or email advising a bill is available to be paid and the ratepayer needs to login to their internet banking portal to download the rate notice.

c. Amendments are required in relation to requests in writing to commence or withdraw the electronic delivery of notices. Most systems in place at the moment seem to allow the ratepayer to opt in or out of the service electronically.

d. AGREE, but perhaps not enough incentive for individual ratepayers to change to electronic notices, an alternative may be to charge more for paper notices, as is the case with Telstra

32. The Local Government Act 1993 (NSW) should be amended to remove section 585 and section 595, so that ratepayers are not permitted to postpone rates as a result of land rezoning, and councils are not required to write-off postponed rates after five years.

a. This would decrease administrative burden of Council

b. AGREE

33. The valuation base date for the Emergency Services Property Levy and council rates should be aligned.

- The NSW Government should levy the Emergency Services Property Levy on a Capital Improved Value basis when Capital Improved Value data becomes available state-wide.

a. Levying at a different time would be confusing for ratepayers

b. It would add additional costs of sending out separate notices, it just makes sense to align the two dates.

c. Councils need clarity around whether the Capital Improved Value or the Unimproved Land Value will be used. This will need to be flexible in the Act.

d. AGREE

34. Councils should be given the choice to directly buy valuation services from private valuers that have been certified by the Valuer General.

a. This is in line with Councils submission to the review

b. Valuation services need to be accredited and align to the Valuer Generals approach for consistency

c. AGREE

|

|

Ordinary Meeting – Tuesday 04 October 2016 Page 278 |

Kioloa Recycling & Waste Facility

In June 2016 Council invited the community to provide input into a review of their local recycling and waste transfer facility operation. Survey forms were widely distributed, letter box dropped in specific areas, made available at the transfer facility and available on-line on the Council website. The response was very pleasing with a total of 5534 survey forms received. The information was manually entered into the database so that the results for each of the individual recycling and waste transfer facilities could be analysed individually.

Kioloa recycling and waste facility received a total of 471 responses, summarised as follows:

Total Responses = 471

Total Responses for Occupancy: 466

Total Responses for Q: 459

Total responses to Q2: 451

Total Responses to Q: 447

|

|

Ordinary Meeting – Tuesday 04 October 2016 Page 284 |

Total responses to Q4a: 345

Total responses to Q4b: 242

Total responses to Q5: 340

Further suggestions/comments for Question 4:

These waste facilities are running at a significant and increasing annual loss. Please number in order of preference (1 through to 10) which of the following options you consider appropriate to improve the efficiency of the facility, with one (1) being your most preferred option and ten (10) being the least preferred option. Please number all boxes. Do you have any further suggested options?

|

1 |

1 weekend per month |

|

2 |

1) Have a 'general

waste' council clean-up / domestic collection every 3 months. |

|

3 |

1) Necessary to open -

school holidays when most people are there and clean-up |

|

4 |

2 day decrease is a 50%

decrease. |

|

5 |

8,9,&10 are all equally the worst options |

|

6 |

A local facility is

mandatory. |

|

7 |

A regular green waste pickup from kerbside in Bawley Point area |

|

8 |

Absentee owners are not always there for regular kerbside pickup - bins are left out etc. These people should be able to use the waste depot as an alternate to the kerbside service at no cost to them. |

|

9 |

Absentee owners given access to the local street garbage bins particularly when departing for home |

|

10 |

AS a ratepayer who uses the facilities of garbage collection in peak periods only, I am entitled to have a facility to dispose of rubbish excess to garbage collection. My house is not rented and only used by family |

|

11 |

As absentee owners we do periodic clean-ups- usually on weekends - and need access to a reasonably close facility to dispose of garden waste or building material on a weekend. |

|

12 |

As population increases so will the amount of waste increase. There needs to be more thought put into allowing growing for growth through the Shoalhaven, not less services |

|

13 |

Ask community for a more detailed survey of what’s needed |

|

14 |

Bawley/Kioloa get comparatively less value for rates than Nowra & Ulladulla - to stop collection of green waste would not go down well |

|

15 |

Be aware that closing the facility would result in more expense for council as people would dump waste in ???? reserves/ bushland and thus require more labour and equipment to service at present. |

|

16 |

Be careful of dumpers |

|

17 |

bring back buyback at the tip |

|

18 |

Bury heads in the sand |

|

19 |

Business model for

green waste seems wrong. Why not drop off for free and sell the mulch? You

get your raw materials free of charge and make the profit on the final

product. |

|

20 |

Buy back already closed which is a huge waste, lots of people in the area used the facility. |

|

21 |

By closing Kioloa transfer station will encourage people dropping waste in reserve thus causing more costs to clean it up. |

|

22 |

Charge for collecting mulch, free drop off of garden waste. |

|

23 |

Closing or severely restricting the service would likely lead to a big increase in illegal dumping in the local environment which would be a big negative for our locality. |

|

24 |

Closing the facility is not realistic - Kioloa is simply too far from centralised facilities to be practical. People will go back to dumping in the bush and on the beach |

|

25 |

Closing the facility

will increase illegally dumped rubbish into reserves, as is already the case. |

|

26 |

Closing the Kioloa facility will lead to illegal dumping in the area. Therefore council will need to employ more rangers to police dumpers |

|

27 |

Closing the tip will lead to illegal dumping. What are our rates for? The current services to the Bawley area are poor. |

|

28 |

Considering the number of absentee owners (all paying full rates) & the significant increase of visitors to our local area (4 caravan parks in area) all ??? to a major increase of waste material. How could we not have a local facility? Cost verses tourism? |

|

29 |

Considering the rates paid by owners in our immediate area based on land value compared to rates paid in the centres where the main waste facilities are located and the lack of services and facilities provided by SCC to our immediate area, the subject proposal is disgraceful. |

|

30 |

council

should become more efficient not take facilities away try limiting

jaunts etc. |

|

31 |

Council’s role is to service residents. Return the tip how it use to be i.e. no attendant and gates open 24/7 with distribution bins. |

|

32 |

Delete tip vouchers |

|

33 |

Do not change |

|

34 |

don't charge rate payers for green waste drop off instead charge to get mulch receipts to customers for drop offs |

|

35 |

Don’t close the tip!!! |

|

36 |

Encourage to recycle own waste, such as garden waste, kitchen waste in home compost systems |

|

37 |

Give Bawley Point a fair go. Bawley has been on the end of the line with the Shoalhaven Shire with regard to services before. |

|

38 |

Give each household a green waste bin pick up fortnightly and a bi-annual house clean up. This will allow the closure of Kioloa. |

|

39 |

Green household waste bins and 6 monthly household clean-up campaign of large waste items e.g. washing machines, old furniture, mattresses etc. |

|

40 |

Green waste collection bin service every other week. This could also include food waste as they do in Coffs Harbour to reduce waste in red bin (General waste) collection |

|

41 |

Green waste for mulching - should not be a charge. This would bring Shoalhaven council in line with most other councils in NSW/Aust. |

|

42 |

Green waste removal otherwise green waste is going to increase into general waste bins thus creating another problem |

|

43 |

Half day per week may 2 day in holiday periods |

|

44 |

Have a green bin collection once a month. |

|

45 |

Have another look at your 'independent, external review'. I don't believe a transfer station such as Kioloa can be over $400,000 in deficit annually. Is it possible to see the criteria and findings of that review? Regards Alan |

|

46 |

Have gates permanently open for recycling and increase cost for general waste and sell green waste composite and lessen cost for green drop off. |

|

47 |

Have large bins for general waste & recycling - This would suit people who own holiday houses etc. |

|

48 |

Having the tip open more during our busy season Christmas till Easter and closing to maybe only one day a fortnight or week during the off peak!! |

|

49 |

Here is Kioloa we are 30-45min away from Ulladulla. 'Too far' |

|

50 |

I am happy with the current situation, but can accept a reduced operating programme. closing will create waste dumping |

|

51 |

I can see finding an acceptable balance between reducing costs of operation and maintaining a viable community service but I don't understand the operating at a loss bit. It’s a service not a profit making business like a factory or retailer etc. |

|

52 |

I think that expecting stupid thinking. Let’s close the railways. My preferred option is to reduce the wages of the bureaucrats rather than kit citizens |

|

53 |

I would not like to see anyone lose their job, but maybe use volunteers to man the site 2 days and pay workers 2 days, rather than close the facility |

|

54 |

Ideally 1-2 days p/week with one day being a weekend. Say Friday and Saturday |

|

55 |

If a green waste bin was provided reduce TIP hours |

|

56 |

If closed, gate entrance will be a stockpile for dumped rubbish or it will be dumped somewhere else locally. |

|

57 |

If facility is closed I envisages a serious increase in illegal waste disposal. Road side bins are often overflowing. |

|

58 |

If Kioloa closes we will need pick-ups from home |

|

59 |

If my ticks above were considered it may help reduce operating costs enabling Kioloa tip to remain open, avoiding the illegal dumping of rubbish in other areas, around Bawley and Kioloa |

|

60 |

If no operation some people may dump rubbish |

|

61 |

If our exorbitant illegal rates were not wasted on junkets and councillor vehicles, perhaps there would be extra funds to actually fix the goat track into Kioloa. Do the jobs our illegal rates pay for |

|

62 |

If the Kioloa facility is closed or made beyond the financial reach of residents the local area will become an unsightly rubbish tip. Citizens should be encouraged to responsibly dispose of rubbish by the provision of an accessible waste disposal facility |

|

63 |

If the tip closes the rubbish etc. will be dumped in the Murramarang national park |

|

64 |

If there is no waste facility, people will start either dumping illegally &/or burning off. |

|

65 |

If this is closed, I predict you will see even more rubbish dumped in the national park off Forest Rd. |

|

66 |

If you close the tip, dumping in the state forest will increase. |

|

67 |

Impractical to take green waste all the way to Ulladulla. Please maintain a green waste option. |

|

68 |

improve the productivity, culture and attitude of employees - more money could be made from reclaimed/recycled items if it was done better use internet, have sales days etc. |

|

69 |

In our opinion it is not an option to close waste transfer facilities |

|

70 |

In our opinion it is not an option to close waste transfer facilities |

|

71 |

Include a garden/green waste bin in the fortnightly collection |

|

72 |

Increase gate fees over summer holiday period this won't penalize local ratepayers as much. Kioloa is an important facility for this part if the coast as transporting green waste and recyclables on busy highway to Ulladulla is highly dangerous |

|

73 |

Increase kerbside recycling |

|

74 |

increase rates |

|

75 |

Increase rates to cover costs - removing the service or making it too difficult to access (e.g. up front cost) will result in cost transfer in terms of illegal dumping and spread of rubbish along roads during private transfer to more remote facilities |

|

76 |

Increase services in holiday periods. |

|

77 |

Increased days during

holidays. |

|

78 |

It works okay now. |

|

79 |

Keep annual vouchers & just reduce hours or days - ensuring that at least one day on the weekend remains open |

|

80 |

Keep something open or rubbish will be dumped in the reserve and forest |

|

81 |

Key to gate be

controlled by local man shed at entrance to depot at Kioloa. |

|

82 |

Leave as is, no change |

|

83 |

Leave it the same |

|

84 |

Maintain the voucher system, our rates at work. |

|

85 |

Make green waste tipping free and pay for mulch as in Sydney |

|

86 |

Make the ratepayer suffer decline of services |

|

87 |

Many in our community are weekend residents, we at least need Saturday operational |

|

88 |

May I comment that as a member of Kioloa bush care we already spending time and effort collecting dumped waste. Some people dump their waste in the bush, then take an empty trailer to collect free mulch. Charge for the mulch |

|

89 |

Maybe council could start a proper green waste collection service like other councils in Australia |

|

90 |

Means unregulated dumping, including my box number 7. The current service is brilliant, it means residents do not stock rubbish in their yards or leave on the footpath when otherwise they might. It allows people to dispose of rubbish themselves other than rely on council clean up days |

|

91 |

Must be convenient living in a large town |

|

92 |

My preference is to

have Kioloa facility open for 2 mornings, 2 days per week with all parts of

operation open and possible increased fees. |

|

93 |

No |

|

94 |

No, but it's great that you are asking for input. |

|

95 |

None - We have increased numbers of locals here every year and we like our tip service to remain as is. |

|

96 |

None - Why should we as rate payers travel 60km+ to and from Ulladulla to use a tip when the Kioloa tips works effectively on limited hours and days |

|

97 |

One weekend every 2 weeks |

|

98 |

Operate all day Friday for commercial waste, then operate Sat & Sun 1pm - 5pm for domestic waste. Most people do gardening on the weekend and go to the tip middle to afternoon time of day. |

|

99 |

Our concern is if council decides to close the waste facility some members in our community may dump their waste in the bush. e.g. Ulladulla to far etc. |

|

100 |

our rates pay enough already for employees keep it open longer hrs each day |

|

101 |

Owner’s rate payments should at least partly subsidise operating costs at Kioloa. It is a community service, not a luxury |

|

102 |

People won’t drive to Ulladulla to dump. Our bush will become the tip. |

|

103 |

Please can we receive more than 2 free vouchers yearly? I am 81 years old, love gardening and have to visit tip many times at a cost of $5.40 each time for car full of garden refuse |

|

104 |

Please ensure public landfill and recycling bins for the general public in town for routine small volume collection |

|

105 |

Please keep open - maybe charge more fees |

|

106 |

Provide a bin for green waste |

|

107 |

Provide green waste bins to residents for fortnightly collection |

|

108 |

Provide Large bins to all Premises |

|

109 |

Really would like to keep this (Green waste) |

|

110 |

Recycling be open for the general public 7 days a week should the facility be closed - least desirable outcome. |

|

111 |

Recycling bins are inside secure gate put so accessible to people. Centre only open till one - some days a week, surely that can remain |

|

112 |

Re-directing to Ulladulla will result in significant dumping of waste around the village. |

|

113 |

Reduce days open but maintain socially responsible services i.e. -recycling, disposal of toxic materials, return facility to responsibly dispose of fluorescent tubes |

|

114 |

Reduce significantly the excessive grass mowing beside footpaths and foreshore reserves and divert the monies then saved to the continuance of the smaller waste facilities |

|

115 |

Remember that there are 4 Caravan Parks in this area not service by council. |

|

116 |

Residents cannot carry

green or general waste to other waste transfer’s facilities. We expect

this service as part of our rates. |

|

117 |

Reverse green waste payment system. Should be free to drop off green waste and pay to take mulch. Current system results in waste being dumped in local bush |

|

118 |

Running efficient recycling shop (Charity Op shops make lots of money from free clothes and goods) |

|

119 |

Sack 2 fat cats. Will pay for this community asset. |

|

120 |

Scheduled bulky waste collection or on call bulky waste. |

|

121 |

Sell mulch made from the green waste. |

|

122 |

Stop sending 4 council workers to put a bucket of 'hot mix' in a pothole. Maybe the council will save money instead of trying to cut back our services |

|

123 |

Supply residents with green waste bin - to be collected like garbage bins |

|

124 |

Supply skip and public recycling |

|

125 |

Surely one of the

functions of council is to provide garbage collection and waste disposal

facilities. |

|

126 |

Take no action. Tip to stay open |

|

127 |

taking no action is not an option that will improve the facility, there are very few council services in Bawley and Kioloa already e.g. local community built the footpaths , This contrasts with other areas e.g. Huskisson Vincentia rates are high never the less It would be unreasonable to further reduce our services. |

|

128 |

The best is comprehensive, but the point to keep in mind is that we pay our rates and should not be disadvantage relative to other communities |

|

129 |

The population is increasing

both permanent and holiday weekenders, retirees etc. and council wants to

'cut back'. Why? |

|

130 |

The tip is a service to the community. Given our isolation and lack of other services, the tip is vital. It services the local caravan parks and yard maintenance people. Without it local jobs will go |

|

131 |

There are 3 tourist’s parks and a camping park at Pretty Beach. I don't see how closing Kioloa will achieve a cost effective solution |

|

132 |

There are no other options. Not everyone lives near Ulladulla, or West Nowra. Kioloa is needed as people have to travel west of Termeil (and often North Durras) |

|

133 |

There are none. |

|

134 |

There is no option but to keep open otherwise you will have illegal dumping in the area |

|

135 |

this is a community service not for profit, helps keep our bushland free of dumping |

|

136 |

This is a service you need to provide as a Council |

|

137 |

Tip and rubbish removal is one of council’s primary responsibilities and must be maintained running at a loss or not. |

|

138 |

Tip are core council responsibility, paid for by rates. No increase charge. |

|

139 |

We are very happy with our tip days, time and vouchers, but have suggested minor changes for efficiency improvements. |

|

140 |

We cannot really comment on the above time suggestions, but have had to answer before we could continue the survey - not a good option to be forced into making a selection! However, we would like to see some facility retained at Kioloa. Our residence in Bawley Point is not a permanent living place. We only avail ourselves of the free vouchers for landfill and green waste. We consider the cost of taking the green waste is much too high. Also forcing residents (permanent or otherwise) to take rubbish to Ulladulla will only increase the likelihood of people dumping waste on roadsides or in the SCC public park bins. In spring, when the garden is growing well we make at least fortnightly visits to Bawley Point to mow lawns and there is a great temptation to put the clippings into our landfill bin, but we don't. We have been piling the clippings and pruning’s until we have a trailer load to use our voucher. Also, on some occasions we have even taken a trailer full of clippings and pruning’s back to Canberra where green waste disposal is in most cases free! We also notice the paper survey questions differ from the on-line questions - there are 10 here and only seven on our paper one! |

|

141 |

We feel if you close this tip, the place will look like a pig sty, and I can’t see the caravan parks, taking their waste to Ulladulla daily. People will dump there rubbish in the forest, and there will be an even bigger problem. |

|

142 |

We need a large green

bin for green garden waste which would keep it separate from landfill. VIP |

|

143 |

We pay rates for services, so closing the facility should not be considered. Council has annual losses from the entertainment centre and other facilities but disposing of waste should be made easy so no-one dumps in the bush. |

|

144 |

We pay rates to support public services including a local waste facility. This should not be seen as a profit centre but a public service to rate payers |

|

145 |

Weekend visitors might

prefer Sun & Mon but tradies could possibly prefer Fri/Sat. |

|

146 |

Which is 4 days a week

or open more days which would keep workers/ small businesses. |

|

147 |

Work with the caravan parks to establish an option to drop off general waste and recycling there. The caravan parks already manage large quantises of general waste and recycling on site and dispose of those through council facilities |

|

148 |

You cannot close down, if so people will go bush |

|

149 |

You have it covered above |

Comments for Question 5:

If waste facilities were closed, what services would you like to see in the area?

|

1. |

"on call" bulky waste collection days as well |

|

2. |

$50 Reduction in rates to cover petrol to Ulladulla. Use land for community combined skate park for kids & dog off leash & agility area etc. |

|

3. |

2 half days per month |

|

4. |

5or6 scheduled waste collections per year |

|

5. |

A reduction in the outrageous council rates I pay for which i get pretty much nothing back for. Total rip off for absentee owners |

|

6. |

Add green bins for vegetation |

|

7. |

Add green waste collection |

|

8. |

And see above |

|

9. |

And you will see a lot of dumping of all sorts of rubbish. |

|

10. |

As above |

|

11. |

As Above. Stop wasting money on street scapes |

|

12. |

AS long as there was some form of bulky waste disposal. Can we get green bins? |

|

13. |

At no fee, or allocate 2 vouchers for free pickup |

|

14. |